Cantillon Effect 101

With the recent money printing activity and an expanding wealth inequality problem, talk of the "Cantillon Effect" has taken center stage.

But what is the Cantillon Effect and how does it work?

Here's Cantillon Effect 101!

With the recent money printing activity and an expanding wealth inequality problem, talk of the "Cantillon Effect" has taken center stage.

But what is the Cantillon Effect and how does it work?

Here's Cantillon Effect 101!

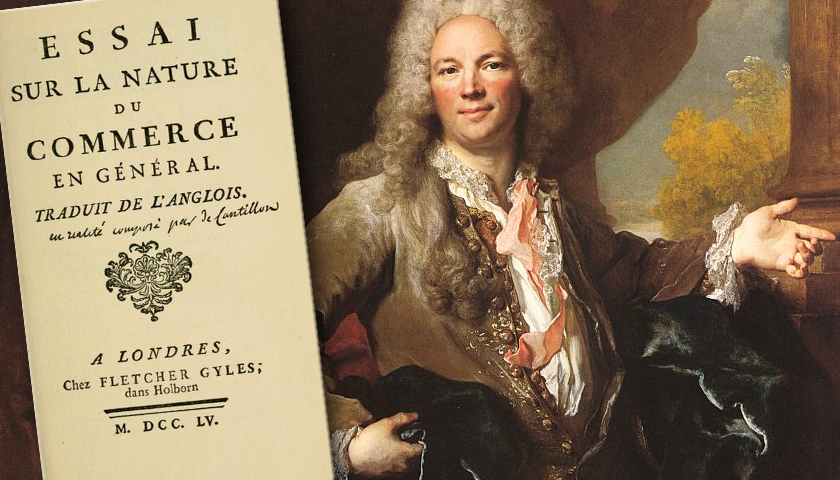

1/ Richard Cantillon was an Irish-French banker, philosopher, and economist born in the 1680s.

His "Essay on the Nature of Commerce in General" is considered a foundational work in the study of the political economy, though it was not published until 1755, well after his death.

His "Essay on the Nature of Commerce in General" is considered a foundational work in the study of the political economy, though it was not published until 1755, well after his death.

2/ While published 265 years ago, the essay has many insights that remain relevant today.

He posited that the early recipients of new money entering an economy will enjoy a much higher standard of living than those it trickles down to.

The "flow path" of new money matters!

He posited that the early recipients of new money entering an economy will enjoy a much higher standard of living than those it trickles down to.

The "flow path" of new money matters!

3/ Let's use a simple story to illustrate his point.

Imagine you live in a small, simple island society.

One morning, you find a package has been delivered to your doorstep from your long lost Uncle FEDerico (who lives in a far away land). The package has $1 million in it.

Imagine you live in a small, simple island society.

One morning, you find a package has been delivered to your doorstep from your long lost Uncle FEDerico (who lives in a far away land). The package has $1 million in it.

4/ No one else knows you have received this package. You now secretly have $1 million.

So naturally, you start spending it and investing it very quickly. Prices are still low, because no one knows these new dollars exist yet!

Your standard of living improves rapidly.

So naturally, you start spending it and investing it very quickly. Prices are still low, because no one knows these new dollars exist yet!

Your standard of living improves rapidly.

5/ You buy yourself the nicest house, the most beautiful clothes, tons of land, and still have some money left over.

But now, people are aware that new money is flowing through the system.

Prices begin to rise as supply has yet to "catch up" to the new demand.

But now, people are aware that new money is flowing through the system.

Prices begin to rise as supply has yet to "catch up" to the new demand.

6/ So while the money allowed you to invest, spend, and dramatically improve your lifestyle, it did not benefit others in the society in the same way.

The sellers of the goods, who received your cash, now face rising prices when they want to consume.

The flow path mattered!

The sellers of the goods, who received your cash, now face rising prices when they want to consume.

The flow path mattered!

7/ This is an ultra-simplified example, but gets at the essence of what the Cantillon Effect describes.

Those receiving the new money injected in an economy first are generally much better off than those receiving it via the trickle down.

This may lead to inequality.

Those receiving the new money injected in an economy first are generally much better off than those receiving it via the trickle down.

This may lead to inequality.

8/ The Cantillon Effect is often discussed when examining the impact of "money printing" of Central Banks globally.

With an injection point of the "new money" at the top, asset owners benefit while the working class may experiencing rising prices for everyday goods like food.

With an injection point of the "new money" at the top, asset owners benefit while the working class may experiencing rising prices for everyday goods like food.

9/ It appears we are seeing some of this today.

For example, global food prices rose in August for the 3rd consecutive month, hurting workers.

Meanwhile, prices of assets like homes and stocks continued to climb, benefiting asset owners. https://www.world-grain.com/articles/14183-fao-global-food-prices-rise-for-third-consecutive-month#:~:text=ROME%2C%20ITALY%E2%80%94%20Stronger%20demand%20and,the%20United%20Nations%20(FAO).&text=The%20FAO%20Cereal%20Price%20Index,was%20led%20by%20coarse%20grains.

For example, global food prices rose in August for the 3rd consecutive month, hurting workers.

Meanwhile, prices of assets like homes and stocks continued to climb, benefiting asset owners. https://www.world-grain.com/articles/14183-fao-global-food-prices-rise-for-third-consecutive-month#:~:text=ROME%2C%20ITALY%E2%80%94%20Stronger%20demand%20and,the%20United%20Nations%20(FAO).&text=The%20FAO%20Cereal%20Price%20Index,was%20led%20by%20coarse%20grains.

10/ Congress is stalling on further fiscal support (designed to be more bottoms-up) and the Fed is weighing further actions.

Developing a view on Cantillon's observations on the distributional consequences of the flow path of money is essential for understanding it all.

Developing a view on Cantillon's observations on the distributional consequences of the flow path of money is essential for understanding it all.

11/ Below are a few resources for learning more about this dynamic and the impact on our present situation.

@matthewstoller had an excellent piece on The Cantillon Effect for @ProMarket_org. https://promarket.org/2020/04/13/the-cantillon-effect-why-wall-street-gets-a-bailout-and-you-dont/

@matthewstoller had an excellent piece on The Cantillon Effect for @ProMarket_org. https://promarket.org/2020/04/13/the-cantillon-effect-why-wall-street-gets-a-bailout-and-you-dont/

12/ @APompliano also talked about this today in his newsletter as he examined the K-shaped recovery. I highly recommend checking it out and subscribing if you haven't already. https://pomp.substack.com/p/the-k-shaped-recovery-is-now-undeniable

13/ So that was Cantillon Effect 101. I hope it was a helpful primer on the topic!

And for more educational threads on money, finance, and economics, check out my meta-thread below. https://twitter.com/SahilBloom/status/1284583099775324161

And for more educational threads on money, finance, and economics, check out my meta-thread below. https://twitter.com/SahilBloom/status/1284583099775324161

Read on Twitter

Read on Twitter