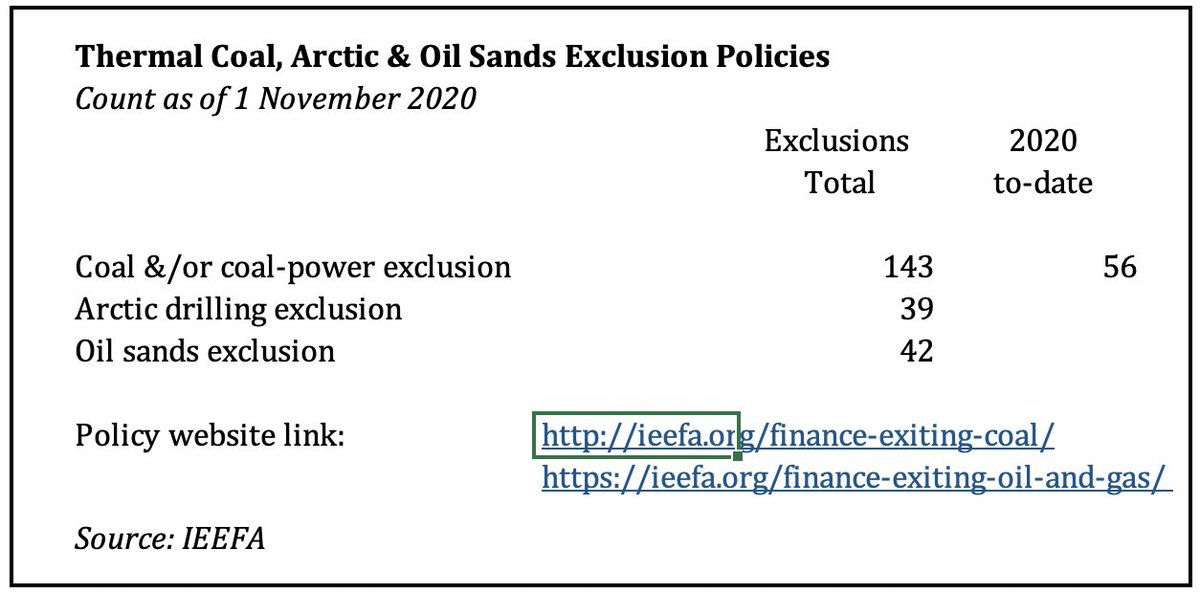

We believe @BlackRock made a profound announcement in January 2020 in announcing “A fundamental reshaping of finance”. We have tracked #56 new or improved coal divestment statements from globally significant financial institutions in 2020 to-date.

https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

https://www.blackrock.com/corporate/investor-relations/larry-fink-ceo-letter

And @BlackRock divested all thermal coal from its US$1.8 trillion of active funds, debt and equity. @PeabodyEnergy is down 85% since, including down 10% one day this week.

And this week we saw both Japan and South Korea announced their commitment to net zero by 2050, following China’s climate leadership on this last month. @IEEFA_AsiaPac

Both &

&  restricted new coal as well this week.

restricted new coal as well this week.  https://ieefa.org/ieefa-why-2020-is-turning-out-be-a-pivotal-year-for-fossil-fuel-exits/

https://ieefa.org/ieefa-why-2020-is-turning-out-be-a-pivotal-year-for-fossil-fuel-exits/

Both

&

&  restricted new coal as well this week.

restricted new coal as well this week.  https://ieefa.org/ieefa-why-2020-is-turning-out-be-a-pivotal-year-for-fossil-fuel-exits/

https://ieefa.org/ieefa-why-2020-is-turning-out-be-a-pivotal-year-for-fossil-fuel-exits/

