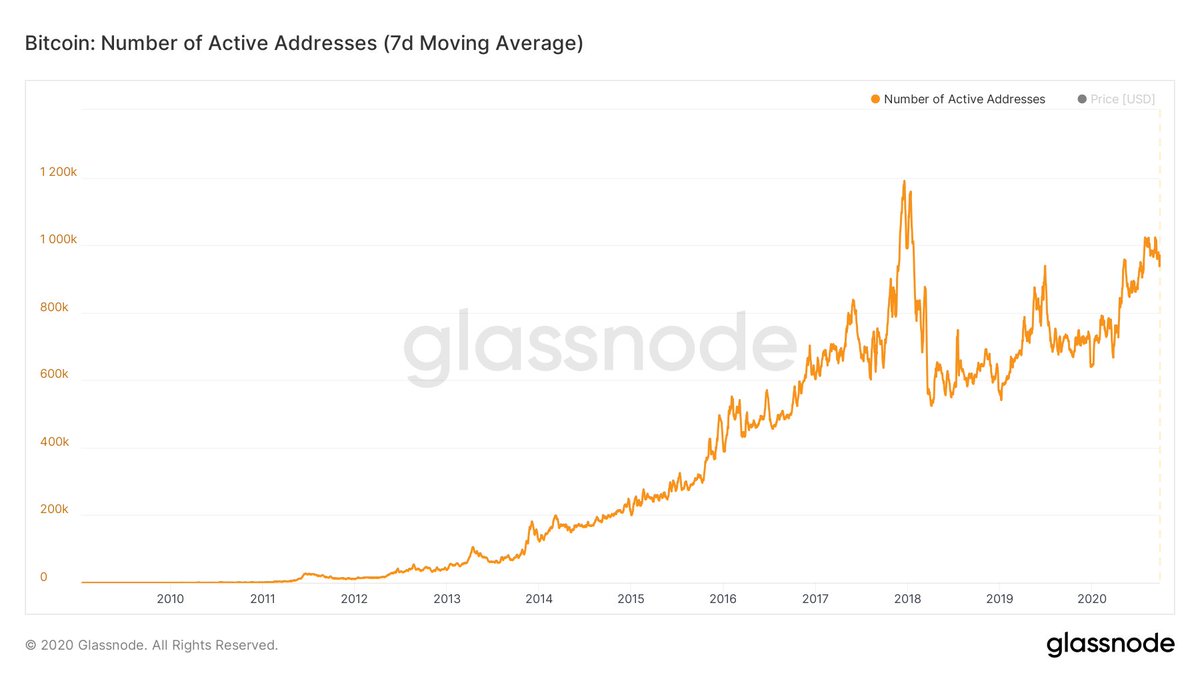

1. Daily Active Addresses

Here's why: Excellent proxy for user growth and useful for identifying periods of high-speculation.

Current Status:

DIY: @glassnode

Here's why: Excellent proxy for user growth and useful for identifying periods of high-speculation.

Current Status:

