Some of you may have seen today’s headlines about a longer delay for fans return to footy and the “Meltdown” of club finances.

I decided to take a look at what might happen at #afcb IF this was to happen (with the usual “bucket of salt” warning).

1/7

I decided to take a look at what might happen at #afcb IF this was to happen (with the usual “bucket of salt” warning).

1/7

2/7

So looking at #afcb income and assuming that:

A) 50% of games have a full stadium

B) Commercial income reduces by the same amount (sponsorship, streaming cash etc)

C) Parachute payments come in

So income drops to £63m ‘ish with parachute payments making the bulk of that.

So looking at #afcb income and assuming that:

A) 50% of games have a full stadium

B) Commercial income reduces by the same amount (sponsorship, streaming cash etc)

C) Parachute payments come in

So income drops to £63m ‘ish with parachute payments making the bulk of that.

3/7

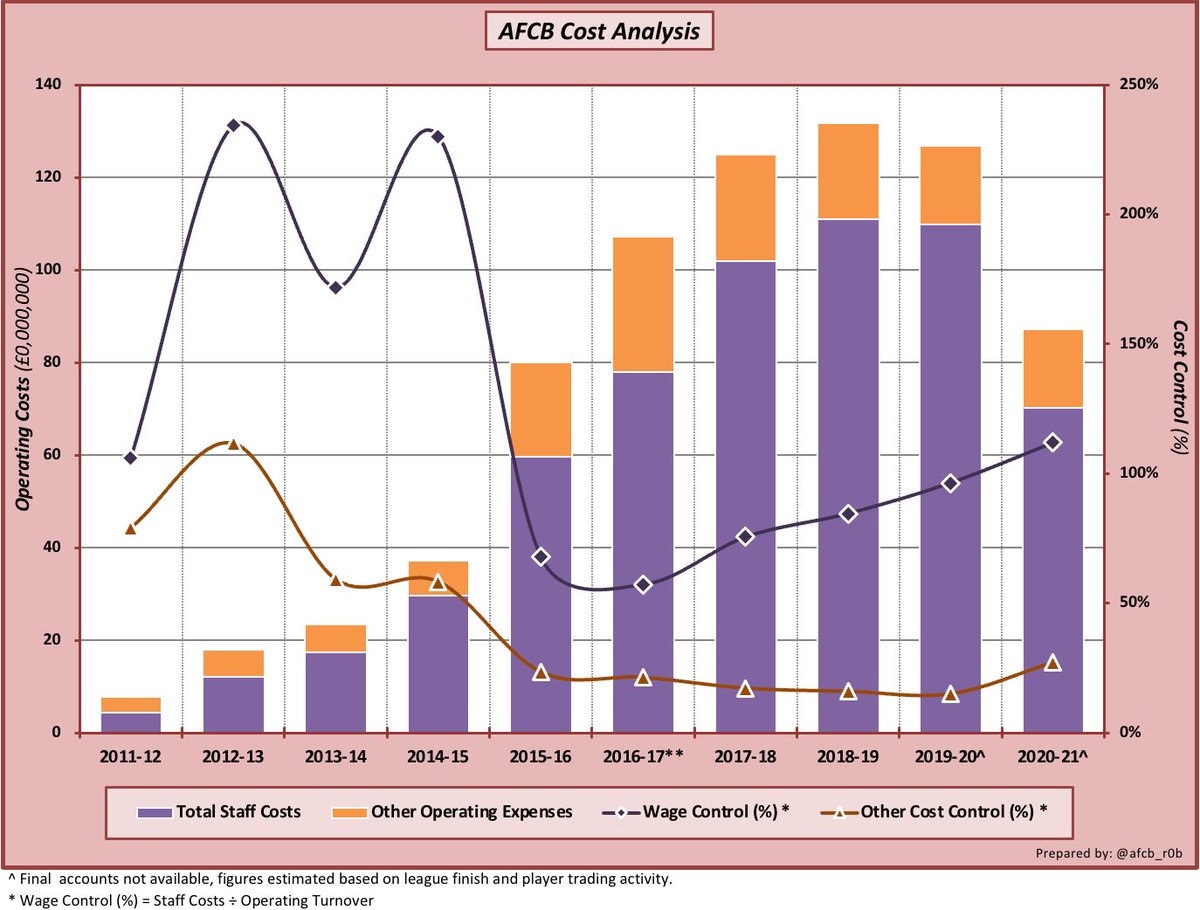

So what about costs? Assuming that:

A) Matchday costs drop by 50%

B) No relegation wage cuts (worst case)

C) No more outgoings or incomings (probably will balance out if they happen)

#afcb costs drop to £87m.

So anyone can do that maths - EBITDA LOSS of £24m!

So what about costs? Assuming that:

A) Matchday costs drop by 50%

B) No relegation wage cuts (worst case)

C) No more outgoings or incomings (probably will balance out if they happen)

#afcb costs drop to £87m.

So anyone can do that maths - EBITDA LOSS of £24m!

4/7

But player trading is our Loan Ranger (bad pun ).

