monitor below chart closely.

$NQ just re-tested the lower support level

$NQ low = 11,598

they can't allow to plunge below 11,600 level.

otherwise, tomorrow bloodbath.

see below Support & Resistance levels

super accurate

stop-run levels on both sides: bulls & bears https://twitter.com/kerberos007/status/1318918295714750464

https://twitter.com/kerberos007/status/1318918295714750464

$NQ just re-tested the lower support level

$NQ low = 11,598

they can't allow to plunge below 11,600 level.

otherwise, tomorrow bloodbath.

see below Support & Resistance levels

super accurate

stop-run levels on both sides: bulls & bears

https://twitter.com/kerberos007/status/1318918295714750464

https://twitter.com/kerberos007/status/1318918295714750464

$NQ support & strong resistance levels

4-hr chart since Aug

$NQ above 11,600 = strong support (late Aug)

once breaking down below 11,600 (in Sep), then

it became strong resistance

then,

once it breaking above 11,600 (in Oct), it became strong support

super accurate TA?

4-hr chart since Aug

$NQ above 11,600 = strong support (late Aug)

once breaking down below 11,600 (in Sep), then

it became strong resistance

then,

once it breaking above 11,600 (in Oct), it became strong support

super accurate TA?

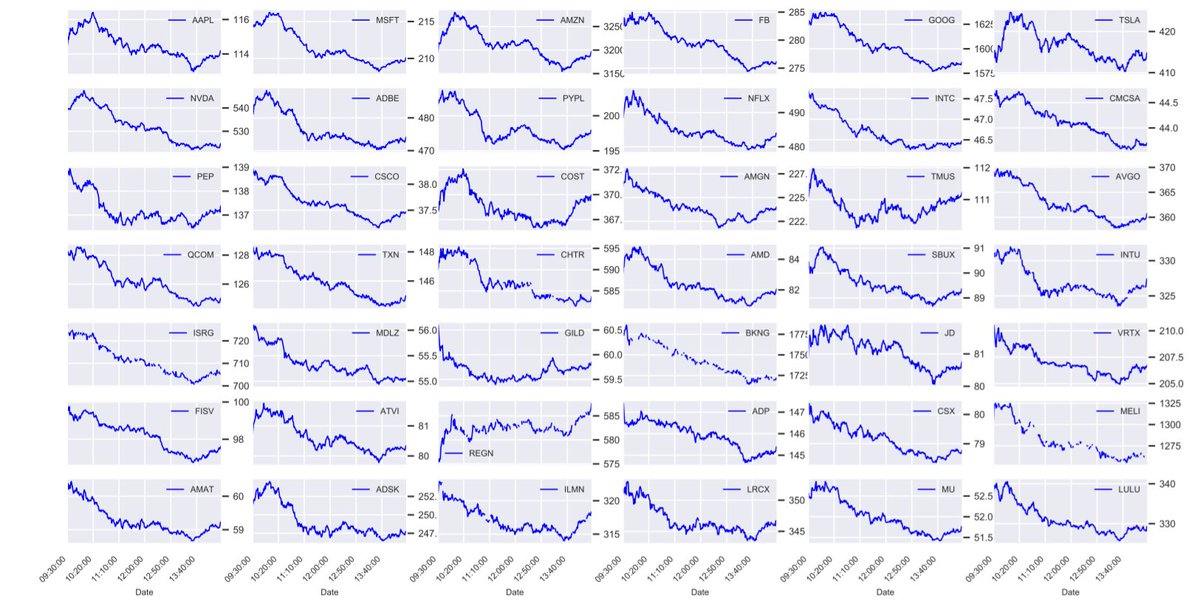

$NDX (not $NQ)

$NQ futures has ON real volume

$NDX is an index; there is no real volume

$NDX volume is approximated by aggregating volumes from individual component stock using weighted avg

not 100% accurate, but close for our purposes.

below: use your imaginations

$NQ futures has ON real volume

$NDX is an index; there is no real volume

$NDX volume is approximated by aggregating volumes from individual component stock using weighted avg

not 100% accurate, but close for our purposes.

below: use your imaginations

$GC = $Gold futures.

Magnet = 1900

liquidity hunting everywhere.

a chart is worth a million words.

no comment needed.

Magnet = 1900

liquidity hunting everywhere.

a chart is worth a million words.

no comment needed.

FWIW:

$NQ: E-mini NDX-100

Oct 30 expiry: next Friday

Max Pain: 11,700

#NQ is too volatile and OI is very thin;

mostly, short-term speculators.

so, Max Pain changes daily, and is not reliable.

$NQ: E-mini NDX-100

Oct 30 expiry: next Friday

Max Pain: 11,700

#NQ is too volatile and OI is very thin;

mostly, short-term speculators.

so, Max Pain changes daily, and is not reliable.

