It’s worth bearing in mind that Satoshi is probably Paul Le Roux; a legit (if wayward) genius, exact fit both for skills and utility of the system, and one of the few people with a) a very serious real-world need for anonymity and b) the technical chops to actually maintain it.

Barefaced stuff from Nic Carter.

https://medium.com/@nic__carter/bitcoin-at-12-f6fce39cb9bb

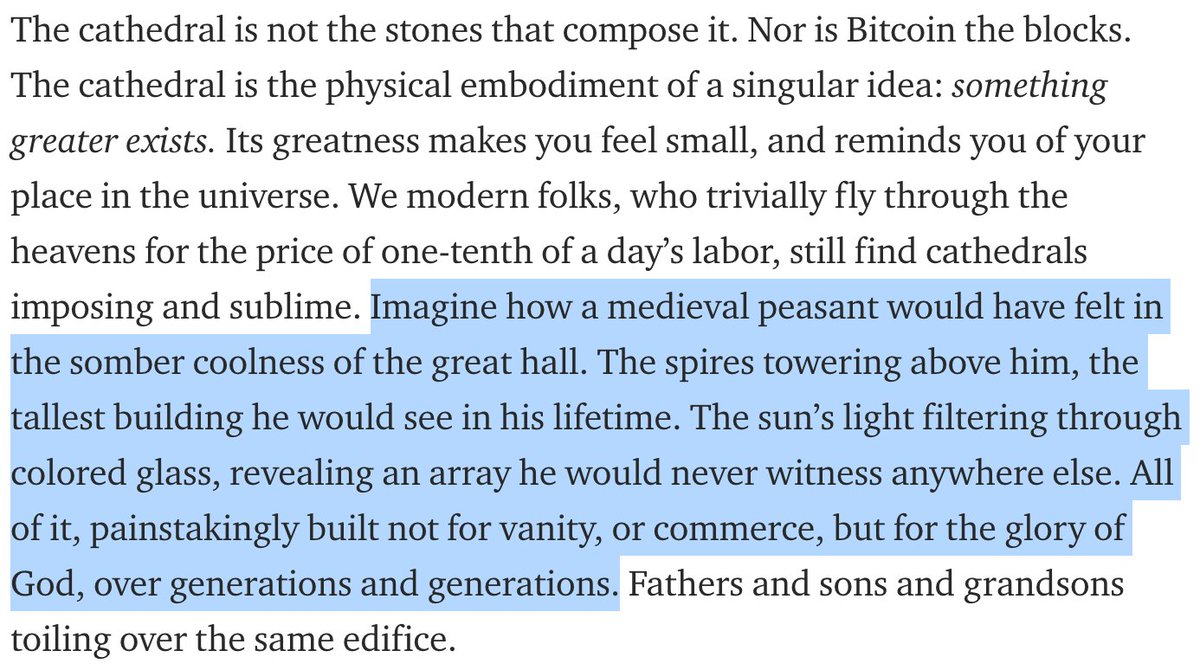

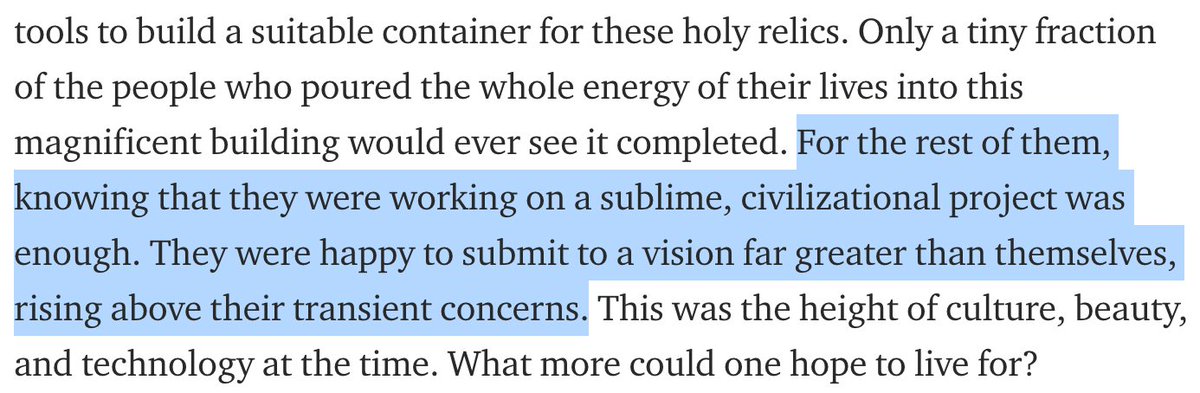

He writes about devotion to something larger than oneself and serving long-term non-financial interests knowing full well Bitcoin is 99.9% composed of intensely individual short-term interest in making money.

https://medium.com/@nic__carter/bitcoin-at-12-f6fce39cb9bb

He writes about devotion to something larger than oneself and serving long-term non-financial interests knowing full well Bitcoin is 99.9% composed of intensely individual short-term interest in making money.

