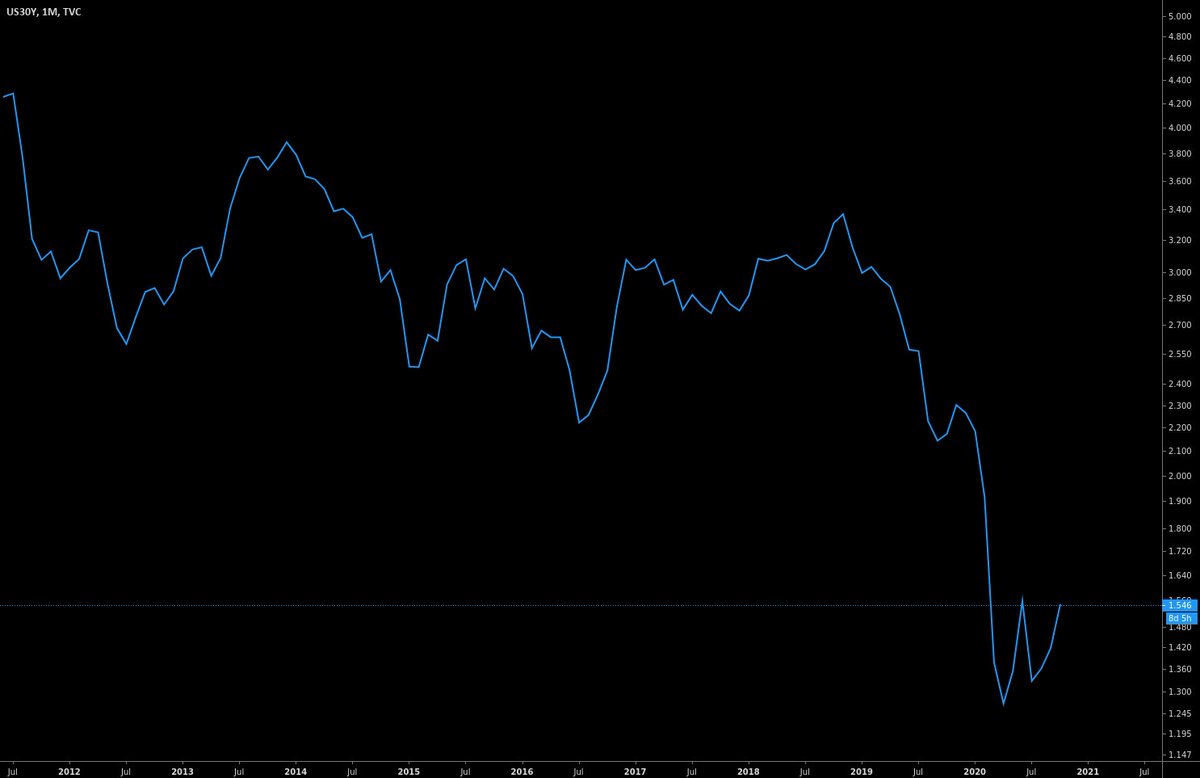

$GC $US30Y

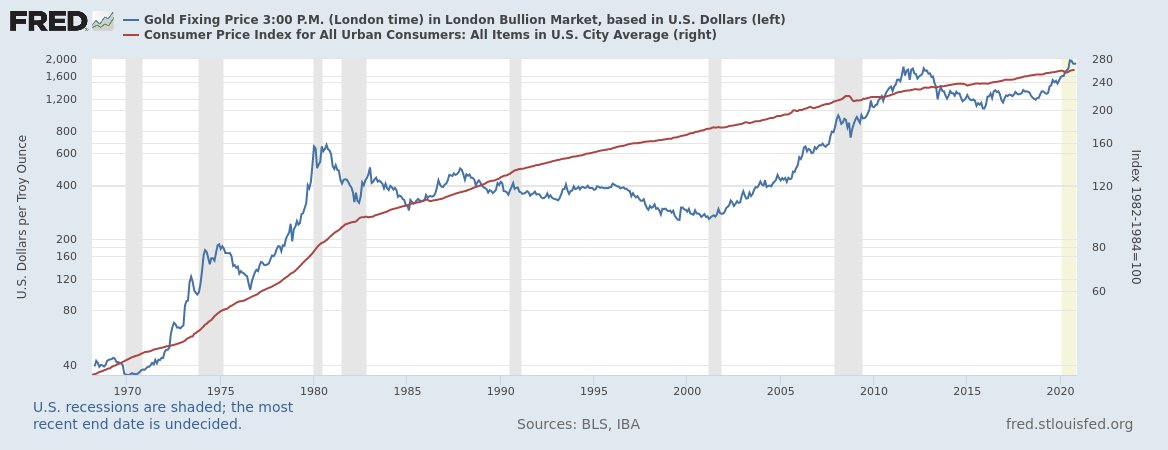

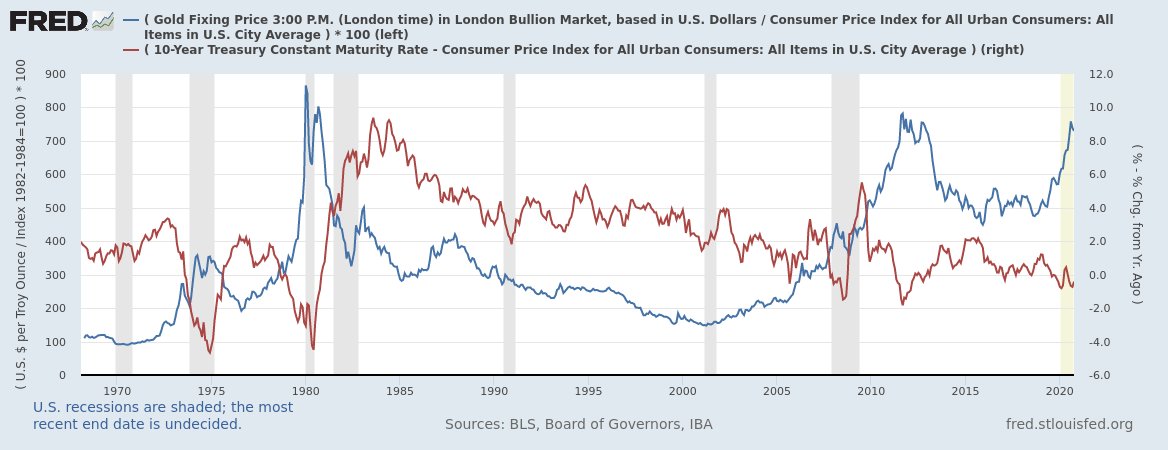

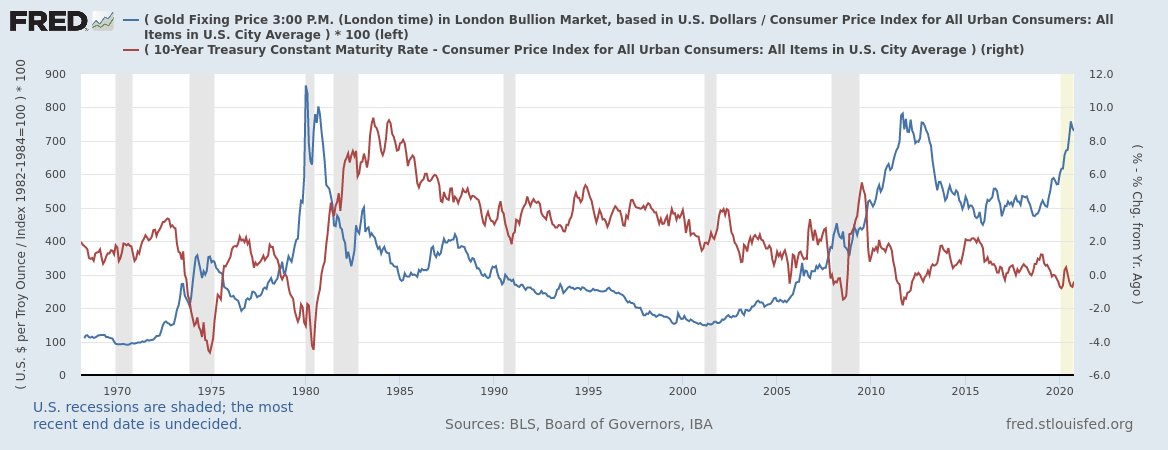

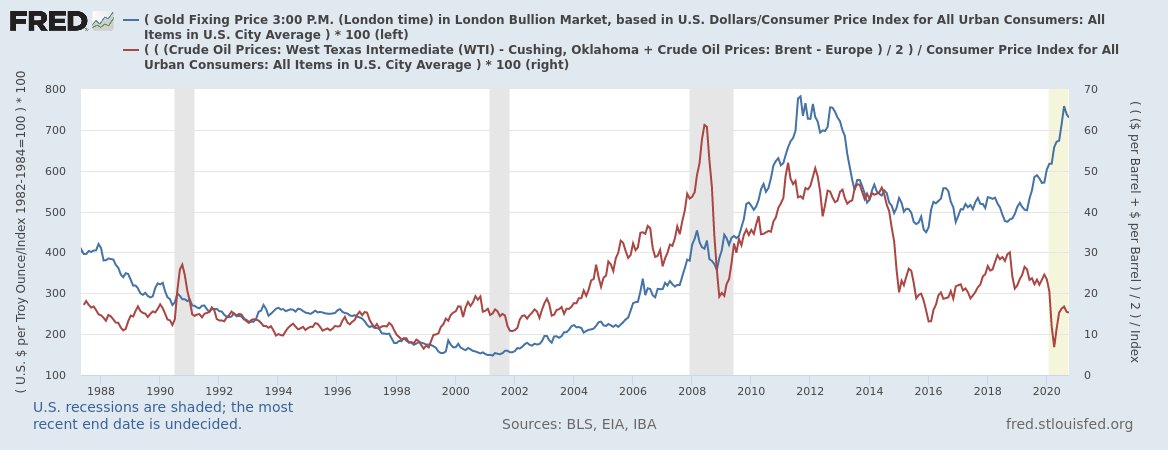

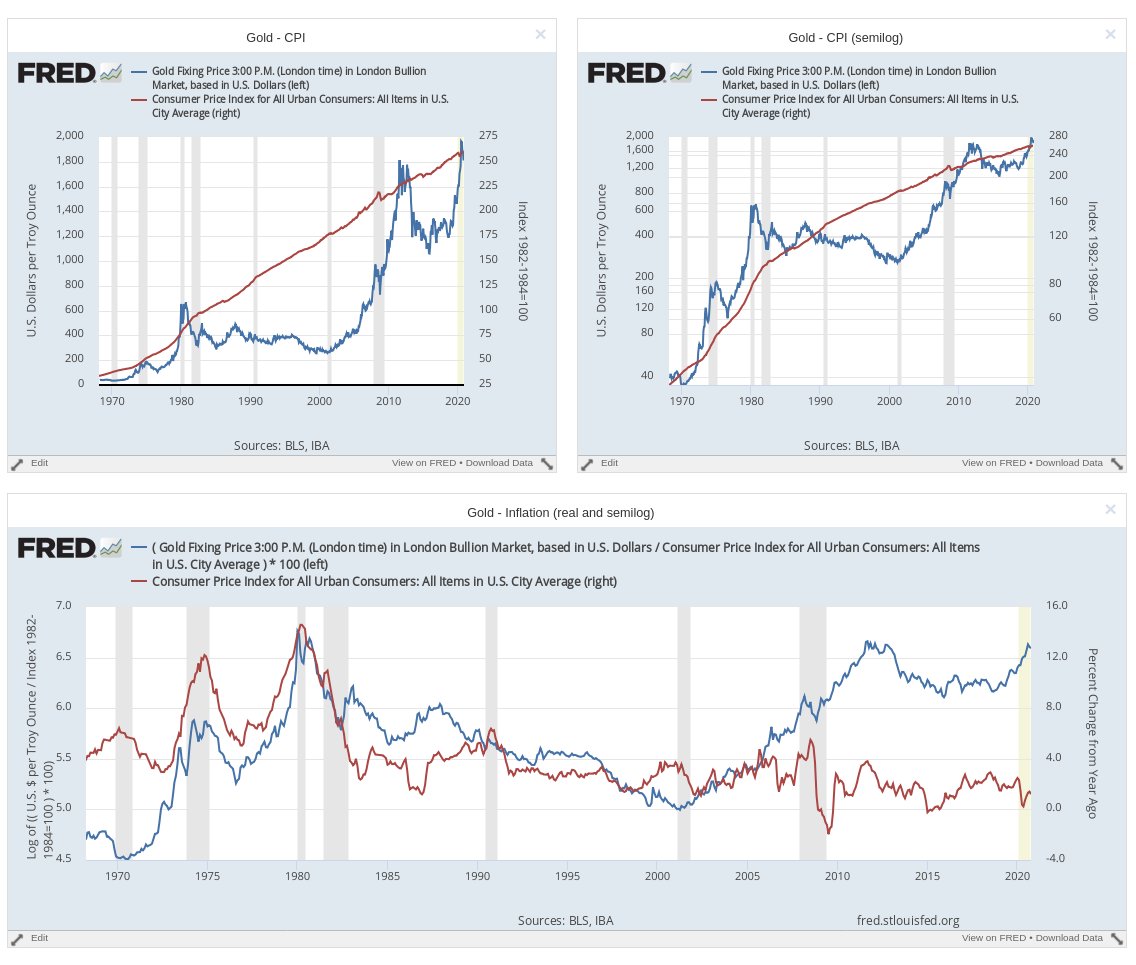

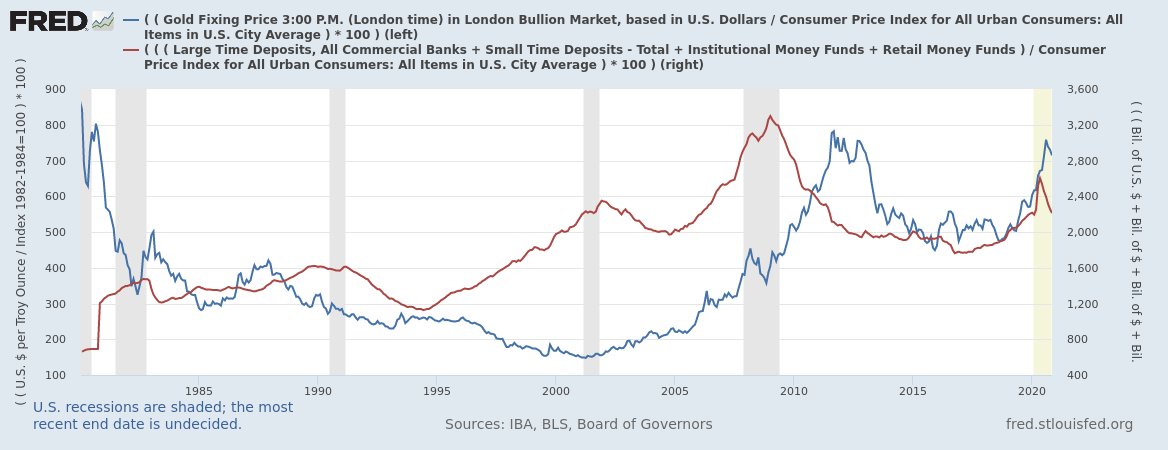

El oro descontado por inflación está a un 20% de su maximos histórico (Los 70 fueron asperos). Sigue o las tasas lo frenan? Manotazo de ahogado de la tasa o cambio de tendencia?