DIY: @glassnode

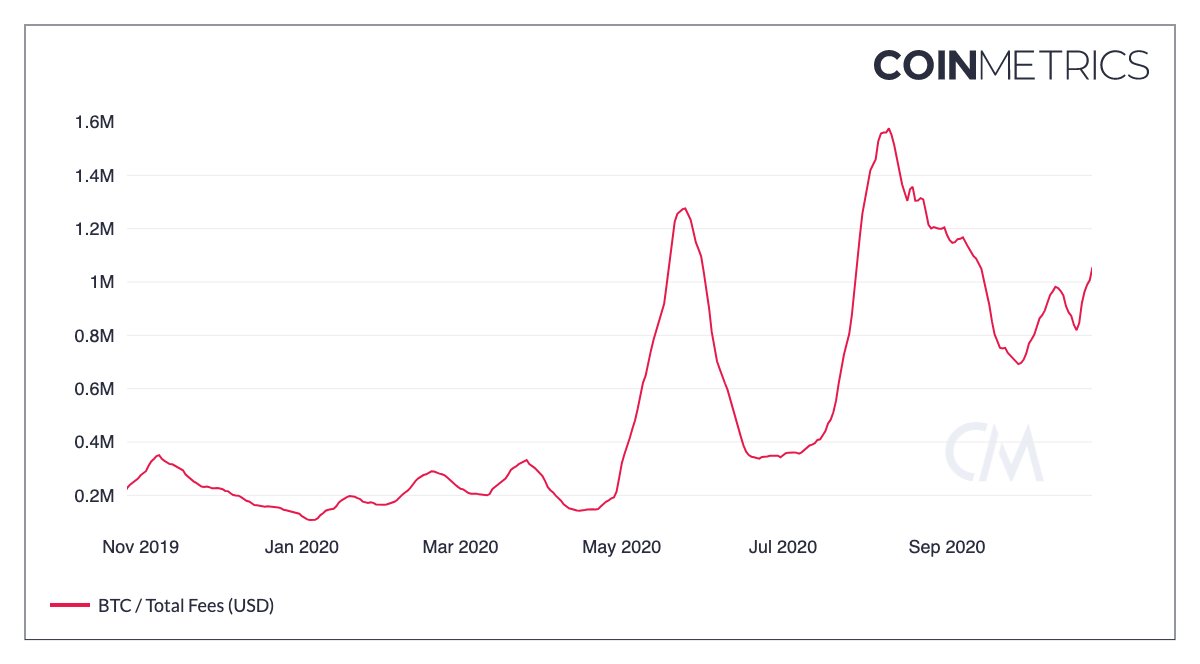

2. Daily Total Tx Fees (USD)

Here's why: Perhaps the cleanest metric that shows the demand for Bitcoin block space.

Current Status:

DIY: @coinmetrics

Here's why: Perhaps the cleanest metric that shows the demand for Bitcoin block space.

Current Status:

DIY: @coinmetrics

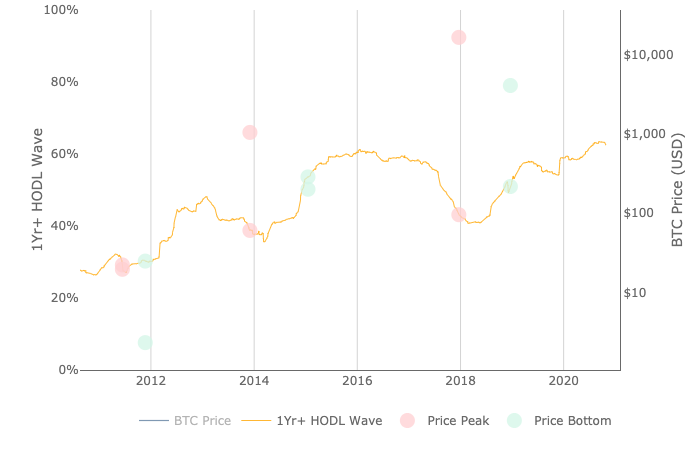

3. % of BTC supply held for > 1 year

Here's why: Shows investor confidence and conviction in BTC as a store of value that rivals gold.

Current Status: (near ATHs)

(near ATHs)

DIY: https://www.lookintobitcoin.com/charts/1-year-hodl-wave/

Here's why: Shows investor confidence and conviction in BTC as a store of value that rivals gold.

Current Status:

(near ATHs)

