#VeChain X Automated Market Maker DEX

Decentralized Exchanges, AMM, Liquidity providers, arbitrage traders, Smartcontracts, @VexchangeIO and @UniswapProtocol.

What is it all about and what is their connection.

It's a long thread but in my opinion very interesting.

$VET

1/16

Decentralized Exchanges, AMM, Liquidity providers, arbitrage traders, Smartcontracts, @VexchangeIO and @UniswapProtocol.

What is it all about and what is their connection.

It's a long thread but in my opinion very interesting.

$VET

1/16

2/16

Since chickens are used a lot as analogy in the VeChain community. I use this egg vending machine I found in China to explain an AMM DEX.

are used a lot as analogy in the VeChain community. I use this egg vending machine I found in China to explain an AMM DEX.

If you ever traded on a DEX in 2017, you probably know what a horrible experience it was.

$VET

Since chickens

are used a lot as analogy in the VeChain community. I use this egg vending machine I found in China to explain an AMM DEX.

are used a lot as analogy in the VeChain community. I use this egg vending machine I found in China to explain an AMM DEX.

If you ever traded on a DEX in 2017, you probably know what a horrible experience it was.

$VET

3/16

These DEXs work(ed) the same way as a CEX like OceanEx; with an orderbook, but based on smart contracts.

So what made Uniswap/Vexchange DEX "user friendly" and how does it work?

Uniswap works with something called an Automated Market Maker protocol; no orderbooks.

$VET

These DEXs work(ed) the same way as a CEX like OceanEx; with an orderbook, but based on smart contracts.

So what made Uniswap/Vexchange DEX "user friendly" and how does it work?

Uniswap works with something called an Automated Market Maker protocol; no orderbooks.

$VET

4/16

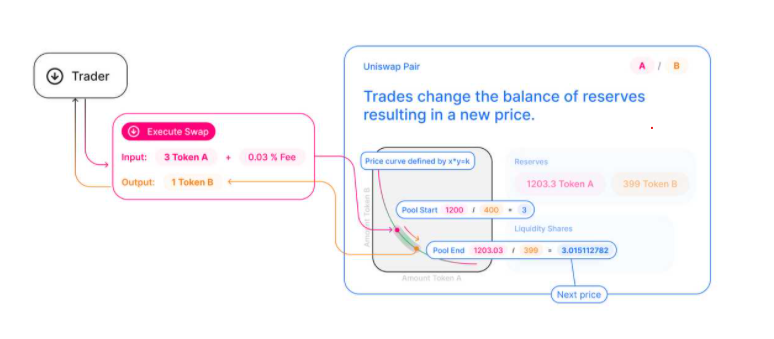

To explain "Automated Market Maker protocol" we go back to our vending machine (VM).

First you need to know that our VM is a special one, you can put money in it and get eggs(tokens), but you can also put eggs in it and get money.

$VET

To explain "Automated Market Maker protocol" we go back to our vending machine (VM).

First you need to know that our VM is a special one, you can put money in it and get eggs(tokens), but you can also put eggs in it and get money.

$VET

5/16

So who determines what the value of the eggs are?

That's where a formula comes in.

( x

x  =

=  )

)

The VM has a rule. The amount of times the amount of

times the amount of  in the VM has to stay constant. Which means, when you take an egg, the amount of

in the VM has to stay constant. Which means, when you take an egg, the amount of  in the VM should rise.

in the VM should rise.

$VET

So who determines what the value of the eggs are?

That's where a formula comes in.

(

x

x  =

=  )

)The VM has a rule. The amount of

times the amount of

times the amount of  in the VM has to stay constant. Which means, when you take an egg, the amount of

in the VM has to stay constant. Which means, when you take an egg, the amount of  in the VM should rise.