https://twitter.com/katanga_uranium/status/1319313026747666433

El oro descontado por inflación está a un 20% de su maximos histórico (Los 70 fueron asperos). Sigue o las tasas lo frenan? Manotazo de ahogado de la tasa o cambio de tendencia?

https://twitter.com/katanga_uranium/status/1319313026747666433

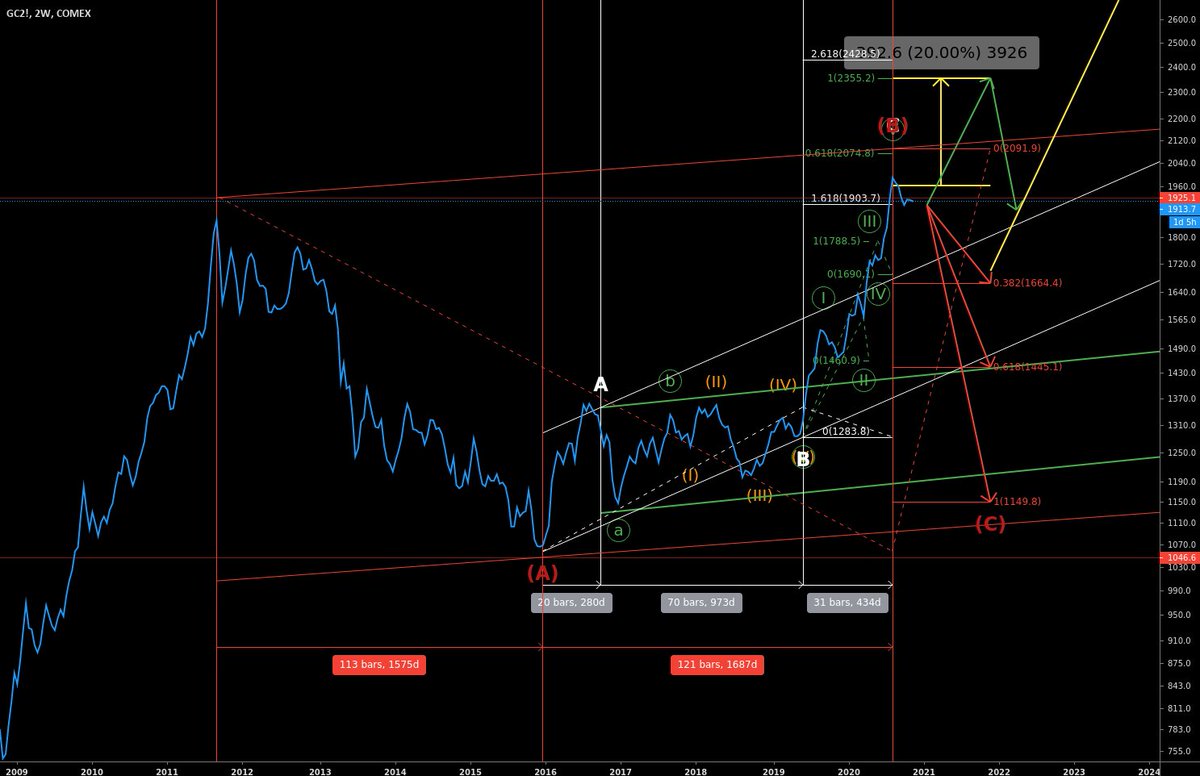

$GC #Gold Macro view

The winner of Round 1 is $US10Y

Also deflated gold and biweekly gold. Will it make that extra 20% to go past the 1980 deflated high (2430 at today values) ?

With yields current trend this does not seem possible!

https://twitter.com/katanga_uranium/status/1319313026747666433

The winner of Round 1 is $US10Y

Also deflated gold and biweekly gold. Will it make that extra 20% to go past the 1980 deflated high (2430 at today values) ?

