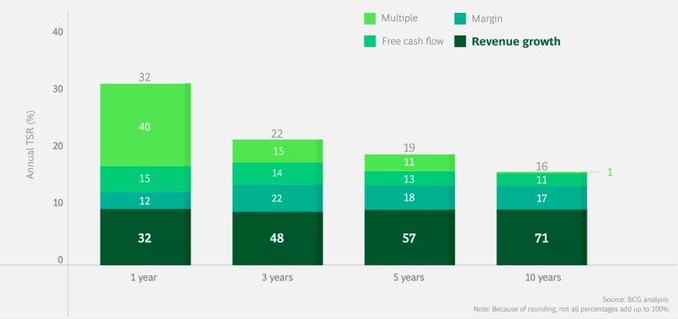

Like I think it has been beaten into the head of every analyst since like 2015. It's right up there with "Grow Fast or Die Slow" for informing Consumer-TMT / Tiger Cub analyst thought.

And, when you think about it, it makes sense: over 10 years, a 10% revenue CAGR = +159% revenue growth. 15% = 305% growth.

It's rare for multiples / margins to change that dramatically in mature business (without a massive change in the underlying company).

Likewise, capital return tends to get priced in fairly quickly. And, as shares appreciate, capital return becomes less material.

Likewise, capital return tends to get priced in fairly quickly. And, as shares appreciate, capital return becomes less material.

So, yes, over a decade, the top performers probably have robust topline growth. Has been true in past decades as well. Intuitive, reasonable statement. Not controversial.

But how helpful is this to us as investors?

1) Are we good at identifying companies that will deliver strong topline growth over a decade?

2) And should this even be our goal?

1) Are we good at identifying companies that will deliver strong topline growth over a decade?

2) And should this even be our goal?

Growth factor returns have generally not been spectacular over time (with variation between sectors and how you define "growth"). But maybe this is just a shortfall of a quant process, and can be improved upon if you focus on competitive advantages and their duration.

I think it's pretty hard to make forecasts a decade out. True, growth / ROICs have been slower to mean revert in recent years... so maybe it's going to get easier going forward?

But I'd still bet on it being pretty difficult. A decade is a *really* long time.

But I'd still bet on it being pretty difficult. A decade is a *really* long time.

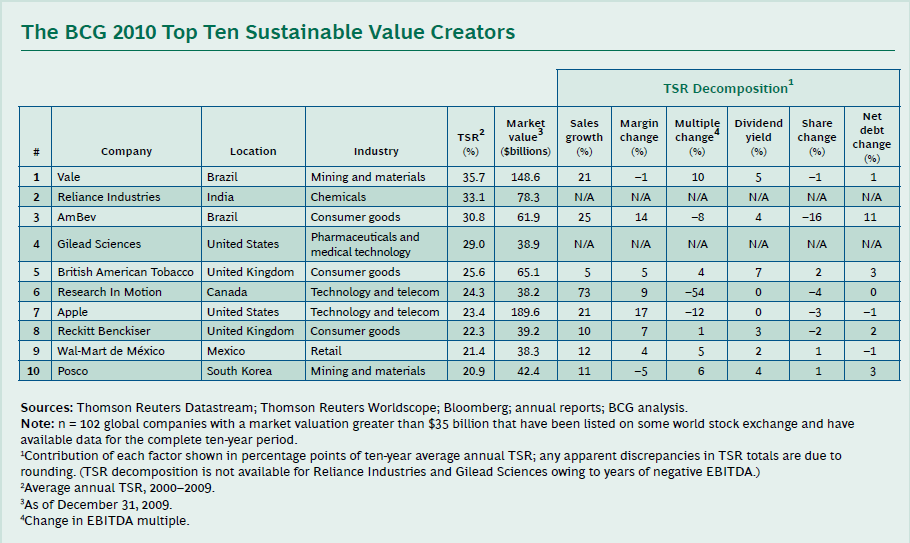

Like if I think back to 2010, what would you have been buying as a long-term oriented growth manager? Maybe Amazon and Google, sure. But maybe also Express Scripts. Or Franklin Resources. Or Juniper. Or some OFS company (shale revolution!!).

But is this even the right pursuit? Over what time frame do we exist as investors?

It varies from person to person... but, unless you are in Omaha, it sure isn't a decade. If you are *very* lucky, you have 3 years before you get fired (by your PM or your clients). Usually less.

It varies from person to person... but, unless you are in Omaha, it sure isn't a decade. If you are *very* lucky, you have 3 years before you get fired (by your PM or your clients). Usually less.

And, if we are being evaluated on a 1-3 year time horizon, multiples do matter (as @corry_wang said in his note).

There's nothing wrong with passing on a company due to valuation. Consider SPLK - if you bought it in 2013 /14, you would have had a rough few years as that multiple compressed. Very difficult (professionally and psychologically) to hold a position that doesn't work for years.

(And a poor use of capital as well... there's no prize for suffering with a stock. You should have some idea of when / why a stock might appreciate. Your job is to maximize IRR on your portfolio)

I've seen more and more notes (sellside and buyside) basing valuations on 2030-2035 numbers, discounted back. Personally, I'm uncomfortable allocating capital today based on very long term forecasts. I'm not that smart.

I will forecast a few years, and ask myself, "how will people think about this company differently in 2-3 years?". And while that question embeds long term expectations, and how I think those will evolve... I am a little more comfortable answering it.

I don't think any of this is insightful... it's probably roughly consensus.

Just feels like folks are doing a lot of mental gymnastics to justify why what has worked should keep working.

Just feels like folks are doing a lot of mental gymnastics to justify why what has worked should keep working.

Read on Twitter

Read on Twitter