THREAD

Collection of biotech public markets wisdom from others. Mostly in tweet format. Will keep adding

1). Simplest ideas are best

2). Always think of "margin of safety"

3). Manage risk. Swap bad ideas for good ideas

4). Stories AND science matter

5). Many different styles

Collection of biotech public markets wisdom from others. Mostly in tweet format. Will keep adding

1). Simplest ideas are best

2). Always think of "margin of safety"

3). Manage risk. Swap bad ideas for good ideas

4). Stories AND science matter

5). Many different styles

1). "Simplest ideas are best"

Saved this @jposhaughnessy tweet. It's a good all-purpose guideline

Saw a scientist pen a $VSTM thesis ahead of AACR 2020 data fail this year. There were too many variables that had to go right, yet were mostly unknowable https://twitter.com/jposhaughnessy/status/1106623231249825792

Saved this @jposhaughnessy tweet. It's a good all-purpose guideline

Saw a scientist pen a $VSTM thesis ahead of AACR 2020 data fail this year. There were too many variables that had to go right, yet were mostly unknowable https://twitter.com/jposhaughnessy/status/1106623231249825792

2). "Always think of 'margin of safety'"

This is concept that certain investors (EcoR1) have borrowed from other sectors & applied to biotech

It's about avoiding co's that are close to being fully-valued & have few catalysts ahead. Instead, look for overlooked ones w catalysts

This is concept that certain investors (EcoR1) have borrowed from other sectors & applied to biotech

It's about avoiding co's that are close to being fully-valued & have few catalysts ahead. Instead, look for overlooked ones w catalysts

3). "Manage risk. Swap good ideas for bad ideas"

From @Sanctuary_Bio

See how he swapped $BLU for $UMRX and minimized downside?

You have to have really good sector knowledge to make these quick decisions https://twitter.com/Sanctuary_Bio/status/1281643254669164544

From @Sanctuary_Bio

See how he swapped $BLU for $UMRX and minimized downside?

You have to have really good sector knowledge to make these quick decisions https://twitter.com/Sanctuary_Bio/status/1281643254669164544

4). "Stories AND science matter"

From @juliaskripkaser

Great point about how science is important, but much of what makes a long idea "work" is how the story is communicated to non-technical investors

Ever notice how many bio fund PMs aren't scientists? https://twitter.com/juliaskripkaser/status/1193975549816905728

From @juliaskripkaser

Great point about how science is important, but much of what makes a long idea "work" is how the story is communicated to non-technical investors

Ever notice how many bio fund PMs aren't scientists? https://twitter.com/juliaskripkaser/status/1193975549816905728

5). "Many different biotech trading/investing styles"

From @brendan_49

He succinctly identifies three "archetypes" that can be emulated in this space

On "Quality", @buysidebio adds: "It’s remarkable how many high quality stories slip thru cracks" https://twitter.com/brendan_49/status/1302262879828291591

From @brendan_49

He succinctly identifies three "archetypes" that can be emulated in this space

On "Quality", @buysidebio adds: "It’s remarkable how many high quality stories slip thru cracks" https://twitter.com/brendan_49/status/1302262879828291591

THREAD CONT.

Biotech public markets wisdom from others

6). Only look forward

7). Sell side will miss many things

8). The "bottom" is often when you feel sick

9). Don't trade bio's into earnings

10). Don't need to hold into binaries

11). Watch for strength on follow-on offerings

Biotech public markets wisdom from others

6). Only look forward

7). Sell side will miss many things

8). The "bottom" is often when you feel sick

9). Don't trade bio's into earnings

10). Don't need to hold into binaries

11). Watch for strength on follow-on offerings

6). "Only look forward. Take your history with a stock out of the way"

