Here are the 100 things I’ve learned in investing.

I’ve updated this over the years to 1) Share 2) Reduce my own unforced errors 3) Reinforce the good habits, like #47.

(THREAD)

I’ve updated this over the years to 1) Share 2) Reduce my own unforced errors 3) Reinforce the good habits, like #47.

(THREAD)

1. Most of this list is dedicated to insight on stock picking, but know this: It's darn hard to beat the market. 99% of people are best served steadily buying and holding low-cost index funds at the core of their portfolios -- and I may be understating that 99% figure.

2. Looking for a diversified, low-cost index-fund core? Vanguard is what I recommend to anyone who asks. Three flavors: 1) Stocks and bonds: Target date funds. 2) Entire world stock market: $VT. 3) Entire world stock market, split up between U.S. and foreign: $VTI + $VXUS.

3. Being contrarian doesn't mean just doing the opposite. The "contrarian" street-crosser gets run over by a truck.

4. In any financial matter, find out what the other person's incentives are. Discount accordingly.

5. Even a gut investment call should have some numerical thinking to back it up. But before you get too carried away with a 100-tab DCF…

6. My all-time favorite Warren Buffett quote: "We like things that you don't have to carry out to three decimal places. If you have to carry them out to three decimal places, they're not good ideas."

7. Mistakes made in your 20s are better than mistakes in your 50s. Mistakes involving $100 are better than mistakes involving $100,000.

8. Don’t buy stocks on margin, no matter how "can't miss" the opportunity is. That blend of leverage and arrogance is exactly what gets Wall Street in trouble. The difference is that we're not too big to fail.

9. Don't waste time mastering things that simply don't work (see lessons 10 through 12).

10. Example No. 1: day trading. Like playing roulette, you'll have some victories, and you may be able to fool yourself into thinking you're skillful. The house just hopes you keep playing.

11. Example No. 2: technical analysis. The only chart pattern worth noting is the jagged, but likely downward-sloping line of your savings if you follow these techniques.

12. Example No. 3: leveraged ETFs. Bastardized ETFs like the Direxion Daily Financial Bull 3X ($FAS) are another great way to lose money. Even if you guess right on direction, the mathematics of the daily reckoning mean these instruments are long-term losers.

13. The effort to save more than 10% of your salary is more efficient, effective, and rewarding than the effort to return more than 10% on those savings.

14. Having a strong opinion (let alone acting on it) is overrated. Knowing 20 stocks cold beats being able to challenge Jim Cramer in the lightning round.

15. Albert Einstein allegedly declared compound interest "the most powerful force in the universe." High-interest credit card debt aims that force against your wallet. To get compound interest pointed in the right direction, save (and invest) early and continuously!

16. Casinos use chips instead of cash for a reason. Similarly, it’s easy to lose sight that stocks represent real companies. Peter Lynch uses another gambling analogy: "Although it's easy to forget sometimes, a share is not a lottery ticket ... it's part-ownership of a business."

17. Have your BS detector handy with other investors. When you hear their "big fish" stories, know that their brilliant track records likely have more to do with selective memory, poor scorekeeping, or a statistically insignificant time period than skill.

18. A great Buffett reason not to fudge our taxes: "We'll never risk what we have for what we don't have and don't need."

19. Those who know what they're doing make complexity seem simple. Folks who don't (or are trying to sell you something) make simplicity complex. A clear sign of the latter: jargon.

20. Mike Tyson’s line is a great reminder for humility: "Everybody has a plan until they get punched in the mouth."

21. Asset allocation is more important than stock picking. Say you're holding a race among five horses and five human beings. Many investors spend their time trying to rank the five human beings, when they're better off just betting on the five horses.

22. If you don't understand it, don't buy it until you do.

23. *Sigh* -- hard work is required to beat the market. Per Peter Lynch: "The person that turns over the most rocks wins the game. And that's always been my philosophy."

24. On the plus side, the results of hard work can be breathtaking. The 10,000-hour examples Malcolm Gladwell used included Bill Gates and the Beatles. (cont.)

