[Thread] $DIS 4hr. A recent @StockDweebs stock pick is a stock you should buy and hold for yearsss to come. Why? To start $DIS this week has seemingly found support at previous resistance/support levels from March low's. Stochastic RSI looking oversold + possible MACD crossover

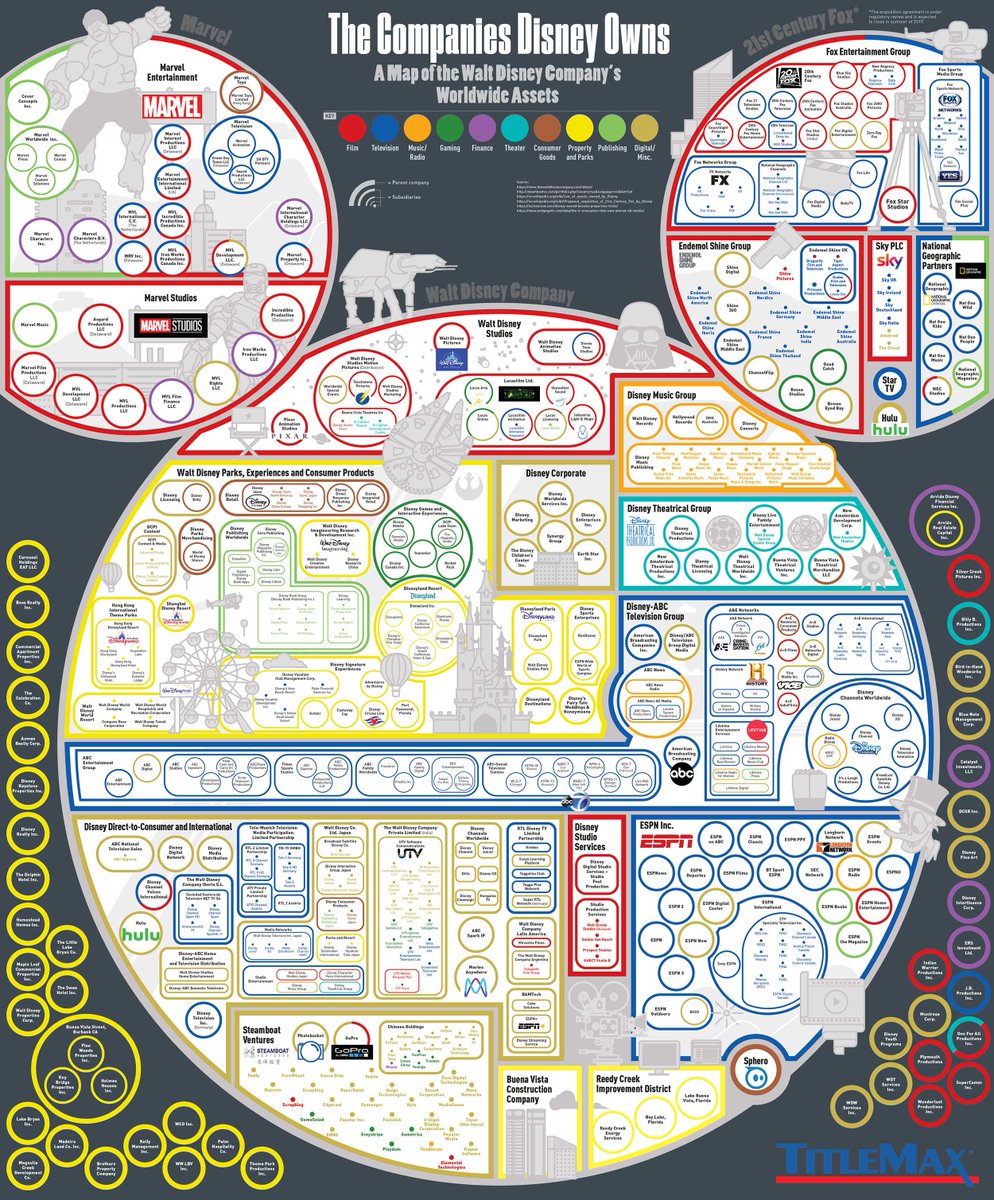

1/ Now unfortunately $DIS moves w/ the airline stocks such as $BA $SAVE $AAL etc. due to the ongoing crisis. But $DIS has something that all these other companies really don't have. Diversification! $DIS is a conglomerate and I don't think people understand just how much they own

2/ $DIS is everywhere. I could spend all day talking about everything they own, but I'd like to focus on just a few areas other than the obvious Theater, Properties & Parks. I want to focus on Streaming (Disney+) + TV ( #ESPN). The point here is they have a lot going for them.

