Please share: The Charity Tax Group website now has a full summary of what we know about the extended #JobRetentionScheme (until December) and local #BusinessGrants. The Job Support Scheme has been postponed until the furlough scheme ends https://www.charitytaxgroup.org.uk/news-post/2020/furlough-scheme-extended-economic-support-announced/

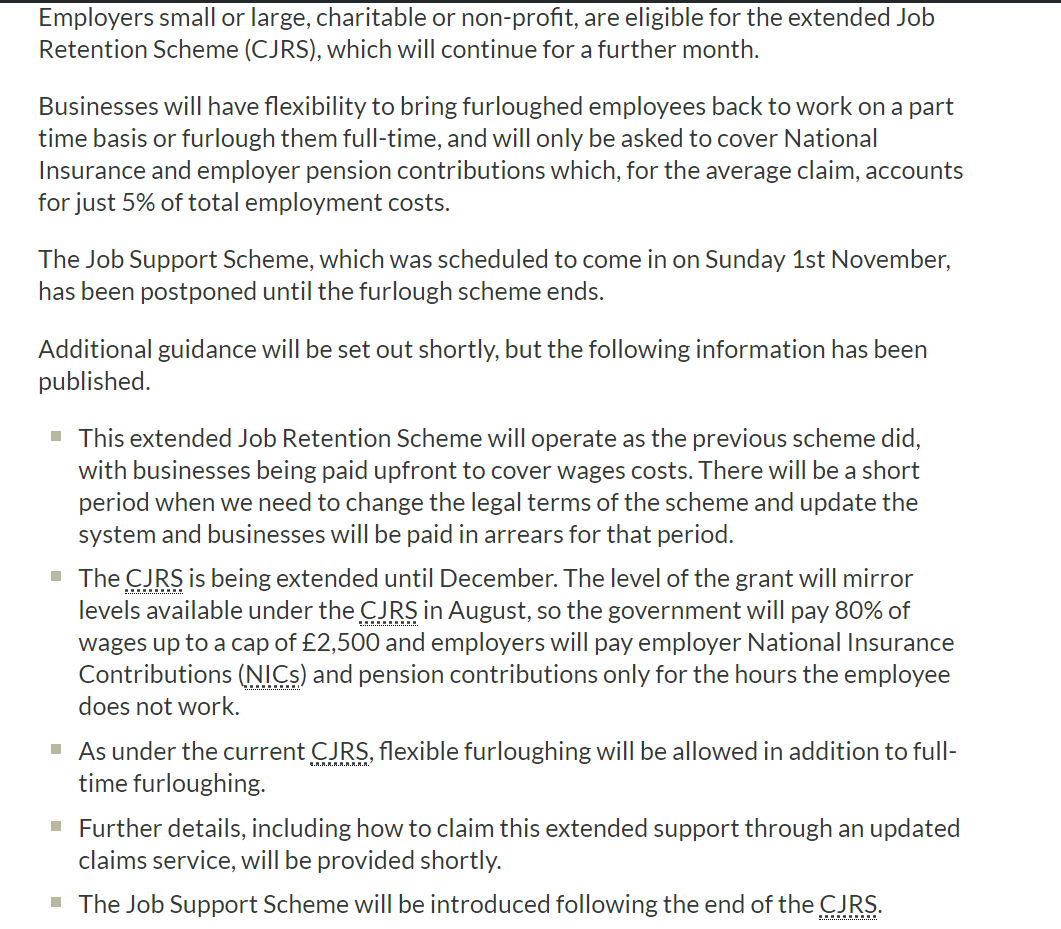

The guidance confirms charities can use the extended #JobRetentionScheme. Key takeaways include: Part-furloughing ; Same repayment/claiming system same but new service planned; August rules apply - Govt pay 80% (capped at £2.5k) & employers pay ER NICs + pension contributions

; Same repayment/claiming system same but new service planned; August rules apply - Govt pay 80% (capped at £2.5k) & employers pay ER NICs + pension contributions

; Same repayment/claiming system same but new service planned; August rules apply - Govt pay 80% (capped at £2.5k) & employers pay ER NICs + pension contributions

; Same repayment/claiming system same but new service planned; August rules apply - Govt pay 80% (capped at £2.5k) & employers pay ER NICs + pension contributions

