[THREAD] Lightspeed $LSPD

Lightspeed provides a cloud-based omnichannel commerce platform to small and medium-sized businesses.

This Canadian company is growing fast and has started to attract investors’ attention.

Time to do my first thread on this upcoming business!

Lightspeed provides a cloud-based omnichannel commerce platform to small and medium-sized businesses.

This Canadian company is growing fast and has started to attract investors’ attention.

Time to do my first thread on this upcoming business!

1/ The Business

Lightspeed helps SMB’s to transition into the new digital economy.

The company is mainly focused on the retail, hospitality, and golf industries.

Lightspeed is active in >100 countries with over 77.000 customer locations.

Lightspeed helps SMB’s to transition into the new digital economy.

The company is mainly focused on the retail, hospitality, and golf industries.

Lightspeed is active in >100 countries with over 77.000 customer locations.

2/ Business Model

Revenues are derived from two sources:

1. Software and Payment Revenues (89%)

2. Hardware and Other Revenues (11%)

50%+ of revenues are derived from the US, followed by the Netherlands and Canada (both around 10.5%)

Revenues are derived from two sources:

1. Software and Payment Revenues (89%)

2. Hardware and Other Revenues (11%)

50%+ of revenues are derived from the US, followed by the Netherlands and Canada (both around 10.5%)

3/ Business Model

The company follows a land and expand strategy.

Lightspeed first onboards customers for a specific use case and then cross- and up-sells its services to said customers.

Lightspeed divides its services into front-end, back-end and payments.

The company follows a land and expand strategy.

Lightspeed first onboards customers for a specific use case and then cross- and up-sells its services to said customers.

Lightspeed divides its services into front-end, back-end and payments.

4/ Business Model

Some notable services:

- Lightspeed Payments: Payment processing solution

- eCommerce: Online marketplace across different channels

- Analytics Suite: Data insights into business operations

- Loyalty

- Accounting

- POS

Some notable services:

- Lightspeed Payments: Payment processing solution

- eCommerce: Online marketplace across different channels

- Analytics Suite: Data insights into business operations

- Loyalty

- Accounting

- POS

5/ Business Model

Lightspeed has partnered up with Stripe to launch Lightspeed Capital

Eligible merchants can be provided with financing up to $50.000

More convenient, accessible, and efficient than traditional SMB loans

Basically like Square Capital

Lightspeed has partnered up with Stripe to launch Lightspeed Capital

Eligible merchants can be provided with financing up to $50.000

More convenient, accessible, and efficient than traditional SMB loans

Basically like Square Capital

6/ Industry

- Strong tailwinds from the increasing need for omnichannel solutions for SMB’s

- 80% of the market still using legacy systems according to the CEO

- $113B TAM based on SMB’s within retail and restaurants

- Strong tailwinds from the increasing need for omnichannel solutions for SMB’s

- 80% of the market still using legacy systems according to the CEO

- $113B TAM based on SMB’s within retail and restaurants

7/ Competitors

- Lightspeed competes in a fragmented market with many players

- The company faces strong competition from big players like $SQ $PYPL and $SHOP

- Also competition from niches and smaller players such as $PAR & $FOUR

- Lightspeed competes in a fragmented market with many players

- The company faces strong competition from big players like $SQ $PYPL and $SHOP

- Also competition from niches and smaller players such as $PAR & $FOUR

8/ Management

Founder and CEO Dax Dasilva has been running the business since 2005

94% Approval rate on Glassdoor and still only 44 years young

Holds 13.7% of outstanding shares

The popular investment group ARK has recently started to add shares

Founder and CEO Dax Dasilva has been running the business since 2005

94% Approval rate on Glassdoor and still only 44 years young

Holds 13.7% of outstanding shares

The popular investment group ARK has recently started to add shares

9/ Growth Strategy

1.Expanding the customer base

2.Expand Payment & Financial Solutions

3.Expand Average Revenue Per User (ARPU)

4.M&A

Lightspeed has been aggressive with acquisitions in 2019, acquiring four companies with a combined deal size of $207M ($133M LTM Revenues)

1.Expanding the customer base

2.Expand Payment & Financial Solutions

3.Expand Average Revenue Per User (ARPU)

4.M&A

Lightspeed has been aggressive with acquisitions in 2019, acquiring four companies with a combined deal size of $207M ($133M LTM Revenues)

