The Federal Reserve ("Fed") and Treasury have been lowering interest rates, running bigger deficits, increasing debt, and printing money at an increasing pace for decades.

Thread . . .

1/

Thread . . .

1/

One effect of these policies is boom and bust cycles, which benefit some and hurt most.

The Federal Reserve ("Fed") and Treasury have been lowering interest rates, running bigger deficits, increasing debt, and printing money at an increasing pace for decades.

2/

The Federal Reserve ("Fed") and Treasury have been lowering interest rates, running bigger deficits, increasing debt, and printing money at an increasing pace for decades.

2/

One effect of these policies is that they create boom and bust cycles, which benefit some and hurt most.

We witnessed this in 2000, 2008, 2020, and more will come.

We are at the end of a well documented long term debt cycle that has repeated for hundreds of years.

3/

We witnessed this in 2000, 2008, 2020, and more will come.

We are at the end of a well documented long term debt cycle that has repeated for hundreds of years.

3/

These types of cycles generally come along once every 100 years, with the last one happening during the great depression during the 1930s. This has been studied by economists, especially @RayDalio, who founded the world's largest hedge fund.

4/

4/

He provides a simple explanation of these cycles in this video. ().

5/

5/

For decades, the polices have been to borrow more money and kick the can down the road. At the end of a long term debt cycle, it becomes difficult to kick the can any further without major consequences.

6/

6/

This is because they have exhausted all of their tools and anything further they do have bigger negative implications.

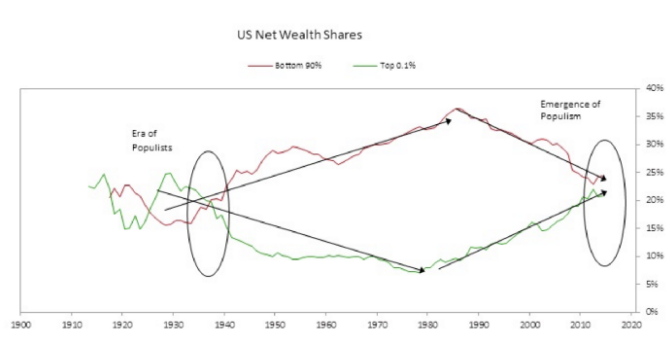

The consequences are increasing wealth inequality, and populism (i.e. extreme politicians and civil unrest with protests and riots), and inflation.

7/

The consequences are increasing wealth inequality, and populism (i.e. extreme politicians and civil unrest with protests and riots), and inflation.

7/

Many economists believe it will get much worse. I see no signs to disagree. Here is a graph of wealth inequality & populism over the last 100 years.

8/

8/

There are only four ways to solve the financial problems we face at the end of the long term debt cycle.

1. Austerity (spend less than they earn through taxes). We all know that relying on politicians to be financially responsible will never happen.

9/

1. Austerity (spend less than they earn through taxes). We all know that relying on politicians to be financially responsible will never happen.

9/

It also requires the citizens willing to endure great hardship for a long time. Seems unlikely.

2. Debt defaults. This would mean the USA would default on Treasury bonds. This would result in a epic global depression and the demise of the USA. Seems unlikely.

10/

2. Debt defaults. This would mean the USA would default on Treasury bonds. This would result in a epic global depression and the demise of the USA. Seems unlikely.

10/

3. Transfer of money (increased taxation). Seems likely, but not effective. Those with the most to lose will seek tax shelters.

4. Inflation (via devaluation of currency). The Fed will print money and try to inflate away the debt problems.

11/

4. Inflation (via devaluation of currency). The Fed will print money and try to inflate away the debt problems.

11/

It has been happening since 2008 and will continue to happen at an exponential pace. The pandemic has accelerated it and has made it clear to many that "the economy" is a house of cards.

12/

12/

The Fed has openly stated in its public meetings that it will do "whatever it takes" to support the economy. In simple terms, this means they will print more money and provide a backstop.

This is great right? Maybe.

13/

This is great right? Maybe.

13/

Depending on your income, savings, and how you chose to invest.

In many cases, the values of stocks, bonds, and real estate have skyrocketed. This is directly a result of printing money commonly called the Cantillion effect.

14/ https://www.aier.org/article/cantillon-effects-and-money-neutrality/#:~:text=The%20Cantillon%20Effect%20refers%20to,flow%20path%20through%20the%20economy

In many cases, the values of stocks, bonds, and real estate have skyrocketed. This is directly a result of printing money commonly called the Cantillion effect.

14/ https://www.aier.org/article/cantillon-effects-and-money-neutrality/#:~:text=The%20Cantillon%20Effect%20refers%20to,flow%20path%20through%20the%20economy

Simultaneously many people are unemployed or living paycheck to paycheck. Many people who are working don't have much free time (my definition of rich) because they are busy trying to make ends meet.

If you are the beneficiary of rising asset prices, great.

15/

If you are the beneficiary of rising asset prices, great.

15/

But it's important to know the reason why. In most cases, it is not that the investments are producing more income, but it is that people are willing to pay more. Mostly because it is a SoV and there is too much money in the system and it has no where else to go.

16/

16/

In addition, there are hundreds of zombie companies, which are firms whose debt servicing costs are higher than their profits. They are kept alive by cheap money from borrowing or capital infusion from wealthy investors (private equity) who want to drive value

17/

17/

One signal of a bubble is when we see non-investors talking about how they are making money trading (i.e. Robinhooders). We have met all of the others too (from Big Debt Crisis):

19/

19/

All of this is unsustainable and bound to create another bust cycle. It could be fast, or slow. It could be soon or it could take years. I have no idea. If anyone that tells you they do, it probably shows how much they don't know versus how much they do.

20/

20/

@michael_saylor, CEO of Microstrategy, said it best. The reason people are willing to pay more for these assets is that holding cash is like holding an "ice cube that’s melting".

Inflation is melting your purchasing power and we are forced

21/

Inflation is melting your purchasing power and we are forced

21/

to invest it in risky assets to keep what we save. The Fed has openly stated they have a goal to have more than 2% per year targeted inflation. Thus having cash for the next few years will reduce year buying power by **at least** 2% per year.

22/

End

22/

End

Read on Twitter

Read on Twitter