An update thread on our Gloversville facility.

Revenue is king. NOI lives and dies by it. And we make AGGRESSIVE rental increase projections on a lot of our new facility acquisitions.

We purchased this facility about two months ago.

It was 67% occupied with poor management. https://twitter.com/sweatystartup/status/1306193869931978752

Revenue is king. NOI lives and dies by it. And we make AGGRESSIVE rental increase projections on a lot of our new facility acquisitions.

We purchased this facility about two months ago.

It was 67% occupied with poor management. https://twitter.com/sweatystartup/status/1306193869931978752

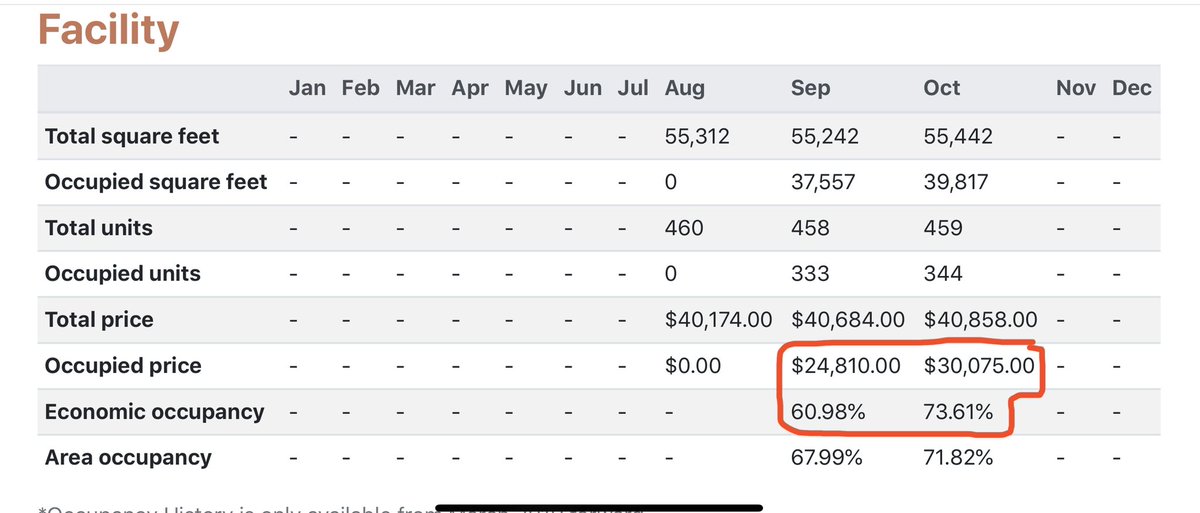

It was doing $25k a month in revenue and $10k in expenses.

Our plan was to increase rents 20% on day one (30 days notice) for all customers to get them up to market rent.

We did it, and we projected losing about 35 tenants (10%).

Our plan was to increase rents 20% on day one (30 days notice) for all customers to get them up to market rent.

We did it, and we projected losing about 35 tenants (10%).

Well we lost about 15 tenants, but we had a NET GAIN of 11 new customers.

We did $30,000 in October.

INCREASED economic occupancy by 13%.

NOI going from $15k to $20k a MONTH in the first 60 days.

From $180k to $240k a year.

If you value this facility at an 8 cap...

We did $30,000 in October.

INCREASED economic occupancy by 13%.

NOI going from $15k to $20k a MONTH in the first 60 days.

From $180k to $240k a year.

If you value this facility at an 8 cap...

We took it from being worth $2.25MM to $3MM in 60 days.

$750k out of thin air!

Wait till we build our 10k sq ft of additional storage in here and fill her up to 90%!

$750k out of thin air!

Wait till we build our 10k sq ft of additional storage in here and fill her up to 90%!

This is a huge win for our team.

We can be more confident than ever heading into our next few acquisitions knowing our revenue projections are soft and we may just blow them out of the water! Just like we did here!

Onward and upward!

We can be more confident than ever heading into our next few acquisitions knowing our revenue projections are soft and we may just blow them out of the water! Just like we did here!

Onward and upward!

Read on Twitter

Read on Twitter