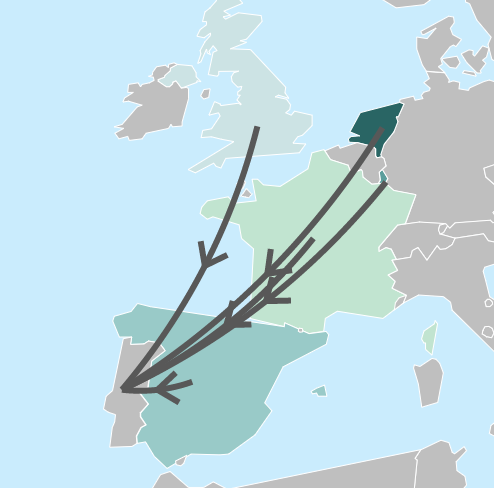

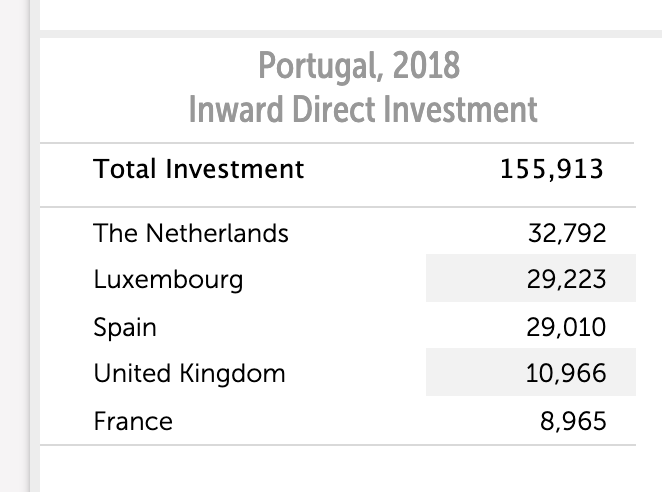

According to IMF data, the Netherlands was the biggest source of Foreign Direct Investment in Portugal in 2018, bigger than neighbouring Spain, 3 times more than France.

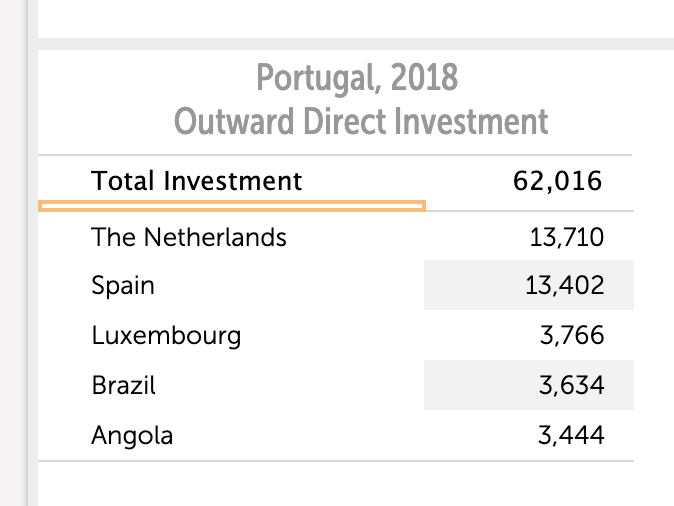

Incidentally, the Netherlands was also the biggest recipient of Portuguese Foreign Direct Investment.

This is a bit strange because you'd struggle to see what all this investment actually is in terms of tangible assets (factories, etc.). So what are they?

