Would appreciate feedback on my "best" idea at this moment. Beware, it’s ugly. $HNRG produces thermal coal, an industry in obvious secular decline. Crux is: $HNRG is small enough to profitably retain its tiny share of the world for a while and potentially grow if/when others exit

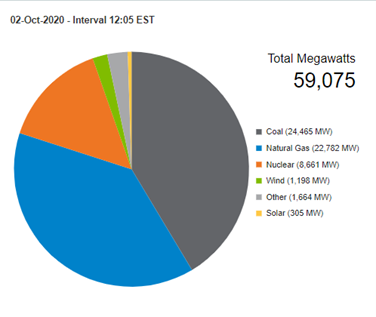

$HNRG is based in IN, produces only IL basin tons, and sells 70% of to customers in the state of IN, where much of the grid still relies on coal and where coal is politically powerful & socially kosher. Here’s a current grid snapshot from MISO (which isn’t purely IN):

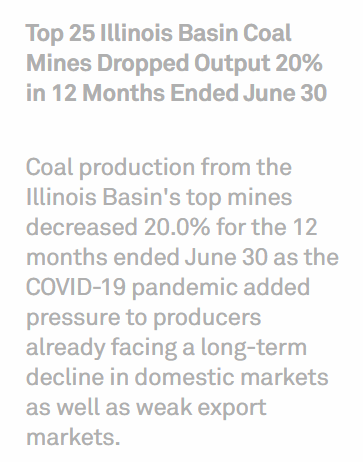

The IL Basin has shrunk prod 20% y-o-y, and big players are $BTU, $ARLP, White Stallion, and Murray. $BTU is the largest coal producer & their bonds trade at 60 cents. $ARLP had cut all workers in ILB. White Stallion isn’t long for the world, and Murray is already in a messy BK.