in the VM should rise. $VET

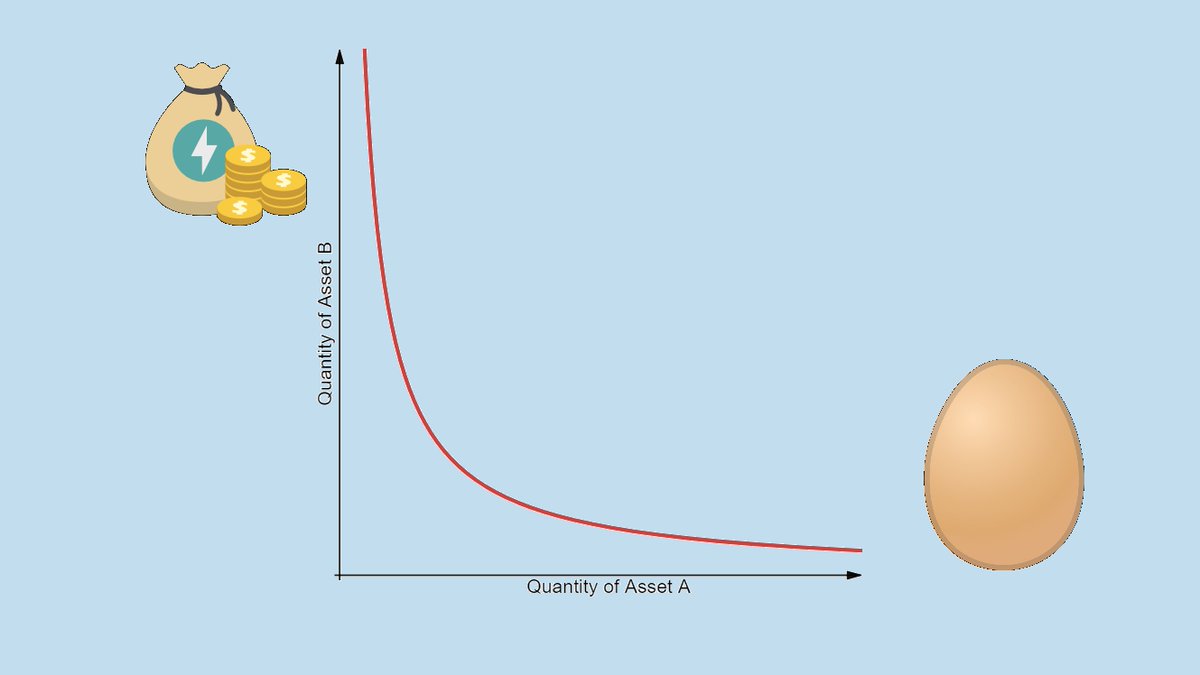

6/16

So if you buy more eggs, you have to pay more and more for each egg.

This process is visualized in the graph.

To give a practical example.

If there is a VM with 5 eggs and 10$ in it. The constant factor is 50.

If you buy 1 egg, you have to pay $2.50. -> (4*12.50=50)

$VET

So if you buy more eggs, you have to pay more and more for each egg.

This process is visualized in the graph.

To give a practical example.

If there is a VM with 5 eggs and 10$ in it. The constant factor is 50.

If you buy 1 egg, you have to pay $2.50. -> (4*12.50=50)

$VET

7/16

If you buy another egg you have to pay $4.16. -> (3*16.67=50)

You buy another egg, you pay $8.33. ->(2*25=50)

As you can see, it is important that there are lots of eggs and Dollars in the VM or else your purchases will have a lot of influence on the price; slippage.

$VET

If you buy another egg you have to pay $4.16. -> (3*16.67=50)

You buy another egg, you pay $8.33. ->(2*25=50)

As you can see, it is important that there are lots of eggs and Dollars in the VM or else your purchases will have a lot of influence on the price; slippage.

$VET

8/16

You might be wondering, who actually put these eggs and dollars in the VM and why?

This is where liquidity providers (LP) come in.

When there is an empty machine the first LP basically sets the price by putting a certain amount of eggs and Dollars in the VM. (listing)

$VET

You might be wondering, who actually put these eggs and dollars in the VM and why?

This is where liquidity providers (LP) come in.