With yields current trend this does not seem possible!

https://twitter.com/katanga_uranium/status/1319313026747666433

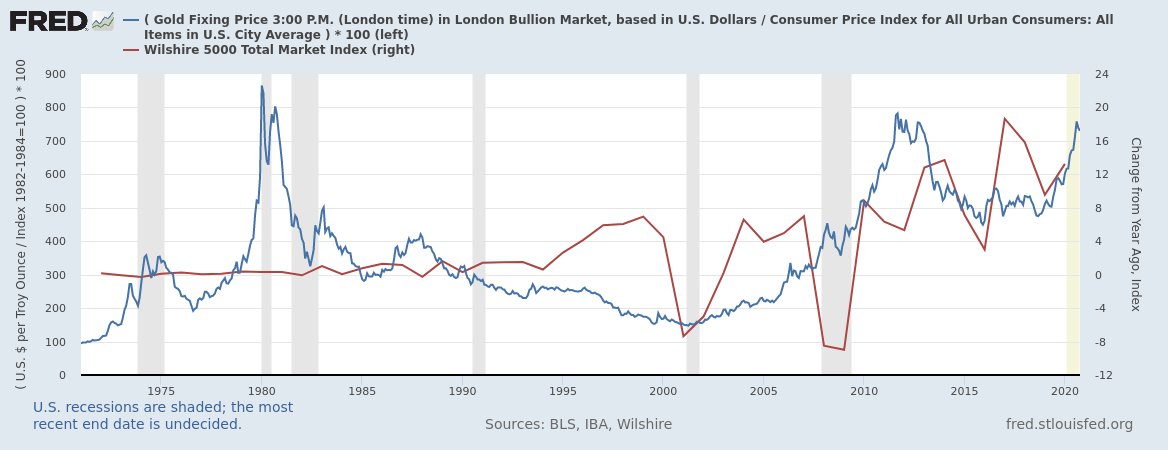

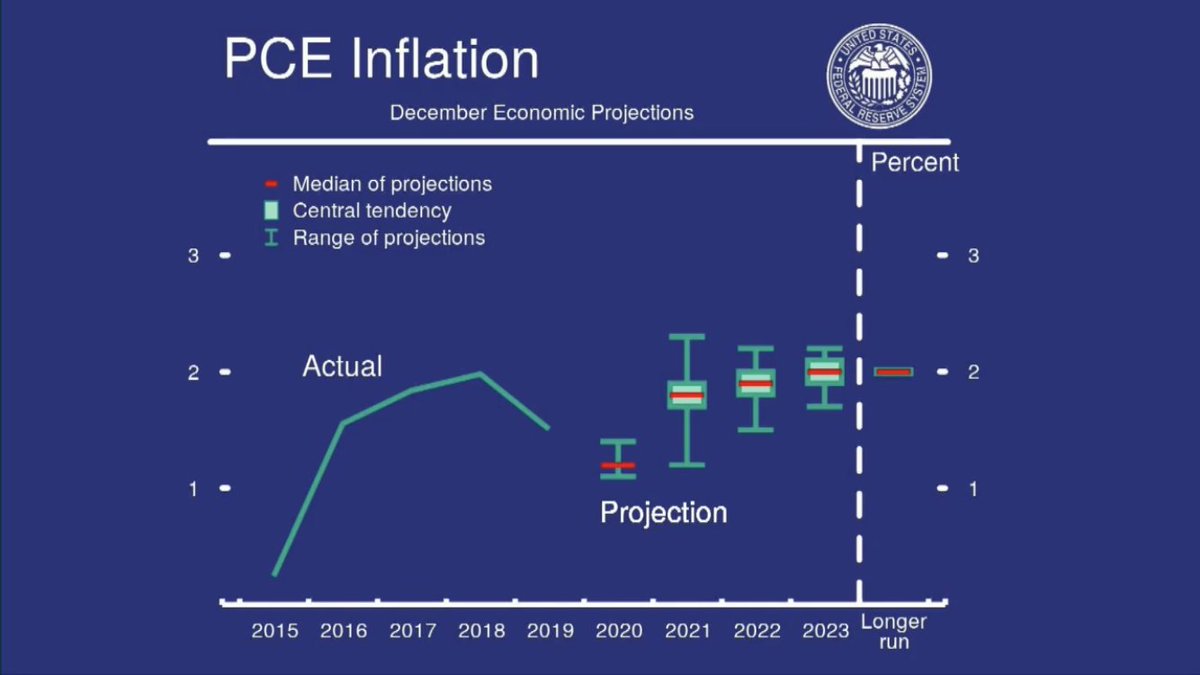

$GC #Gold Macro View!