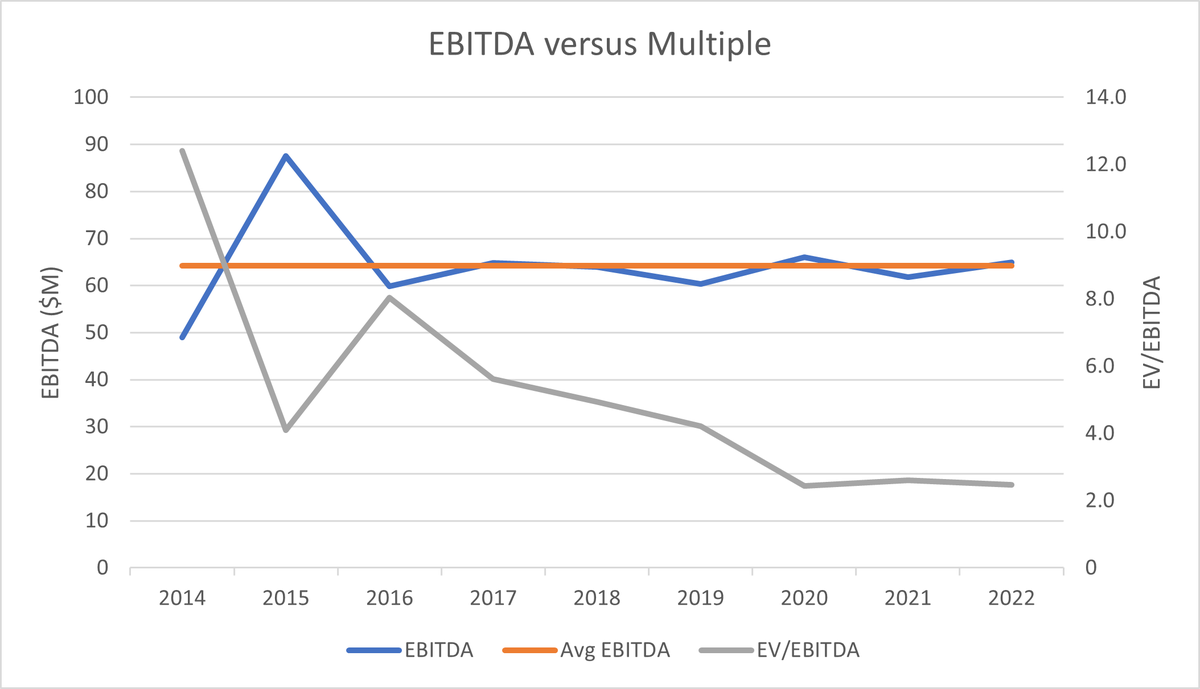

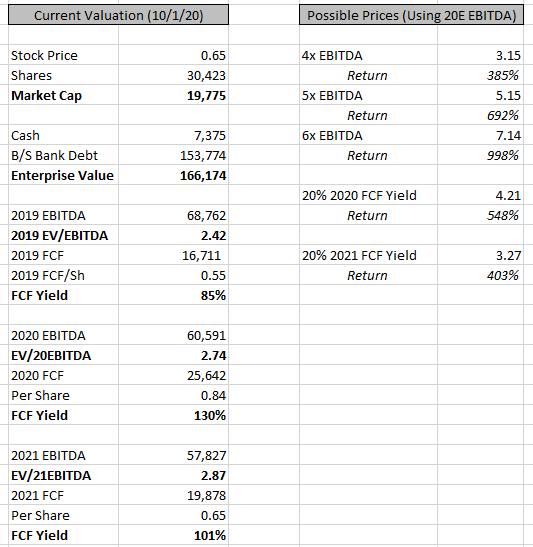

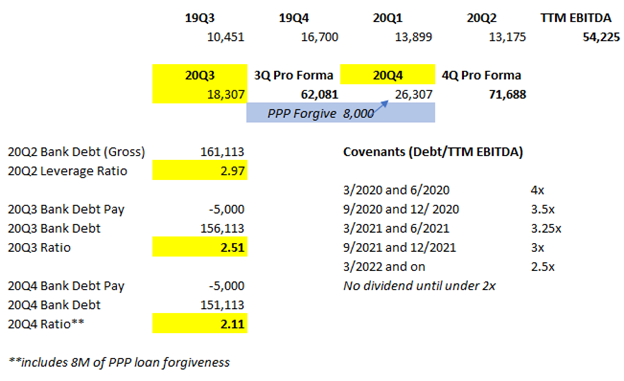

One arrow in the quiver of bears involves the $HNRG debtload. However, they amended their covenants this year (market didn't care) and I believe they have ample breathing room (plus a forgivable $10M PPP loan). Here’s where I come out for their TTM EBITDA over various periods.

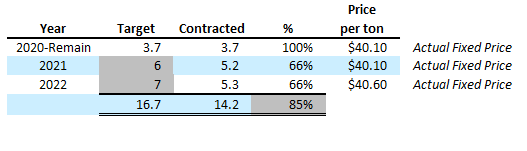

I believe $HNRG will (easily?) survive b/c they’ve contracted out years at very FCF+ prices. If you produce 150M tons, you can’t do that (see: $BTU); $HNRG produces 7M, and has 5.25M sold at $40+/ton out thru '22. Spot is $34. $HNRG's cash cost is $29, which is ~lowest in ILB.

