I finally gave this episode a listen. Great and provocative interview as always from @ErikSTownsend.

Below I’ll share some general comments on MMT along with some thoughts that came to mind while listening to Erik’s conversation with @StephanieKelton.

A thread. https://twitter.com/macrovoices/status/1319410149468098560

Below I’ll share some general comments on MMT along with some thoughts that came to mind while listening to Erik’s conversation with @StephanieKelton.

A thread. https://twitter.com/macrovoices/status/1319410149468098560

1- Let’s start by dispelling common misperceptions. Many people don’t understand MMT yet think they do.

It’s helpful to distinguish two aspects of MMT. The 1st is mainly descriptive; a plain description of how our current fiat monetary system works in reality.

It’s helpful to distinguish two aspects of MMT. The 1st is mainly descriptive; a plain description of how our current fiat monetary system works in reality.

2- Many people, including many classical and Austrian economists, do not appreciate this (largely correct) part of MMT.

To better understand it, see @wbmosler’s succinct MMT White Paper, most of which I would consider merely descriptive. Link: http://moslereconomics.com/mmt-white-paper/

To better understand it, see @wbmosler’s succinct MMT White Paper, most of which I would consider merely descriptive. Link: http://moslereconomics.com/mmt-white-paper/

3- The 2nd part of MMT is normative. This is what gets all the attention, but importantly, it’s not a necessary component of MMT.

@StephanieKelton is the champion of this ‘normative MMT’. She lays it out in her book, “The Deficit Myth”, available here: https://www.amazon.com/Deficit-Myth-Monetary-Peoples-Economy/dp/1541736192

@StephanieKelton is the champion of this ‘normative MMT’. She lays it out in her book, “The Deficit Myth”, available here: https://www.amazon.com/Deficit-Myth-Monetary-Peoples-Economy/dp/1541736192

4- Parts of Kelton’s book do indeed just describe our current system. So let’s try to tease out where the normativity comes in.

@wbmosler writes:

The relevance of MMT today is that “MMT understandings put policy options on the table that were not previously considered viable.”

@wbmosler writes:

The relevance of MMT today is that “MMT understandings put policy options on the table that were not previously considered viable.”

5- I think this sentence is at the heart of it all.

Many proponents of MMT will invoke the theory to make normative statements about how we *should* use economic policy to achieve certain aims that they consider desirable.

This is the part of MMT that gets the most attention.

Many proponents of MMT will invoke the theory to make normative statements about how we *should* use economic policy to achieve certain aims that they consider desirable.

This is the part of MMT that gets the most attention.

6- In other words, much of what you hear about MMT amounts to policy prescriptions based on the fact that the government, as the exclusive issuer of its currency, can ultimately print as much money as it wants, subject to the constraint of inflation.

(More on inflation later.)

(More on inflation later.)

7- These normative pronouncements often interweave the descriptive elements of MMT into them. For example:

“Because govts who borrow in their own currency can (technically) never run out of money, they *should* use these powers to provide healthcare and fight climate change.”

“Because govts who borrow in their own currency can (technically) never run out of money, they *should* use these powers to provide healthcare and fight climate change.”

8- The 1st part of the sentence is demonstrably true (the only caveat being inflation, and that the users of the currency may lose faith in it).

The 2nd part is normative. It’s a statement of what some people think we *should* do given how our current monetary system is set up.

The 2nd part is normative. It’s a statement of what some people think we *should* do given how our current monetary system is set up.

9- So people who say they “disagree with MMT” either...

A) don’t know what they’re saying;

B) disagree with the normative statements about economic policy that many MMT proponents make; or

C) agree with MMT’s descriptive power, but think our current system is deeply flawed.

A) don’t know what they’re saying;

B) disagree with the normative statements about economic policy that many MMT proponents make; or

C) agree with MMT’s descriptive power, but think our current system is deeply flawed.

10- FWIW, I fall in Camp B & C from the previous tweet (and maybe a little A? ).

).

Now that we’ve cleared that up, l’ll use the rest of this thread to address some specific points from the @MacroVoices interview.

).

).Now that we’ve cleared that up, l’ll use the rest of this thread to address some specific points from the @MacroVoices interview.

11- (Paraphrase)...

Erik: Doesn’t money printing dilute the value of money? Isn’t that a form of tax?

Stephanie: People think of S/D, that if you increase supply, the value falls. But no! It depends what happens with that extra money. Every deficit is good for *someone*.

Erik: Doesn’t money printing dilute the value of money? Isn’t that a form of tax?

Stephanie: People think of S/D, that if you increase supply, the value falls. But no! It depends what happens with that extra money. Every deficit is good for *someone*.

12- This answer ignores Erik’s point about inflation being a (stealth) tax. Merely saying that “every deficit is good for someone” is misleading...

When the government taxes Peter to give to Paul, surely that’s good for Paul. But what about Peter??

When the government taxes Peter to give to Paul, surely that’s good for Paul. But what about Peter??

13- Ms. Kelton’s response also misses the crux of Erik’s question. Economics 101 tells us that when you increase the supply of something, the value of each individual unit of that thing falls.

Why would this basic economic concept not hold true for money?

Why would this basic economic concept not hold true for money?

14- When inflation comes about, MMT’s proposed method to control it is taxes (the focus often being on “taxing the rich”).

But Erik points out a flaw in the logic: taxing the rich does not guarantee that their spending will fall...

But Erik points out a flaw in the logic: taxing the rich does not guarantee that their spending will fall...

15- The rich, as Erik notes, have enough money to continue spending despite the tax.

So to really get the rich to spend less and curb inflation, we’d have to tax them half to death and basically cripple them.

In a just & free society, this is not an acceptable solution, IMO.