).

Assuming #afcb “factors” future transfer instalments, the current trading position unlocks about £79m cash (after interest on factoring) with ca £4m loan fees on top.

So all looks very rosy with £59m in the bank doesnt it?

But player trading is our Loan Ranger (bad pun

).

).Assuming #afcb “factors” future transfer instalments, the current trading position unlocks about £79m cash (after interest on factoring) with ca £4m loan fees on top.

So all looks very rosy with £59m in the bank doesnt it?

5/7

But hidden in this are £31m #afcb owes in transfer instalments and £16m to repay last season’s factoring of Mousset & Mings sales.

Taking this off means we have around £12m in the Bank after all current trading and with only 50% of games at full capacity.

BUT. THAT. IS. GOOD!

But hidden in this are £31m #afcb owes in transfer instalments and £16m to repay last season’s factoring of Mousset & Mings sales.

Taking this off means we have around £12m in the Bank after all current trading and with only 50% of games at full capacity.

BUT. THAT. IS. GOOD!

6/7

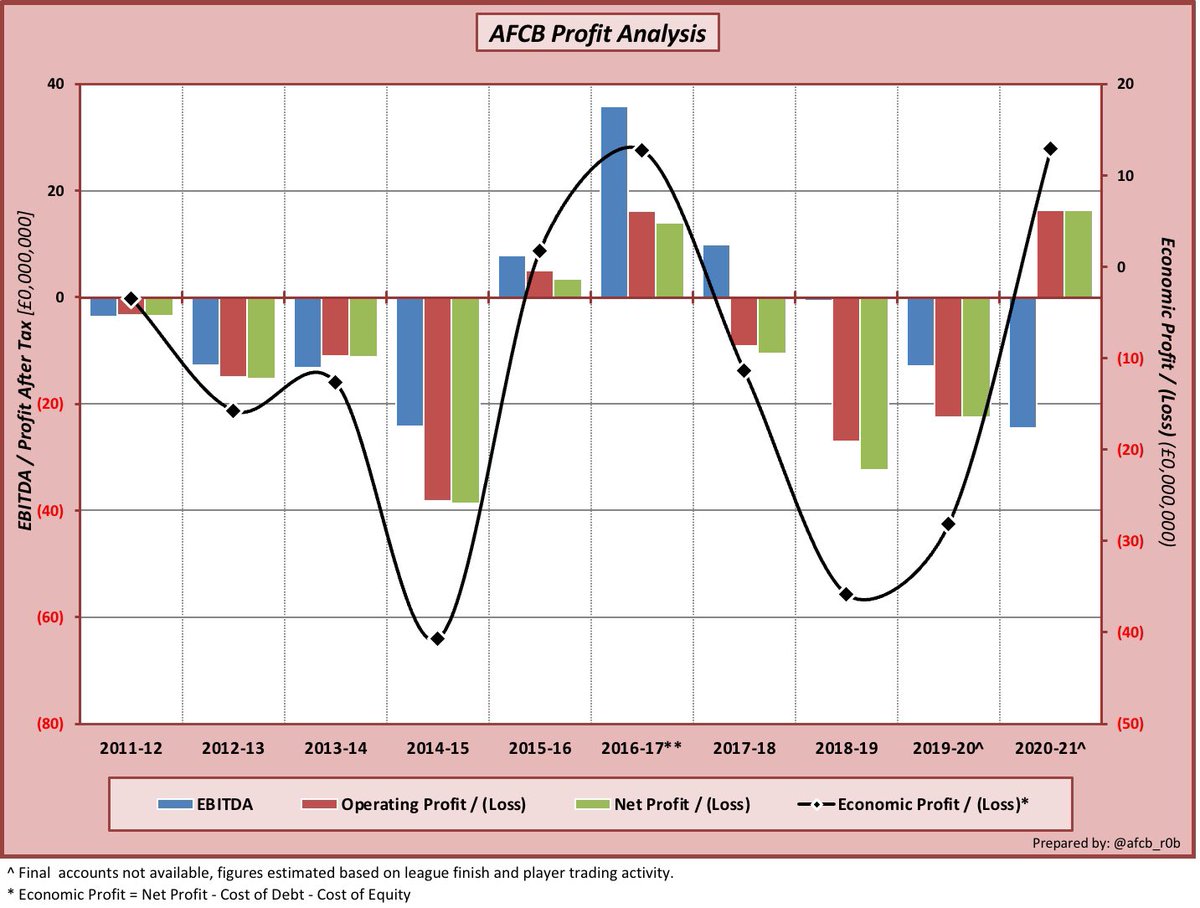

There seems enough cash to see #afcb through the season and to pay off any emergency loans Max may have shoved in last season. But probably more player sales before we buy imo.

From an FFP perspective (profit based assessment) we should be ok as well so we can breath...

There seems enough cash to see #afcb through the season and to pay off any emergency loans Max may have shoved in last season. But probably more player sales before we buy imo.

From an FFP perspective (profit based assessment) we should be ok as well so we can breath...

Read on Twitter

Read on Twitter