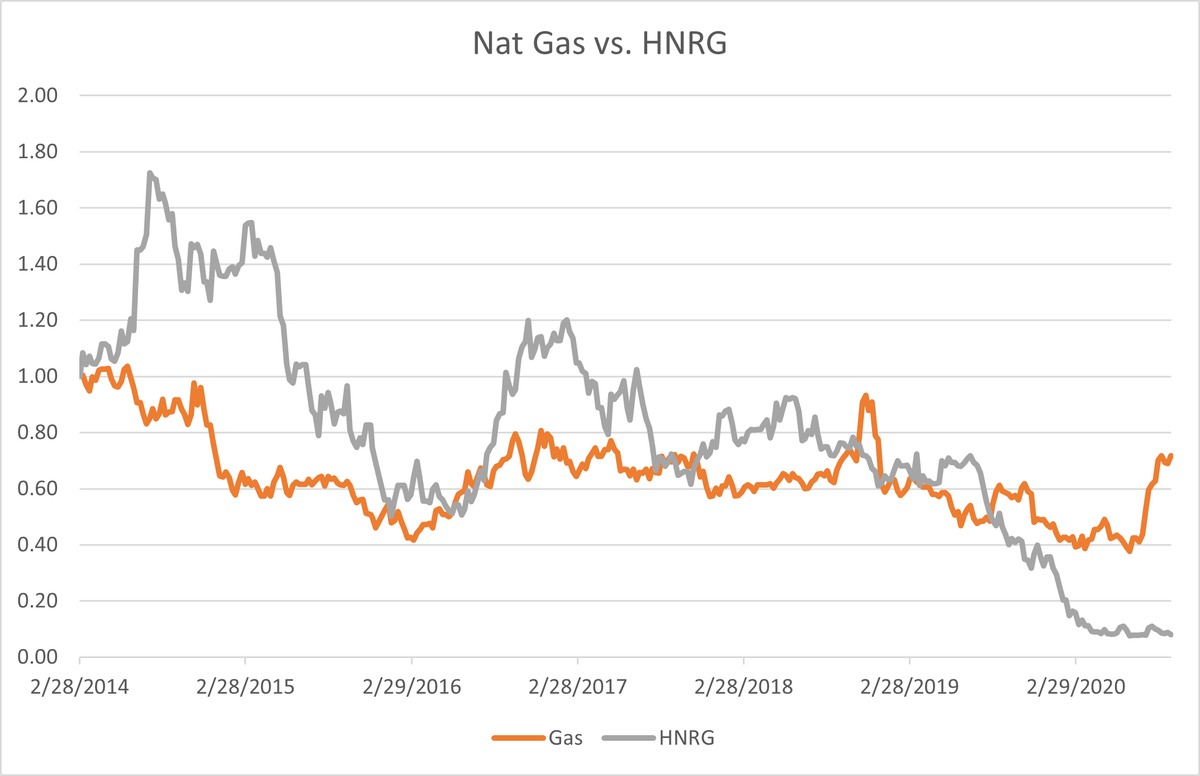

If $HNRG is forced to sell tons at $35, then this is not much of a winner; their current EV is probably ~right. However, if you believe that nat gas will be mid-2’s or higher over the next years (as associated gas from shale wells declines), then the demand for coal will increase

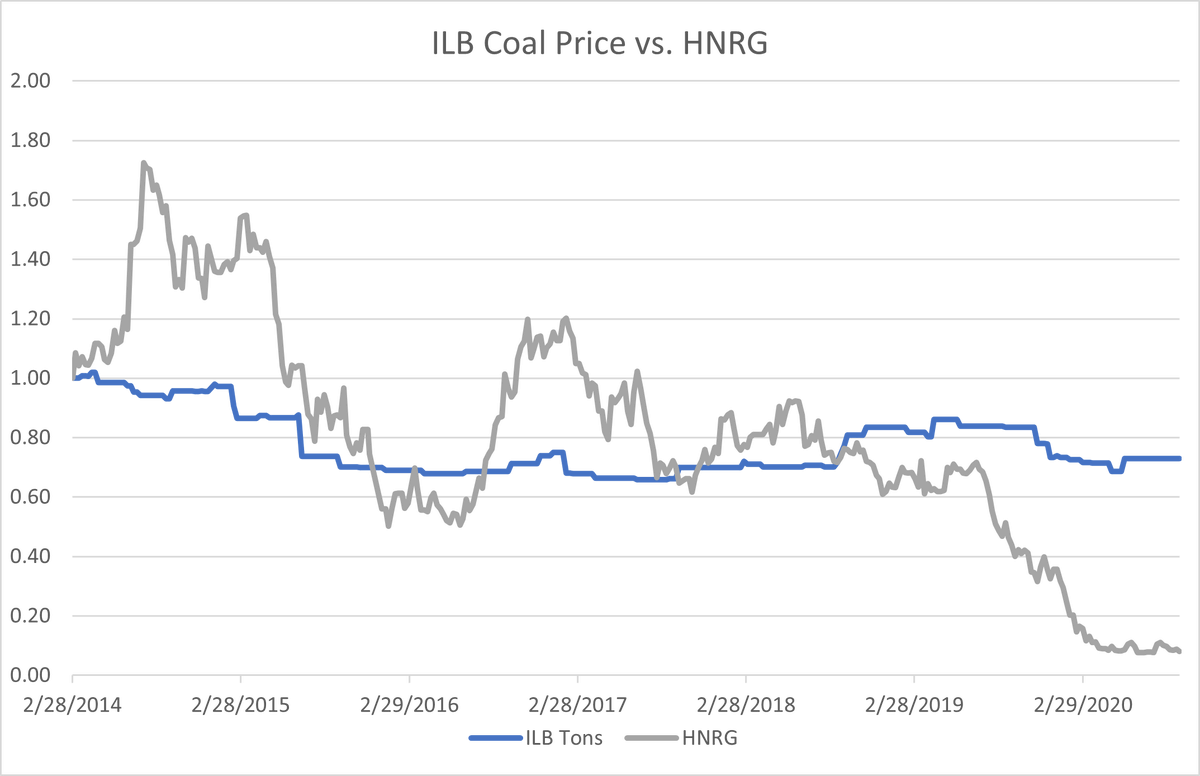

Check out natural gas leading $HNRG over time. This looks to me like an over-reaction on the downside (if you believe me on the covenant piece). [Obviously the "peer" group has traded horribly too, but again, I think the competitive positions are very different.]