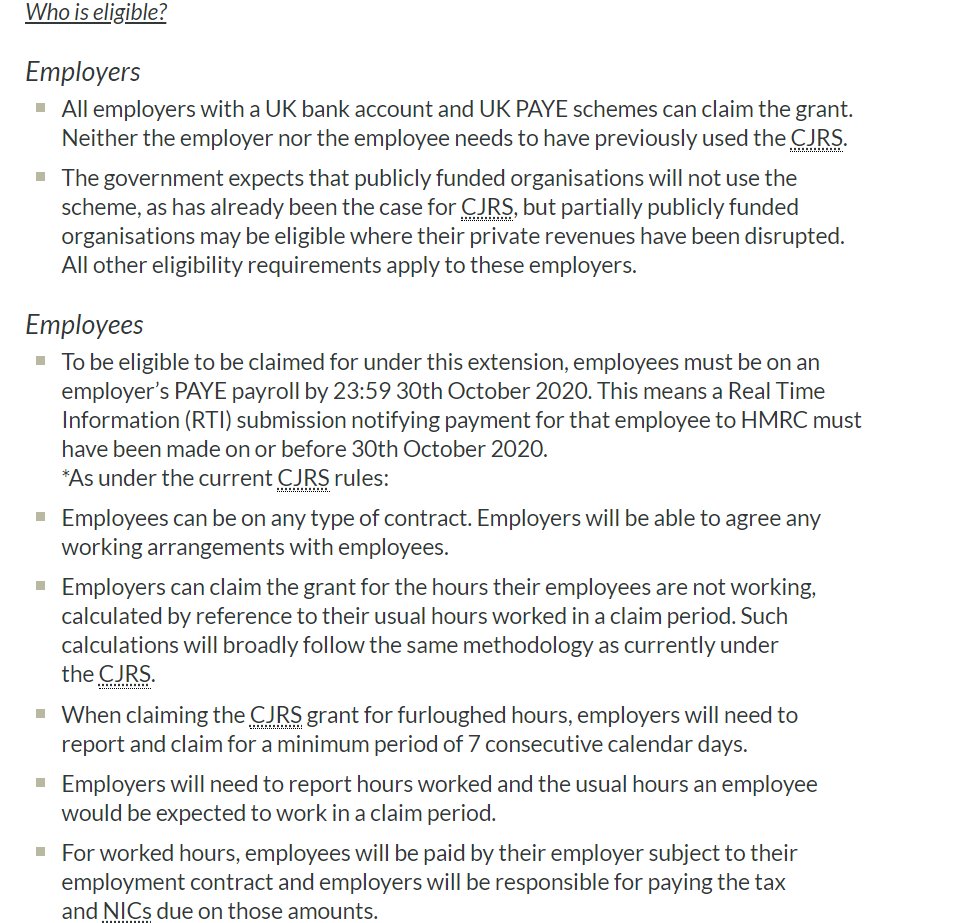

More info on #JobRetentionScheme: Neither the employer nor the employee needs to have previously used it; same rules on publicly funded organisations apply; Employees can be on any type of contract; Must have been on the payroll on 30 October

Extended #JobRetentionScheme: what support is being provided and employer costs? For hours not worked by the employee, the government will pay 80% of wages up to a cap of £2,500. Employers will cover ER NICS and pension contributions; Employers can top up wages if they wish

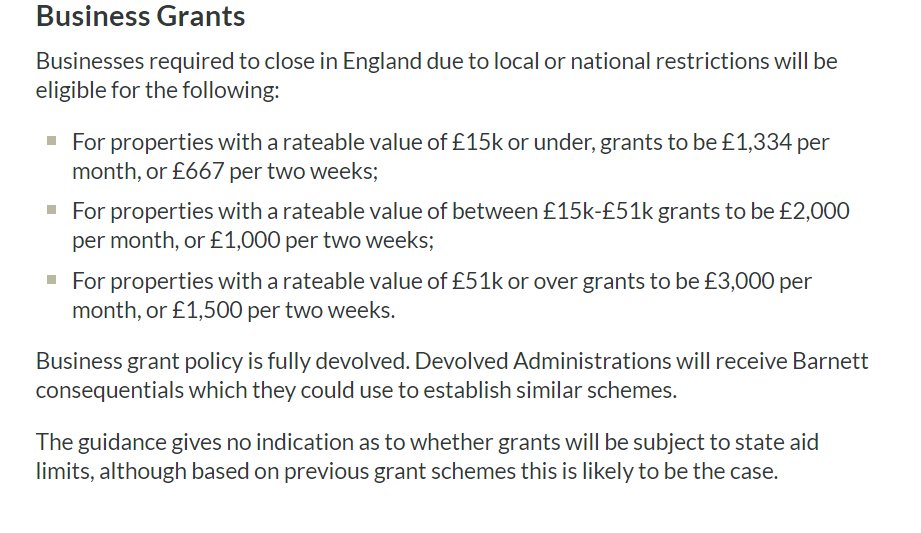

Lastly, businesses required to close in England due to local or national restrictions will be eligible for #BusinessGrants (see details in the graphic). NB grants will most likely be subject to #StateAid restrictions. Applies to England only as responsibility for grants devolved

Please share - this summary of the extended #JobRetentionScheme & #BusinessGrants may be of interest to your followers @CFGtweets @NCVO @sccoalition @CIOFtweets @CommLeisureUK @Aimuseums @ACFoundations @CharityRetail @ACEVO @bufdg @NAVCA @DSC_Charity @AMRC https://www.charitytaxgroup.org.uk/news-post/2020/furlough-scheme-extended-economic-support-announced/

Read on Twitter

Read on Twitter