When there is an empty machine the first LP basically sets the price by putting a certain amount of eggs and Dollars in the VM. (listing)

$VET

9/16

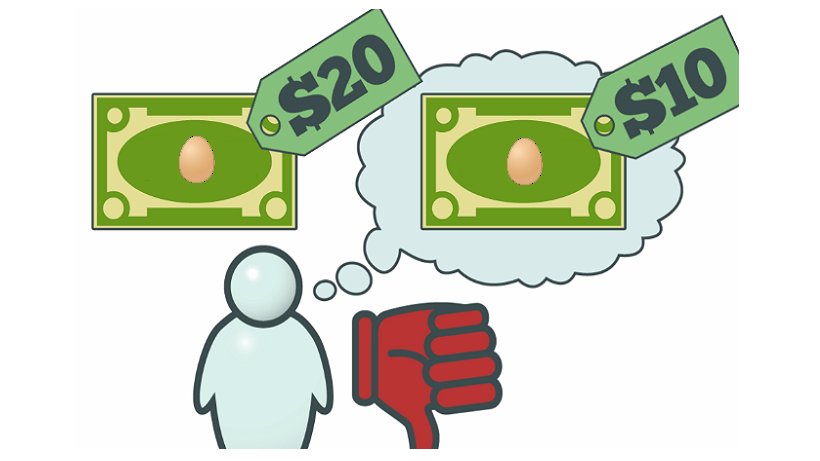

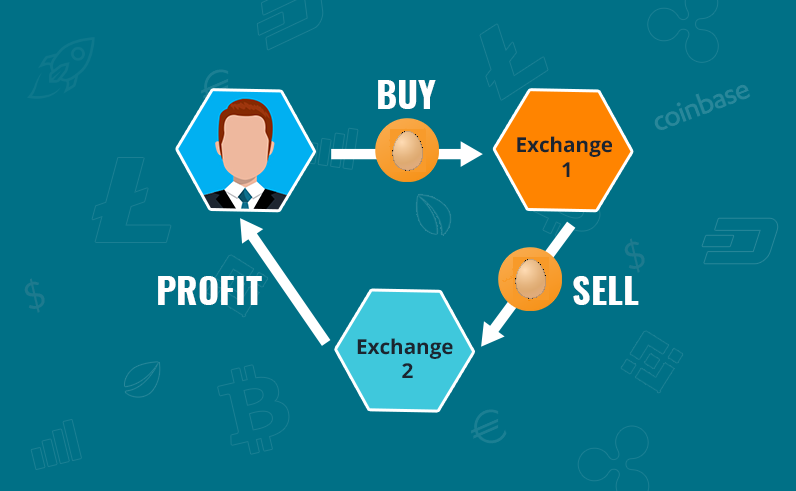

If he is smart, he looks at the current price of the eggs on other markets (CEXs) and puts e.g. $1000 and a number of eggs with a market value of $1000 in the machine, if he doesn't, arbitrage traders will make profit of the price difference between markets.

$VET

If he is smart, he looks at the current price of the eggs on other markets (CEXs) and puts e.g. $1000 and a number of eggs with a market value of $1000 in the machine, if he doesn't, arbitrage traders will make profit of the price difference between markets.

$VET

10/16

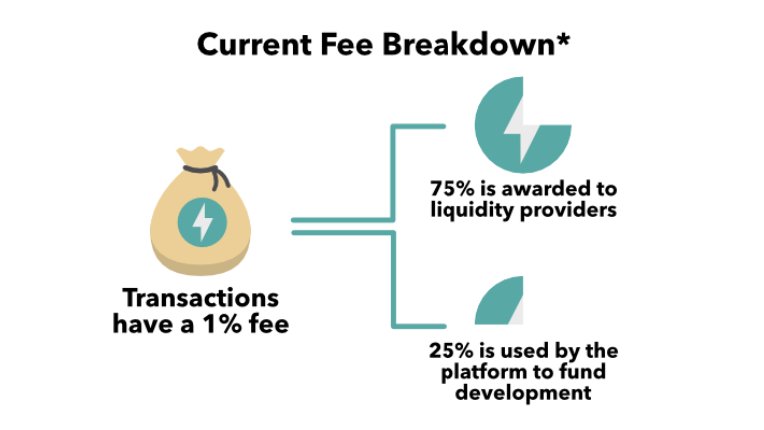

But why would someone provide liquidity?

Every trade that is made on the specific trade pair, a certain trade fee goes to the LP pool. E.g. 1%.

