Global Equity Positioning

Thread 1/5

$SPX $ACWI $EEM $EFA

US equity % in MSCI All World Index:

- 59%, an ATH & well > DotCom

US GDP as % of world:

- 24%

Global investors are overweight US

US BofA GFMS

"Most crowded trade" in history of Global FMS

- US Tech

Thread 1/5

$SPX $ACWI $EEM $EFA

US equity % in MSCI All World Index:

- 59%, an ATH & well > DotCom

US GDP as % of world:

- 24%

Global investors are overweight US

US BofA GFMS

"Most crowded trade" in history of Global FMS

- US Tech

2/5

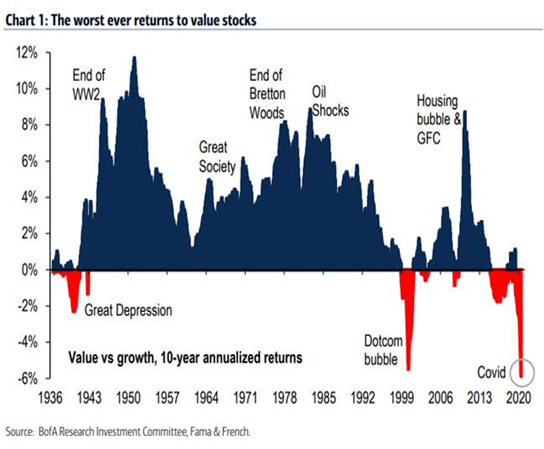

Global investors are OW Growth

- It is so obvious you should own Tech / Growth

- Is this really the time you want to be overweight Growth?

- Being long the consensus trade at historic extremes...how well has that worked?

$VTV $VUG $SPX

Global investors are OW Growth

- It is so obvious you should own Tech / Growth

- Is this really the time you want to be overweight Growth?

- Being long the consensus trade at historic extremes...how well has that worked?

$VTV $VUG $SPX

3/5

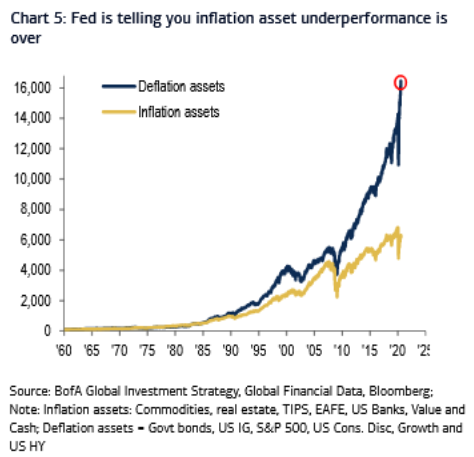

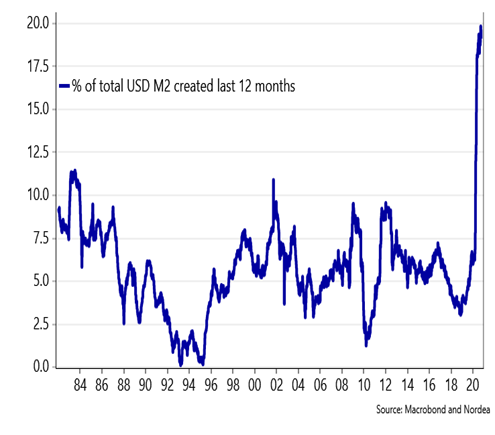

The world is long DEFLATION assets

And after a 40-year bond bull market...it sure has been a winner

Could:

FISCAL stimulus + trade friction + food price increases + populism

...introduce INFLATION?

Positioning for deflation remains huge despite recent Reflation trade

The world is long DEFLATION assets

And after a 40-year bond bull market...it sure has been a winner

Could:

FISCAL stimulus + trade friction + food price increases + populism

...introduce INFLATION?

Positioning for deflation remains huge despite recent Reflation trade

4/5

US =

- 59% of All World Index

- 39% of Global Aggregate Bond index

The investment world is thus very long US Dollars

Pundits always focus on Dollar debt by foreigners

They ignore the far larger Dollar assets by foreigners

Is this the time to be very long USD?

$DXY

US =

- 59% of All World Index

- 39% of Global Aggregate Bond index

The investment world is thus very long US Dollars

Pundits always focus on Dollar debt by foreigners

They ignore the far larger Dollar assets by foreigners

Is this the time to be very long USD?

$DXY

5/5

The most crowded trades are:

$NDX

$DXY (yes, the $9 trillion net long > $35bn net short)

$SPX

$TLT

$IEF

$VUG (Growth)

Deflation

The least crowded trades are:

$EFA

$EEM

$GLD (yes, still)

$DBA (Soft commodities)

$VTV (Value)

Inflation

What could possibly spark a switch?

The most crowded trades are:

$NDX

$DXY (yes, the $9 trillion net long > $35bn net short)

$SPX

$TLT

$IEF

$VUG (Growth)

Deflation

The least crowded trades are:

$EFA

$EEM

$GLD (yes, still)

$DBA (Soft commodities)

$VTV (Value)

Inflation

What could possibly spark a switch?

Read on Twitter

Read on Twitter