How much you pay yourself first determines how quickly you can reach financial independence.

Let's say you're making $60k per year at a job.

Your salary grows at 4% per year.

Assume 8% growth on your investments.

Let's see what happens

[Thread]

Let's say you're making $60k per year at a job.

Your salary grows at 4% per year.

Assume 8% growth on your investments.

Let's see what happens

[Thread]

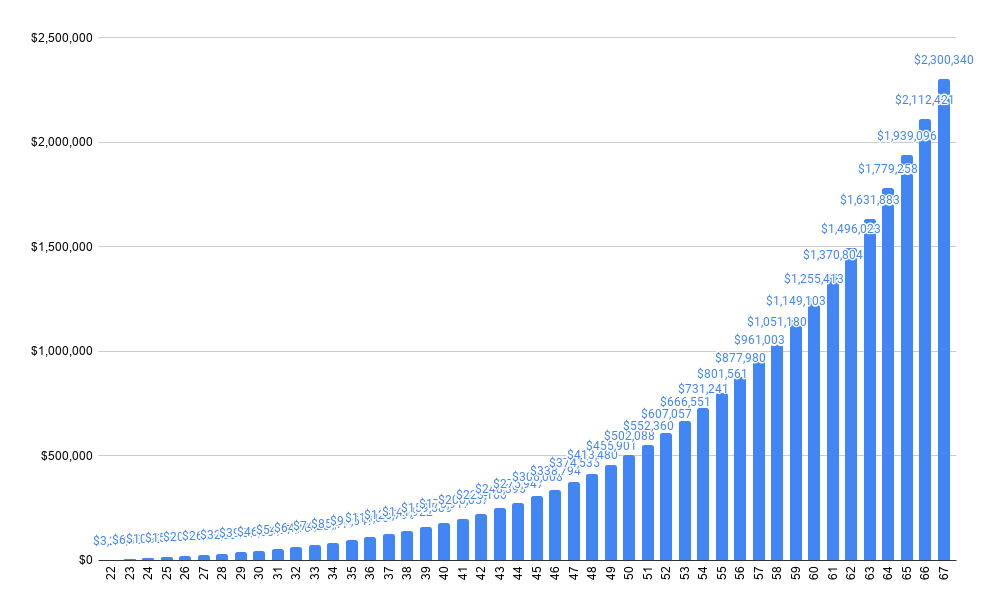

Let's say you pay yourself 5% first.

This is entirely doable by contributing to your 401(k) up to your employer's match.

You become a millionaire at 58.

Your nest egg will grow to $2.3 million by age 67

This is entirely doable by contributing to your 401(k) up to your employer's match.

You become a millionaire at 58.

Your nest egg will grow to $2.3 million by age 67

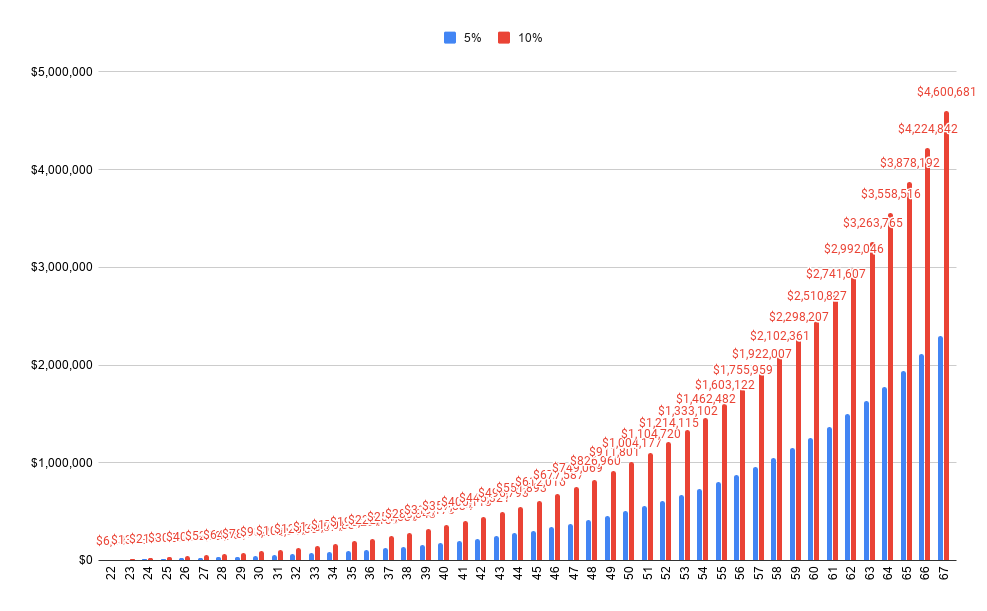

Now let's double that to 10%.

Potentially doable by 401(k) match alone, or increasing it slightly above the match.

You become a millionaire 8 years earlier at 50.

Your nest egg doubles to $4.6 million by age 67.

Potentially doable by 401(k) match alone, or increasing it slightly above the match.