24. (cont.) In middle school, Gates had access to a high-end computer terminal; in high school, he’d log 20 to 30 hours of programming time at the University of Washington each weekend plus 3AM to 6AM open time-sharing slots on weekdays. (cont.)

24. (cont.) By the time the Beatles broke out on the Ed Sullivan show in 1964, the Beatles had played an estimated 1,200 shows, some lasting eight hours!

25. On the minus side, none of the time spent checking and rechecking your portfolio’s gyrations counts toward those 10,000 hours. And know that 10,000 hours is a prerequisite for mastery -- not a guarantee.

26. Diversification doesn't entail making a whole bunch of dangerous investments and hoping they cancel out. That's the financial equivalent of stabbing your leg to cure your flu.

27. One of my favorite lessons from the poker table: Action is overrated. The best players (and investors) are constantly weighing the opportunities, but rarely are they moved to act.

28. A similar sentiment by Vanguard founder Jack Bogle: "Time is your friend; impulse is your enemy."

29. Selling is frequently a bad move b/c 1) We sell potential multi-bagger winners that would more than make up for our losers. 2) Outside of retirement accounts, selling kicks in voluntary taxes.

30. Adding money to winners > Adding money to losers. This one’s hard. One way I try to remind myself: Every 10-bagger has to double first; Every total loss has to drop 50% first.

31. In practice, it’s more important to tailor your portfolio allocations to your emotions than to total theoretical returns. E.g. If having an extra 10% in cash keeps you from selling out of your stocks during a crash, it’s worth it.

32. In the hands of a good storyteller, almost every stock sounds like a winner. Assume you're not hearing the whole story.

33. A question to ask before buying a stock: "What's my competitive advantage on this stock? Do I really know something the market doesn't?" The more specific the advantage, the better.

34. Sweat the big stuff.

35. Too many of us are too enamored with "so you're saying there's a chance" opportunities. A Hail Mary belongs on the gridiron or in the pew -- not in the brokerage account.

36. A good rule of thumb from fellow Fool Buck Hartzell: "If a home is selling for 150 times the monthly rent (or less), it's generally a good deal. If it's selling for more than 200 times the monthly rent of a comparable property, you're better off renting."

37. One of the toughest facts about investing is that a proper track record takes decades. Charlatans can do quite well for years and years. There isn’t a ready solution that I’ve seen, but focusing on process rather than results helps.

38. While price matters, it’s hard to overpay for a truly great growth company. Like in a marriage, the trick is to correctly identify one, build conviction by learning more quarter after quarter, and try to hold on through the inevitable tough times. (cont.)

38. (cont.) Buying Amazon at its dotcom bubble peak meant seeing its shares fall more than 90% as the bubble burst and holding a losing position even a decade later. It also meant a 10+ bagger two decades later.

39. When applicable, use the tax system to your advantage. Retirement accounts like 401(k)s and IRAs can be huge boons.

40. It’s at least twice as easy to sound intelligent being pessimistic about the future as it is being optimistic; Relatedly, the truly smart money often sounds dumb in the moment.

41. Options promise big gains in short time periods. The problem? About three out of every four expire worthless. Contrast that with a stock, which doesn't expire.

42. Sir John Templeton's quote: "'This time it's different' are the four most expensive words in the investing language." The details change, but the basic storylines remain the same.

43. Investing should be closer to stand-up than improv. Be open to a “Yes, and” and ready for hecklers, but take the time to write a thoughtful script ahead of time.

44. A key Buffett quote to understand: "Time is the friend of the wonderful company, the enemy of the mediocre." Why is this so? Partially because "you only find out who is swimming naked when the tide goes out."

45. Jumping from one flavor of the week to the next isn't continuous learning.

46. Sorry, market timers: Per Peter Lynch: "If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes." Benjamin Graham agrees: "It is absurd to think that the general public can ever make money out of market forecasts."