10/ Financials

From 2016-2020 revenues and gross profit have been growing at 40%+ CAGR

Q1 2021 ending last June, Lightspeed saw a 50% YoY revenue growth and 70% in Q4 2020

GTV has grown from $7.1B in 2017 to $22.3B for FY2020, 46% CAGR

From 2016-2020 revenues and gross profit have been growing at 40%+ CAGR

Q1 2021 ending last June, Lightspeed saw a 50% YoY revenue growth and 70% in Q4 2020

GTV has grown from $7.1B in 2017 to $22.3B for FY2020, 46% CAGR

11/ Financials

Gross margins in a declining trend since 2019 due to increased focus on payment processing solutions

ARPU increased 15% YoY from $200 to $230 in FY 2020

No single customer accounted for more than 1% of revenues

>40% of customers use >1 Lightspeed module

Gross margins in a declining trend since 2019 due to increased focus on payment processing solutions

ARPU increased 15% YoY from $200 to $230 in FY 2020

No single customer accounted for more than 1% of revenues

>40% of customers use >1 Lightspeed module

12/ Financials

Company has not reported positive operating earnings since public reporting

Sales & Marketing expenses have significantly decreased as % of revenues

G&A costs quite high at 20% of revenues

Relative increases in R&D again since FY 2018

Company has not reported positive operating earnings since public reporting

Sales & Marketing expenses have significantly decreased as % of revenues

G&A costs quite high at 20% of revenues

Relative increases in R&D again since FY 2018

13/ Financials

Operating losses as % of revenues are currently much lower than before

Net losses have substantially declined, although both losses are still significant at more than -40% of revenues

Company has not reported positive FCF yet and does not appear to do so soon

Operating losses as % of revenues are currently much lower than before

Net losses have substantially declined, although both losses are still significant at more than -40% of revenues

Company has not reported positive FCF yet and does not appear to do so soon

14/ Financials

Lightspeed holds >$200M in cash and $46.7M in total debt

Extensive usage of equity financing to fund operations (~$340M in the last two fiscal years)

Lightspeed is well capitalized for now but might rely on issuing shares again soon with current annual losses

Lightspeed holds >$200M in cash and $46.7M in total debt

Extensive usage of equity financing to fund operations (~$340M in the last two fiscal years)

Lightspeed is well capitalized for now but might rely on issuing shares again soon with current annual losses

