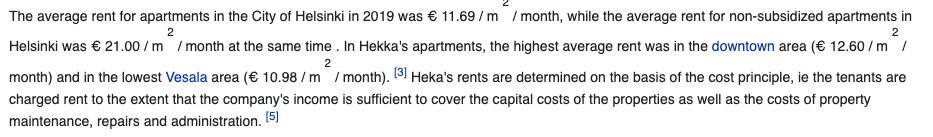

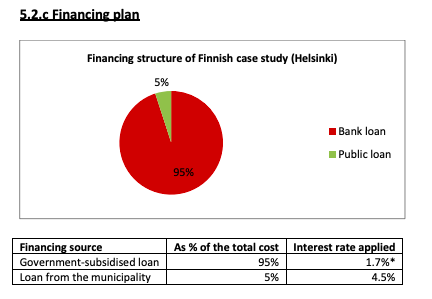

The largest landlord in Finland is simply the city of Helsinki. The homes are publicly owned, publicly financed, & rents are set at cost, or about 1/2 market rate.

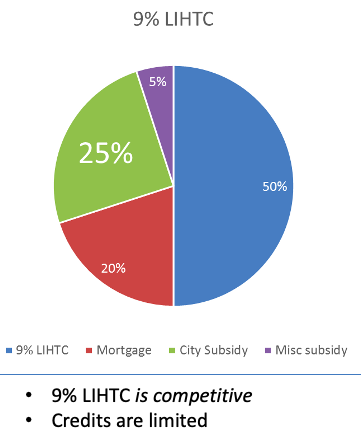

US has a public-private competitive tax credit where affordability lasts 30 years then dies

https://www.abecip.org.br/admin/assets/uploads/anexos/pekka-averio-finlandia.pdf

US has a public-private competitive tax credit where affordability lasts 30 years then dies

https://www.abecip.org.br/admin/assets/uploads/anexos/pekka-averio-finlandia.pdf

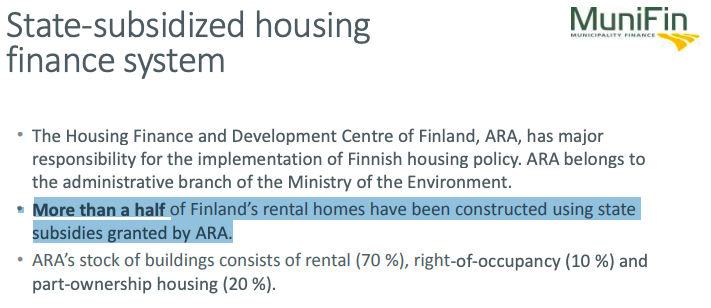

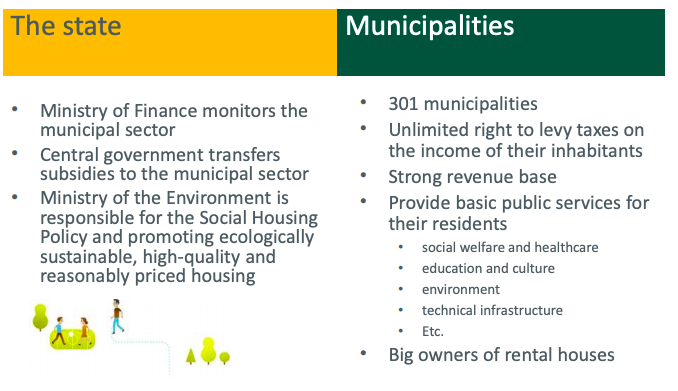

In Finland, gov guarantees the loans for the city to build and pays most of the interest with subsidy.

In the US we have a competitive process that if you win, you get to sell tax credits to banks to cover part of your cost. And then you take out a loan, and apply for more $$.

In the US we have a competitive process that if you win, you get to sell tax credits to banks to cover part of your cost. And then you take out a loan, and apply for more $$.

Big takeaway here is that in the US, we more or less set a limit on the amount of affordable housing that could get financed each year by capping LIHTCs. There are of course tax-exempt bonds and other non-competitive funds, but they aren't too useful for new construction.

Letting municipalities simply develop projects and guaranteeing that when they want to do so they money will be there (guaranteeing loans, subsidizing interest) and having fewer onerous requirements appears to be not only a simpler system, but also one that produces more housing

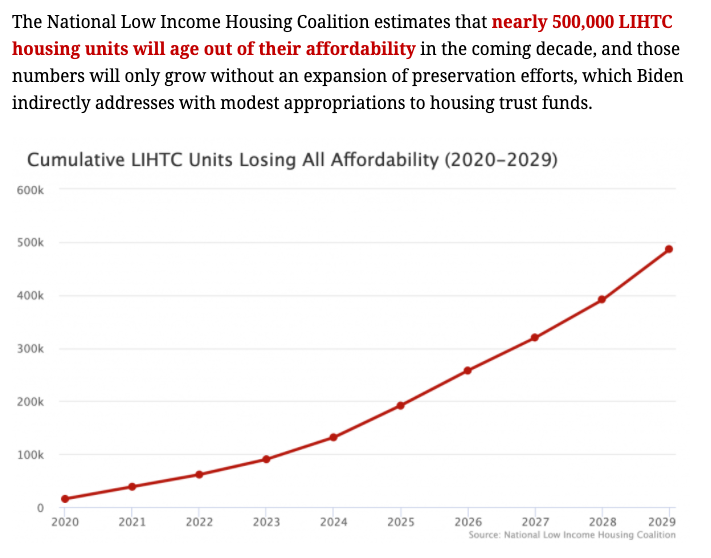

Yes, the 30-year maximum on affordability is going to start producing some bad results over the next decade. LIHTC got off the ground really in the early 90s, ie about 30 years ago. @NLIHC estimates half a million lost units by 2030.

https://twitter.com/akgerber/status/1322969992929906690?s=20

https://twitter.com/akgerber/status/1322969992929906690?s=20

sorry @jdcmedlock it's not the IRS fault they got wrapped up in this program. Reagan's fault.

Read on Twitter

Read on Twitter