Alpha Pro Tech (NYSE:APT) is looking incredible right now. It’s a company practically built for COVID that is trading at a discount. Let me show you.

Disclaimer: I am long APT. I am not a financial advisor. This is my own research and does not constitute investment advice. 1/18

Disclaimer: I am long APT. I am not a financial advisor. This is my own research and does not constitute investment advice. 1/18

Data that is not my own is used through this thread. Credit goes to those who made it. 1.5/18

The company operates through two segments:

Building Supply

● Housewrap

● Synthetic roof underlayment

● Other woven material

Disposable Protective Apparel

● Shoecovers

● Bouffant caps

● Gowns

● Coveralls

● Lab coats

● Frocks

● Face masks

● Eye shields

2/18

Building Supply

● Housewrap

● Synthetic roof underlayment

● Other woven material

Disposable Protective Apparel

● Shoecovers

● Bouffant caps

● Gowns

● Coveralls

● Lab coats

● Frocks

● Face masks

● Eye shields

2/18

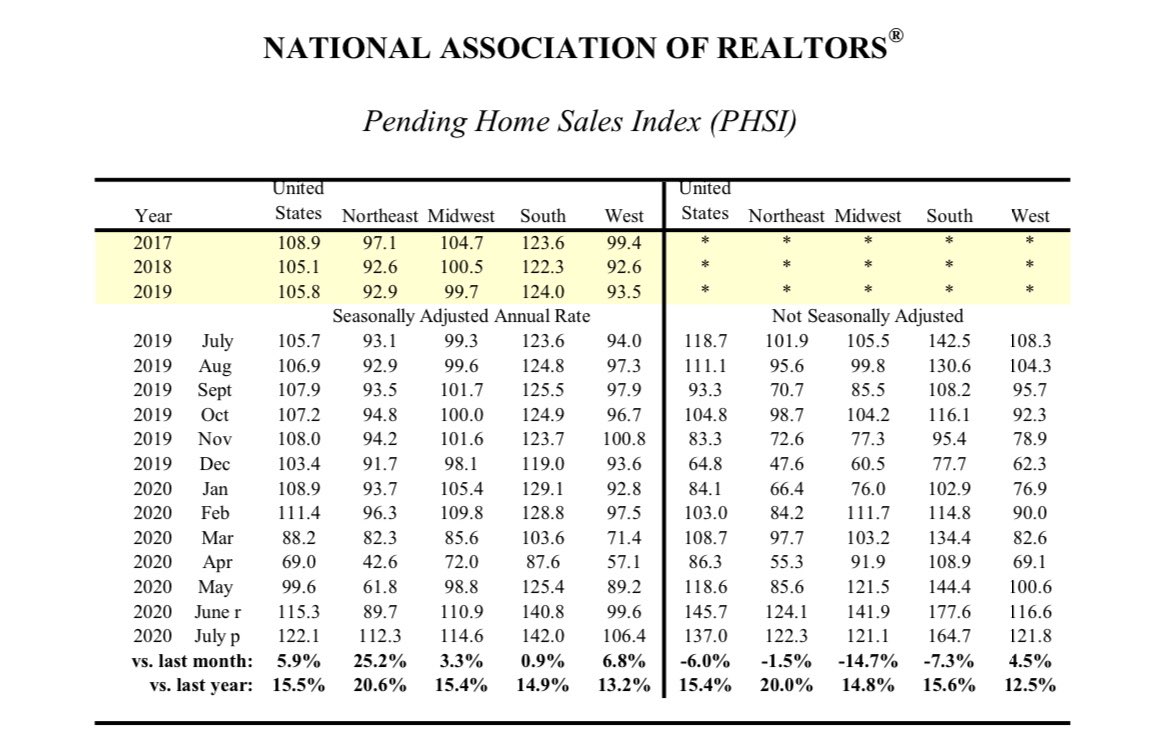

COVID-19 has been a nightmare for real estate in the big cities, but has been a boon for the homebuilders, sellers in the burbs. Home sales and building have been booming ever since the real estate agents returned, with home sales exceeding new listings. 3/18