47. Keep a journal (or spreadsheet) of your stock picks, complete with your rationale for each move. Then look back on it to see if you were right. We may think we're good dressers, but all it takes is a high-school yearbook to prove otherwise.

48. Step aside, high blood pressure: Inflation is the silent killer.

49. The more we learn about investing, the more we want to start doing exotic things (naked straddle options, anyone?) and buying stock in obscure companies no one has heard of. Maybe it's boredom, maybe arrogance, or maybe the desire to impress. (cont.)

49. (cont.) Or the glory of being right when few saw it coming. Guilty as charged on all counts! When I'm at risk of going off the deep end, I try to remember that stock picking isn't diving. As Buffett has noted, there are no extra points (or returns) for degree of difficulty.

50. The 13 Steps to Investing Foolishly is excellent advice: https://www.fool.com/how-to-invest/thirteen-steps/index.aspx

51. Somewhere around 80% of actively managed mutual funds (as opposed to market-matching index funds) don't beat the market.

52. The old saying goes, "success has many fathers, while failure is an orphan." Combine that with our willingness to overvalue one-event “streaks,” and I start to wonder: Do we overvalue managers that leave a successful organization to turn around a woeful organization?

53. Common sense is as uncommon in investing as it is in real life.

54. This Einstein maxim is spot-on for stock analysis: "Everything should be made as simple as possible, but no simpler." Both clauses are crucial.

55. Just because a company or industry is set to change the world doesn't mean it's a great investment. Beyond looking at valuation, there tends to be a Wild West of players until a few winners emerge. (cont.)

55. (cont.) Of course, the dotcom-bubble-era Internet companies, but also automobiles (there have been about 3,000 U.S. car companies), and even breakfast cereals (there were 80+ cereal start-ups just in Battle Creek, Michigan in the first decade of the 1900’s). (cont.)

55. (cont.) Market beater Ralph Wanger notes, "Since the Industrial Revolution began, going downstream -- investing in businesses that will benefit from new technology rather than investing in the technology companies themselves -- has often been the smarter strategy." (cont.)

55. (cont.) The winnowing down of new industry players also reinforces to me why it’s a great strategy to invest in the leading companies vs. laggards and why “winners keep winning.” Advantages compound.

56. Greater risk theoretically yields greater reward, but a stupid investment is just a stupid investment.

57. Long-tail events (aka black swans), as explained in

@nntaleb's Incerto series, are by definition unpredictable. And brutal. Since life isn’t a Monte Carlo simulation, we should think hard about our true personal risk tolerances. #YOLOsLessPopularEmoBrother

@nntaleb's Incerto series, are by definition unpredictable. And brutal. Since life isn’t a Monte Carlo simulation, we should think hard about our true personal risk tolerances. #YOLOsLessPopularEmoBrother

58. My three strikes against extreme goldbugs. Strike one: Gold’s value can't be estimated with basic math (since it just sits around producing nothing). (cont.)

58. Strike two: Wharton professor Jeremy Siegel showed that going back to the 1800s, its return has barely kept up with inflation and is left in the dust by stocks and bonds. (cont.)

58. Strike three: Gold as a doomsday investment doesn't make much sense. If the apocalypse (financial or otherwise) actually comes, you're probably screwed regardless.

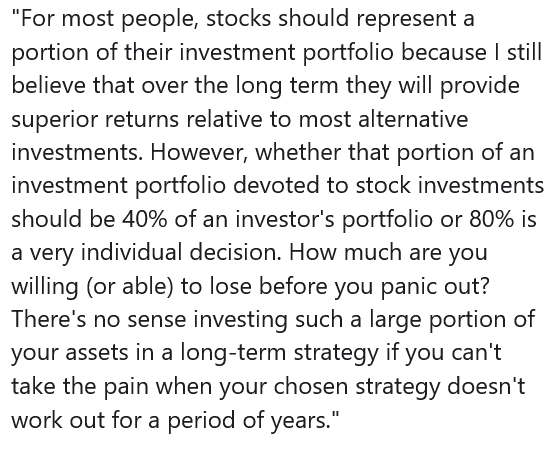

59. Falling knives can be death -- especially when they're rusty and gross.

60. A related point: No one consistently times the bottom or top of a stock's price (let alone the market of stocks!).

61. Don't let the false modesty of investing greats fool you into false confidence.

62. There are no sure-thing stock picks. As master investor T. Rowe Price noted: "No one can see ahead three years, let alone five or ten. Competition, new inventions -- all kinds of things -- can change the situation in twelve months." Diversification = Humility.