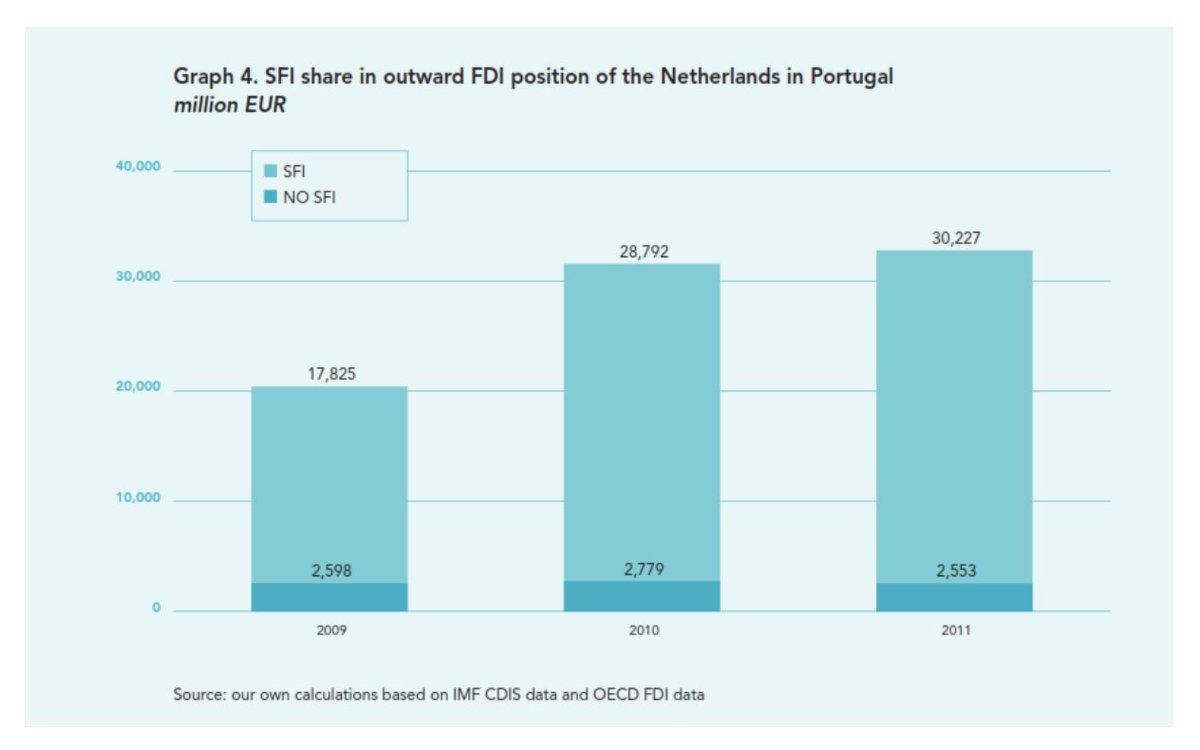

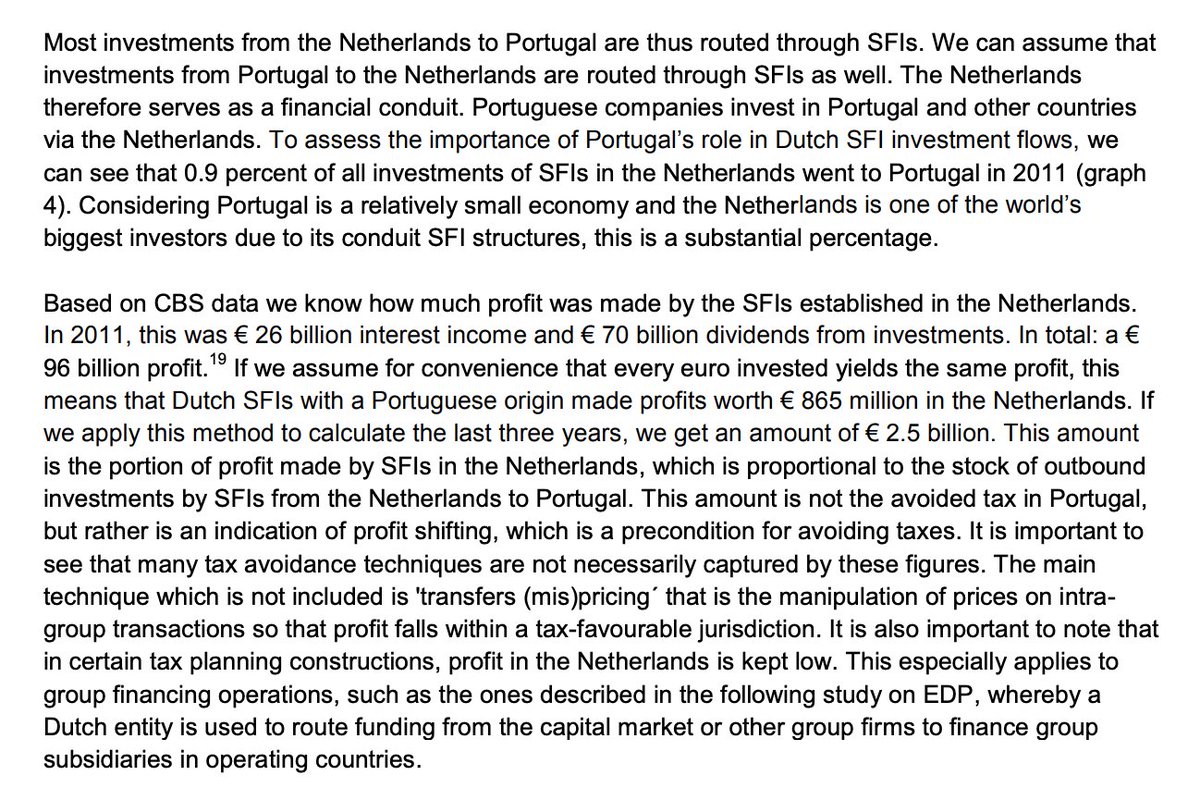

This very interesting report sheds light on this. By recouping IMF and OECD data, it shows that most of this investment is through Special Financial Institutions (SFI), or mailbox companies.

https://www.somo.nl/wp-content/uploads/2013/09/Avoiding-Tax-in-Times-of-Austerity.pdf

https://www.somo.nl/wp-content/uploads/2013/09/Avoiding-Tax-in-Times-of-Austerity.pdf

In fact, this FDI from Portugal to the Netherlands and from the Netherlands to Portugal is... Portuguese companies investing in Portugal though financial conduits in the Netherlands, mostly for tax purposes.

One prominent example analysed in the report is EDP, the former public electricity supplier now owned by the Chinese Three Gorges concern https://www.somo.nl/avoiding-tax-in-times-of-austerity/

FDI data is from the IMF: https://data.imf.org/%3Fsk%3D40313609-F037-48C1-84B1-E1F1CE54D6D5&ved=2ahUKEwjD7I3nmOTrAhXR_KQKHVMEBpYQFjAEegQISxAB&usg=AOvVaw1SZNYfa47JYL_R_ALszH1I&cshid=1599933541688

This IMF paper finds that "phantom investment into corporate shells with no substance and no real links to the local economy may account for almost 40 percent of global FDI" https://www.imf.org/en/Publications/WP/Issues/2019/12/11/what-is-real-and-what-is-not-in-the-global-fdi-network