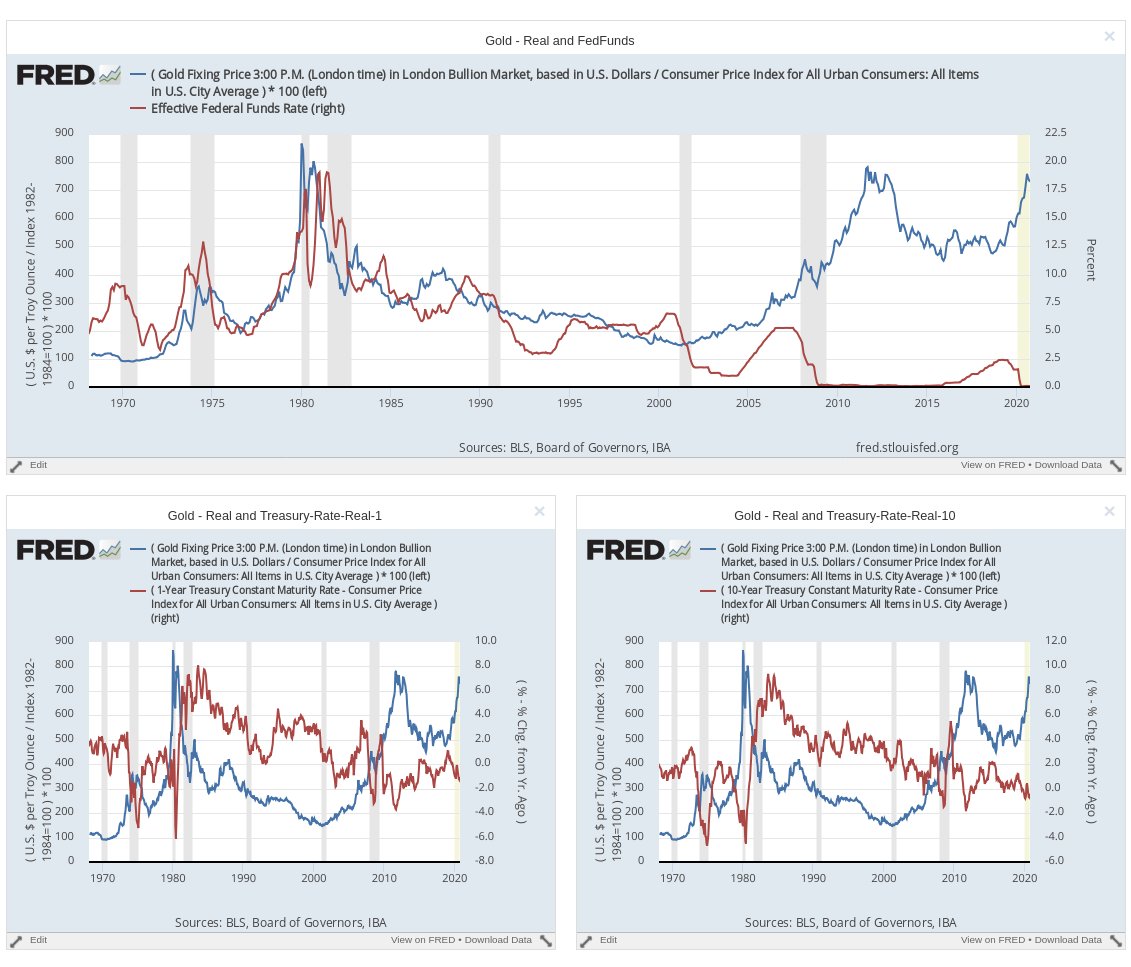

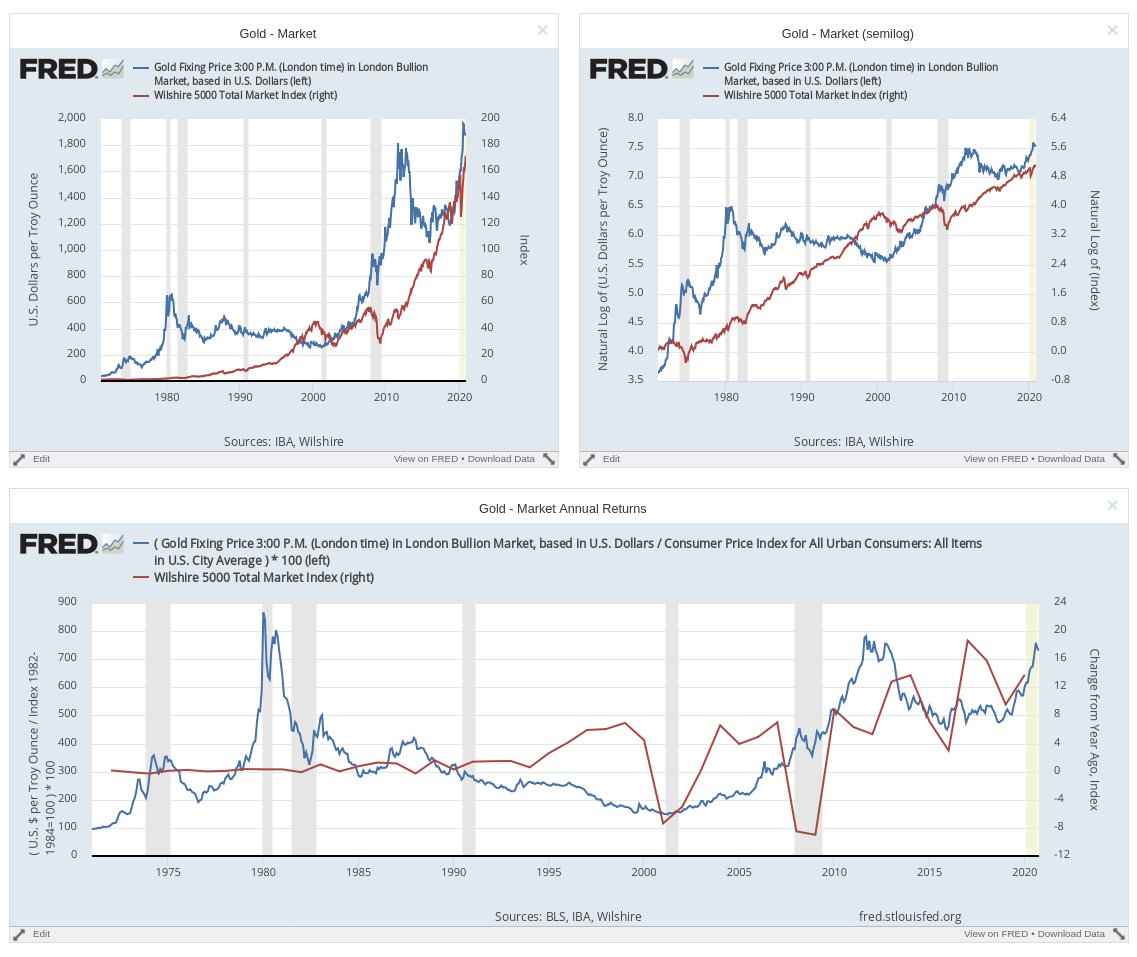

Vs. Inflation, Real Yields and market returns!

Due to no rapid recovery expected: no inflation in sight, bond prices continue high with stable yields and the market pricing a future vaccine, this doesn't look good for gold. Unless equity markets collapse!

Vs. Inflation, Real Yields and market returns!

Due to no rapid recovery expected: no inflation in sight, bond prices continue high with stable yields and the market pricing a future vaccine, this doesn't look good for gold. Unless equity markets collapse!

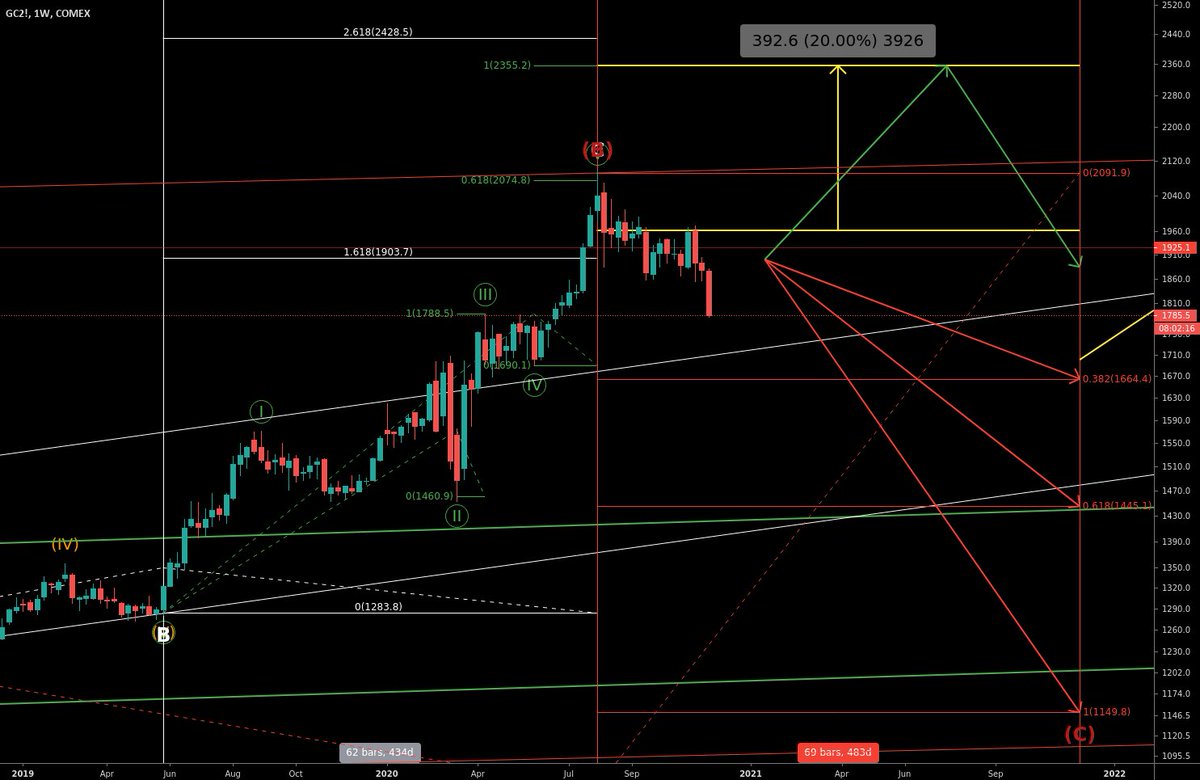

$GC #GOLD consuming my patience!

