Thread:

(1/xx) So everyone is talking about how @SushiSwap or @SwerveFinance are gonna kill @UniswapProtocol or @CurveFinance by draining liquidity from the original protocol via offering a "revenue-sharing-governance-token".

(1/xx) So everyone is talking about how @SushiSwap or @SwerveFinance are gonna kill @UniswapProtocol or @CurveFinance by draining liquidity from the original protocol via offering a "revenue-sharing-governance-token".

(2/9) While these "vampire attacks" are innovative, both protocols failed to innovate any functionality so far. So lets take a look how the forked protocols are comparing to their original ones. Lets start with @UniswapProtocol.

(3/9) In TVL @UniswapProtocol lost 1.3 billion USD, sitting at 690mil TVL and 24h volume sits at 266mil USD. On first glance the loss in liquidity and volume is significant. Lets take a look at @SushiSwap

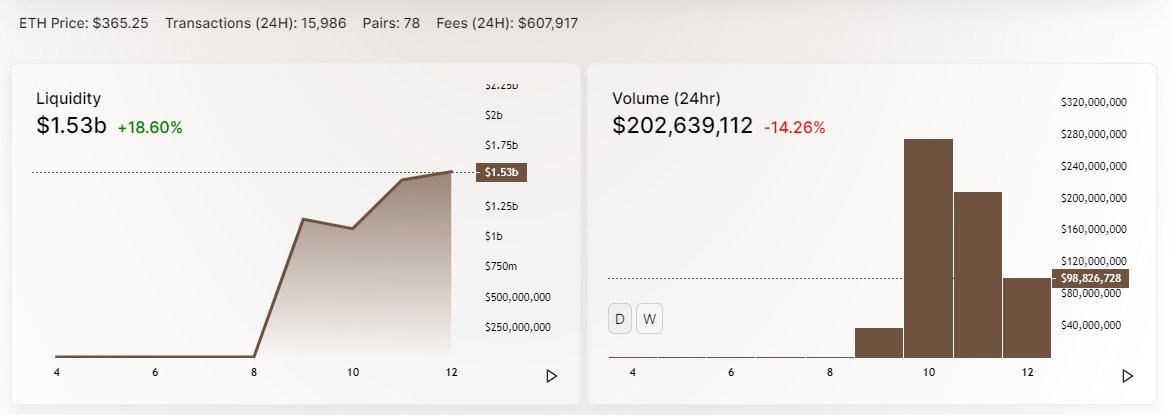

(4/9) So @SushiSwap wins the round for TVL, which is astonishing with 1.53 billion USD (more than Uniswap lost), but generated "only" 200mil USD in volume. That is 66mil less than Uniswap. But what is important for LP?

(5/9) LP care about profit and fees. So @UniswapProtocol generated 800.000$ in Fees for LP in the last 24h, while @SushiSwap generated 500.000$ for LP + 100.000$ for Sushi stakers.

(6/9) So for Uni, a LP providing 1000$, would get 1,15$ in fees (41% annualized), while on Sushi a LP would get 0,32$ in fees (11% annualized). So why is there so much Liquidity in Sushiswap? Because it is subsidized by Sushi with a drop of Sushi tokens with yield of up to 1000%

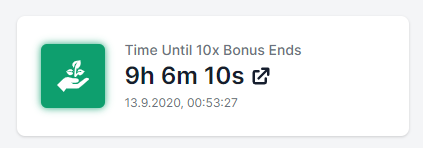

(7/9) So what is going to happen on 13/09 at 00:53? These subsides will drop by 90%, down to 2-10% annulized. This means, LPs will approximatly make 100% (double) the yield on Uniswap than on Sushiswap... if TVL moves back to Uni, slippage will improve but fees will suffer.

(8/9) So I am curious how the next 2 weeks will turn out and aligne incentives for LP between Uniswap and Sushiswap. And lets not forget that others like @imMoonSwap are trying to copy the model from Sushi right now, possibly draining further liquidity from both.

(9/9) In the end, it is clear that if we reached a status quo, these vampire attacks could be a real threat for existing dapps. However, we are far from "finished" and I am sure @haydenzadams and his team will continue to innovate and push us forward. Thank you for that!

(FIN) Since this is my first thread, I am tagging @DeFi_Dad, @sassal0x and @Tetranode, since they are LP themselves or might find this informative. Oh and I am going to make another thread about @CurveFinance and @SwerveFinance... hang in tight.

Read on Twitter

Read on Twitter