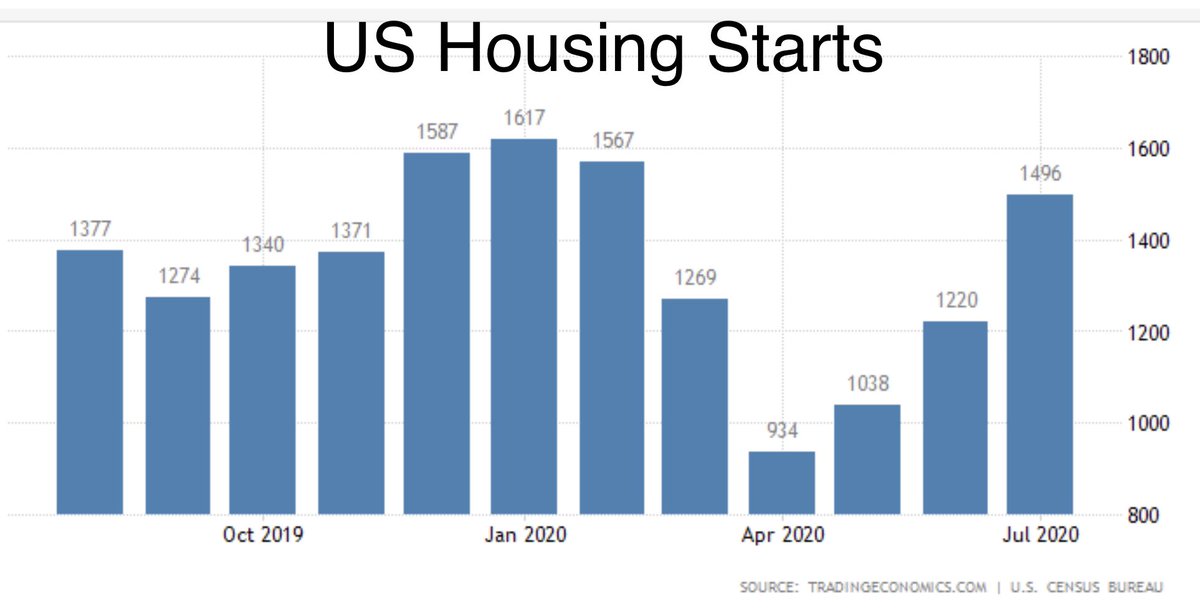

US Housing Starts (i.e. construction) are up, which has been reflected in the lumber futures which are up almost 300% from lows and over 200% YTD. 4/18

