COMPANY LIFECYCLES

It is useful to think of companies as having a lifecycle

1. STARTUP

- these companies historically were rarely listed on the stock exchange

- they need Cash and are highly risky

1/11

It is useful to think of companies as having a lifecycle

1. STARTUP

- these companies historically were rarely listed on the stock exchange

- they need Cash and are highly risky

1/11

- almost everything about them is unclear even if their plans are loudly stated

- best for regular investors to avoid and leave them to specialized experts who can help guide them through those uncertain early days

2/11

- best for regular investors to avoid and leave them to specialized experts who can help guide them through those uncertain early days

2/11

2. EARLY GROWTH like Tesla after its IPO

- consuming Cash and generally spending capital that builds up over time

- investing at this time is real Equity Investing

- and success can be enormously rewarding like 100x

3/11

- consuming Cash and generally spending capital that builds up over time

- investing at this time is real Equity Investing

- and success can be enormously rewarding like 100x

3/11

- but it is typically NOT necessary to invest at the IPO

- patiently watching to see the real progress of the business Model will often allow a better Entry Point a few years in before the next stage starts to take real effect

4/11

- patiently watching to see the real progress of the business Model will often allow a better Entry Point a few years in before the next stage starts to take real effect

4/11

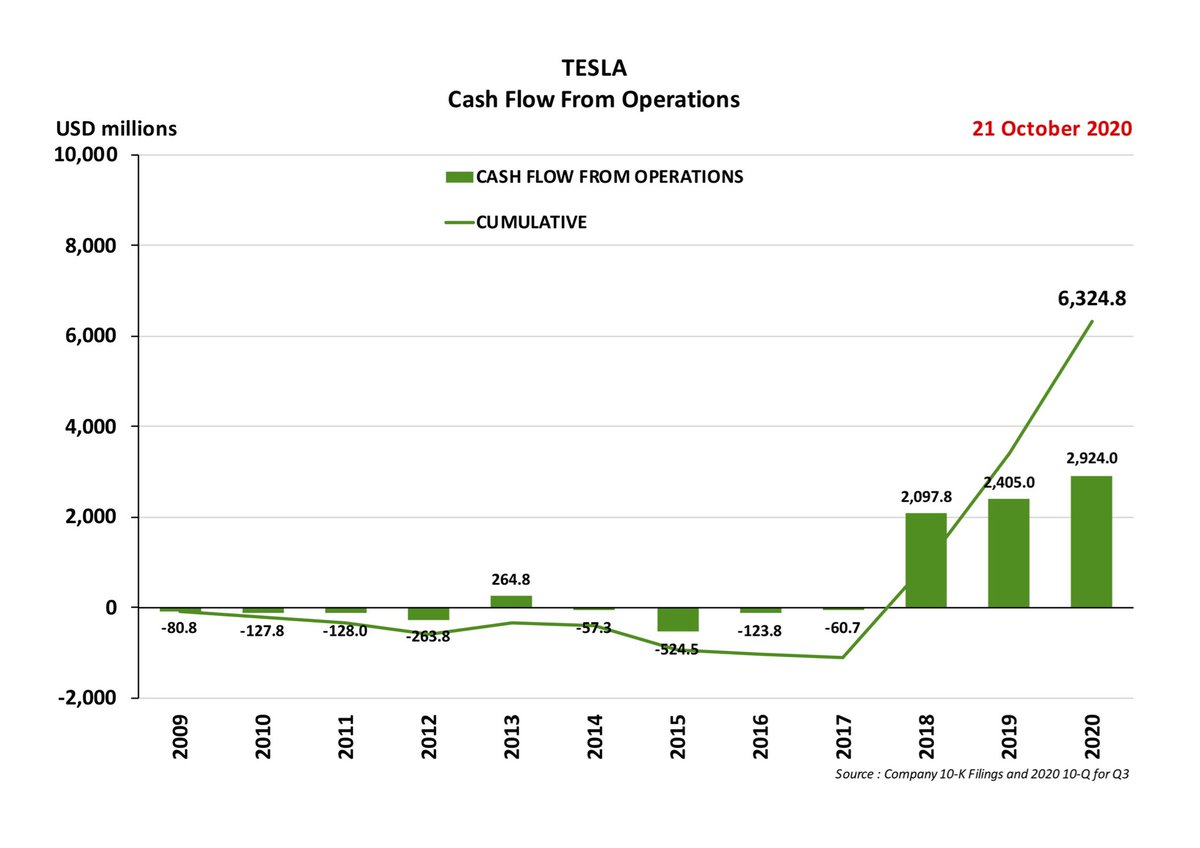