(near ATHs) DIY: https://www.lookintobitcoin.com/charts/1-year-hodl-wave/

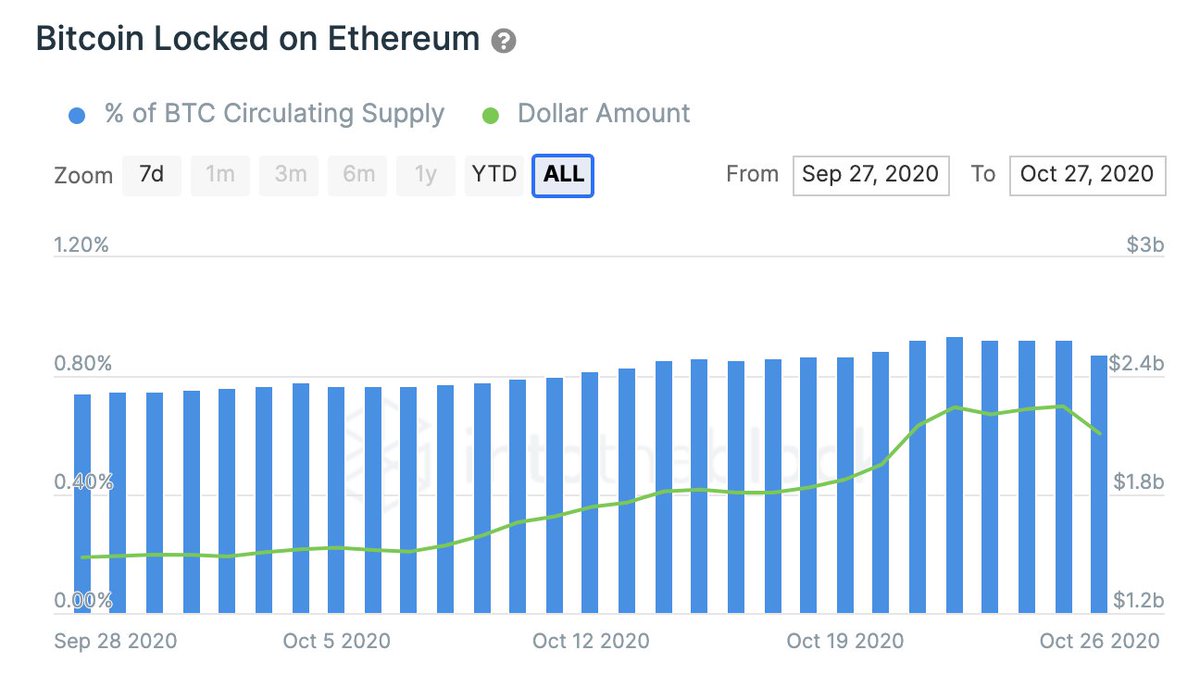

4. BTC Locked on Ethereum

Here's why: Good indicator for when BTC is being used in #DeFi and becoming a productive asset.

Current Status: (>$2B locked)

(>$2B locked)

DIY: @intotheblock

Here's why: Good indicator for when BTC is being used in #DeFi and becoming a productive asset.

Current Status:

(>$2B locked)

(>$2B locked)DIY: @intotheblock

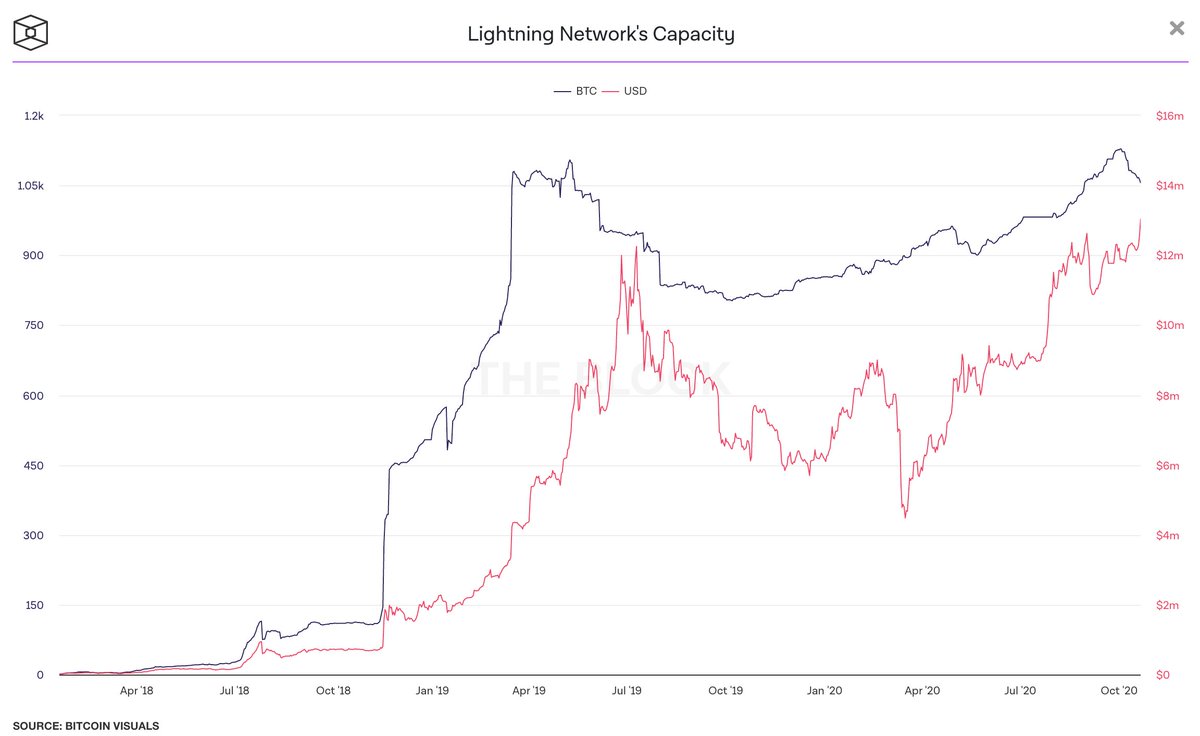

5. BTC Locked in Lightning

Here's why: Demonstrates Bitcoin's viability as a payment network.