Ironically, the spot price of ILB coal was actually lower in 2017 than it is now and yet $HNRG’s share price didn’t react as extremely. I think there was some forced selling this time as $HNRG fell below $3 and under $100M in market cap. What small cap fund can buy a $20M m-cap?

Again, in 2017, it’s not like thermal coal was a “hot” investment, and $HNRG had nearly $200M in gross debt, whereas I think they’ll be close to $150M by year-end this year (with a not dissimilar earnings outlook - arguably better if you believe the shale money is drying up)

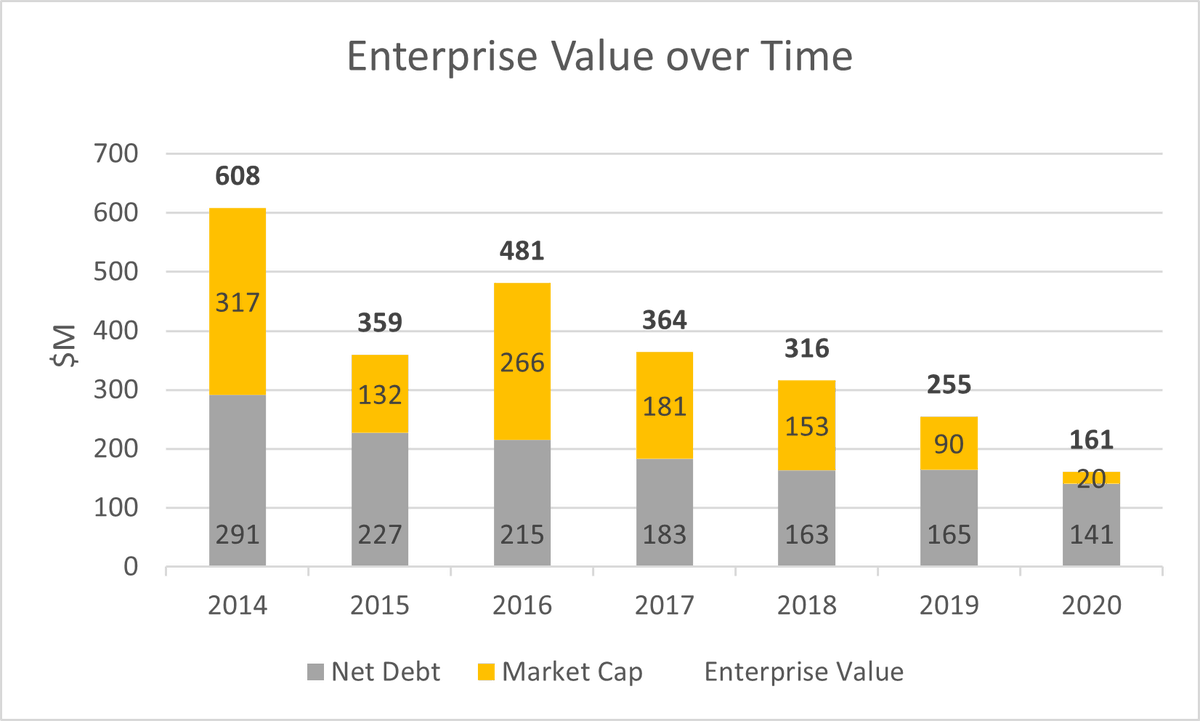

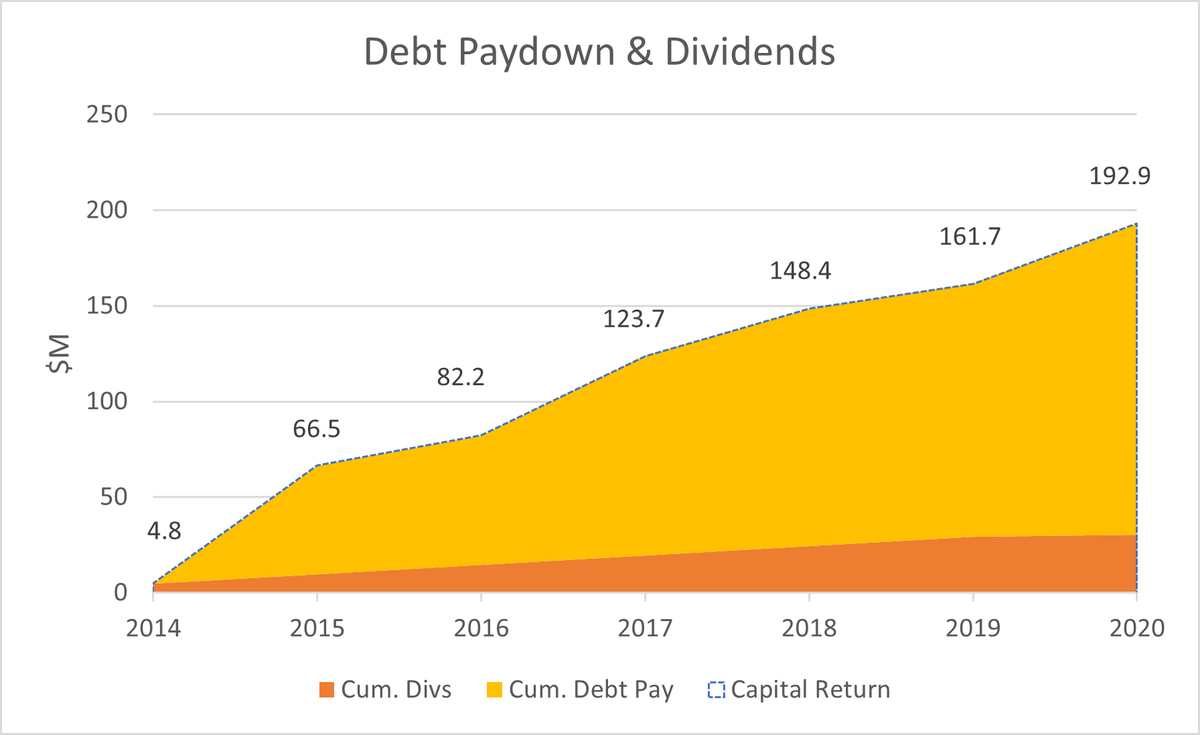

You’ll notice the shrinking EV, but you’ll also note that this small company has been paying down a ton of debt. Between divs and debt paydown, from 2015 on, $HNRG has “given” equity-holders $30M a year on avg. They’ll paydown $1/sh of debt this year (on 65c stock price).

For all of the volatility and tragedy of the stock price, the underlying business has been remarkably stable and well-managed. Look at the EBITDA over time; FWIW, ’19 was a bad year from a FCF perspective b/c one mine was especially capital intense & hard-going. It's closed now.

If I’m not missing something glaring, I really think this has great potential from here. Natural gas futures for winter 2021 and 2022 are in the 3’s, and that’s a great recipe for $HNRG making 2021 and 2022 sales NOW at prices they like. Here’s a few ways to look at valuation:

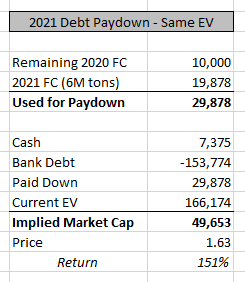