The 20% to the deflated ATH still seems a lot to me. I don't care money printing, M2, etc. Real yields where -4% on that days, now we have 0% and attractive yield ratios on value stocks!

Next bull cycle after correction!

https://twitter.com/lisaabramowicz1/status/1329365990912757760

The 20% to the deflated ATH still seems a lot to me. I don't care money printing, M2, etc. Real yields where -4% on that days, now we have 0% and attractive yield ratios on value stocks!

Next bull cycle after correction!

https://twitter.com/lisaabramowicz1/status/1329365990912757760

$GC #Gold

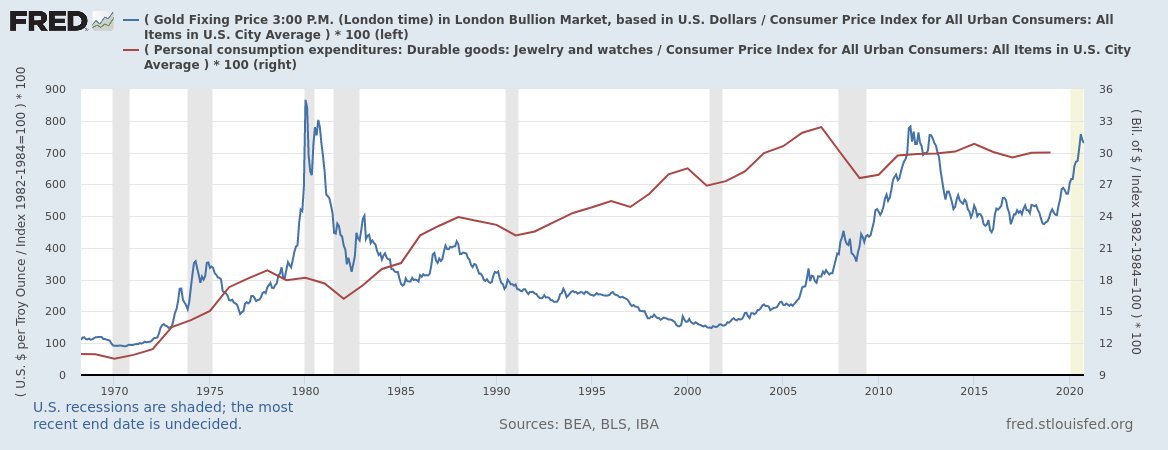

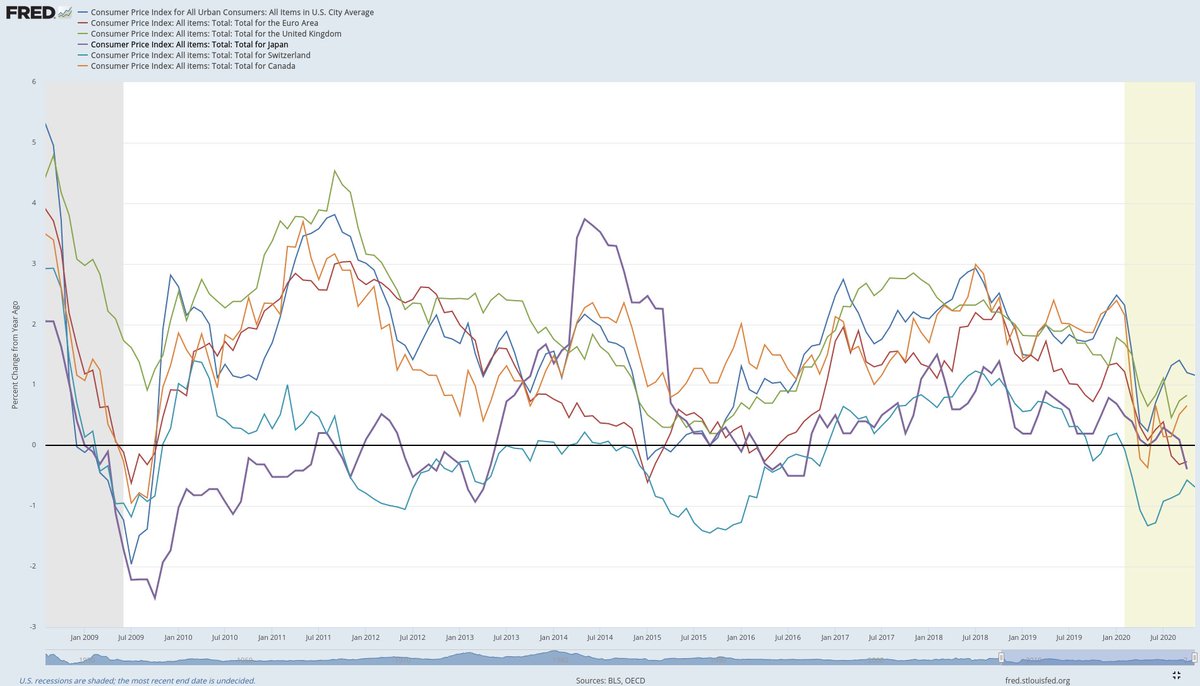

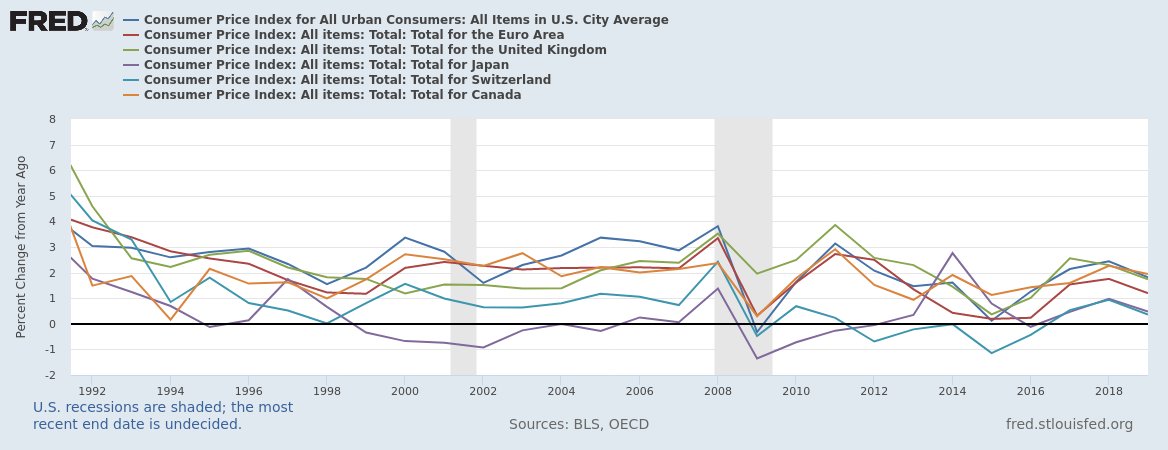

Adding Jewelry and Watches to my collection of Gold graphs!