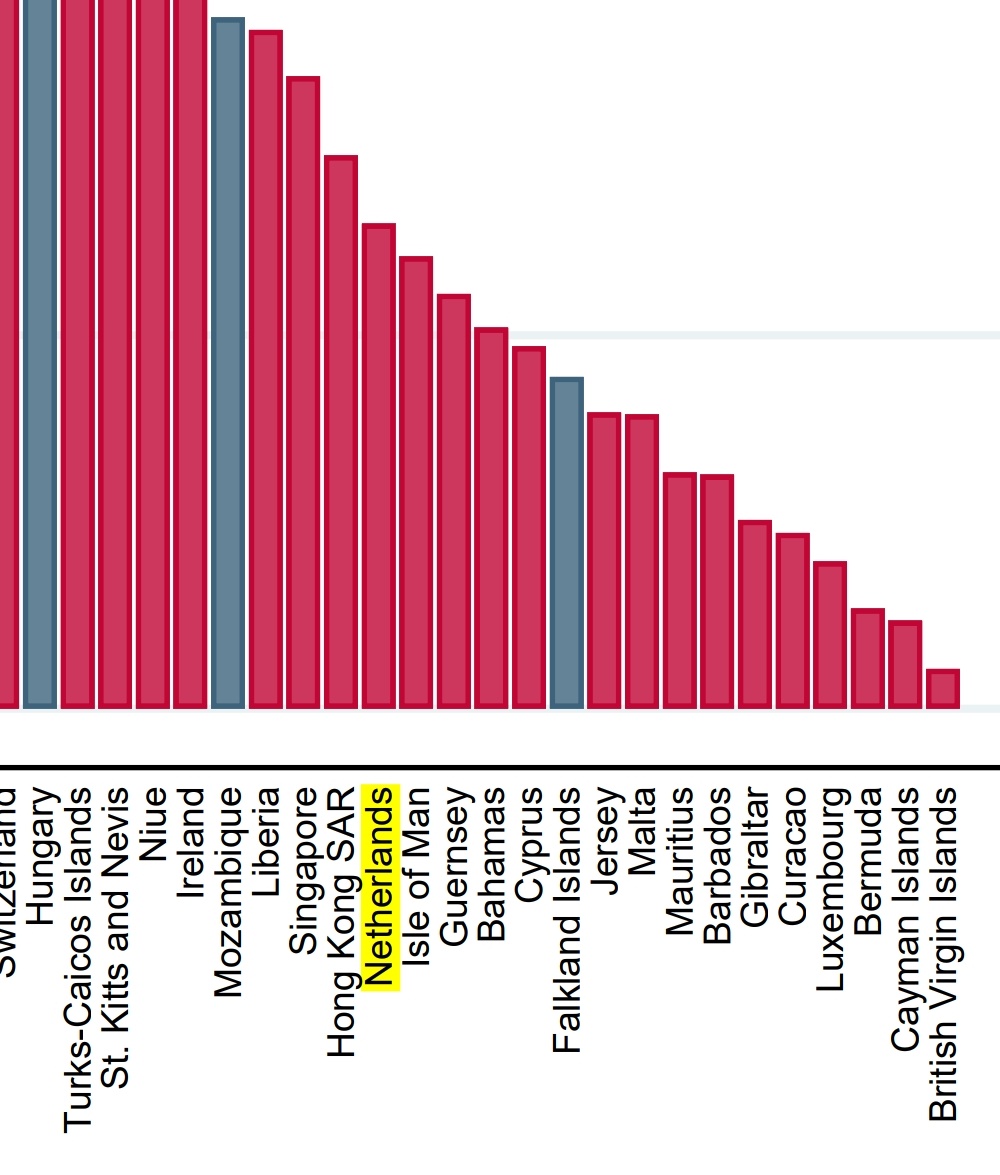

From the same paper: "the Netherlands, Luxembourg, Hong Kong, Switzerland, Singapore, Ireland,

Bermuda, the British Virgin Islands and the Cayman Islands jointly host more than 40 percent

of global FDI although their combined share of global GDP is only around 3 percent"

Bermuda, the British Virgin Islands and the Cayman Islands jointly host more than 40 percent

of global FDI although their combined share of global GDP is only around 3 percent"

It finds that the proportion of "real" Dutch FDI is just above 20%. More than 70% of it is "phantom" FDI, flows routed through the NL only for accountancy purposes. The Netherlands is in good company here.

