Thread Alert

Thread Alert

The @ecb preseident madame @Lagarde drops yet another

BOMBSHELL

BOMBSHELL on the market neutrality principle.

on the market neutrality principle. Twitter-review, especially in context of green transition and role of the ECB as a market-maker and shaper. FYI @Isabel_Schnabel

1/

https://www.bloomberg.com/news/articles/2020-10-14/lagarde-says-ecb-needs-to-question-market-neutrality-on-climate

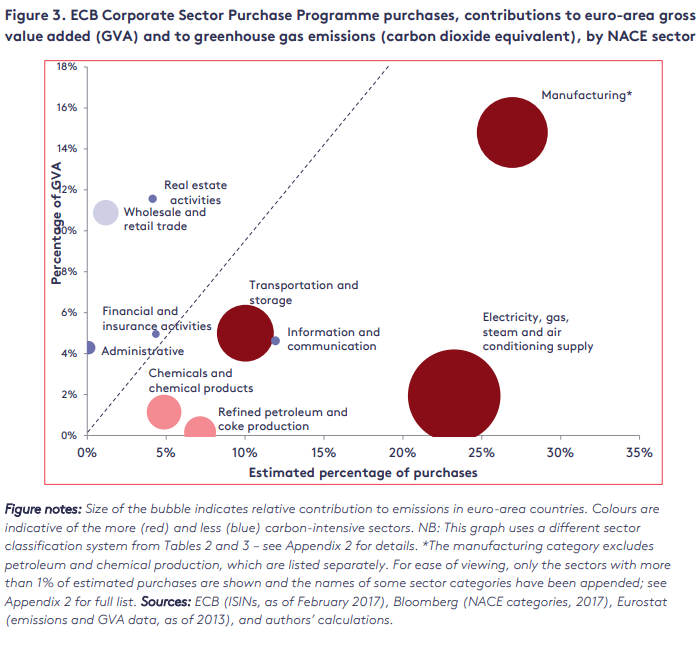

A guiding principle of the ECB’s approach to monetary policy is the concept of ‘market neutrality’. In terms of the Corporate QE programme, the ECB perceives and chooses to implements this principle by buying bonds that mirror the composition of the eligible bond market.

2/

2/

This conceptualization/implementation of market neutrality leads to a carbon bias, as capital and carbon intensive corporates - which often require large amounts of finance – are over represented in the CSPP list of eligible bonds. (A paper coming out on this next week)...

3/

3/

Importantly the concept of market neutrality is actually more blurry than seems. A case has been made that market neutrality is not consecrated into EU law, and instead of being a legal requirement its more akin to a doctorine.

4/thread

@PositiveMoneyEU https://www.positivemoney.eu/2019/09/ecb-market-neutrality-doctrine/

4/thread

@PositiveMoneyEU https://www.positivemoney.eu/2019/09/ecb-market-neutrality-doctrine/

To begin with, it is worth noting that by choosing to reflect the current make-up of the corporate bond market the ECB pro-actively distorts the market’s dynamism and reinforces the status quo.

5/thread

https://www.lse.ac.uk/granthaminstitute/publication/the-climate-impact-of-quantitative-easing/

5/thread

https://www.lse.ac.uk/granthaminstitute/publication/the-climate-impact-of-quantitative-easing/

Can the ECB really be considered sincerely market neutral in of itself if it supports industry incumbents and locks-in market distortions?

6/ thread

6/ thread

We @jryancollins argue such distortions include an overly myopic emphasis on short versus long-term profits/horizons as well as the carbon bias. A more climate friendly approach to monetary policy might be more market neutral over the long-term.

7/ thread https://neweconomics.org/uploads/files/NEF_BRIEFING_CENTRAL-BANKS-CLIMATE_E.pdf

7/ thread https://neweconomics.org/uploads/files/NEF_BRIEFING_CENTRAL-BANKS-CLIMATE_E.pdf

Far from following a minimalist approach to market neutrality, by accepting and purchasing a variety of private sector assets through its monetary operations the ECB conducts credit operations with the private sector to foster economic growth.

8/thread

https://www.bruegel.org/2019/02/greening-monetary-policy/

8/thread

https://www.bruegel.org/2019/02/greening-monetary-policy/

Similarly, @BJMbraun shows the @ecb has played a role of market maker (shaping and co-creating markets) by trying to shoring securitization market. The same could be said about the ECB’s current purchases of commercial paper under the CSPP.

9/thread https://academic.oup.com/ser/advance-article-abstract/doi/10.1093/ser/mwy008/4883362?redirectedFrom=fulltext

9/thread https://academic.oup.com/ser/advance-article-abstract/doi/10.1093/ser/mwy008/4883362?redirectedFrom=fulltext

In another piece, @DanielaGabor @BJMbraun @benjlemoine make the case that ECB operations are geared towards protecting one specific cadre of the market – banks and asset managers, which then...

10/thread https://www.socialeurope.eu/enlarging-the-ecb-mandate-for-the-common-good-and-the-planet

10/thread https://www.socialeurope.eu/enlarging-the-ecb-mandate-for-the-common-good-and-the-planet

"decide which firms and sectors have access to credit, what is considered productive and useful, what may prosper and what must fail”. While @emacampiglio shows that choosing to purchase bonds versus equity shares is in of itself not market neutral ( @GRI_LSE link above)

11/thread

11/thread

While @jvtklooster and @clemfon have shown that small and medium enterprises benefit less from the CSPP – thus the CSPP is bias against SMEs.

12/thread https://www.tandfonline.com/doi/full/10.1080/13563467.2019.1657077

12/thread https://www.tandfonline.com/doi/full/10.1080/13563467.2019.1657077

Pointing to the ECJ's ruling on the OMT @stanjourdan argues that there is legal precedent where the ECB has moved beyond the market neutrality approach and to intervene in the functioning of markets to align them with societal good.

13/thread https://www.positivemoney.eu/2019/09/ecb-market-neutrality-doctrine/

13/thread https://www.positivemoney.eu/2019/09/ecb-market-neutrality-doctrine/

So should market neutrality be the principle that guides monetary policy @Lagarde? Well no, not if the welfare of markets are put well before people and our planet.

Sorry @bundesbank really time we adopt a common sense monetary policy, put people and planet before markets.

Sorry @bundesbank really time we adopt a common sense monetary policy, put people and planet before markets.

Read on Twitter

Read on Twitter