If multiple people added liquidity in the VM, the fee gets shared over the LPs according to their stake of the pool.

$VET

But why would someone provide liquidity?

Every trade that is made on the specific trade pair, a certain trade fee goes to the LP pool. E.g. 1%.

If multiple people added liquidity in the VM, the fee gets shared over the LPs according to their stake of the pool.

$VET

11/16

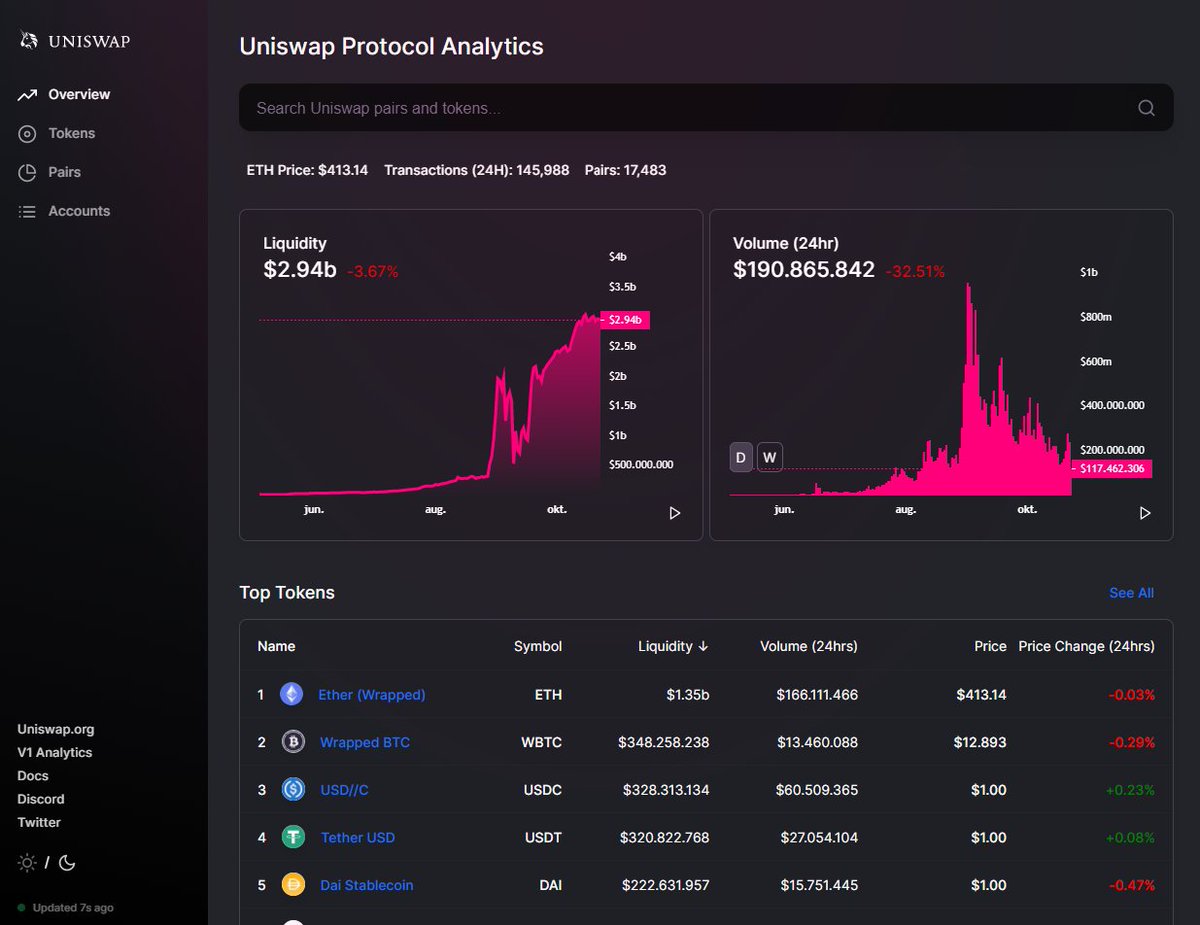

What happened during the DeFi hype?