3. STRONG GROWTH ramp where the numbers start to become substantial like Tesla from 2018~2021

- consuming Cash and generally spending capital that builds up over time

- but Operating Cash Flow may now be starting to turn meaningfully positive

5/11

- consuming Cash and generally spending capital that builds up over time

- but Operating Cash Flow may now be starting to turn meaningfully positive

5/11

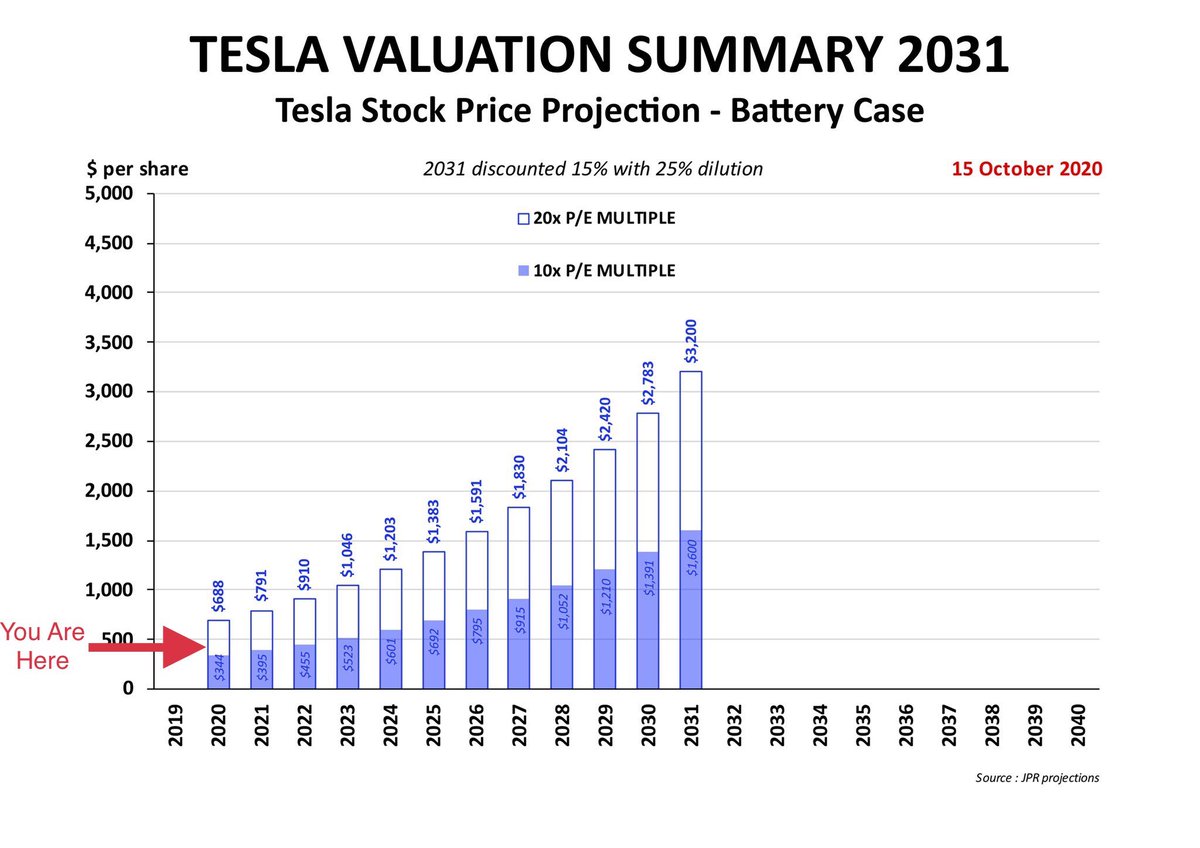

- investing at this time is real Equity Investing

- and success can be very rewarding like 10x as you can see in my analyses

6/11

- and success can be very rewarding like 10x as you can see in my analyses

6/11

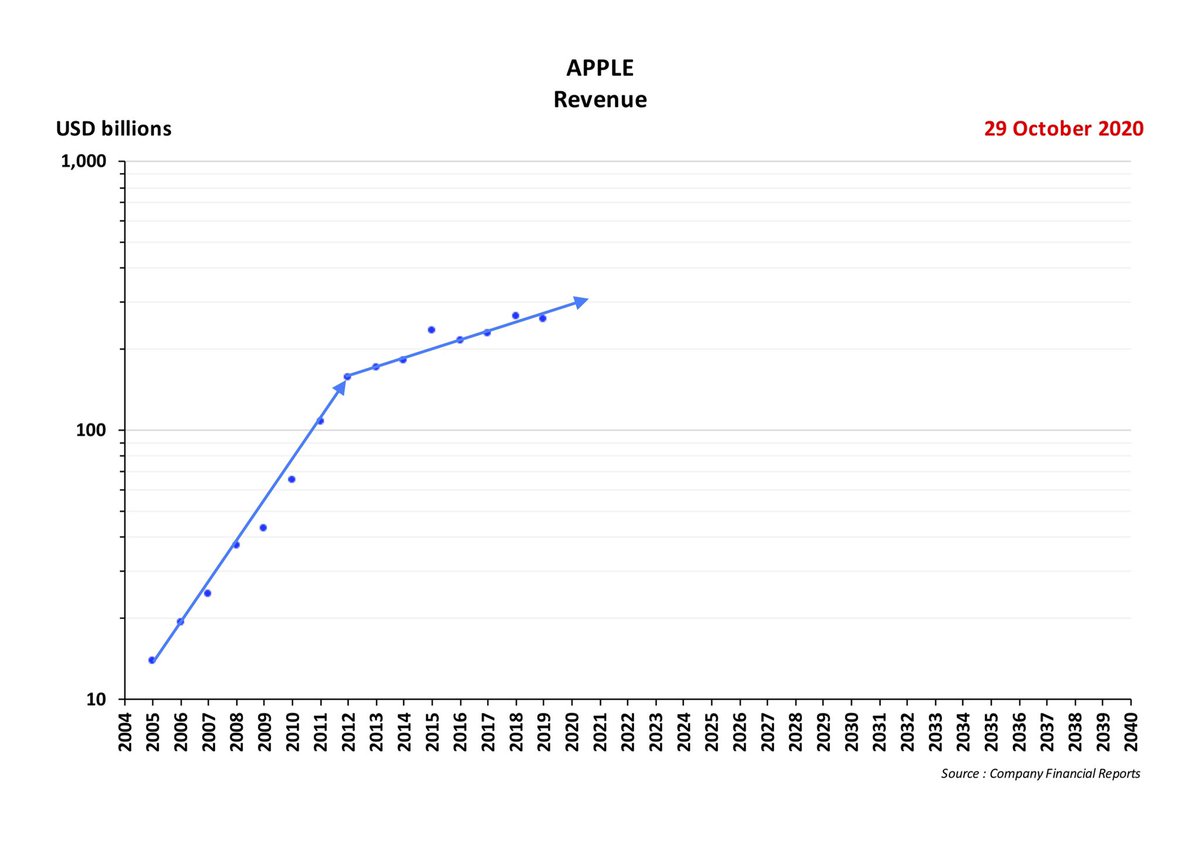

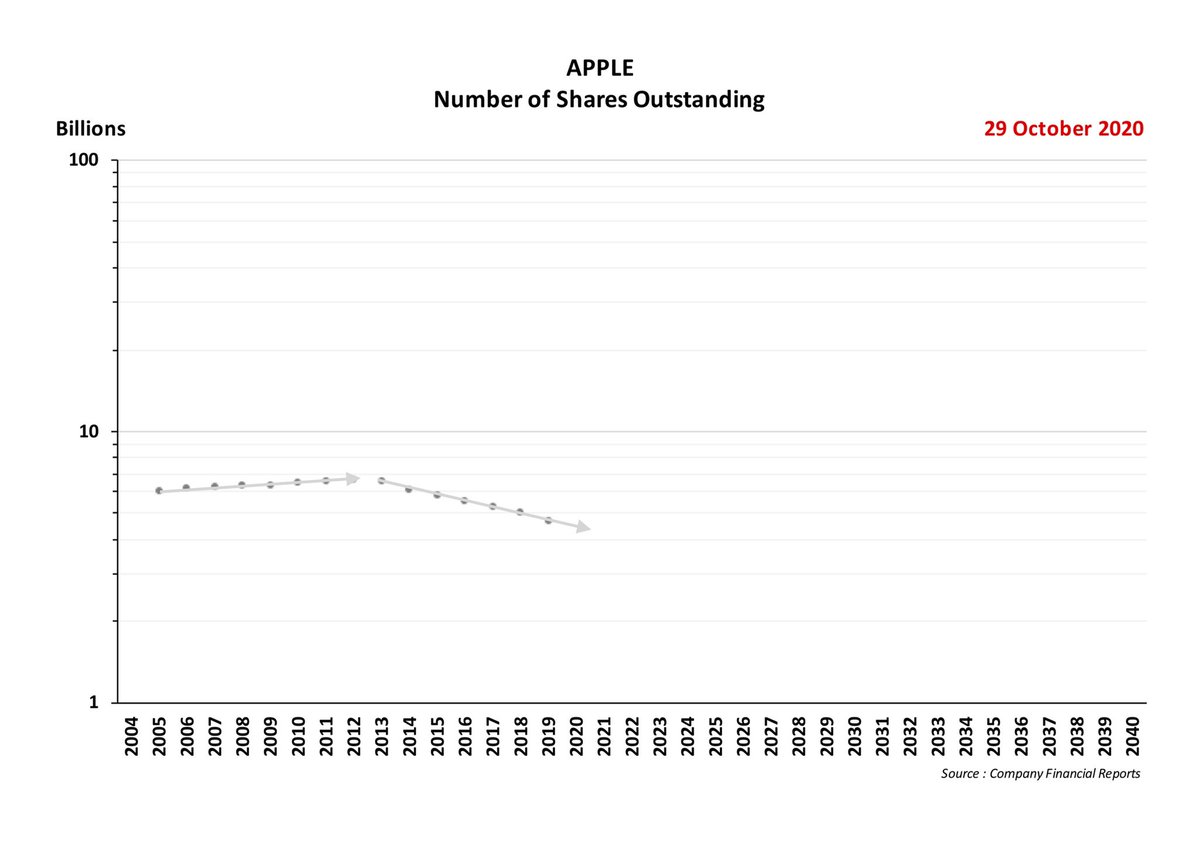

4. LATE GROWTH and beginning of transition into MATURITY like Tesla MAY be in 2031 or APPL probably is today in 2020

- Free Cash Flow is very positive and the successful company often has more Cash than it knows what to do with

7/11

- Free Cash Flow is very positive and the successful company often has more Cash than it knows what to do with

7/11

- these are conditions that Bond Investors like but the successful company really does not need that kind of borrowed money

- dividends are likely to have started

8/11

- dividends are likely to have started

8/11

- and depending on the business prospects the company may be buying back its shares i.e. returning their capital to its shareholders

9/11

9/11

- sometimes the shares of these companies really start to look like Equivalent Bonds because they are effectively giving both income and capital back to their investors

10/11

10/11

Read on Twitter

Read on Twitter