Personal income tax implementation in Oman would be a game-changer for the region. https://www.bloomberg.com/news/articles/2020-11-02/oman-to-implement-unprecedented-measures-to-curb-budget-deficit?srnd=premium-middle-east&sref=euelgVQS For just a snap-shot at why raising govt revenue is so important right now, here are some basic data points on Omani public finance. *Thanks to my new Haver Analytics access

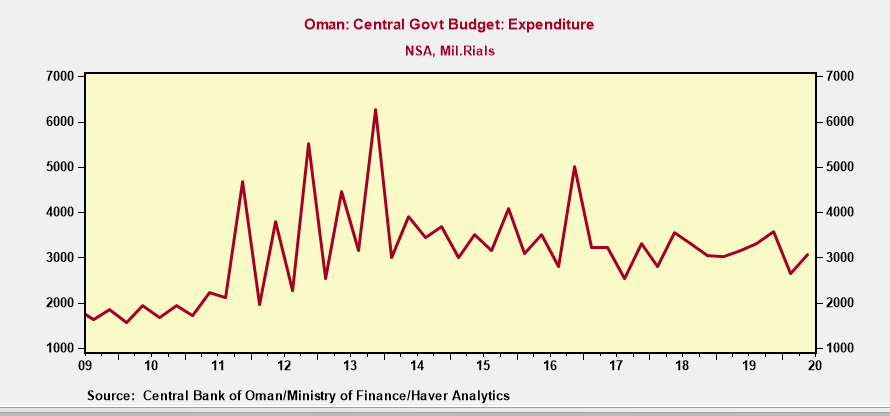

Gov expenditure has been pretty flat for the last few years, with a dip last year in late 2019. This correlates to the late 2014 oil price decline and then the late 2016 OPEC+ agreement that boosted oil prices again.

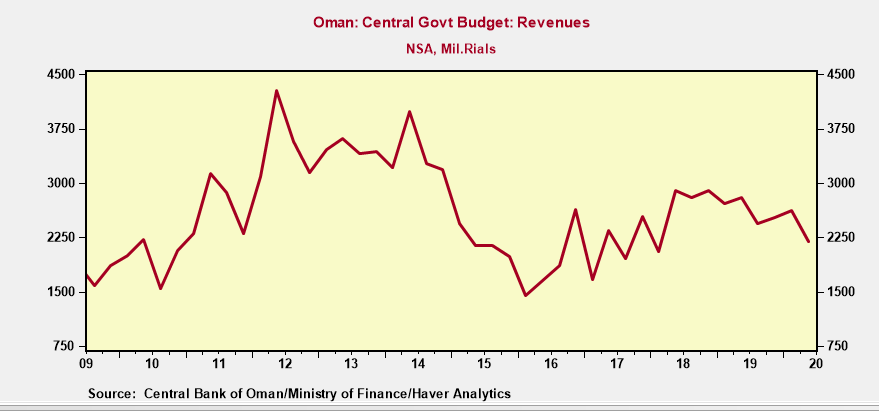

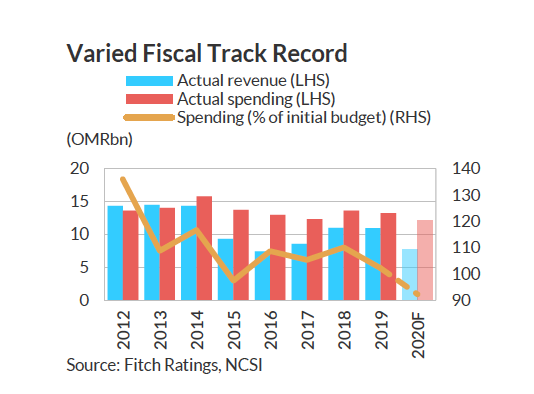

But, government revenue looks like this--There is a spending to revenue gap, persistent across the Gulf, but especially sharp in Oman.

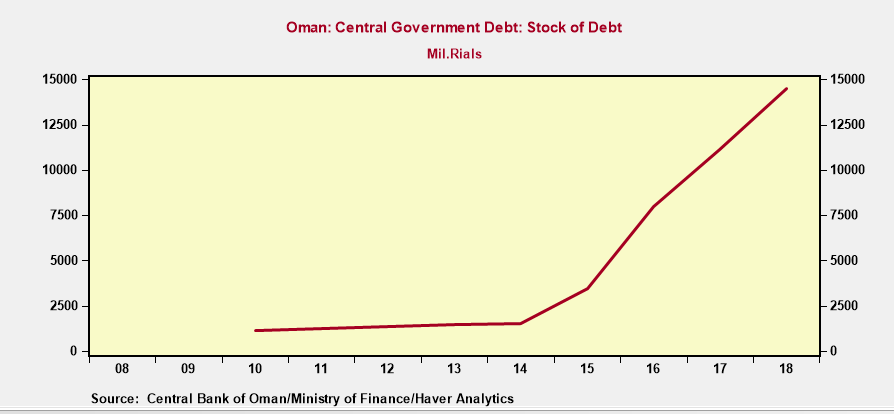

In the interim, government debt levels have soared. All of these trends relate to the structural changes in oil markets since late 2014, and the long-term patterns of expected social spending across the Gulf states, spending that no longer is sustainable => taxes & budget cuts.

However, I'm not sure that a targeted income tax only on the highest earners/wealthy is the right start. Better to develop a more equitable tax across the board, at different rates, so that everyone gets into the habit. Expect some capital flight from the wealthy before '22.

Read on Twitter

Read on Twitter