Let’s say you’re @verdadcap or @GregObenshain and you want to just look at the equity value created by debt paydown. Let’s say the $165M EV is correct. They’ll pay-down another ~$1/sh over the next 1.5 years is my guess, and that’d translate to a 150% return to equity.

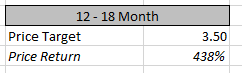

All that being said: I think I’m hoping for $3.5 for $HNRG in the next 18 months if natural gas can hold on, if $HNRG can make some new sales, and if there’s not some terrible production problem (always a concern w/ mines). 4x gets me out of the bed in the morning.

Lastly, MGMT + Board owns 30% of the outstanding shares. Thanks for the time; would really appreciate reactions. @vanckzhu @EnergyCynic @phantom3434 @mr_skilling @Greenbackd @VolteFaceInvest @Pivotal_Capital @mac003_c @redcanoecap @BayStInvesting @valueinvestor03 @SuperMugatu

@power_miso How could I forget you!?

Read on Twitter

Read on Twitter

![Check out natural gas leading $HNRG over time. This looks to me like an over-reaction on the downside (if you believe me on the covenant piece). [Obviously the "peer" group has traded horribly too, but again, I think the competitive positions are very different.] Check out natural gas leading $HNRG over time. This looks to me like an over-reaction on the downside (if you believe me on the covenant piece). [Obviously the "peer" group has traded horribly too, but again, I think the competitive positions are very different.]](https://pbs.twimg.com/media/EjV7lH_WoAAVChf.png)