The religious language is not an accident. Nor is the use of big fancy words to convey authority. This man is transparently hacking the meaning-making centre of your brain.

Unreal... You sort of have to respect the honesty here from @tracyalloway: “ #Bitcoin  because fuck truth; fuck actually making sense; fuck integrity; it’s good at recursively leveraging confused people’s hopes & dreams to manufacture a demand pyramid.”

because fuck truth; fuck actually making sense; fuck integrity; it’s good at recursively leveraging confused people’s hopes & dreams to manufacture a demand pyramid.”  https://twitter.com/tracyalloway/status/1323416097891078145

https://twitter.com/tracyalloway/status/1323416097891078145

because fuck truth; fuck actually making sense; fuck integrity; it’s good at recursively leveraging confused people’s hopes & dreams to manufacture a demand pyramid.”

because fuck truth; fuck actually making sense; fuck integrity; it’s good at recursively leveraging confused people’s hopes & dreams to manufacture a demand pyramid.”  https://twitter.com/tracyalloway/status/1323416097891078145

https://twitter.com/tracyalloway/status/1323416097891078145

When you understand that it’s fake, but that the incentive coordination and resulting behaviour is nonetheless real, *and* that there’s no way to exploit that knowledge for profit, you understand Bitcoin.

https://twitter.com/michaeljburry/status/1328446965730795521

https://twitter.com/michaeljburry/status/1328446965730795521

There’s a madness of crowds effect that comes from the way the behaviour appears to ‘confirm’ its own theory to itself, regardless of whether the theory is coherent.

I.e. By participating in the demand pyramid based on false impressions and plausible-sounding narratives that no-one is incentivised (and few are equipped) to question, the virus spreads, more people buy in, number goes up, and hooks deepen.

That madness of crowds effect is, as @tracyalloway points out, a reliable phenomenon. You can bet on it. And maybe more interestingly, you can also target it and exploit it, proactively, if you have a way to print fake dollars.

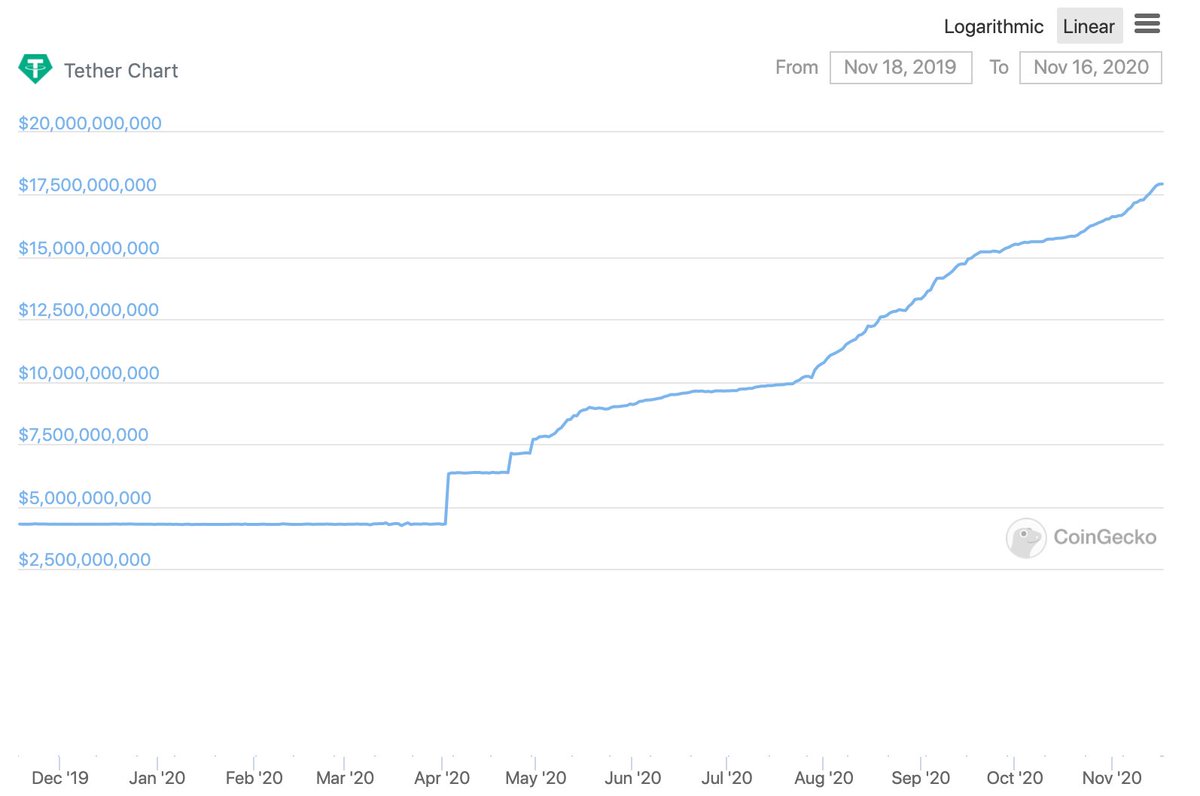

The miraculous $14 billion USDT year that Tether has had since the price of BTC cratered in March, violating the narrative, is the most undiscussed and curiously anti-interesting thing in crypto. In a culture supposedly built on verifiability, people don’t want to know. Why?

