Which DTC telehealth company was the second-fastest startup to join the unicorn club, grew sales (91% recurring) at a 128% CAGR since 2018 with 71% gross margins, can you buy for only ~9x next year’s sales at a $1.6B valuation?

You'd be correct if you guessed Hims & Hers, which is merging with Howard Mark's fund Oaktree Capital's SPAC $OAC in a deal set to close in Q4.

Here's an overview of its platform, market, and competition:

Here's an overview of its platform, market, and competition:

Hims covers an increasing range of markets from hair loss, ED, dermatology, mental health, and primary care.

Its customers are mostly millennials, 80% of which are first-time buyers, who may not want to talk about these stigmatized conditions with in-person providers.

Its customers are mostly millennials, 80% of which are first-time buyers, who may not want to talk about these stigmatized conditions with in-person providers.

Customers fill out their information online and are connected with a provider over chat, video, or phone who then can write a prescription for medication that can be delivered in discrete packaging by Hims through a subscription or sent to their local pharmacy.

Revenue growth decelerated from 209% last year to 67% this year and projected 30% for the following two years (probably a baseline) while gross margins stabilize in the mid-70s. They are still unprofitable but can expect to be EBITDA-positive by 2023.

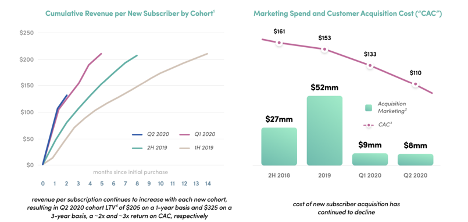

Unit economics remain strong with a 3x 3-year LTV/CAC. LTV is improving with newer cohorts and CAC continuing to decrease as Hims establishes its brand (+65 NPS)

LTV is expected to continue to improve over time as Hims enters into additional markets like Sleep and Fertility.

LTV is expected to continue to improve over time as Hims enters into additional markets like Sleep and Fertility.

Its main competition is Ro, which is also focused on many of the same categories. Ro also offers an online cash pay pharmacy business that charges $5/month/drug.

This article compares the two and for most medications, Hims appears to be more expensive: https://sciencific.com/bluechew-vs-hims-vs-roman-which-erectile-dysfunction-product-works-for-you/

This article compares the two and for most medications, Hims appears to be more expensive: https://sciencific.com/bluechew-vs-hims-vs-roman-which-erectile-dysfunction-product-works-for-you/

GoodRx is also a potential competitior. It already has the telehealth platform and now with its subscription Gold Plan, drugs like Sildenafil can be delivered right to your door. With its pharmacy marketplace as its front door, it has strong optionality.

https://www.goodrx.com/blog/introducing-goodrx-gold-prescription-mail-delivery/

https://www.goodrx.com/blog/introducing-goodrx-gold-prescription-mail-delivery/

So, I am not sure they have a strong moat. Its marketing efforts are on point but there isn’t much to stop a customer from taking advantage of the low-margin consults and taking the prescription to their local pharmacy.

Getting access to proper healthcare is expensive, time-consuming, and frustrating.

Hims introduces transparency, convenience, and cost-savings at a time when 3/4 of millennials would prefer to take charge of their health and look online for medical advice.

Hims introduces transparency, convenience, and cost-savings at a time when 3/4 of millennials would prefer to take charge of their health and look online for medical advice.

With an EV of ~$1.6B, a massive untapped market, and trading at a significant discount to peers, R/R at these levels seems compelling. The founder is very impressive, and so is the investor base (like Founders Fund and Oaktree).

https://res.cloudinary.com/forhims/image/upload/v1601546466/documents/investors/HH-Investor_Presentation.pdf

https://res.cloudinary.com/forhims/image/upload/v1601546466/documents/investors/HH-Investor_Presentation.pdf

Disclosure: I started a small position in my personal portfolio and Luca Capital owns shares as well

Read on Twitter

Read on Twitter