#ASRoma 2019/20 accounts cover a season when they finished 5th in Serie A and reached the last 16 of the Europa League. Impacted by COVID-19 in the last 3 months. After year-end The Friedkin Group purchased the club from fellow American James Pallotta. Some thoughts follow.

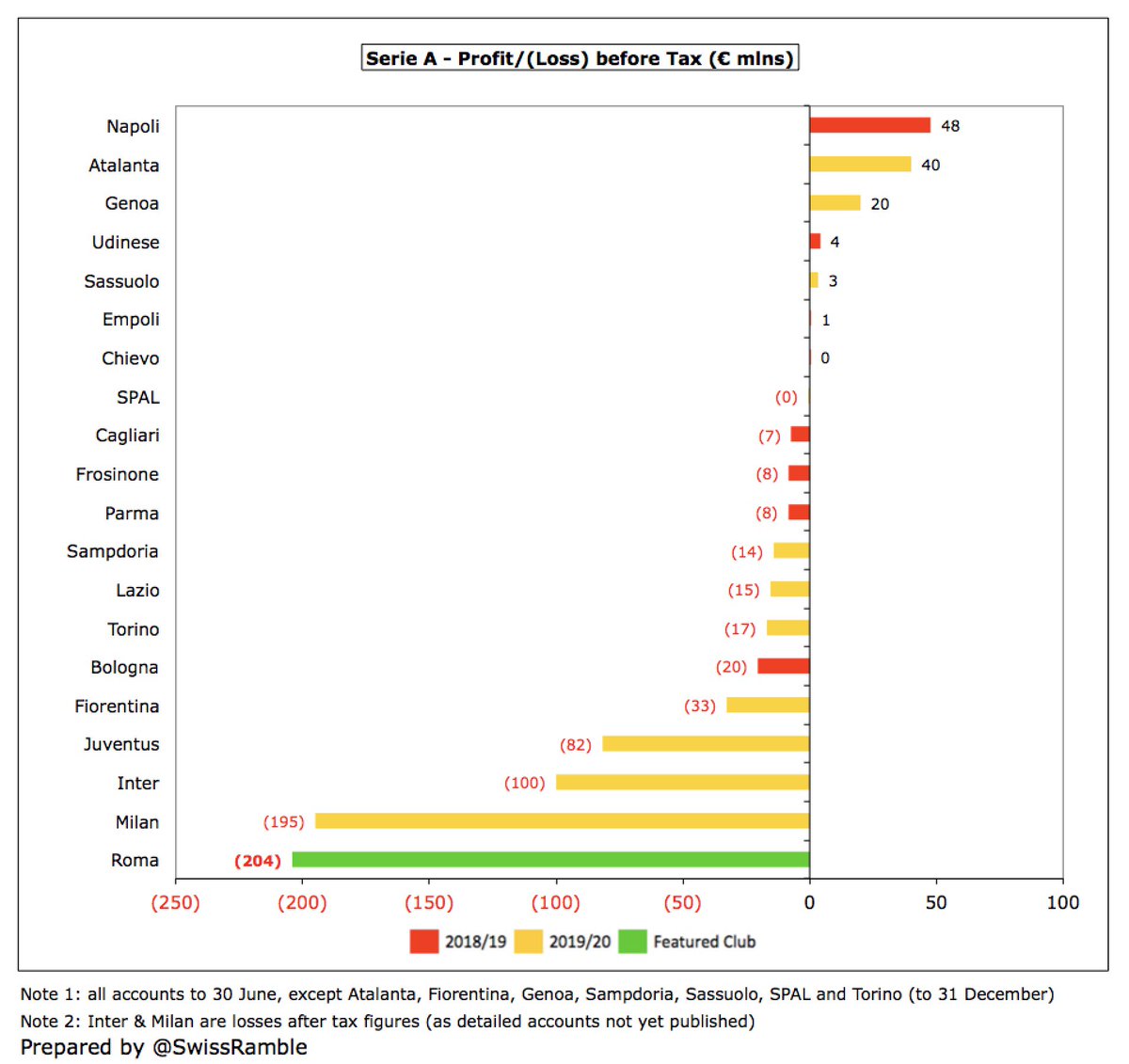

#ASRoma loss before tax shot up from €15m to €204m, their highest ever loss, as revenue fell €87m (37%) from €236m to €149m and profit on player sales slumped €111m to €18m, only partly offset by €24m (6%) reduction in operating expenses. After tax loss was also €204m.

#ASRoma revenue reduction was mainly TV, down €59m (41%) to €86m, partly due to playing in Europa League instead of Champions League prior year, though also falls in commercial, down €20m (36%) to €35m, and match day, down €13m (39%) to €21m. Player loans up €4m to €7m.