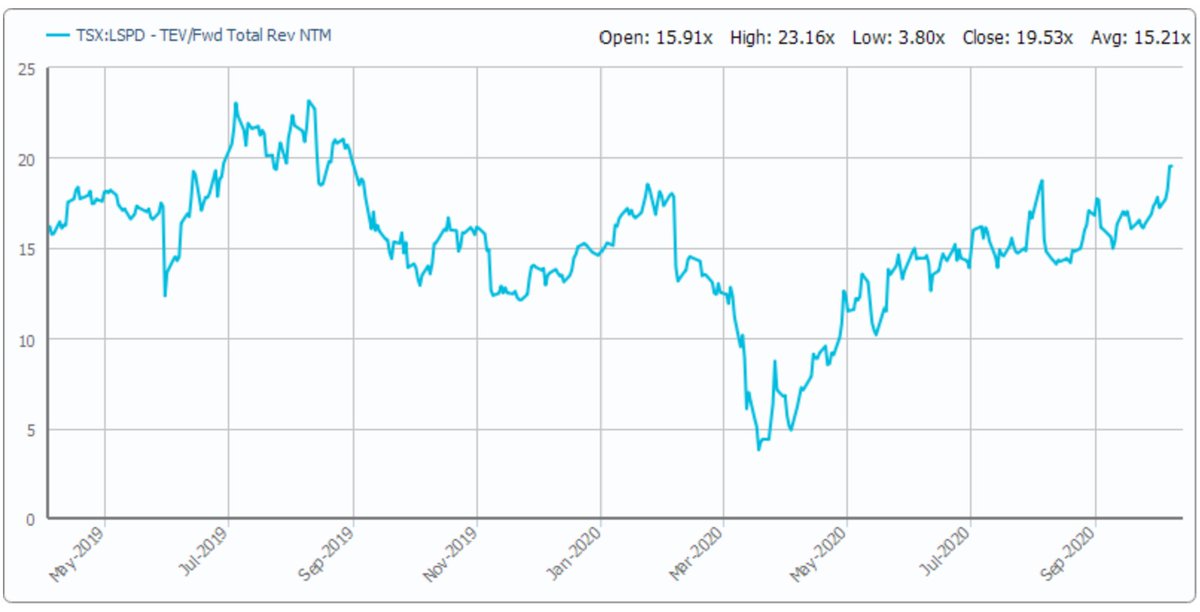

15/ Valuation

Mcap: 3.86B USD

- Historic EV/Sales: 7-35

- Average & Median: 21.5

- Current: 26

- Historic EV/NTM Sales: 4-23

- Average & Median: 15

- Current: 19.5

Mcap: 3.86B USD

- Historic EV/Sales: 7-35

- Average & Median: 21.5

- Current: 26

- Historic EV/NTM Sales: 4-23

- Average & Median: 15

- Current: 19.5

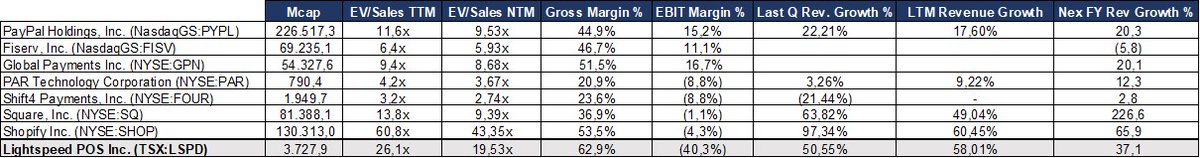

16/ Valuation

Compared to peers, Lightspeed appears quite expensive

Valuation can be partly explained by high revenue growth

However, Lightspeed is losing much more money than peers

Compared to peers, Lightspeed appears quite expensive

Valuation can be partly explained by high revenue growth

However, Lightspeed is losing much more money than peers

17/ Risks

- Cyclical SMB exposure

- Customer industries strongly impacted by COVID-19 (Retail & Hospitality)

- Very competitive landscape with bigger innovators

- Liquidity issues in the future due to heavy losses

- Cyclical SMB exposure

- Customer industries strongly impacted by COVID-19 (Retail & Hospitality)

- Very competitive landscape with bigger innovators

- Liquidity issues in the future due to heavy losses

18/ Personal take

Things I like:

- Holistic platform with an omnichannel focus

- High top-line growth

- International exposure

- Founder-led with a sizeable ownership

- Large TAM and tailwinds

Things I like:

- Holistic platform with an omnichannel focus

- High top-line growth

- International exposure

- Founder-led with a sizeable ownership

- Large TAM and tailwinds

19/ Personal take

Things I dislike:

- Lack of moat / competitive edge

- Heavy loss-making with no sight of profitability for the near-term

- Declining gross margins

- Valuation

Things I dislike:

- Lack of moat / competitive edge

- Heavy loss-making with no sight of profitability for the near-term

- Declining gross margins

- Valuation

20/ Conclusion

I believe Lightspeed has a strong customer value proposition by aiding SMB’s into their omnichannel transition. The company’s platform in combination with a land and expand strategy has generated significant growth in a promising industry.

I believe Lightspeed has a strong customer value proposition by aiding SMB’s into their omnichannel transition. The company’s platform in combination with a land and expand strategy has generated significant growth in a promising industry.

21/ Conclusion

Nevertheless, lack of differentiation, large losses and high valuation make the r/r unappealing to me for now. I will continue to follow the company and might start a small position in the future if the thesis improves.

Let me know what you think!

Nevertheless, lack of differentiation, large losses and high valuation make the r/r unappealing to me for now. I will continue to follow the company and might start a small position in the future if the thesis improves.

Let me know what you think!

@GetBenchmarkCo Also made a great thread on the company yesterday and managed to just beat me to it

Highly recommend to check that out as well! https://twitter.com/GetBenchmarkCo/status/1314300096259989509?s=20

Highly recommend to check that out as well! https://twitter.com/GetBenchmarkCo/status/1314300096259989509?s=20

Read on Twitter

Read on Twitter![[THREAD] Lightspeed $LSPDLightspeed provides a cloud-based omnichannel commerce platform to small and medium-sized businesses. This Canadian company is growing fast and has started to attract investors’ attention.Time to do my first thread on this upcoming business! [THREAD] Lightspeed $LSPDLightspeed provides a cloud-based omnichannel commerce platform to small and medium-sized businesses. This Canadian company is growing fast and has started to attract investors’ attention.Time to do my first thread on this upcoming business!](https://pbs.twimg.com/media/Ej5ayM3XcAAho7z.jpg)