Because it serves Bitcoin. The goal of a fake-$ scam would be to manufacture real-$ demand for Bitcoin using fake demand — by painting the tape in a way that appears to ‘confirm’ the Bitcoin narrative, generating FOMO. https://twitter.com/bascule/status/1329580017446047748

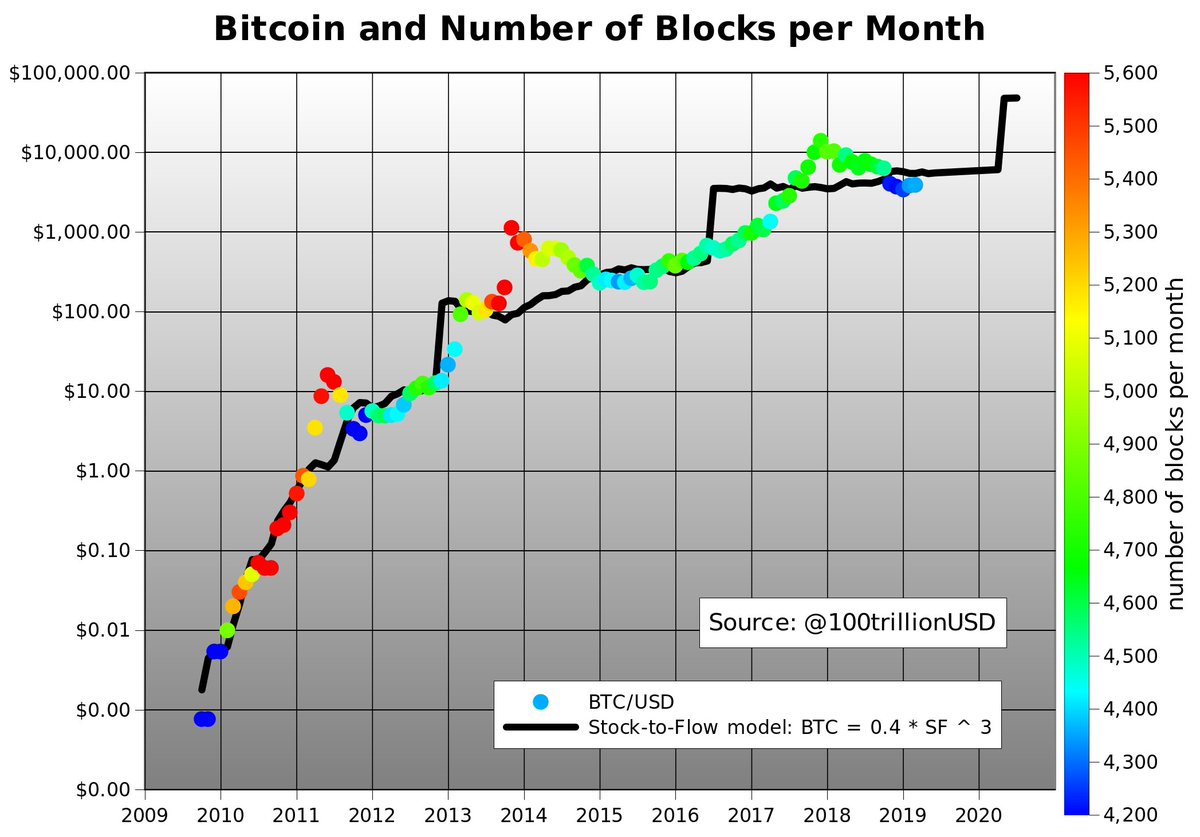

The stock-to-flow model of price, for example, predicts imminent 10x+ returns due to the block reward halving. It’s mechanically nonsensical, of course, but who cares? It sounds plausible and creates an impression, stimulating the right receptors, and that’s what matters.

We cannot know how much of the 14 billion USDT printed this year is real or air, and so long as Tether can maintain that plausible deniability, and as long as 1 USDT trades @ $1.00 on anonymous exchanges, the effect of the scam only pushes in one direction for BTC, up.

If it works, and successfully stimulates an influx of real-$ buyers, pushing the price up further, they’ll get away with it. And Bitcoin can’t be directly harmed by the scheme. So everyone looks away and stays quiet. Or rather, plays dumb, like this: https://twitter.com/_ConnerBrown_/status/1328372323230081026

If people are trading on faked price signals, that’s ethically wrong, and goes against everything Bitcoiners say they stand for. But, of course, it can always be circularly justified (in one’s head) as being a problem that #Bitcoin  (theoretically) fixes.

(theoretically) fixes.

(theoretically) fixes.

(theoretically) fixes.

Read on Twitter

Read on Twitter