Ah, Equinor. They publicly posted their NA shale postmortem, which I applaud, but, sadly, when you get accountants to opine on what-went-wrong, the answer is some version of "accounting." A  /1

/1

/1

/1

Little Easter egg on page 12. Let us hope that the LA Austin Chalk is not at an "early stage of development," but at the end of the line. Because it's bad. /3

Chesapeake Marcellus JV in 2008. Talisman Eagle Ford JV in 2010. Equinor wanted to learn about shale from their JV partners, but wound up paying top dollar for University of Phoenix associates degrees. On the Gulf of Mexico, nonop performed and operated exploration did not. /4

The report goes on and on about controls, but this is a story of competence, not controls. In hindsight, paying big $$ for Brigham, Chesapeake Marcellus, going to look like mistakes. But capitalism rewards action! You can't be the smartest person in the room without a deal. /5

These acquisitions were always going to suck. But did they suck harder than they needed to? Reader, they did. And the reason is not in controls or systems or integration, but because the leadership didn't care to compete. Even this report, a postmortem, does not address... /6

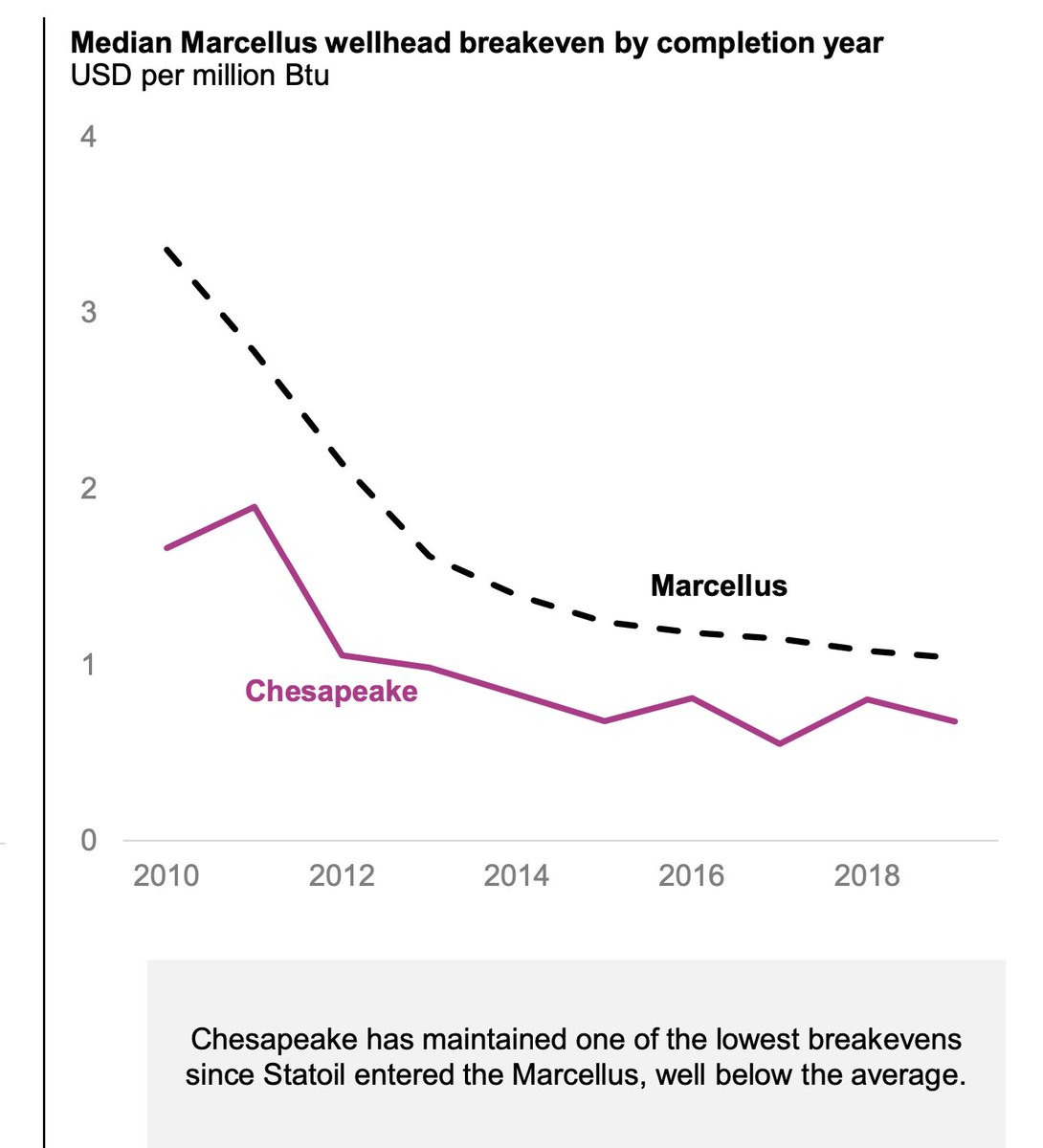

... the first question I would ask: How did you perform against offset operators? I realize that my focus on this question can come across as mischievous, given my former job, but it's insane that in a postmortem of what went wrong you hire Rystad. < $1/MMbtu b/e?? Really? /7

I mean, < $1 could be real if you ignore gathering, transportation, but "cheap excluding all costs," is a dumb story. And let's not bury the lede. HOW DID $EQNR PERFORM AGAINST DIRECTLY OFFSETTING OPERATORS? This report doesn't know. They don't know. /8

My first job out of MBA school was at a power company in the wake of Enron exploding. This company also shattered investors by overinvesting in gas turbines. The solution? Prevent billions in future writeoffs by instituting a board approval gatekeeper. People like me. /9

Imagine the uselessness of that job. I'm asking a guy who ran nukes, nuclear submarines, and went to war, "Is that an approved price deck?" Piss off, pipsqueak. What I learned: You either trust your management or you don't. If you don't, fire them. /10

And what I learned in my years of looking at companies that perpetually lost money, made bad decisions, set cash on fire: why aren't you looking at the smart people around you and doing THAT? What will it take for you to swallow your ego and admit you don't know everything? /end

Read on Twitter

Read on Twitter