63. Cash on a struggling company's balance sheet buys time for a turnaround, but beware beyond that flexibility. Theses like “this company is basically selling for its cash” can prove elusive when the company is bleeding cash flow. See also underlying real estate assets.

64. Done properly, value investing has proven to work quite well. But as successful growth-investor Bill O'Neil warns, "What seems too high and risky to the majority generally goes higher, and what seems low and cheap generally goes lower."

65. The Pareto Principle (aka the 80/20 Rule) is just as true in the stock market as it is in all aspects of life. A handful of mega-winner stocks and a handful of days over decades drive returns.

66. Related to #65, valuation metrics matter less and less the smaller the market cap, the greater the quality of the business, and the larger the growth opportunity.

67. Know thyself. Know your weaknesses and strengths. Here's a specific example from Joel Greenblatt:

68. Index ETFs are amazing tools for ultra-low-cost buy-and-hold diversification, but do the devil’s work when used to day trade.

69. If you just heard of the company yesterday, don't buy its stock today.

70. The Internet and better regulations have largely eliminated data availability advantages. The problem now is isolating which data are actually meaningful. Better results stem from increasing the signal-to-noise ratio.

71. Even if you rely on advice from others, heed the words of bond fund legend Bill Gross: "Finding the best person or the best organization to invest your money is one of the most important financial decisions you'll ever make." Familiarity alone isn't protection.

72. Stuff that leads to suckerdom: greed, laziness, unearned trust, ignorance, and shortcuts. When in doubt financially, do the opposite of your favorite athlete.

73. Make sure to get the right odds. As George Soros puts it, "It's not whether you're right or wrong that's important, but how much money you make when you're right and how much you lose when you're wrong."

74. Initial valuation matters, but generally, over longer periods of time (decades, not years), stocks have returned more than bonds. The more decades you have left, the more of your portfolio should be in stocks to stave off inflation.

75. In theory, well-timed share buybacks are better than dividends. They save on taxes and allow the people who know the company best to buy up shares when the market acts crazy. In practice, I'll usually take dividends.

76. Some of the most misinterpreted words in investing: Peter Lynch's "Buy what you know." It's more like "Research what you know and then consider buying."

77. Beware of becoming an Enron baby. It’s one thing to hold shares and participate in the upside of the company you’re helping to build. It’s another if you’re “all-in.” It feels amazing in good times, awful when you’re laid off during a recession.

78. There are many paths to the top of the investing mountain, but some are more fraught with peril -- and there are very few trailblazers.

79. Numbers frequently lie -- especially in isolation. Say you spot a P/E ratio of eight. Sounds darn cheap! But is that industry's profitability rapidly deteriorating? Was there a one-time item that temporarily juiced the bottom line? (cont.)

79. (cont.) Is an upstart competitor hungrily eyeing its lunch? Are new regulations threatening its livelihood? Is it a cyclical industry? Is it in a country that has a really poor reputation for accounting fraud or government interference? You get the idea.

80. Mergers and acquisitions are overrated. Somewhere between 50% and 85% of mergers fail to boost value. The frequency of achieving promised "synergies" should be filed somewhere between unicorns and no-hitters.

81. It's hard to be an independent thinker when the pressures to conform are daily and good investment theses can look ugly for years before paying off. (cont.)

81. (cont.) Ben Graham said it this way: "Even the intelligent investor is likely to need considerable willpower to keep from following the crowd." (cont.)

Read on Twitter

Read on Twitter