As you can see in the graph, more people started trading on Uniswap which means: LPs get more fees. This followed with people adding more Liquidity to the platform.

This improved the trading experience; less slippage. (tweet nr 6/7)

$VET

What happened during the DeFi hype?

As you can see in the graph, more people started trading on Uniswap which means: LPs get more fees. This followed with people adding more Liquidity to the platform.

This improved the trading experience; less slippage. (tweet nr 6/7)

$VET

12/16

Currently the hype is a bit over, but the liquidity is still there and it will be interesting to see how Uniswap and Vexchange will grow.

An interesting feature I've currently seen is AMM Chaining. You can trade your token for any other token as long as there are LPs.

$VET

Currently the hype is a bit over, but the liquidity is still there and it will be interesting to see how Uniswap and Vexchange will grow.

An interesting feature I've currently seen is AMM Chaining. You can trade your token for any other token as long as there are LPs.

$VET

13/16

The platform will automatically trade between the right pairs. (You do have to pay double trading and transaction fees since you basically do multiple trades in the background). I explained it in this short thread. https://twitter.com/Martijncvv/status/1306692942715912192

The platform will automatically trade between the right pairs. (You do have to pay double trading and transaction fees since you basically do multiple trades in the background). I explained it in this short thread. https://twitter.com/Martijncvv/status/1306692942715912192

