1/x Bank Summary

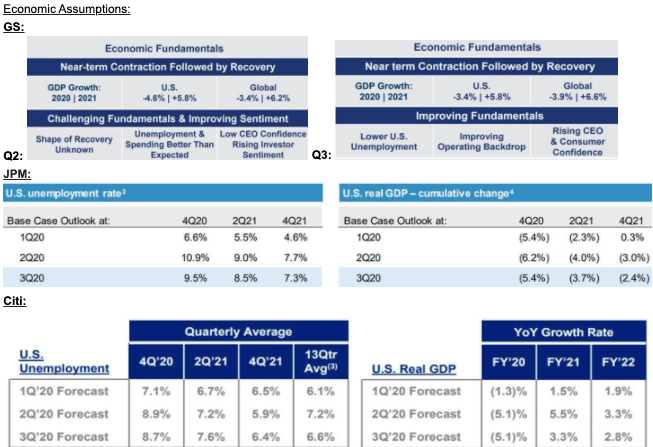

Banks are past peak reserve builds and have started to release reserves as the economic base case is improving. Deposit’s / consumer currently strong due to the stimulus, but this is expected to revert into higher charge offs & delinquencies in early/mid 2021.

Banks are past peak reserve builds and have started to release reserves as the economic base case is improving. Deposit’s / consumer currently strong due to the stimulus, but this is expected to revert into higher charge offs & delinquencies in early/mid 2021.

2/x

Support: Bank balance sheets are well prepared (maybe over prepared) for upcoming economic headwinds. Rates are low and will remain low until 2022-2023 which will support risk assets. Liquidity is abundant, but weak NII trajectory remains unchanged with big banks < ~2% NIM's

Support: Bank balance sheets are well prepared (maybe over prepared) for upcoming economic headwinds. Rates are low and will remain low until 2022-2023 which will support risk assets. Liquidity is abundant, but weak NII trajectory remains unchanged with big banks < ~2% NIM's

3/x

Going forward: Banks either need to boost NII via loan growth, hope the yield curve steepens, or continue to improve their non-interest income mix. Capital market performance sustainability is in question and the rise of SPAC’s and direct listings are a headwind to IB.

Going forward: Banks either need to boost NII via loan growth, hope the yield curve steepens, or continue to improve their non-interest income mix. Capital market performance sustainability is in question and the rise of SPAC’s and direct listings are a headwind to IB.

4/x

Catalysts: Buyback resumption (hopefully after Q4) will be a big tailwind (banks built CET1 capital in the quarter, leaving excess capital). Dimon hopes to deploy in 1Q20. Fiscal stimulus could help boost LT rates and drive inflation.

Value: Banks are quite cheap...

Catalysts: Buyback resumption (hopefully after Q4) will be a big tailwind (banks built CET1 capital in the quarter, leaving excess capital). Dimon hopes to deploy in 1Q20. Fiscal stimulus could help boost LT rates and drive inflation.

Value: Banks are quite cheap...

5/x

Strategy: As the world is shifting online $JPM is doubling down on offline, net opening 37 branches in Q3 (highest # of new branches since 2011). The strategy is a mid-term growth driver since JPM received approval to enter 10 new states, putting them in 48.

Strategy: As the world is shifting online $JPM is doubling down on offline, net opening 37 branches in Q3 (highest # of new branches since 2011). The strategy is a mid-term growth driver since JPM received approval to enter 10 new states, putting them in 48.

6/x

Insight from @gamesblazer06 - Dimon has “no interest in protecting just NII” $JPM is not interested in taking the Fed cash and dumping it into TLT at low rates to marginally improve NII (and get crushed when rates rise). Indicates LT positioning for curve steepening.

Insight from @gamesblazer06 - Dimon has “no interest in protecting just NII” $JPM is not interested in taking the Fed cash and dumping it into TLT at low rates to marginally improve NII (and get crushed when rates rise). Indicates LT positioning for curve steepening.

7/7

Anyone to follow for an opinion on exchanges right now? $CBOE, $ICE, $NDAQ, $CME trading at a 6% forward P/E discount to the S&P (in-line ex-CBOE) vs 5-yr ave premium of 20%. $CBOE is looking cheap at 20% discount to peers. Will VIX products recover as volatility dissipates?

Anyone to follow for an opinion on exchanges right now? $CBOE, $ICE, $NDAQ, $CME trading at a 6% forward P/E discount to the S&P (in-line ex-CBOE) vs 5-yr ave premium of 20%. $CBOE is looking cheap at 20% discount to peers. Will VIX products recover as volatility dissipates?

@MarcRuby I found your pieces below very informative. Thank you and I love the blog. Any thoughts on CBOE's underperformance or your favorite exchange operator?

https://netinterest.substack.com/p/the-new-power-brokers

https://netinterest.substack.com/p/disrupting-bloomberg https://netinterest.substack.com/p/plumbing-the-worlds-markets-the-story

https://netinterest.substack.com/p/the-new-power-brokers

https://netinterest.substack.com/p/disrupting-bloomberg https://netinterest.substack.com/p/plumbing-the-worlds-markets-the-story

Read on Twitter

Read on Twitter