A bit more on global debt issues, spurred by the @petersgoodman article.

As noted in the NYT, debt service deferral cannot be the only way to help low income countries, as not all low income countries are highly indebted.

Yet some countries really do have too much debt

1/x

As noted in the NYT, debt service deferral cannot be the only way to help low income countries, as not all low income countries are highly indebted.

Yet some countries really do have too much debt

1/x

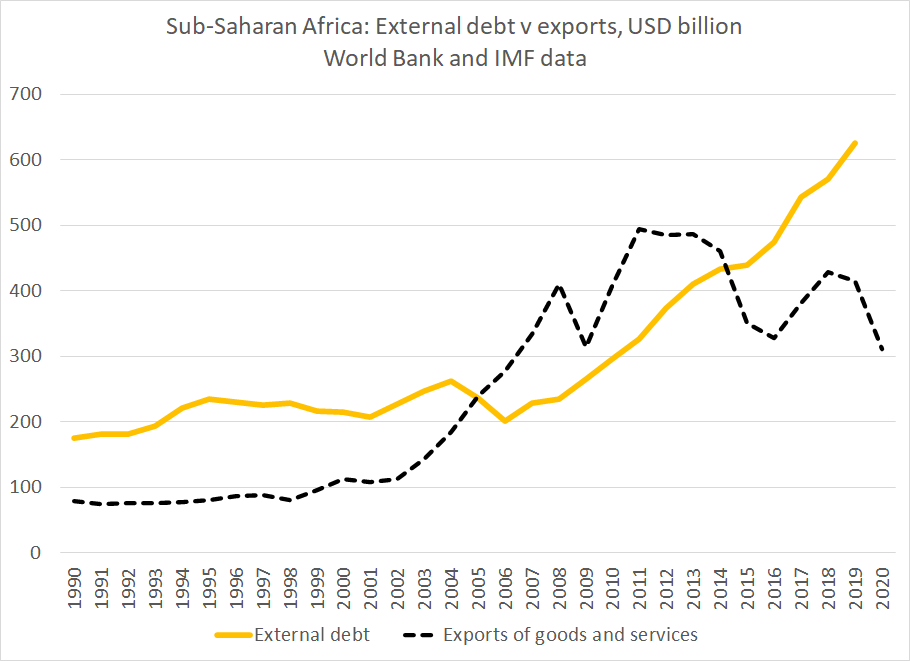

As the chart above shows, African countries borrowed heavily between 2010 and 2019 -- so external debt, net of reserves, rose from around $100b to over $400b ...

That's a problem now, as exports (needed to repay external debt) are down. External debt is now 2x exports

2/x

That's a problem now, as exports (needed to repay external debt) are down. External debt is now 2x exports

2/x

And since most of the new debt has come from Chinese policy banks and the bond market not traditional bilateral lenders or the MDBs, it carries a fairly high (for Africa) interest rate. Interest payments are rising faster than total debt

3/x

3/x

Focusing narrowly on public debt to GDP imo misses the real problem: project finance often is off the public balance sheet, and a lot of Africa's externa debt carries a relatively high interest rate. Interest payments relative to exports are back at pre-HIPC levels

4/x

4/x

The G-20's DSSI tried to treat all low income debt countries debt uniformly, but it didn't really work.

The bulk of both China's debt and bonded debt is concentrated in 10 of the 70 countries. The distribution is not uniform ...

5/x

The bulk of both China's debt and bonded debt is concentrated in 10 of the 70 countries. The distribution is not uniform ...

5/x

For the heavily indebted countries (Angola, where the IMF continues to ignore the concerns about sustainability in its program; Zambia; Laos, Mozambique and probably others) the modest short-term payments deferral provided by the DSSI is simply insufficient.

6/x

6/x

For others, deferring payments in 2020 and the first half of 2021 for 2-3 years only adds to the debt service spike created by the pattern of existing bond amortizations. It doesn't actually help much -- a broader restructuring is needed to give time for a real recovery

7/x

7/x

And finally for the bulk of the DSSI countries, even with full Chinese policy bank participation, there just isn't that much bilateral debt coming due. Help needs to come through different channels

8/x

8/x

That is why in my view it was a mistake to think of debt service suspension as the primary way of supporting low income countries in a pandemic.

the debt service deferral should serve a different purpose ...

9/x

the debt service deferral should serve a different purpose ...

9/x

Namely, the deferral of debt service in is needed to assure that the necessary mobilization of international concessional resources to help fight the pandemic doesn't go to the repayment of Chinese or commercial debts (especially in countries with high debt levels).

10/x

10/x

These points are discussed, tho perhaps more obliquely, the interim report of the Group of Thirty

11/x

https://group30.org/publications/detail/4799

11/x

https://group30.org/publications/detail/4799

Peter Goodman did the world a service by drawing attention to the limited nature of the global response.

The low interest rates in advanced economies don't flow naturally through to low income countries. That takes international institutions!

12/12 https://www.nytimes.com/2020/11/01/business/coronavirus-imf-world-bank.html

The low interest rates in advanced economies don't flow naturally through to low income countries. That takes international institutions!

12/12 https://www.nytimes.com/2020/11/01/business/coronavirus-imf-world-bank.html

Read on Twitter

Read on Twitter