A thread on #AirBnB, which will become a great public business because (i) it's the best product in a very large market, (ii) strong fundamentals led by hosts, (iii) a lack of discipline that's dragged on profitability can absolutely be overcome! (1/x)

2/x Why #AirBnB wins with customers (vs #hotels): top 3 purchase criteria are price, selection, and trust. AirBnB has lower prices, is close enough on trust after years of investment. Need to continue investing in selection

#userexperience https://qz.com/779121/airbnb-vs-hotel-cost-comparison-you-can-rent-an-entire-home-on-airbnb-for-the-price-of-a-hotel-room/

#userexperience https://qz.com/779121/airbnb-vs-hotel-cost-comparison-you-can-rent-an-entire-home-on-airbnb-for-the-price-of-a-hotel-room/

3/x #airbnb prices should decrease. Why? Host occupancy rates improving but today average ~30%, well below hotels' 60%+. But hosts can still make rent / mortgage at 30%. As occupancy rates improve-> prices go down

#airbnb #hotels

https://www.alltherooms.com/analytics/average-airbnb-occupancy-rates-by-city/ https://www.forbes.com/sites/amydobson/2019/06/24/the-most-profitable-airbnb-locations-in-the-us/#62b9833f2271

#airbnb #hotels

https://www.alltherooms.com/analytics/average-airbnb-occupancy-rates-by-city/ https://www.forbes.com/sites/amydobson/2019/06/24/the-most-profitable-airbnb-locations-in-the-us/#62b9833f2271

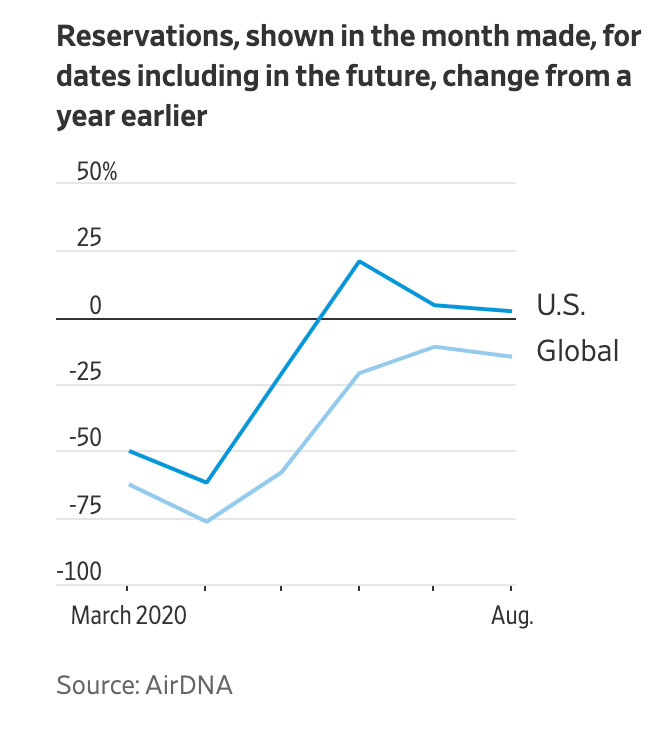

4/x Overall volume/industry will be fine: company has rebounded nicely from COVID. Participates in an extremely large travel market (vacation rentals alone are $87B)

https://www.wsj.com/articles/how-airbnb-pulled-back-from-the-brink-11602520846?mod=e2tw

https://www.wsj.com/articles/how-airbnb-pulled-back-from-the-brink-11602520846?mod=e2tw

5/x Profitability has lagged in recent years and it's a fair question on whether AirBnB has strong fundamentals. #AirBnB's burn has actually held up pretty well during COVID, with a $400M loss in Q2. What we see: fundamentals are  (cont'd) https://www.bloomberg.com/news/articles/2020-03-12/airbnb-s-loss-nearly-doubles-in-fourth-quarter-before-virus-hit?srnd=technology-vp

(cont'd) https://www.bloomberg.com/news/articles/2020-03-12/airbnb-s-loss-nearly-doubles-in-fourth-quarter-before-virus-hit?srnd=technology-vp

(cont'd) https://www.bloomberg.com/news/articles/2020-03-12/airbnb-s-loss-nearly-doubles-in-fourth-quarter-before-virus-hit?srnd=technology-vp

(cont'd) https://www.bloomberg.com/news/articles/2020-03-12/airbnb-s-loss-nearly-doubles-in-fourth-quarter-before-virus-hit?srnd=technology-vp

6/x #AirBnB's largest variable expense -- Sales & Marketing costs at ~30%. This is concerning to many. But is this spend for #consumer acquisition? Majority of AirBnB's traffic is direct and ~90% is organic (SimilarWeb). https://twitter.com/modestproposal1/status/1184834411063365632?s=21

7/x More likely, much of S&M is for the supply side (hosts), and this is high ROI spend. You win by having better selection than competitors - and AirBnB needs to continue investing, despite 10M listings (Airdna) to 1.4M rooms for Marriott

8/x Presumably AirBnB has both a large sales force and customer success team for Superhosts (est. ~5% of hosts) to continue signing up new hosts. This is a great investment! And S&M as a % of revenue should decrease over time https://www.airdna.co/blog/airbnb_superhost_status#:~:text=We%20began%20this%20analysis%20by,achieved%20Superhost%20status%20in%202017.

9/x Am also optimistic #AirBnB will continue adding large numbers of #hosts. Why? AirBnB host is now a real occupation -> which unlocks supply. E.g. in Austin, median earnings per month is $3k. And occupancy rates should also improve over time https://www.airdna.co/blog/airbnb-data-how-to-earn-more-with-marketminder

10/x #AirBnB also has reasonable take rate (~15%) with room to grow. In aggregating majority of demand for hosts, AirBnB has strong competitive position and can increase take rate over time - partic if introducing host advertising model. #commissions #ads http://abovethecrowd.com/2013/04/18/a-rake-too-far-optimal-platformpricing-strategy/

11/x What makes me worried: Unnecessary move into managed marketplace. Acquired #HotelTonight in '19, had moved towards directly managing supply. Yes that's what modern marketplaces are doing, but #AirBnB doesn’t need this for great product #marketplaces https://skift.com/2020/05/05/airbnb-cuts-25-percent-of-workforce-and-downsizes-hotel-investments/

12/x What else makes me worried: Non-core investments. Yes #AirBnB significantly descoped during COVID-19, incl. Transportation, Studios, Hotels, Lux. But didn't go far enough: high-burn Experiences business still out there without clear #PMF

https://skift.com/wp-content/uploads/2020/05/Aibnb-announcement.pdf

https://skift.com/wp-content/uploads/2020/05/Aibnb-announcement.pdf

13/x All that said, going public can be really good for a company. #AirBnB will come out as a profitable, disciplined company following the difficult COVID-19 cuts and public company pressure

My full article on subject here: https://www.linkedin.com/pulse/airbnb-become-great-public-host-led-business-brian-cramer

My full article on subject here: https://www.linkedin.com/pulse/airbnb-become-great-public-host-led-business-brian-cramer

Read on Twitter

Read on Twitter