This thing is telling us that no inflation is coming short term (CPI data is monthly), oil price may be just expectation and/or there is a need for dollars (I'm talking to you $DXY, first gold then dollar)!

Adding Jewelry and Watches to my collection of Gold graphs!

This thing is telling us that no inflation is coming short term (CPI data is monthly), oil price may be just expectation and/or there is a need for dollars (I'm talking to you $DXY, first gold then dollar)!

#Gold $GC Thank you Macro. Down scenario wins!

I'm watching you $DXY and $CL!

https://twitter.com/katanga_uranium/status/1329482664357863424

I'm watching you $DXY and $CL!

https://twitter.com/katanga_uranium/status/1329482664357863424

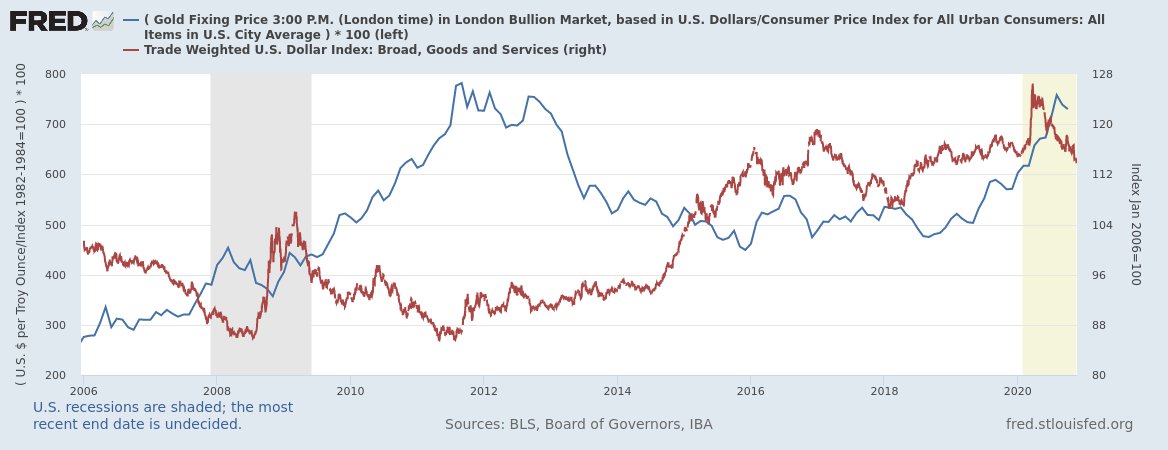

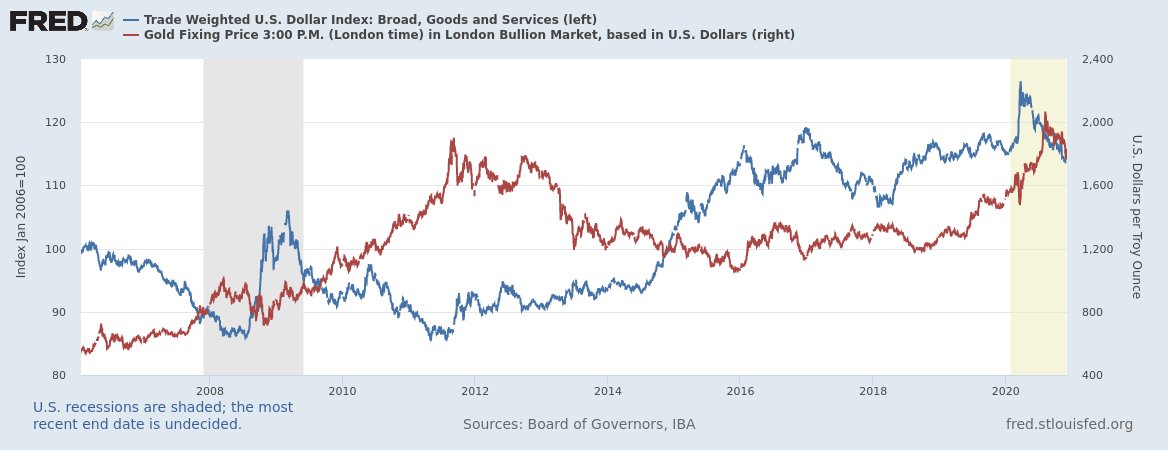

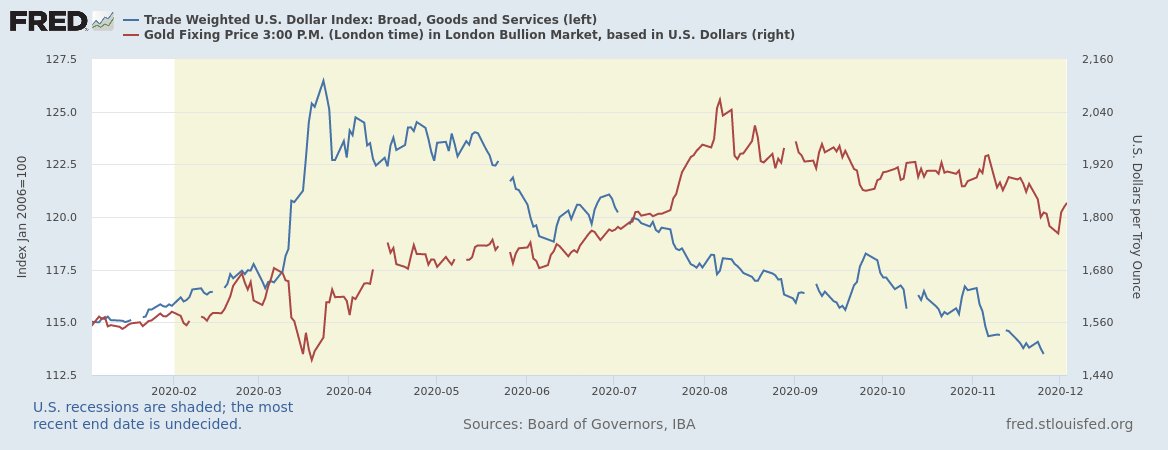

#Gold $GC Vs. Dollar. Somebody is lying!