3/ Streaming. This year $DIS released their long-anticipated Disney+ and to date they have garnered over 65mil. subscribers, or just 1/3 of $NFLX's total subscriber base. $DIS also owns #Hulu which has 30mil subscribers (FYI they are planning an international rollout in 2021).

4/ ESPN. Americans love their sports and what else? Betting! Recently $DKNG announced an exclusive multi-year deal with #ESPN + $CZR. ESPN is 80% owned by ABC, Inc. which is an indirect subsidiary of The Walt Disney Company $DIS. https://www.barrons.com/articles/draftkings-stock-hits-record-deal-with-espn-internet-wagering-51600116751

5/ So we got Disney+ for the kiddos and #ESPN sports watching/betting for the adults. #Hulu's live TV should take care of most other target audiences. What does $DIS do? Boom . Offers a bundle to have all 3 for the price of $69.99 a year. I mean who isn't going to buy that?

. Offers a bundle to have all 3 for the price of $69.99 a year. I mean who isn't going to buy that?

. Offers a bundle to have all 3 for the price of $69.99 a year. I mean who isn't going to buy that?

. Offers a bundle to have all 3 for the price of $69.99 a year. I mean who isn't going to buy that?

6/ For their latest Q3 ER $DIS announced a $4.72 net loss due to parks being closed as well early acquisition of

21st Century Fox (another catalyst for streaming). But the stock actually gained 5% in AH. Why? Their EPS were expected to be at a loss of -.64 instead it was +.08.

21st Century Fox (another catalyst for streaming). But the stock actually gained 5% in AH. Why? Their EPS were expected to be at a loss of -.64 instead it was +.08.

7/ No surprise here why $DIS was able to salvage their EPS given how much they own. If you value $DIS based solely on the near-term problems they are in, you're missing the point. The surge in demand for at-home entertainment has actually benefited $DIS.

8/ Let's hit the weekly $DIS chart that shows that it's found support from previous resistance dating back to Sept 2015 (crazy, huh?). $DIS is really just getting started b/c the Disney that comes out of this crisis will be incredibly diff from the one that went in.

9/ Not sure how to finish this thread lmao, but near-term again $DIS looks to have retraced its gain and is basing. AVWAP from recent sell-off's will be the resistance as $DIS tries to reclaim its 55ema

from recent sell-off's will be the resistance as $DIS tries to reclaim its 55ema . Could see this go towards upper channel in the late fall/winter.

. Could see this go towards upper channel in the late fall/winter.

from recent sell-off's will be the resistance as $DIS tries to reclaim its 55ema

from recent sell-off's will be the resistance as $DIS tries to reclaim its 55ema . Could see this go towards upper channel in the late fall/winter.

. Could see this go towards upper channel in the late fall/winter.

10/ a key takeaway here is that $DIS is a buy b/c once the lockdown eases up it will allow more of Disney's theme parks to open as well as theaters. I don't doubt that we will see $DIS experience incredible exponential growth in the future. Just something to think about :)

11/ [Update] $DIS still respecting this channel and at this point all the bad PR is priced in. More than likely we see further consolidation (vol. has been decreasing lately) and a slow grind up to test that upper dashed trend line.

Read on Twitter

Read on Twitter![[Thread] $DIS 4hr. A recent @StockDweebs stock pick is a stock you should buy and hold for yearsss to come. Why? To start $DIS this week has seemingly found support at previous resistance/support levels from March low's. Stochastic RSI looking oversold + possible MACD crossover [Thread] $DIS 4hr. A recent @StockDweebs stock pick is a stock you should buy and hold for yearsss to come. Why? To start $DIS this week has seemingly found support at previous resistance/support levels from March low's. Stochastic RSI looking oversold + possible MACD crossover](https://pbs.twimg.com/media/Ei3n6NYU8AAFEcD.jpg)

![11/ [Update] $DIS still respecting this channel and at this point all the bad PR is priced in. More than likely we see further consolidation (vol. has been decreasing lately) and a slow grind up to test that upper dashed trend line. 11/ [Update] $DIS still respecting this channel and at this point all the bad PR is priced in. More than likely we see further consolidation (vol. has been decreasing lately) and a slow grind up to test that upper dashed trend line.](https://pbs.twimg.com/media/EjRlSEtUYAAPFaT.jpg)