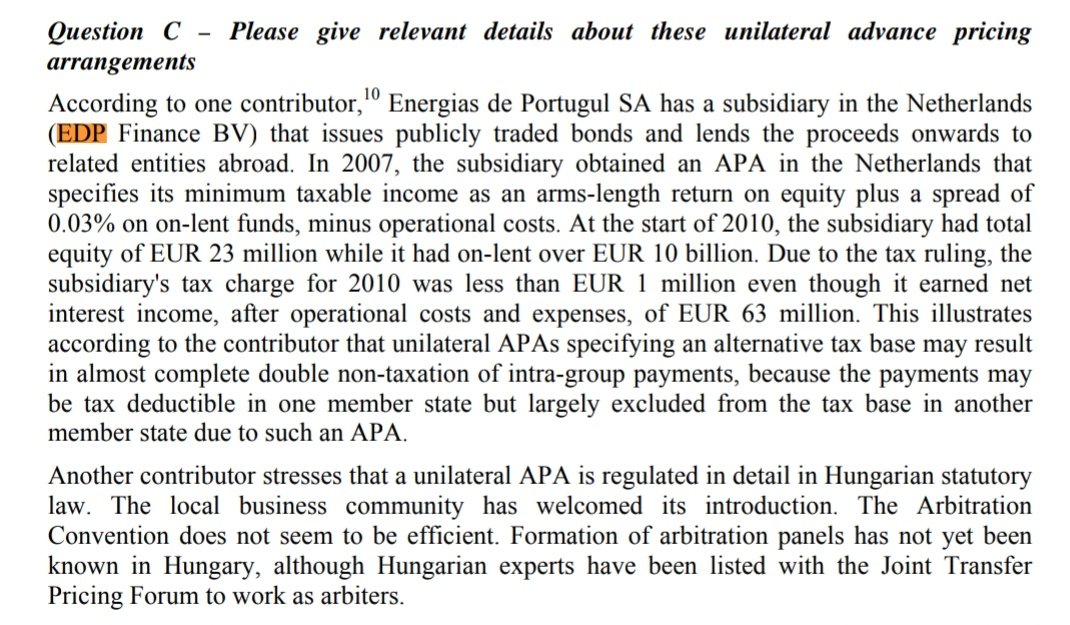

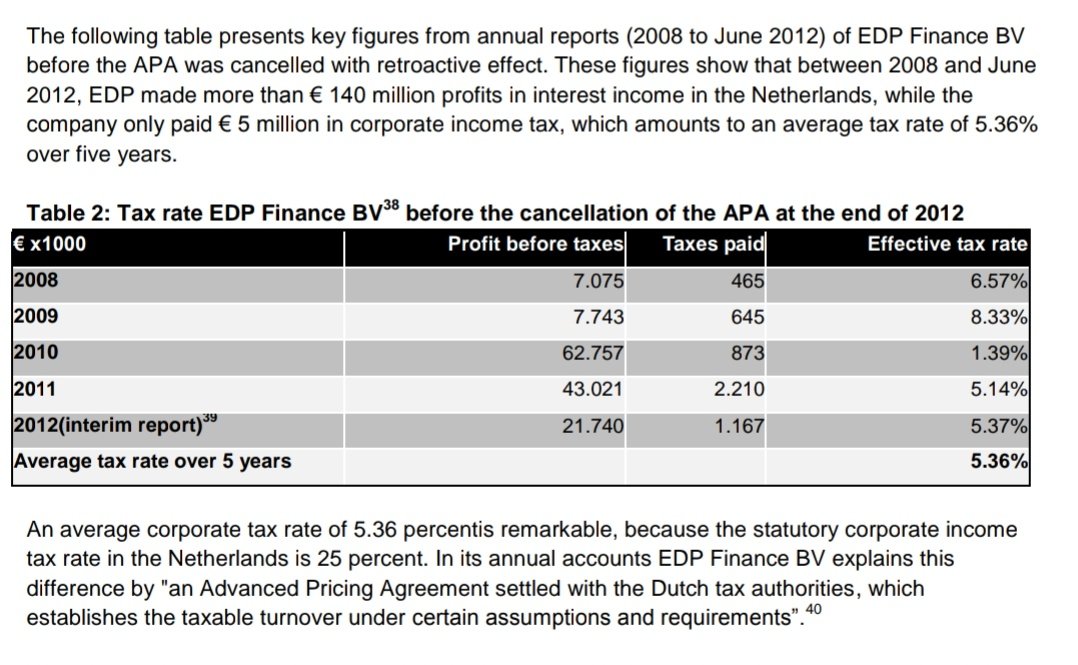

How the agreement between Dutch tax authorities (revoked in 2012) made it possible for EDP to be taxed at 5% (second pic from the SOMO)

http://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/common/consultations/tax/double_non_tax/summary_report.pdf&ved=2ahUKEwi_8J_O5OXrAhUSiIsKHS5vC38QFjAAegQIYhAC&usg=AOvVaw3CAnqXSxkvGj0VfQyRCLE1

http://ec.europa.eu/taxation_customs/sites/taxation/files/resources/documents/common/consultations/tax/double_non_tax/summary_report.pdf&ved=2ahUKEwi_8J_O5OXrAhUSiIsKHS5vC38QFjAAegQIYhAC&usg=AOvVaw3CAnqXSxkvGj0VfQyRCLE1

This based on great work by @fernandezamster et al.

Read on Twitter

Read on Twitter