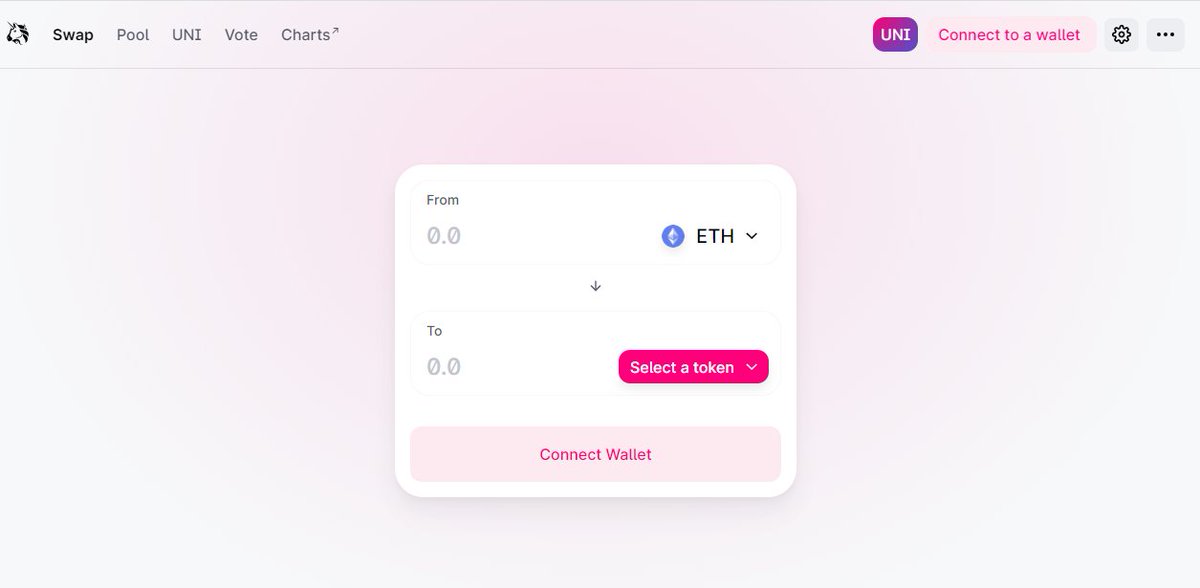

14/16

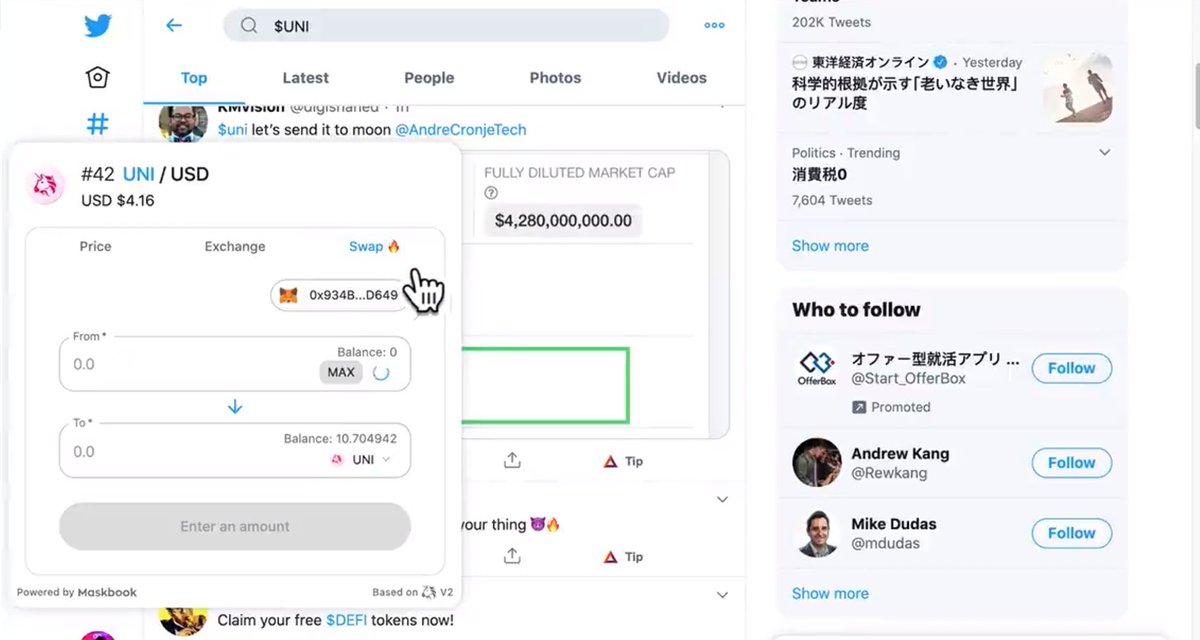

Another cool feature is a trading widget which will automatically pop up whenever your mouse hovers on a ticker like $VET on Twitter. You can instantly trade on the AMM DEX.

https://twitter.com/Martijncvv/status/1310888755356725248

Another cool feature is a trading widget which will automatically pop up whenever your mouse hovers on a ticker like $VET on Twitter. You can instantly trade on the AMM DEX.

https://twitter.com/Martijncvv/status/1310888755356725248

15/16

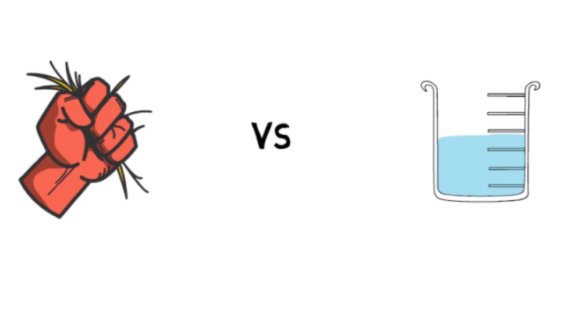

One thing I didn't mention is the risk for LPs which is called "Impermanent Loss":

"A difference between holding an asset versus providing liquidity in that asset."

I won't explain that in this thread but do know providing liquidity is not without risks.

$VET

One thing I didn't mention is the risk for LPs which is called "Impermanent Loss":

"A difference between holding an asset versus providing liquidity in that asset."

I won't explain that in this thread but do know providing liquidity is not without risks.