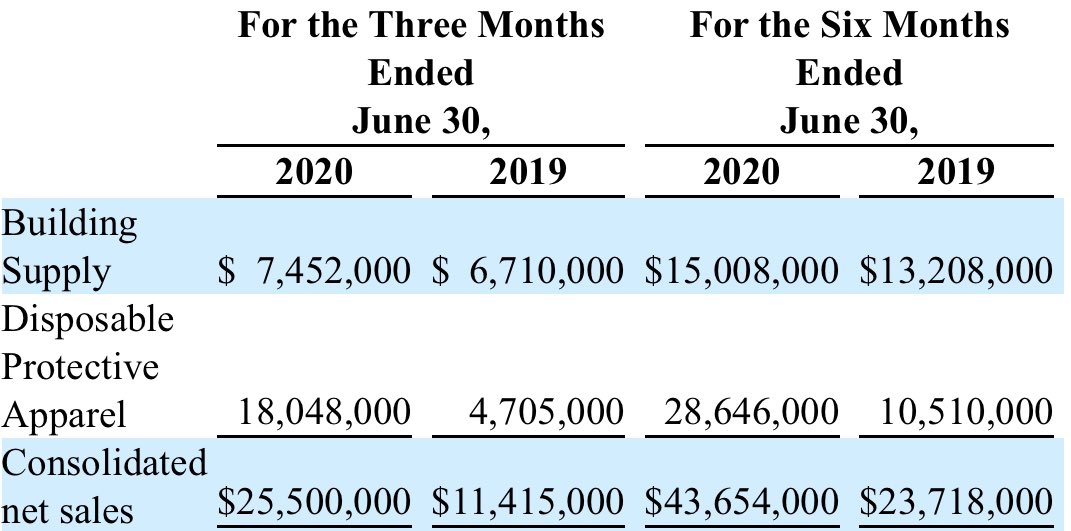

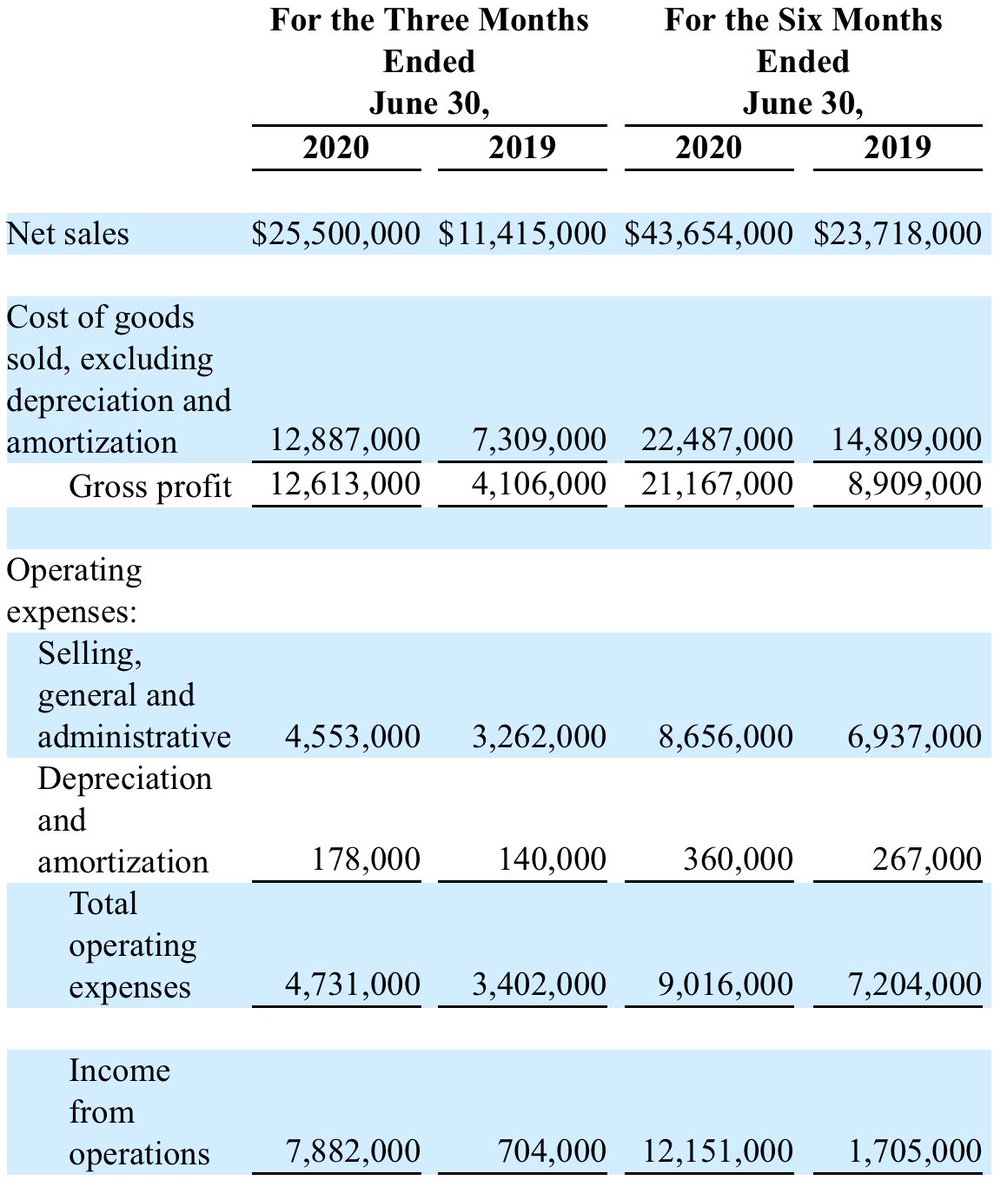

Accordingly, APT’s Building Supply segment has seen strong growth, as can be seen in the net sales per segment. (Most recent 10-Q. Shoutout to BamSEC @getBamSEC)