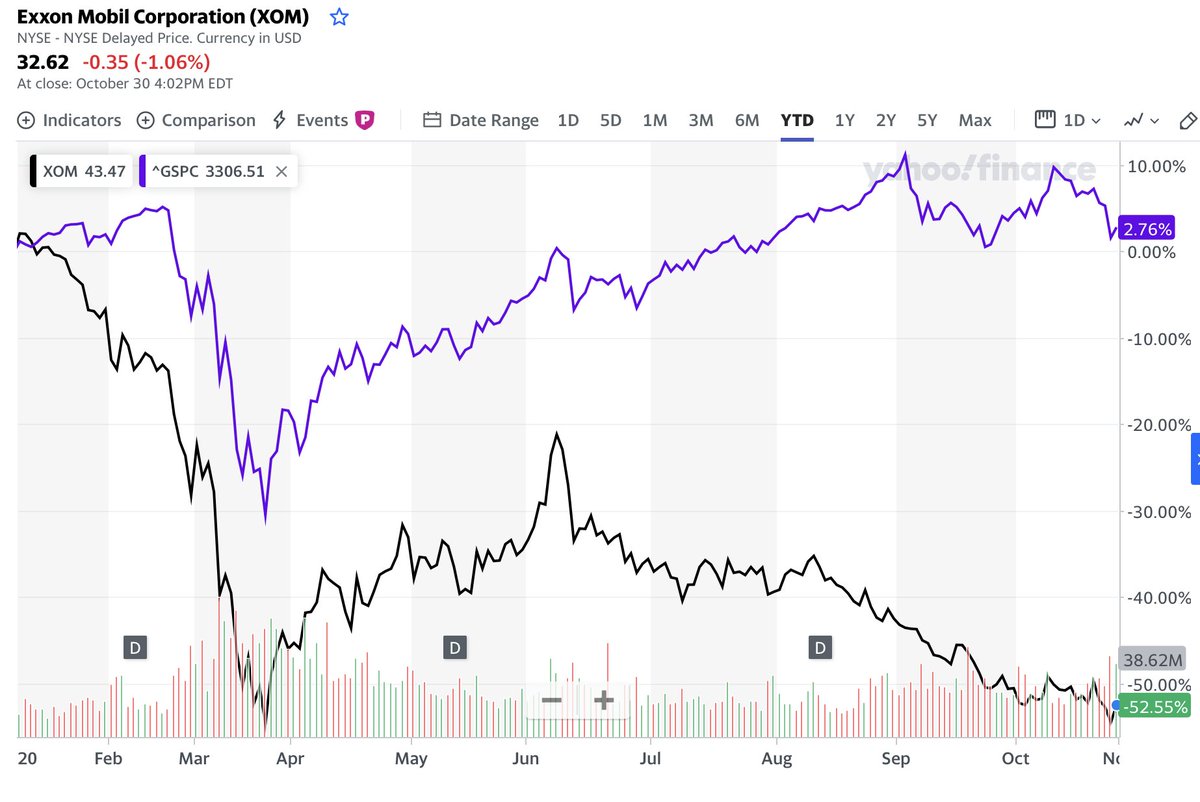

But I bet @BlackRock is really annoyed they didn’t follow their own advice on stranded asset risks. Blackrock has followed @ExxonMobil’s climate science denial all the way down. Fossil fuels are proving a real wealth hazard!

We at @IEEFA_AsiaPac suggested @BlackRock divest fossil fuel laggards back in August 2019. https://ieefa.org/ieefa-report-blackrocks-fossil-fuel-investments-wipe-us90-billion-in-massive-investor-value-destruction/

We referenced Blackrock’s own clear research showing climate’s financial risks are under-priced. https://www.blackrock.com/institutions/en-zz/insights/blackrock-investment-institute/physical-climate-risks

Despite belatedly acknowledging climate risks, Larry Fink was spruiking oil & gas February 2020 @financialReview https://www.afr.com/chanticleer/blackrock-s-coal-mining-pragmatism-20200225-p5447p

BlackRock says engagement without a deadline and with no consequences is how it ‘works’ ESG, because they would rather avoid divesting collapsing firms?!

BlackRock engaged with @generalelectric all the way through its coal power driven collapse.

BlackRock engaged with @generalelectric all the way through its coal power driven collapse.

IEEFA’s @generalelectric report we wrote with Tom Sanzillo & @kathy_hipple, suggesting GE cut its losses in coal power back in June 2019. https://ieefa.org/ieefa-report-ge-made-a-massive-bet-on-the-future-of-natural-gas-and-thermal-coal-and-lost/

GE did exit new coal power plant development, very belatedly and at massive cost to its shareholders, like @BlackRock.

https://www.reuters.com/article/ge-power/update-1-ge-plans-to-stop-making-coal-fired-power-plants-idUSL3N2GI2M3 @BLKsBigProblem

https://www.reuters.com/article/ge-power/update-1-ge-plans-to-stop-making-coal-fired-power-plants-idUSL3N2GI2M3 @BLKsBigProblem

By comparison, Marubeni Corporation of Japan saw the light a lot earlier, exiting in September 2018, helping set in motion a major rethink of #coal climate risks across Japan.

@IEEFA_AsiaPac's Marubeni Corp report in July 2018 by @simonjnicholas. https://ieefa.org/ieefa-report-marubenis-coal-commitments-are-putting-its-power-business-in-jeopardy/

@IEEFA_AsiaPac's Marubeni Corp report in July 2018 by @simonjnicholas. https://ieefa.org/ieefa-report-marubenis-coal-commitments-are-putting-its-power-business-in-jeopardy/

Read on Twitter

Read on Twitter