Me->

Don't worry & never regret.

I understand those 5 Rs saving cost you big opportunity. What my personal experience is that until things are in watchlist it will always be neglected.

2

Don't worry & never regret.

I understand those 5 Rs saving cost you big opportunity. What my personal experience is that until things are in watchlist it will always be neglected.

2

Me->

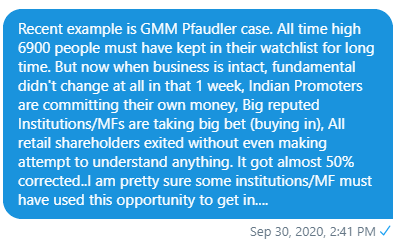

You watchlist will keep growing & so the negligence. It's like they are extra players and they never get chance to play.

There are so many good stocks. We can't buy each of them. Once you like something & have conviction you need to take some position.

3

You watchlist will keep growing & so the negligence. It's like they are extra players and they never get chance to play.

There are so many good stocks. We can't buy each of them. Once you like something & have conviction you need to take some position.

3

Me->

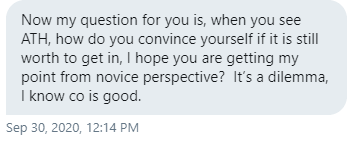

Once a stock is part of portfolio however small you will always tend to find out about it.

If a fall happens due to marker sentiment or some rumour/confusion that's the time to get in.

This is where your conviction get tested.

4

Once a stock is part of portfolio however small you will always tend to find out about it.

If a fall happens due to marker sentiment or some rumour/confusion that's the time to get in.

This is where your conviction get tested.

4

Me->

If you didn't show your brave side/logical side you will again regret. Like many people are regretting March/Apr fall when they didn't buy their favourite stocks which were all time high before & available at 50% discount...

5

If you didn't show your brave side/logical side you will again regret. Like many people are regretting March/Apr fall when they didn't buy their favourite stocks which were all time high before & available at 50% discount...

5

Me->

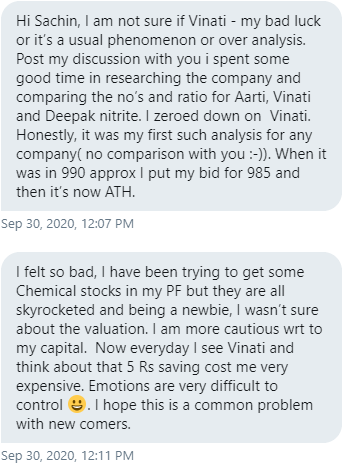

Now comes your dilemma part on ATH.

Dilemma will be higher if your time frame of stock is smaller.

Dilemma will be higher if your time frame of stock is smaller.

6

Now comes your dilemma part on ATH.

Dilemma will be higher if your time frame of stock is smaller.

Dilemma will be higher if your time frame of stock is smaller.6

Me->

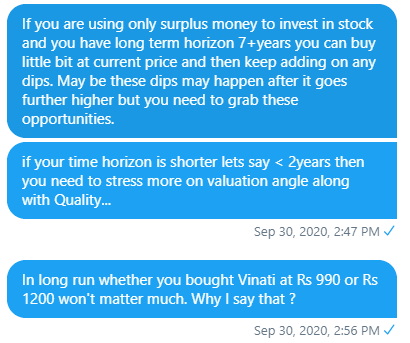

Let me explain with your example.

You missed buying Vinati Organics at Rs 990.

Now you decided to buy it at Rs 1200

Consider Vinati gave 18% CAGR return in next 10yrs

You decided to invest Rs 39600. You will get 33 shares of Vinati at Rs 1200 instead of 40 shares at 990

7

Let me explain with your example.

You missed buying Vinati Organics at Rs 990.

Now you decided to buy it at Rs 1200

Consider Vinati gave 18% CAGR return in next 10yrs

You decided to invest Rs 39600. You will get 33 shares of Vinati at Rs 1200 instead of 40 shares at 990

7

It costed you 7 shares but still you have decent 33 shares to compound better than having 0 shares in case you didn't invest at all because of dilemma that it is ATH.

8

8

Only thing is that for Rs 990 your return will be higher in CAGR terms with more shares in demat...but at Rs 1200 with 33 shares isn't bad at all.

9

9

Read on Twitter

Read on Twitter