#ASRoma lowered wage bill €29m (16%) from €184m to €155m, while other expenses were cut €11m (12%) to €84m. However, there were increases in player amortisation, up €11m (13%) to €94m, depreciation, up €6m to €10m, and net interest payable, up €4m to €32m.

Most Italian clubs have reported large losses in 2019/20, due to impact of the pandemic, but #ASRoma €204m post-tax loss is the worst in Serie A, ahead of Milan €195m, Inter €100m and Juventus €90m. Note: many clubs have 31 December year-end, so accounts do not reflect COVID.

In fact, #ASRoma €204m loss is the second highest ever reported in Italy, only surpassed by Inter’s €207m in 2006/07. It is also the third highest ever in Europe, also behind #MCFC 2010/11 €218m loss.

#ASRoma loss was not helped by profit on player sales falling from €129m to just €18m, mainly El Shaaraway to Shanghai €13m and Gerson to Flamengo €4m. The previous season was boosted by the big money sales of Alisson, Manolas, Pellegrini and Strootman.

#ASRoma are no strangers to losses, though €204m is their highest since €115m in 2003. In fact, the last time they made a profit (before tax) was back in 2009 – and that was just €3m. Since then, they have suffered losses 11 years in a row, adding up to nearly half a billion.

Profit on player sales had been increasingly important for #ASRoma, averaging €89m a year over the preceding 4 years before dropping to €18m in 2020. Next summer they will hope to realise profits on some players currently out on loan, e.g. Florenzi, Under, Kluivert and Olsen.

#ASRoma EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for underlying profitability, as it excludes once-off items like player sales and exceptional items, fell from €(44)m to €(90)m, the worst in Italy by far.

Similarly, #ASRoma operating loss (excluding profit from player sales and interest payable) widened from €131m to €195m, down from €47m only 2 years ago. This is second worst in Serie A, only “beaten” by Juventus €234m, though they offset this with much higher player sales.

#ASRoma €104m (41%) revenue fall since 2018 from €253m to €149m highlights the importance of qualifying for Europe, particularly the Champions League. This was worth €98m in 2018 (TV €84m plus match day €15m), but only €17m in 2020 (TV €14m plus match day €2m).

Following this decrease, #ASRoma €149m revenue is now 5th highest in Italy, over €250m below Juventus’ €407m, though Inter, Milan and Napoli will surely fall when they publish 2019/20 accounts, due to COVID. Revenue mix: TV 58%, commercial 23%, match day 14%, player loans 5%.

In the last 4 years, #ASRoma have only grown revenue by €13m (%), while Inter (up €185m) and Juventus (up €60m) have powered ahead. In the same period, they have also been outpaced by Atalanta, Napoli and Lazio. Only Milan and Fiorentina have a comparable low rate of growth.

Based on 2018/19 revenue, #ASRoma dropped one place to 16th in the Deloitte Money League, just ahead of Lyon, West Ham and Everton, though they must be in danger of dropping out of the top 20 in 2019/20. It is worth noting that they had been as high as 9th in 2007/08.

#ASRoma broadcasting income fell €59m (41%) from €145m to €86m, mainly due to €43m decrease in UEFA prize money from €58m to €14m, though domestic TV also fell €15m (18%) from €87m to €72m. Down to 6th highest in Italy, a long way below Juventus €166m.

In 2018/19 #ASRoma received €75m TV money from Serie A: 50% equal share; 30% performance (15% last season, 10% last 5 years, 5% historical); and 20% supporters. However, 2019/20 revenue was lower, as some income deferred to 2020/21 after some games played in July and August.

It is imperative that #ASRoma do well in the Champions League to boost their broadcasting income, as the TV rights in Serie A are relatively low. Indeed, there were big increases in England and Spain in 2019/20 and France in 2020/21, while Italy was unchanged.