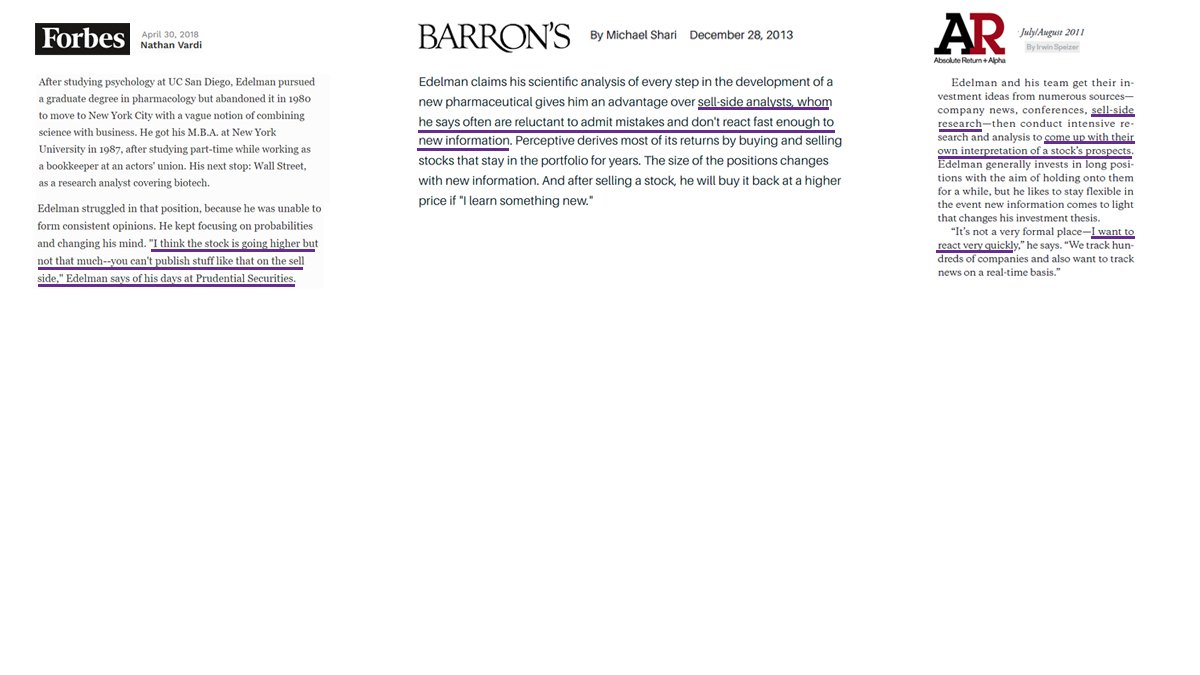

Here, Perceptive talks about thinking in terms of probabilities that a stock goes higher/lower based on new info

Sort of #2 above rephrased. They ignore the past and constantly re-assess for margin of safety

Here, Perceptive talks about thinking in terms of probabilities that a stock goes higher/lower based on new info

Sort of #2 above rephrased. They ignore the past and constantly re-assess for margin of safety

7). "Sell side will miss many things"

Here is Perceptive explaining how sell side analysts are slow to react to new info. They have hard job churning out volumes of written materials

Also, they don't think in terms of "stock is going higher but not much" (margin of safety)

Here is Perceptive explaining how sell side analysts are slow to react to new info. They have hard job churning out volumes of written materials

Also, they don't think in terms of "stock is going higher but not much" (margin of safety)

8). "The 'bottom' is often when you feel sick"

From @AAMortazavi, who has a great sixth-sense

Remember how painful it was watching this innovative sector grind to a standstill before the wave of good news at the end of 2019?

Or in March 2020? https://twitter.com/AAMortazavi/status/1177299266404065283

From @AAMortazavi, who has a great sixth-sense

Remember how painful it was watching this innovative sector grind to a standstill before the wave of good news at the end of 2019?

Or in March 2020? https://twitter.com/AAMortazavi/status/1177299266404065283

9). "Don't trade bio's into earnings season"

From @lblegend33

This is pertinent to trading, not investing, but is evident based on his many years doing this https://twitter.com/lblegend33/status/1026799490496425985

From @lblegend33

This is pertinent to trading, not investing, but is evident based on his many years doing this https://twitter.com/lblegend33/status/1026799490496425985

10). "Don't need to hold into binaries"

From @Pharmdca

This is also pertinent to trading, not investing. It is a viable strategy to consistently sell before readouts https://twitter.com/Pharmdca/status/1191923929973002240

From @Pharmdca

This is also pertinent to trading, not investing. It is a viable strategy to consistently sell before readouts https://twitter.com/Pharmdca/status/1191923929973002240

11). "Watch for strength on follow-on offerings"

From @Biomaven

This is most pertinent to investing, not trading. If the price appreciates after a follow-on (a dilution event), that is a indicator there is strong demand in the long-term https://twitter.com/Biomaven/status/1304059681208401920

From @Biomaven

This is most pertinent to investing, not trading. If the price appreciates after a follow-on (a dilution event), that is a indicator there is strong demand in the long-term https://twitter.com/Biomaven/status/1304059681208401920

Read on Twitter

Read on Twitter