$VET

16/16

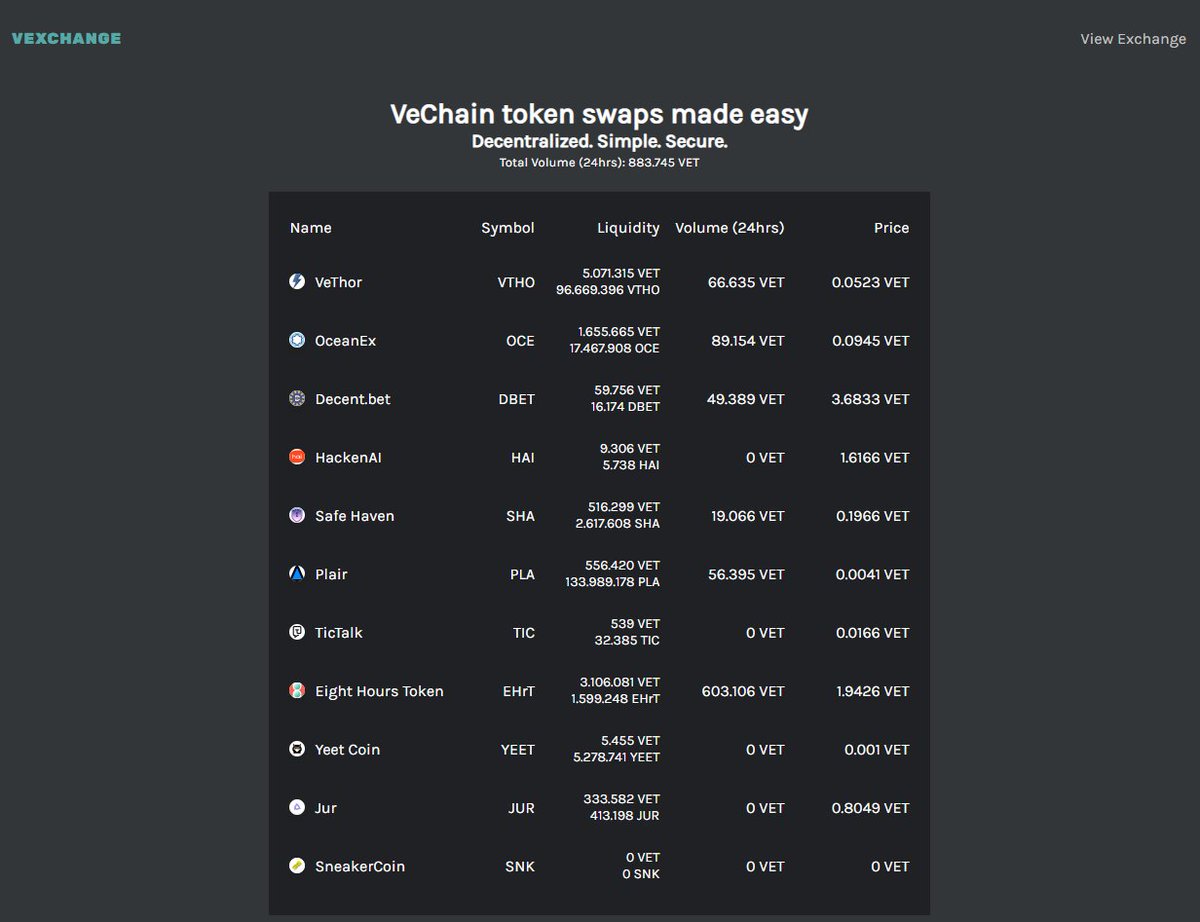

As I mentioned, the VeChain ecosystem has a growing AMM DEX too called @VexchangeIO.

PS. There are different type of AMM protocols. The one I explained (Uniswap/ Vexchange) is called a "Constant Function Automated Market Maker" (CFAMM).

$VET

As I mentioned, the VeChain ecosystem has a growing AMM DEX too called @VexchangeIO.

PS. There are different type of AMM protocols. The one I explained (Uniswap/ Vexchange) is called a "Constant Function Automated Market Maker" (CFAMM).

$VET

If you want to like or RT, please RT the first tweet of the thread.

More explanation threads about #VeChain, check the comments on the tweet below or click #EducationVET for single explanation Tweets.

https://twitter.com/Martijncvv/status/1218895904469651456

https://twitter.com/Martijncvv/status/1218895904469651456

More explanation threads about #VeChain, check the comments on the tweet below or click #EducationVET for single explanation Tweets.

https://twitter.com/Martijncvv/status/1218895904469651456

https://twitter.com/Martijncvv/status/1218895904469651456

Don't forget to join @VexchangeIO. Telegram to follow their developments. http://t.me/vexchange

Read on Twitter

Read on Twitter