0/ The next difficulty epoch will be a golden period for Bitcoin miners.

Here's why

https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

Here's why

https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

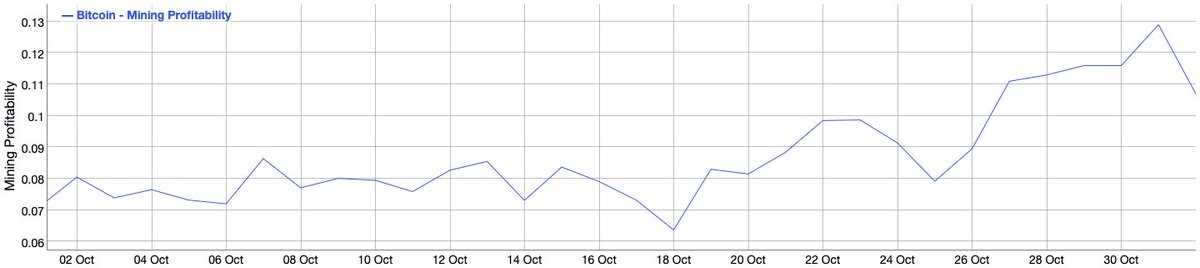

1/ Bitcoin price is roughly 21% higher than its value when the last difficulty adjustment occurred on Oct 18th.

Higher prices usually means more hashrate coming online.

More hashrate means higher difficulty which means higher input costs.

However...

Higher prices usually means more hashrate coming online.

More hashrate means higher difficulty which means higher input costs.

However...

2/ The significant Bitcoin price jump happened to coincide with the end of rainy season in Sichuan.

Sichuan house the dominant share of hashrate during rainy season but when it ends, miners turn off their rigs to transfer to coal-powered regions like Xinjiang.

Sichuan house the dominant share of hashrate during rainy season but when it ends, miners turn off their rigs to transfer to coal-powered regions like Xinjiang.

3/ This is currently taking place and a huge amount of hashrate has come offline.

As a result, Bitcoin difficulty is currently estimated to decline by ~15% in roughly one day.

This means miners will enjoy both higher prices and lower input costs.

As a result, Bitcoin difficulty is currently estimated to decline by ~15% in roughly one day.

This means miners will enjoy both higher prices and lower input costs.

4/ Bitcoin miner margins have already widened due to the $BTC price rises.

However, slower block times has held back revenue growth as there are less blocks being mined due to the hashrate drop.

But this will change when difficulty adjusts.

However, slower block times has held back revenue growth as there are less blocks being mined due to the hashrate drop.

But this will change when difficulty adjusts.

5/ When difficulty adjusts, a myriad of inefficient miners who were operating below breakeven will once again be able to operate profitably.

Combine that hashrate with the rigs currently transitioning away from Sichuan and you can expect much faster block times.

Combine that hashrate with the rigs currently transitioning away from Sichuan and you can expect much faster block times.

6/ More blocks combined with elevated prices combined with lower input costs means Bitcoin miners are about to enjoy extremely wide profit margins during the next difficulty epoch.

Read the full details here – https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

Read the full details here – https://www.hashr8.com/blog/bitcoin-mining-difficulty-rainy-season/

7/ You can also join our mailing list to be the first to get the best updates in Bitcoin mining. http://hashr8.com/#subscribe

Read on Twitter

Read on Twitter