What??? The dollar is going down the same time as gold? Do you really prefer to hold Canadians Dollars, Mexican Pesos, Euros or British Pounds?

DXY triangle is lying. I can bet on dollar going up more than Gold!

https://twitter.com/katanga_uranium/status/1334153513077706754

What??? The dollar is going down the same time as gold? Do you really prefer to hold Canadians Dollars, Mexican Pesos, Euros or British Pounds?

DXY triangle is lying. I can bet on dollar going up more than Gold!

https://twitter.com/katanga_uranium/status/1334153513077706754

#Gold $GC

When savings fall it's a matter of time until gold follows (no correlation with income). Money needs!

This money flows are due to the end of the stimulus and pause in student loan payments? Or going to buy more stocks? With jobless claims rising I suspect the former!

When savings fall it's a matter of time until gold follows (no correlation with income). Money needs!

This money flows are due to the end of the stimulus and pause in student loan payments? Or going to buy more stocks? With jobless claims rising I suspect the former!

#Gold $GC

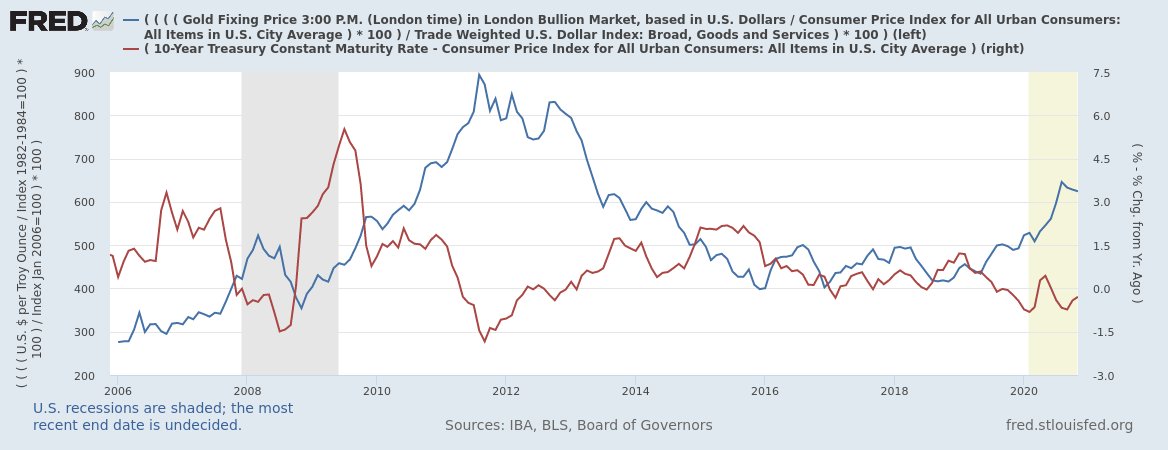

Gold inflation adjusted and Trade-Wighted-Dollar adjusted Vs. real rates!

Only if stimulus (Napier's financial repression) we'll see new highs. Because without this continuing government interventions we'll see rate caps with no inflation!

https://twitter.com/katanga_uranium/status/1339180327282020355

Gold inflation adjusted and Trade-Wighted-Dollar adjusted Vs. real rates!

Only if stimulus (Napier's financial repression) we'll see new highs. Because without this continuing government interventions we'll see rate caps with no inflation!

https://twitter.com/katanga_uranium/status/1339180327282020355

What about #Gold (Inflation and dollar adjusted) Vs. average real rates of mayor developed economies:

With rates data up to October, it's pricing the weaker dollar and/or a rapid surge in inflation. But watch out, Euro Area inflation for October was negative -0.30%!

With rates data up to October, it's pricing the weaker dollar and/or a rapid surge in inflation. But watch out, Euro Area inflation for October was negative -0.30%!

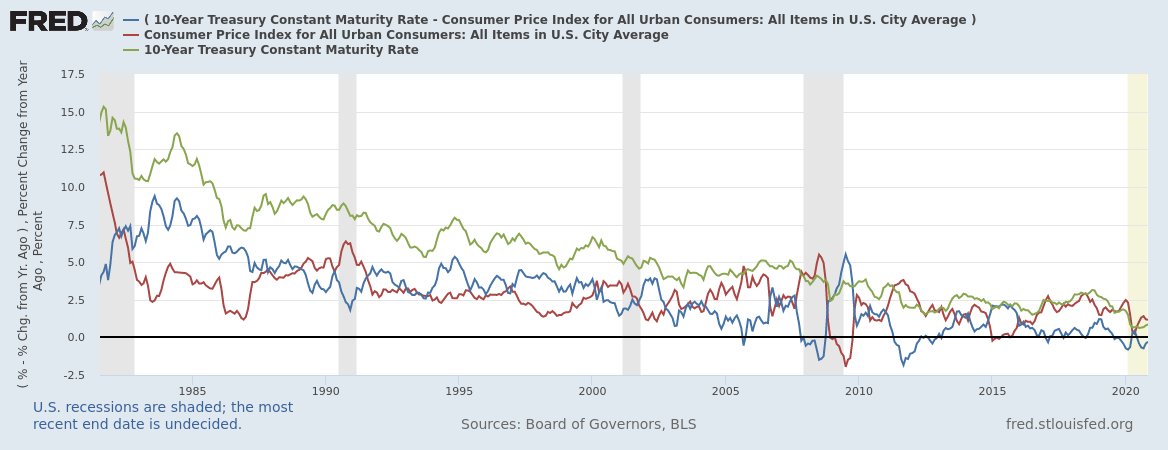

Last 2020 tweet about #Gold $GC!

Why bet against bonds? Yield only went down past 40 years (green) and if you are heavily trying to lend more money you don't want them going up!

Bear while I wait for this-time-is-different inflation and what $DXY does!

and what $DXY does!

https://twitter.com/katanga_uranium/status/1339628169561718787

Why bet against bonds? Yield only went down past 40 years (green) and if you are heavily trying to lend more money you don't want them going up!

Bear while I wait for this-time-is-different inflation

and what $DXY does!

and what $DXY does!https://twitter.com/katanga_uranium/status/1339628169561718787

The chart to show to your #Gold bugs / #Bitcoin  skeptics friends. Gold futures during 1979-1980 !!!

skeptics friends. Gold futures during 1979-1980 !!!

Bitcoin is new and untested and may end badly for most. But I continue to hear arguments against bitcoin that applied to gold. They say why they don't like it not why it can fail!

skeptics friends. Gold futures during 1979-1980 !!!

skeptics friends. Gold futures during 1979-1980 !!!Bitcoin is new and untested and may end badly for most. But I continue to hear arguments against bitcoin that applied to gold. They say why they don't like it not why it can fail!

Read on Twitter

Read on Twitter