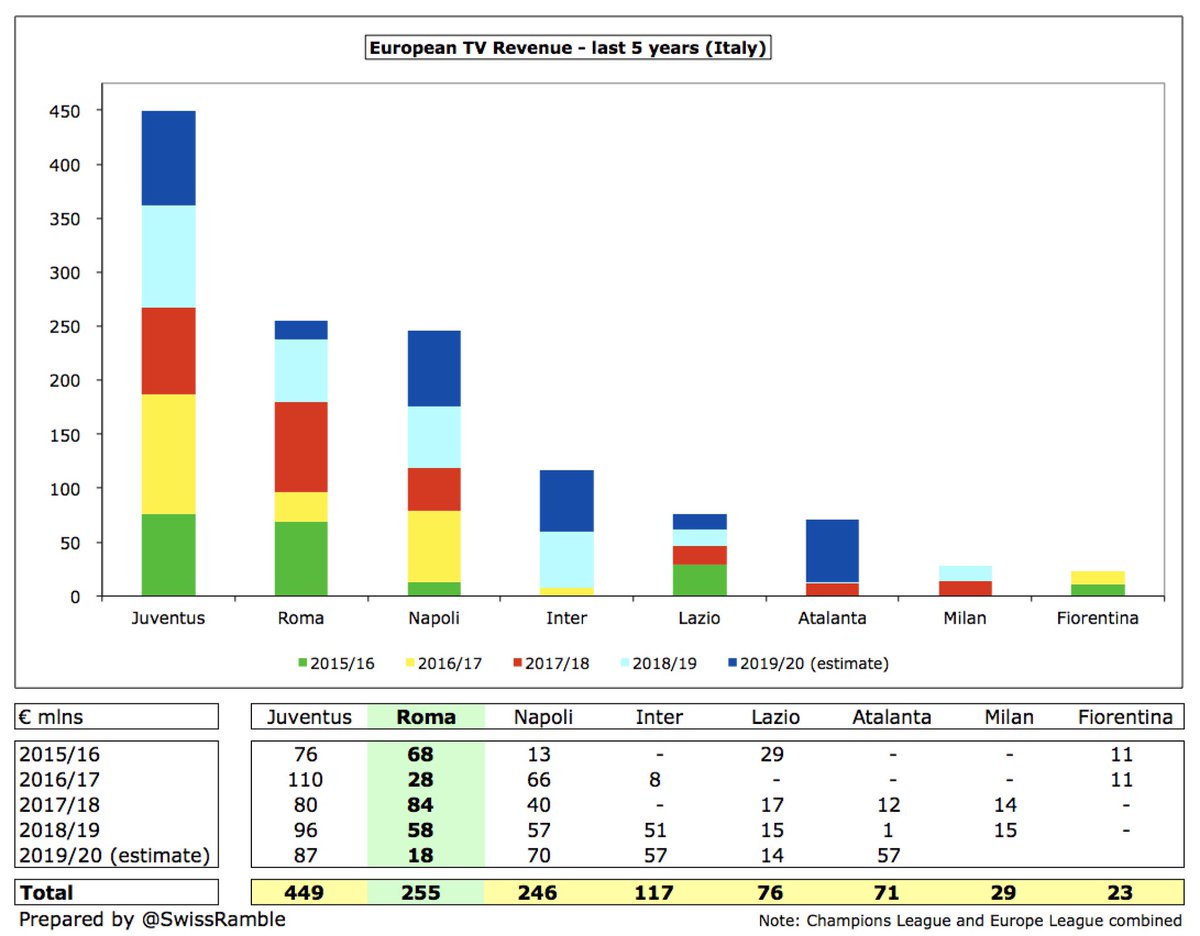

Based on my estimate, #ASRoma earned €18m from the Europa League after reaching the last 16, lower than prior season’s €58m from the Champions League. Other Italian clubs: Juventus €87m, Napoli €70m, Atalanta €57m and Inter €57m. These figures are before any COVID rebate.

It is worth noting the influence on Champions League money of the UEFA coefficient payment (based on performances over 10 years), where #ASRoma only received around €3m in the Europa League in 2019/20, compared to €12m from the Champions League in 2018/19.

The Champions League is extremely important for #ASRoma, who have earned an impressive €255m from Europe in last 5 seasons, only surpassed in Italy by Juventus’ €449m, but ahead of Napoli €246m, Inter €117m, Lazio €76m, Atalanta €71m and Milan €29m.

#ASRoma match day income fell €13m (39%) from €34m to €21m, split domestic €18m (down €7m) & Europe €2m (down €6m). Impacted by playing 6 home games behind closed doors, due to COVID. This was 4th highest in Italy, less than half Juventus €71m.

#ASRoma average attendance decreased from 38,622 to 26,956, again due to 6 games in June and July being played behind closed doors. This remained the 4th highest in Italy behind Inter 41,558, Milan 34,078 and Juventus 28,263, who all saw similar falls to Roma.

#ASRoma continue to work on securing a new stadium, but this has suffered many delays, which may well be a reason that Pallotta sold the club. He said, “If we want to consistently compete with the largest teams in Europe, we need the stadium”, as can be seen by match day revenue.

#ASRoma commercial income fell €20m (36%) from €55m to €35m, partly because of COVID, but also cancellation of Betway agreement, due to Italian regulatory changes prohibiting gambling advertising in football. Now 6th highest in Serie A, much lower than Juventus €186m.

#ASRoma shirt sponsor Qatar Airways will pay €11m a year until 2021, while Hyundai back-of-shirt deal is worth €3m a year. Nike kit deal €6m ended 3 years early in 2021 to look at other opportunities. Long way behind Juventus €93m: Jeep €42m + Adidas €51m.