But, uhm... that’s only a tasty crumb of the loaf. Let’s talk about the elephant in the room that is line 2. 5/18

But, uhm... that’s only a tasty crumb of the loaf. Let’s talk about the elephant in the room that is line 2. 5/18

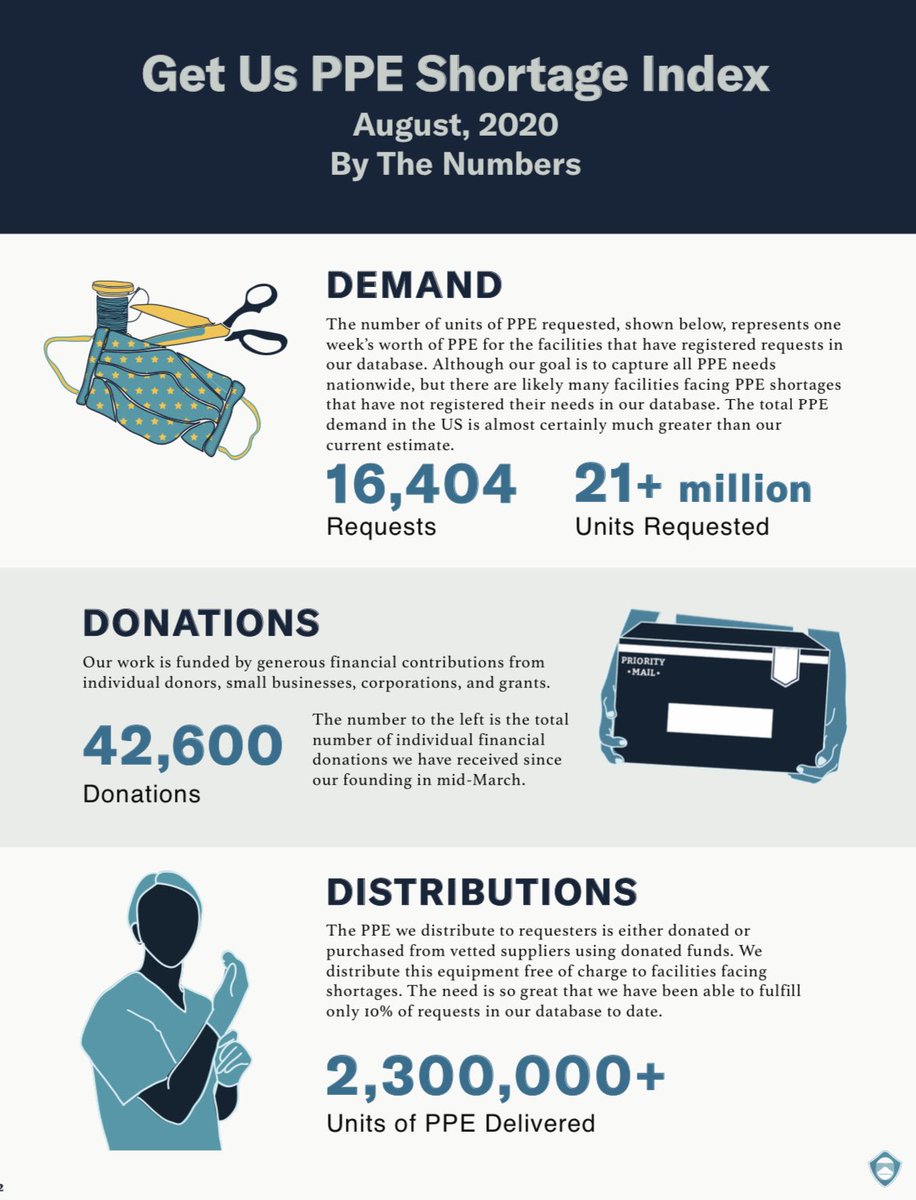

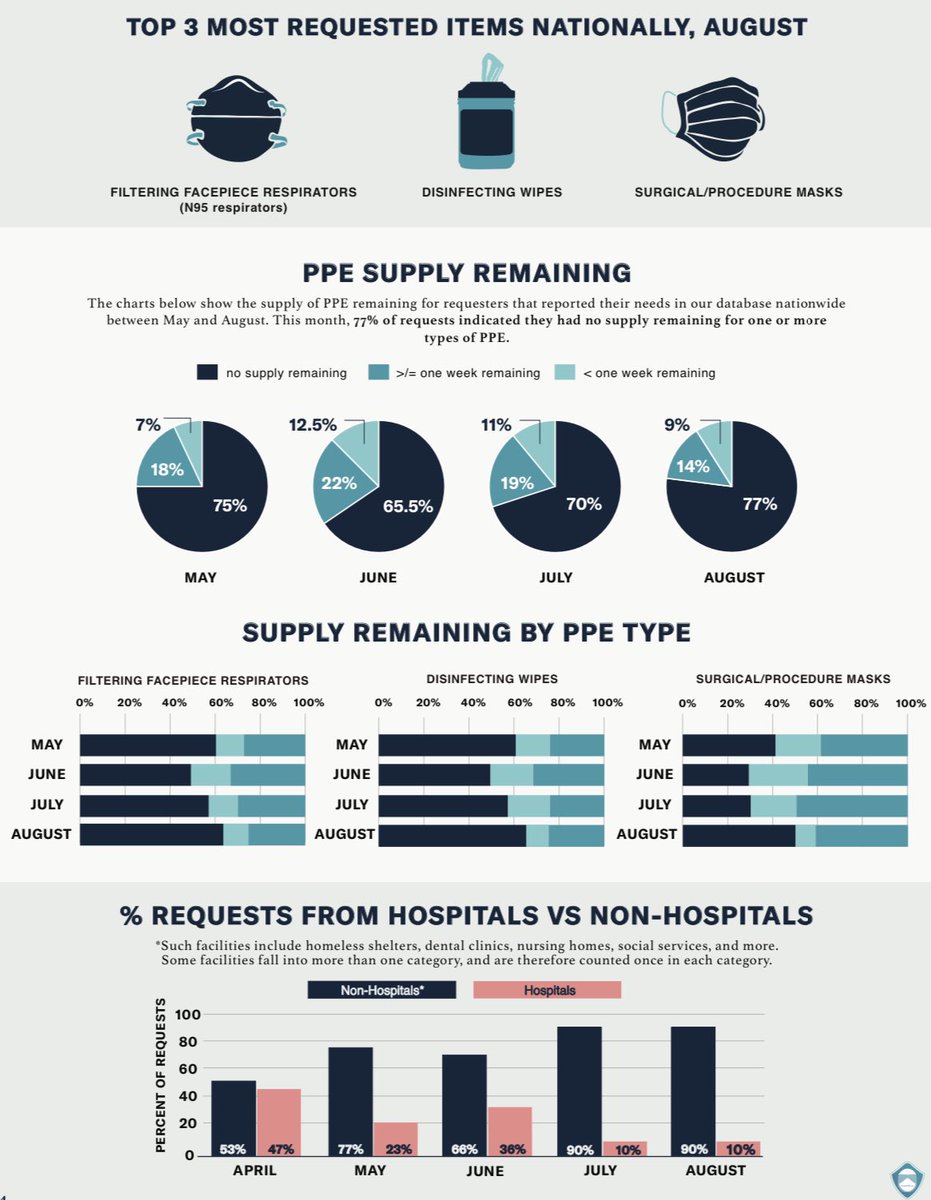

The US is experiencing a shortage of PPE. Many public and private entities including school, hospitals, unis & other entities need and want to stockpile PPE. Gov’t stockpiling will likely be a 4-6 year endeavor as current PPE supply exceeds demand ( http://getusppe.org ) 6/18