So to really get the rich to spend less and curb inflation, we’d have to tax them half to death and basically cripple them.

In a just & free society, this is not an acceptable solution, IMO.

16- More generally, Ms. Kelton assumes that inflation is tractable and ignores the psychological element of inflation (which I explain in tweets 4 & 4A in linked thread below).

The fact is, inflation can be intractable and run away from us (hence the term “runaway” inflation). https://twitter.com/bvddycorleone/status/1315112033973661696

The fact is, inflation can be intractable and run away from us (hence the term “runaway” inflation). https://twitter.com/bvddycorleone/status/1315112033973661696

17- Ms. Kelton understands the elusive nature of inflation. She says: “It's a complex phenomenon. There isn’t an economist on Earth who can write down a model of inflation that will apply in all times.”

If that’s true, how will she control inflation when it rears its ugly head? https://twitter.com/lawrencelepard/status/1322902236888993792

If that’s true, how will she control inflation when it rears its ugly head? https://twitter.com/lawrencelepard/status/1322902236888993792

18- All in all, whatever your or my personal opinions on MMT, I believe it’s extremely important to study and understand, now more than ever, as its implications on the world of economics and investing are simply too consequential to ignore.

19- Bottom line, MMT has gone mainstream. The more people begin to accept & acknowledge its descriptive accuracy, the more it will be used to make normative statements about how governments should wield the “power of the purse” to achieve certain aims that they consider worthy.

HT to a bunch of other folks who helped get me thinking or shape my understanding on MMT:

@kevinmuir @hkuppy @coloradotravis @SantiagoAuFund @profplum99 @GeorgeSelgin @LukeGromen @LawrenceLepard @NathanTankus

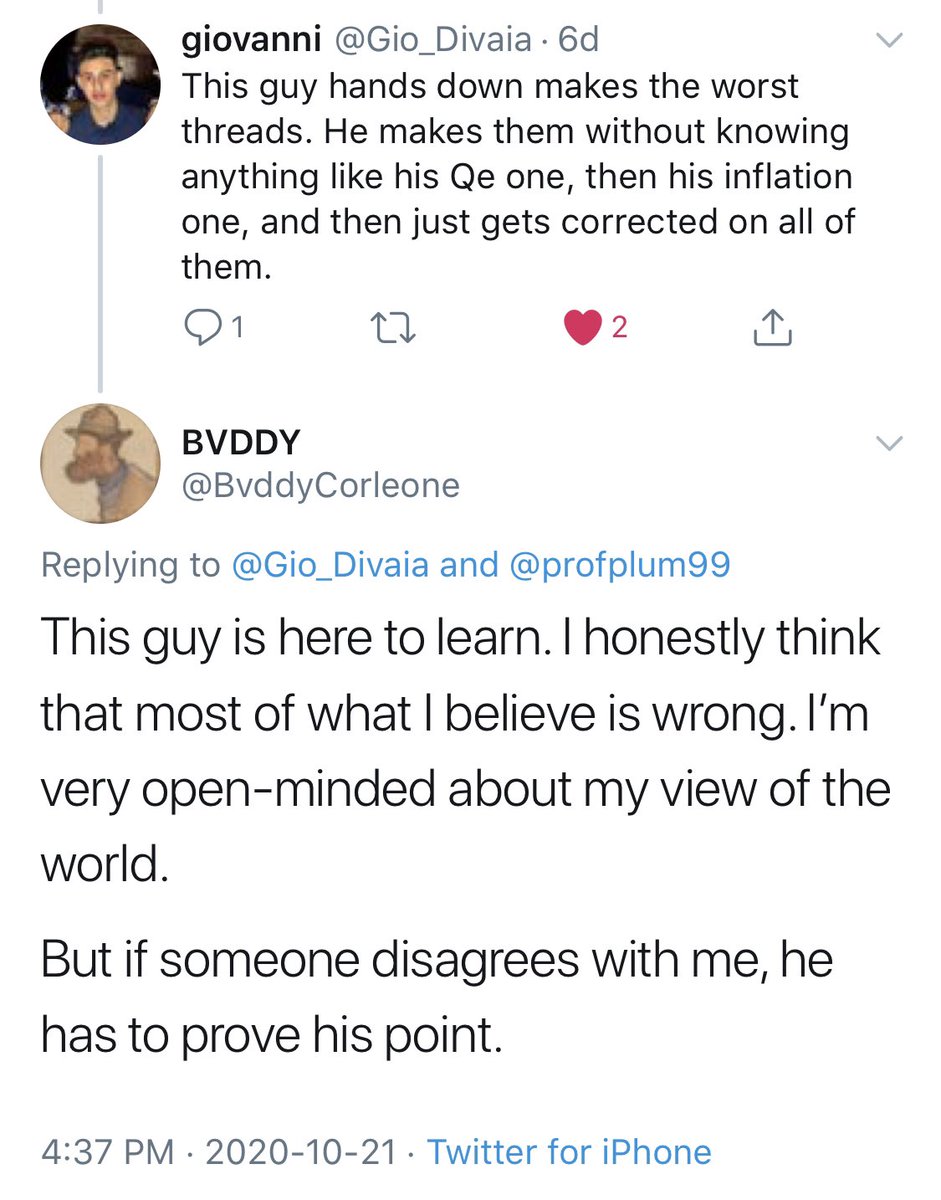

If you think I’m flat-out wrong, just say so and help educate me...

@kevinmuir @hkuppy @coloradotravis @SantiagoAuFund @profplum99 @GeorgeSelgin @LukeGromen @LawrenceLepard @NathanTankus

If you think I’m flat-out wrong, just say so and help educate me...

Read on Twitter

Read on Twitter