#ASRoma new owners will surely be looking to boost commercial income, given the disparity with other leading European clubs. Even before last season’s significant decrease, their €55m in 2018/19 was miles below likes of Barcelona €384m, PSG €363m, Bayern €357m & #MUFC €355m.

#ASRoma player loans income up €4m to €7m, including Schick to RB Leipzig and Defrei to Sassuolo. Leading the way in Italy are Genoa €17m. Roma were also boosted by €5m other player management, though down from €15m, mainly performance bonuses from previous player sales.

#ASRoma wage bill was cut €29m (16%) from €184m to €155m, mainly due to players, coach and some other staff giving up 4 months’ salary from March to June, saving €30m. In last 2 years wages down €4m, but revenue fell €104m, increasing wages to turnover from 63% to 104%.

This encapsulates #ASRoma’s challenge, as their wages have not grown since 2016, while other leading Italian clubs have all increased their wages over that period (though some figures are pre-COVID), e.g. Inter up €68m and Juventus up €63m.

#ASRoma have 4th highest wage bill in Italy of €155m, though a fair way below Juventus €284m, Inter €193m & Milan €185m (though latter two may well fall when 19/20 COVID-impacted accounts are published). On the other hand, above Napoli €135m and well ahead of Atalanta €69m.

Following the increase from 63% to 104%, #ASRoma wages to turnover ratio is now the highest (worst) in Italy, much higher than Juventus 70%, Inter 52% and especially Atalanta 49%. Also significantly above UEFA’s recommended upper limit of 70%, which is a cause for concern.

#ASRoma player amortisation, the annual cost of writing-off transfer fees, increased by €11m (13%) from €83m to €94m, which means that this expense has grown by an incredible €66m from €28m in 2014, i.e. more than tripling in that time.

As a result, #ASRoma player amortisation of €94m is the second highest in Italy, though a long way below Juventus €167m. Maybe surprisingly, they are ahead of big-spending Inter €85m, Napoli €82m and Milan €80m.

#ASRoma have significantly increased gross transfer spend, averaging €107m in last 4 years, but sales have increased even more to €114m, which means they averaged €7m net sales. 2019/20 player purchases included Pau Lopez, Mancini, Diawara, Veretout, Perez and Ibanez.

In fact, over the last 4 seasons, #ASRoma have one of the lowest net spends in Serie A – or, more accurately, net sales of €27m. In stark contrast, the four biggest spenders over this period are: Milan €276m, Juventus €204m, Inter €204m and Napoli €126m.

It’s a different story in gross spend with #ASRoma €429m being the 4th highest in Italy, though over €300m less than Juventus €758m. Also behind Inter €522m and Milan €510m. One interesting comparative is high-flying Atalanta, who are around half as much with €216m.

#ASRoma net financial debt increased €79m from €221m to €300m, as gross debt rose €63m from €255m to €318m, with cash down from €35m to €18m. Debt includes €267m bonds, €28m finance leases (due to IFRS 16), €12m overdraft and €11m owner loans.

#ASRoma gross debt of €318m is the third highest in Italy, behind Inter €461m and Juventus €396m (partly driven by new stadium). In 2019/20 the club replaced the previous Goldman Sachs loan with the issue of a €275m bond to help restructure debt repayments.

#ASRoma net interest payable rose €4m (14%) to €32m, the highest in Italy, ahead of Inter €29m and Juventus €15m. Interest rate on the bond is 5.125%, which is lower than the previous loan’s Euribor 3 months (min 0.75%) plus 6.25%, though is still a major competitive burden.

In addition, #ASRoma owe €191m in transfer fees, €27m higher than prior season. This is the second highest in Italy, only behind Juventus €301m. Other clubs in turn owe Roma €55m, so the net balance is €136m, which is a sizeable rise from €18m just three years ago.

#ASRoma have been very reliant on capital from their owners. The previously approved €150m for 2020 was increased to €210m, of which €60m was paid in 2020 with remaining €150m to be paid by 31st December 2021. In addition, €29m shareholder loan was converted into capital.

#ASRoma have struggled to meet FFP targets in the past, but UEFA have now relaxed their rules, so the 2021 monitoring period will only cover 2 years (2018 and 2019), thus excluding the COVID-19 impacted 2020. In addition, the 2022 monitoring period will now cover 4 years.

Clearly, #ASRoma 2019/20 massive loss was impacted by COVID, but that should not disguise their underlying problems, partly caused by their failure to qualify for the lucrative Champions League, e.g. high wages and debt. Another capital injection from their owners is imperative.

Read on Twitter

Read on Twitter