You become a millionaire 8 years earlier at 50.

Your nest egg doubles to $4.6 million by age 67.

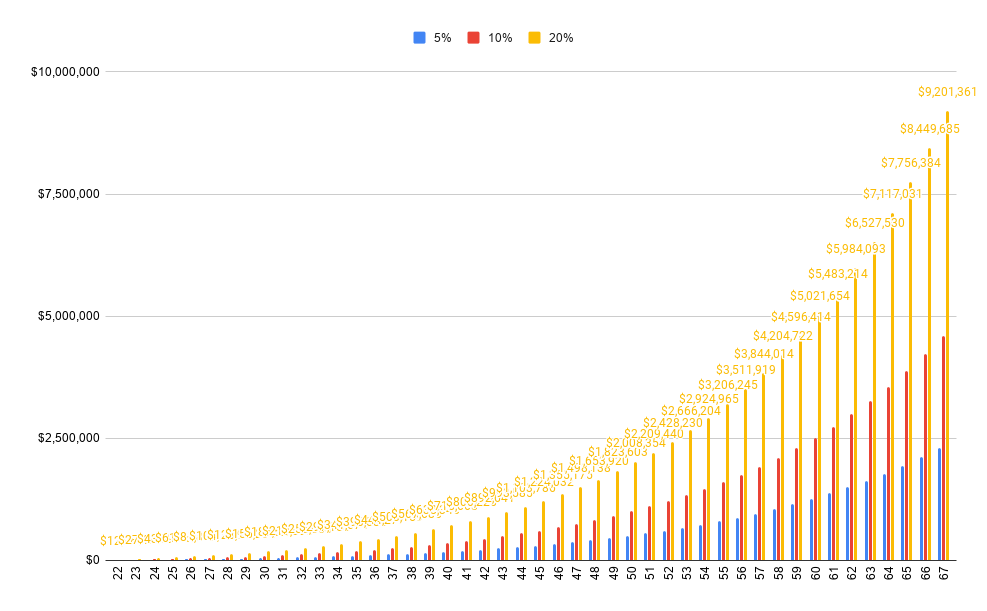

Let's double again to 20%

This is entirely achievable and used to be common wisdom.

You become a millionaire at 44!

Your nest egg double again to $9.6 million at 67.

This is entirely achievable and used to be common wisdom.

You become a millionaire at 44!

Your nest egg double again to $9.6 million at 67.

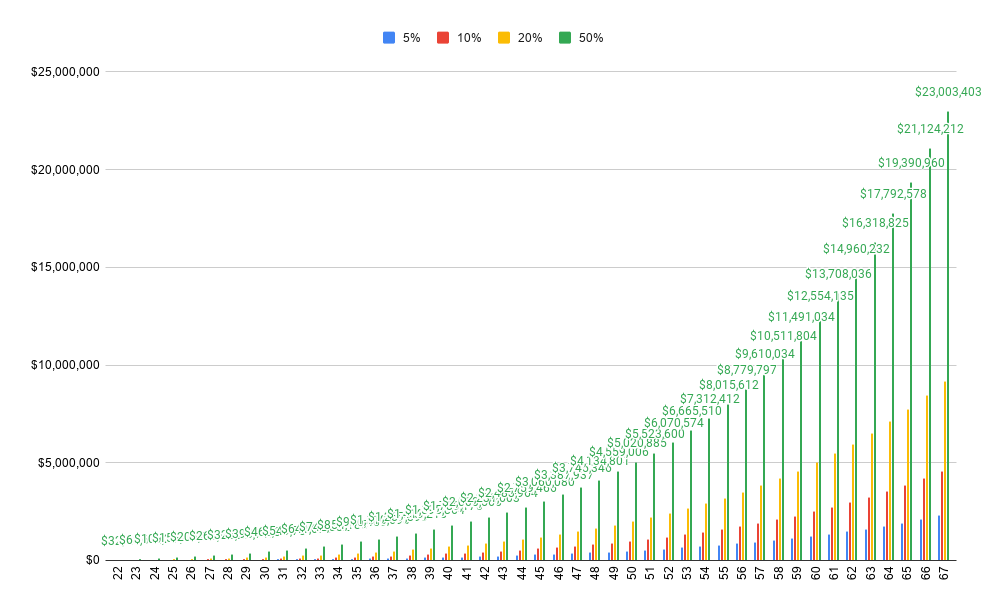

Finally let's do something that seems outlandish, but is also possible.

50% savings rate.

You become a millionaire at 36!

Your nest egg will be $23 million at 67.

50% savings rate.

You become a millionaire at 36!

Your nest egg will be $23 million at 67.

As you can see, doubling your savings rate doubles your outcome and can significantly accelerate your goal of reaching financial independence.

Savings rate is a significant lever to pull.

Pay yourself first, Pay yourself often!

Savings rate is a significant lever to pull.

Pay yourself first, Pay yourself often!

Read on Twitter

Read on Twitter