#S&P500 sector PCR analysis - leading

$SPY, $QQQ &

$XLK, $XLY, etc

2.5 yr data

1 sum calls & puts for all component stocks in the index/sector

2 cal aggregate PCR for the index/sector

3 cal 2.5 yr correlation b/w sector price & sector PCR

4 ranking in the next post

$SPY, $QQQ &

$XLK, $XLY, etc

2.5 yr data

1 sum calls & puts for all component stocks in the index/sector

2 cal aggregate PCR for the index/sector

3 cal 2.5 yr correlation b/w sector price & sector PCR

4 ranking in the next post

Aggregate component stock PCR corr ranking

aggr PCR & QQQ/SPY price corr (2.5 yr)

1 QQQ-103 stks=-62%

2 SPY-502 stks=-60%

3 $MTUM stks=-59%

4 $XLK=-57%

if just include the top 10 stks in QQQ PCR,

the correl b/w PCR & QQQ price is even higher(-ve)

QQQ stk PCR= leading ind

aggr PCR & QQQ/SPY price corr (2.5 yr)

1 QQQ-103 stks=-62%

2 SPY-502 stks=-60%

3 $MTUM stks=-59%

4 $XLK=-57%

if just include the top 10 stks in QQQ PCR,

the correl b/w PCR & QQQ price is even higher(-ve)

QQQ stk PCR= leading ind

In other words

the OTM call strategy works

the higher the QQQ-103 stock call buying, the lower the QQQ-103 PCR, pushing QQQ price higher

but, when at extremes, it became the best Contrarian ind ever

STFR FOMO/Euphoria/greed extreme

BTFD fear/capitulation extreme

the OTM call strategy works

the higher the QQQ-103 stock call buying, the lower the QQQ-103 PCR, pushing QQQ price higher

but, when at extremes, it became the best Contrarian ind ever

STFR FOMO/Euphoria/greed extreme

BTFD fear/capitulation extreme

$SPY OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

with closing price for reference.

up to Jan-2023 leap options

as of Friday, 2020-10-23

with closing price for reference.

up to Jan-2023 leap options

$QQQ OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

with closing price for reference.

up to Jan-2023 leap options

as of Friday, 2020-10-23

with closing price for reference.

up to Jan-2023 leap options

$SPX OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

with closing price for reference.

super bearish in SPX monthly options.

hint: hedging.

as of Friday, 2020-10-23

with closing price for reference.

super bearish in SPX monthly options.

hint: hedging.

$NDX OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

with closing price for reference.

as of Friday, 2020-10-23

with closing price for reference.

$GLD ETF OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

pinned to 178.5 to 180 for next few OpEx.

high OI volume OpEx series have massive call OIs (low PCR)

as of Friday, 2020-10-23

pinned to 178.5 to 180 for next few OpEx.

high OI volume OpEx series have massive call OIs (low PCR)

$HYG ETF OI, OI PCR and Max Pain for all the Options Expiry series.

as of Friday, 2020-10-23

massive put OIs (high PCR) across the board.

pinned to 84.5 to 85 for next few OpEx.

as of Friday, 2020-10-23

massive put OIs (high PCR) across the board.

pinned to 84.5 to 85 for next few OpEx.

speaking of HYG

IEF:HYG ratio (credit) & $VIX correlation

extremely HIGH in times of stress, fear, VIX spike

especially just before Feb & Mar pandemic

in both times $VIX spiked before credit spread

$VIX always knows; as good as $PCR, $JPY & $Gold

this time is different?

IEF:HYG ratio (credit) & $VIX correlation

extremely HIGH in times of stress, fear, VIX spike

especially just before Feb & Mar pandemic

in both times $VIX spiked before credit spread

$VIX always knows; as good as $PCR, $JPY & $Gold

this time is different?

Quiz time P-indicator

P-indicator

another "super contrarian" leading indicator: bottom ind

super complacent, just like $IEF / $HYG credit ratio

see the bottom mystery P-ind

correlation with VIX is extremely high

super accurate contrarian indicator at extremes.

BTFD $VIX strategy

BTFD $VIX strategy

P-indicator

P-indicatoranother "super contrarian" leading indicator: bottom ind

super complacent, just like $IEF / $HYG credit ratio

see the bottom mystery P-ind

correlation with VIX is extremely high

super accurate contrarian indicator at extremes.

BTFD $VIX strategy

BTFD $VIX strategy

by popular demand

total Equity Call/Put Ratio 5-day SMA (P/C ratio reversed)

from 16 exchanges

BTFD when dark blue line (CPR) dip below Capitulation Zone then cross above it

Lottery tickets accumulation when CPR surge above FOMO with Jaws & trend-line break

today = FOMO

total Equity Call/Put Ratio 5-day SMA (P/C ratio reversed)

from 16 exchanges

BTFD when dark blue line (CPR) dip below Capitulation Zone then cross above it

Lottery tickets accumulation when CPR surge above FOMO with Jaws & trend-line break

today = FOMO

Read on Twitter

Read on Twitter