Current Status: Long-term promise potentially but only modest growth in recent years

DIY: @BitMEX @defipulse

Here's why: Demonstrates Bitcoin's viability as a payment network.

Current Status: Long-term promise potentially but only modest growth in recent years

DIY: @BitMEX @defipulse

6. BTC held on exchanges

Here's why: Investors generally move coins onto exchanges when they're looking to sell.

Current Status:

DIY: @viewbasecom

Here's why: Investors generally move coins onto exchanges when they're looking to sell.

Current Status:

DIY: @viewbasecom

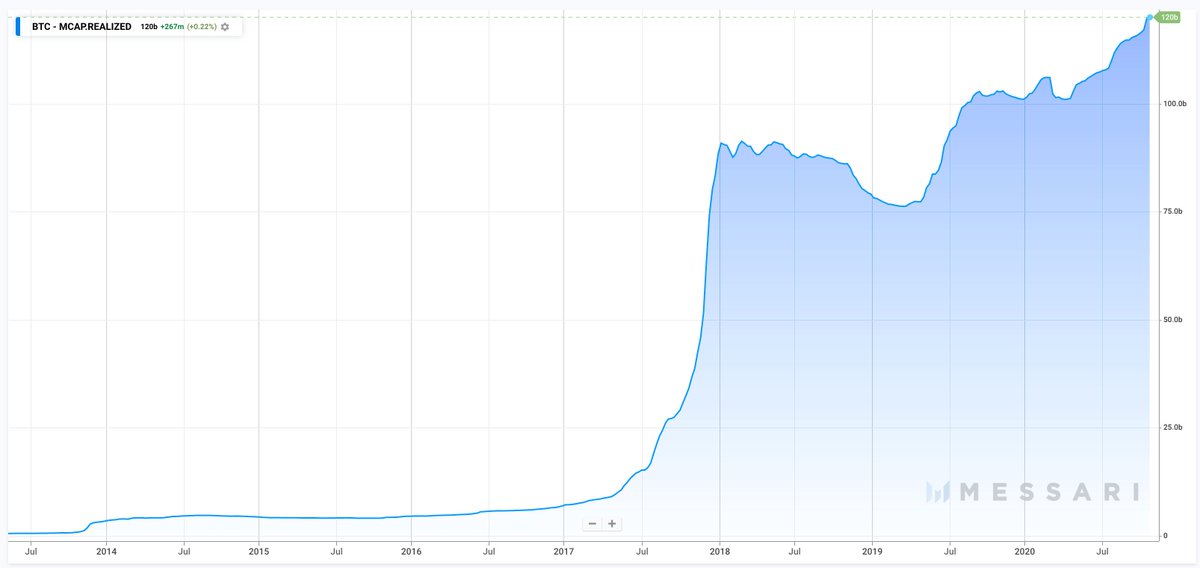

7. Realized Cap

Here's why: Valuing each unit of supply when it last moved provides the aggregate cost basis for BTC holders.

Current Status:

DIY: @MessariCrypto @coinmetrics

Here's why: Valuing each unit of supply when it last moved provides the aggregate cost basis for BTC holders.

Current Status:

DIY: @MessariCrypto @coinmetrics

Looking for more #BTC  fundamentals? Subscribe to my #crypto analytics newsletter @OurNetwork__: http://ournetwork.substack.com/subscribe

fundamentals? Subscribe to my #crypto analytics newsletter @OurNetwork__: http://ournetwork.substack.com/subscribe

fundamentals? Subscribe to my #crypto analytics newsletter @OurNetwork__: http://ournetwork.substack.com/subscribe

fundamentals? Subscribe to my #crypto analytics newsletter @OurNetwork__: http://ournetwork.substack.com/subscribe

Read on Twitter

Read on Twitter