So much said about #China as an emerging lender to Africa (& globally). But there are others worth a mention who've increased their lending to African governments: #SaudiArabia #India #Kuwait #Brazil #UAE Thread. 1/7

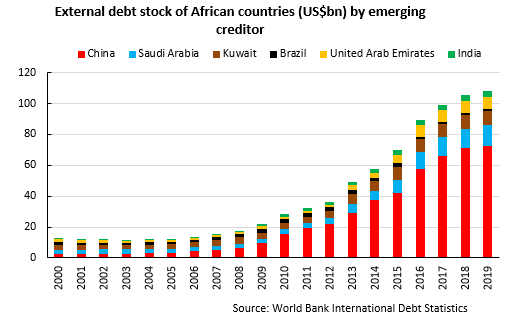

Data been hard to find, but International Debt Statistics, published by @WorldBank just now, show external debt by creditor country. See large growth over past decade (since widespread debt relief). #China by far largest but others' growth important (especially Gulf lenders) 2/7

This often followed by point that it makes solving debt problems harder. As more creditors, not in the Paris Club, with exposure. True, but there's also a positive in African countries being able to source more capital from more places. Needs to be used well of course 3/7

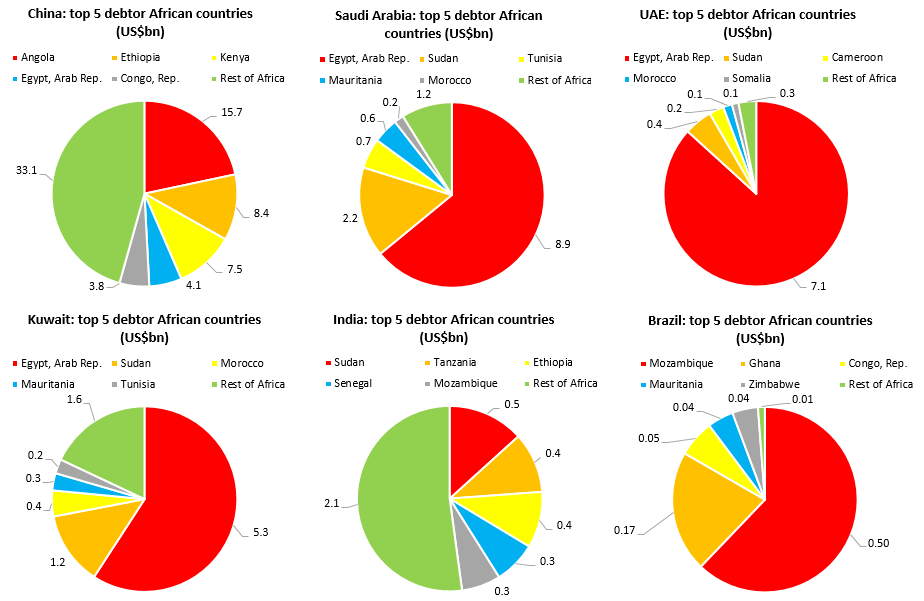

Interesting to see where different emerging creditors focus their lending. Gulf lenders (absent #Qatar as still no data) focus on #Egypt, but #Sudan #Tunisia #Mauritania make up the top 5. Ties to other muslim countries appear important 4/7

Most Gulf lending is at commercial interest rates, some concessional. Large concessional loans of note to #Sudan #Mauritania #Senegal from Kuwait & Saudi Arabia 5/7

Read on Twitter

Read on Twitter