1) Although it is impossible to know where the gold price will top at during this current cycle, we can make some first-order guesses. Gold price based on M2 money supply modeling has back-tested well and thus is a good starting point.

@Frank_Giustra https://twitter.com/DanielaCambone/status/1309852986060013568

@Frank_Giustra https://twitter.com/DanielaCambone/status/1309852986060013568

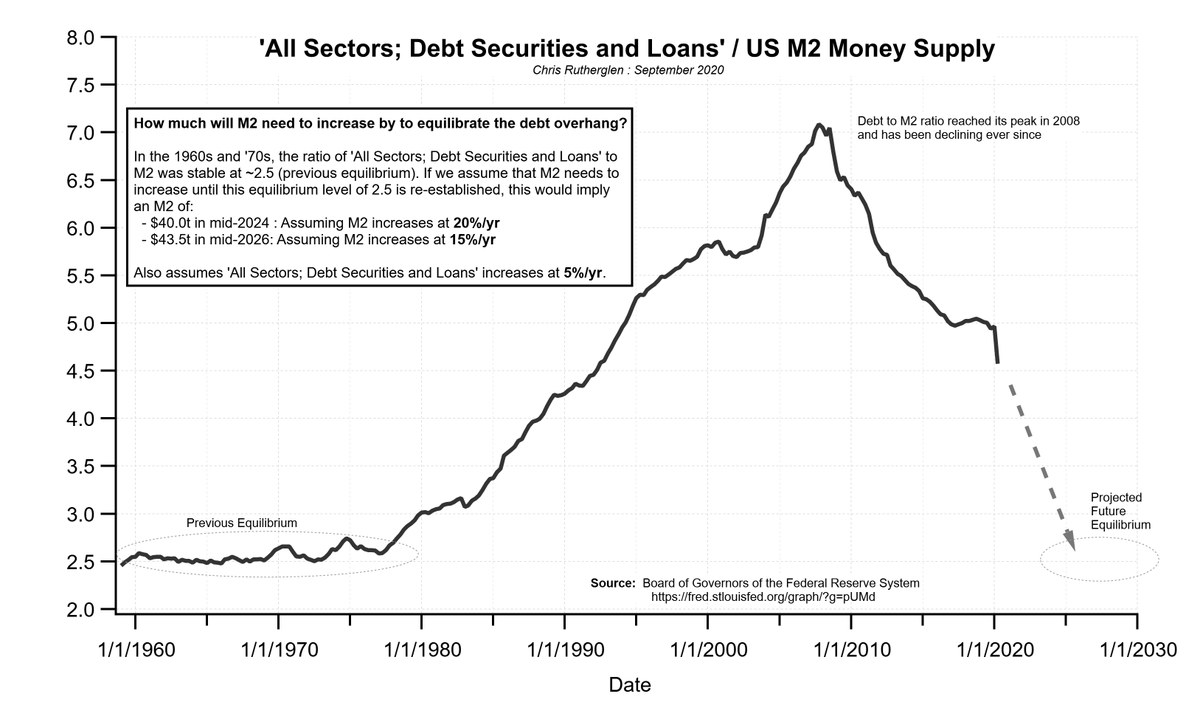

2) Next question is by how much will the money supply (M2) need to increase by to bring the debt-to-money proportions back into equilibrium. In the '60's and '70s, that ratio was ~2.5. From '80s to '08, debt grew faster than M2 pushing the ratio up to 7 and trending down since.

3) To get the debt-to-M2 ratio back to its prior equilibrium level of 2.5, M2 will need to increase to $40t - $43t within the 2024-2026 time-frame.

This would imply a future gold price of $7500 to $8000.

Off-balance-sheet debt (not included) could make this price conservative.

This would imply a future gold price of $7500 to $8000.

Off-balance-sheet debt (not included) could make this price conservative.

5) To get the debt-to-GNP ratio back down to its prior equilibrium ratio of 1.5 will require a considerable nominal GNP growth of the economy (assuming no significant debt-deflation).

The best monetary tool to stimulate nominal growth is inflation.

The best monetary tool to stimulate nominal growth is inflation.

Read on Twitter

Read on Twitter