APT has been ramping up production of N95 masks since March and will continue to do so until the end of the year. Originally, APT only had two phases of production capacity expansion planned, but that turned into three and who knows if it will keep going. 7/18

The first of three phases is complete, with the second to be done soon (could be done now but unannounced). After all is said and done, N95 sales capacity is expected to rise to $100M/year ($25M/quarter) beginning FY2021. 8/18

That $4.7M -> $18M figure we saw before was for the entire DPA segment. We are talking $25M/q for masks alone + all other PPE (face shields have also seen some demand and >$3M/q is expected in second half of 2020, for example). 9/18

What’s even more incredible is APT’s operating leverage. After more than tripling their recent quarter’s gross profit YoY, operating expenses are up only roughly ~40% (!), resulting in a 1000% increase in operating profit YoY! 10/18

Now... why APT masks? APT has a patent on the PFL® (Positive Facial Lock) and uses the Magic Arch feature that “enhance user comfort and product performance.” 11/18

feature that “enhance user comfort and product performance.” 11/18

feature that “enhance user comfort and product performance.” 11/18

feature that “enhance user comfort and product performance.” 11/18

The PFL® ensures a much better seal than your typical mask. It uses a little TwistSeal® at the bottom of the mask to pinch together excess material.

Ever breath in and feel your mask suck into your nose/mouth? Not with this Magic Arch that runs across the face! 12/18

that runs across the face! 12/18

Ever breath in and feel your mask suck into your nose/mouth? Not with this Magic Arch

that runs across the face! 12/18

that runs across the face! 12/18

From personal correspondence with doctors and dentists that have been unable to get their hands on APT masks, I gather they’re simply dissatisfied with other masks in the market. 13/18

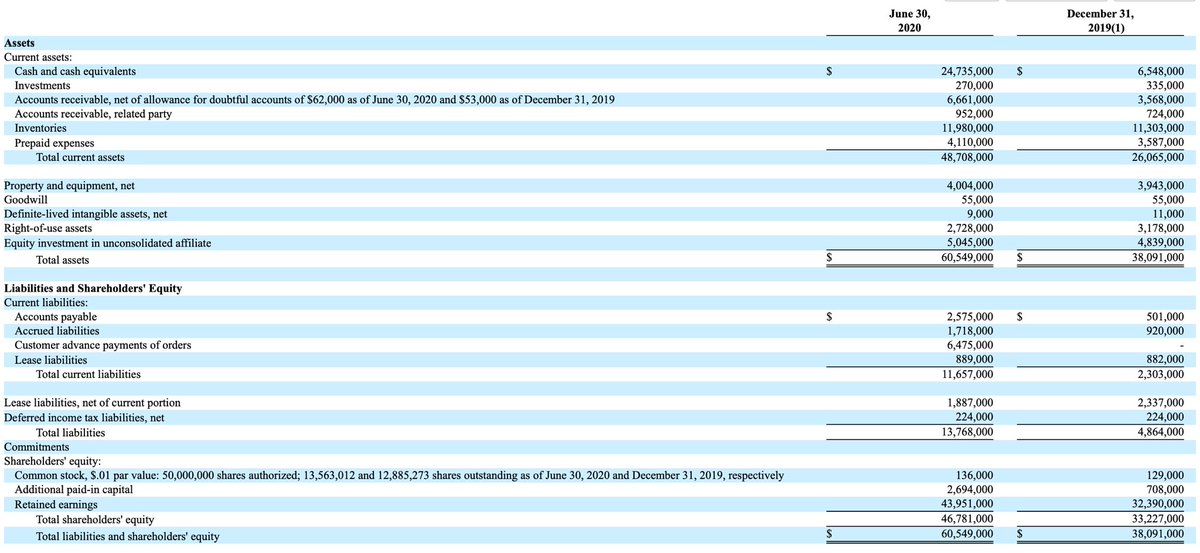

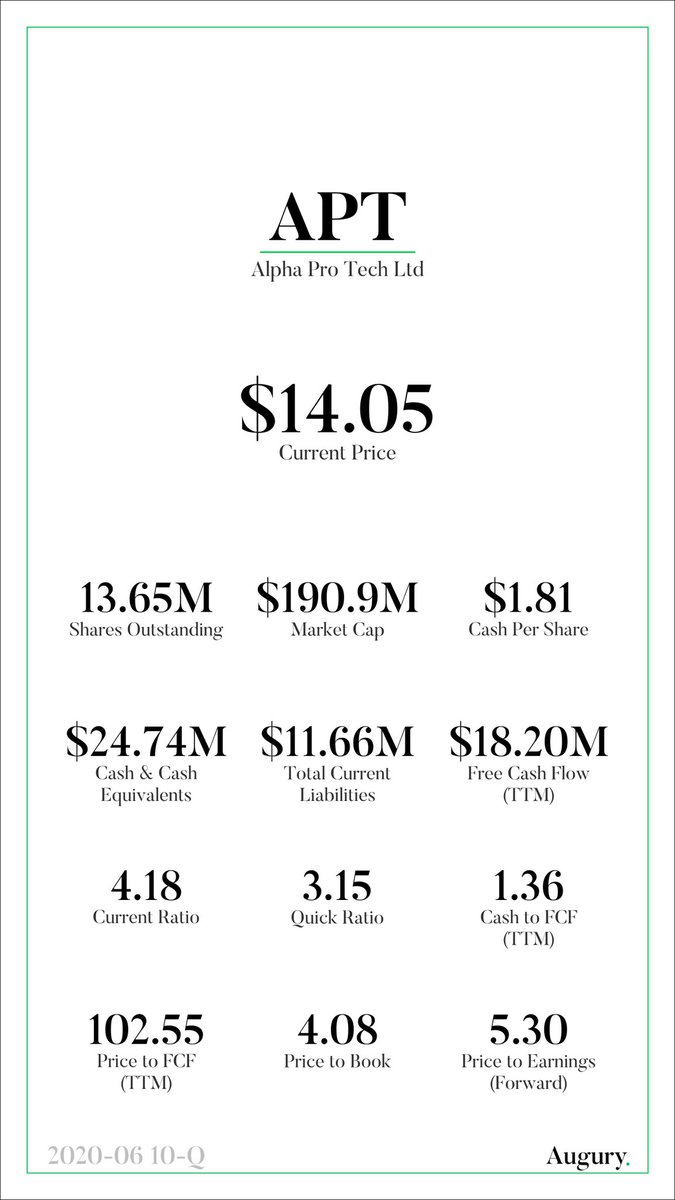

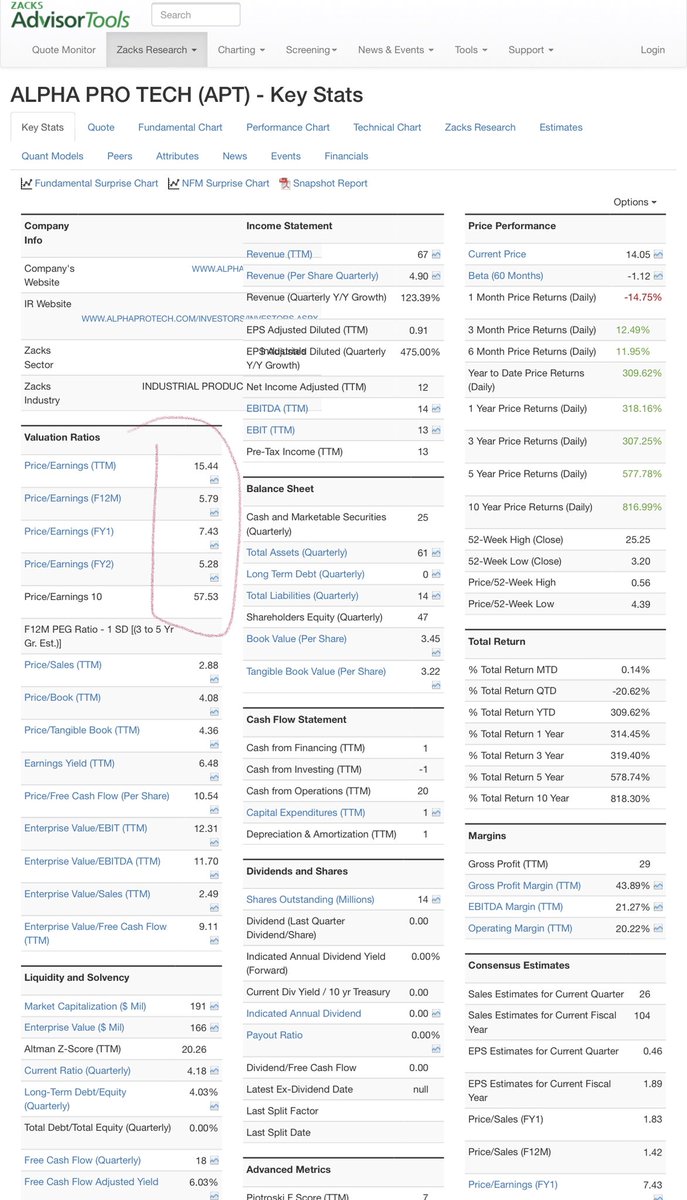

Now let’s talk financials and valuations. APT is a well-run, lean company. It’s had zero debt and has built up a marvelous balance sheet in 2020, almost quadrupling their cash position to ~$1.81/share. 14/18

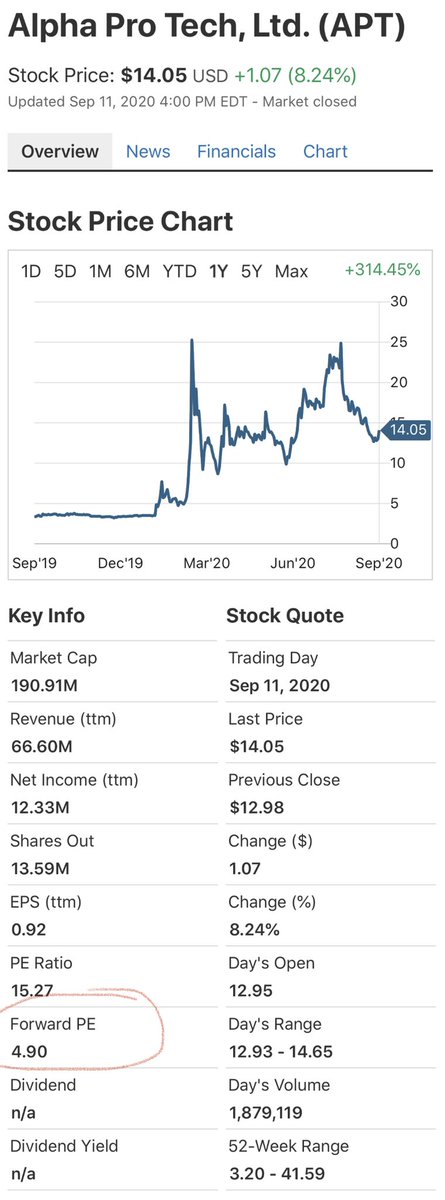

APT’s share price has truly had a wild year as investors have been trying to narrow down the size and duration of this PPE surge. It’s currently sitting at the lower end of the range, at about $14/share. 15/18

It’s trading at a forward P/E multiple that is truly low compared to peers and e.g. NASDAQ index. My own estimates put it at a forward P/E closer to 3. Just look at that current/quick ratio! 16/18

shoutout @AuguryResearch

shoutout @AuguryResearch

Using truly conservative estimates to ensure a wide margin of safety (28% tax rate, 10% WACC/discount, -4% perpetual growth terminal value) my discounted cash flow model puts a price tag of $26. My less conservative estimates value these cash flows quite a bit more (>$34). 17/18

Thanks for reading.

Repeating disclaimers: I am an APT shareholder. I am an astrophysicist, not a financial advisor. This is my own research and does not constitute investment advice. 18/18

Repeating disclaimers: I am an APT shareholder. I am an astrophysicist, not a financial advisor. This is my own research and does not constitute investment advice. 18/18

Read on Twitter

Read on Twitter