Stock Analysis on $SEDG

$SEDG is at the exact confluence of two big areas of growth I love. Solar and Semiconductors.

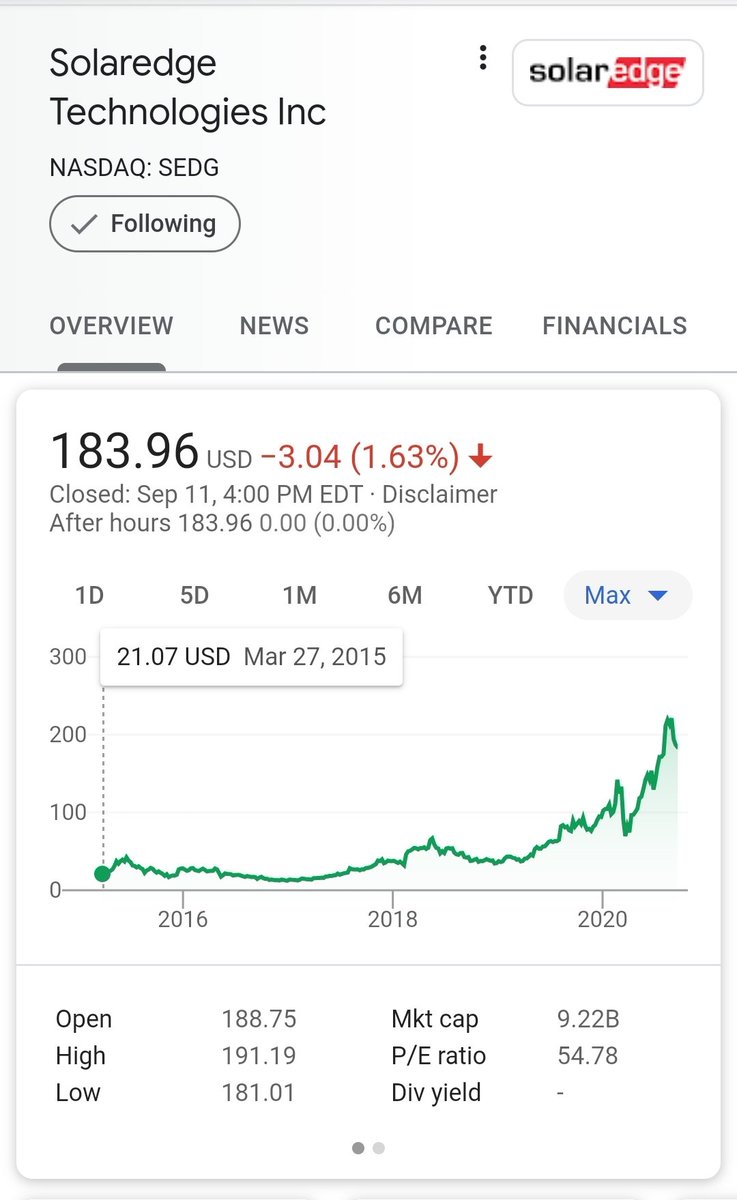

In the past 5 years $SEDG is already a 10 bagger. Even 3 years ago at its lowest it is a 15 bagger and potential 20 bagger soon.

Continued in thread...

$SEDG is at the exact confluence of two big areas of growth I love. Solar and Semiconductors.

In the past 5 years $SEDG is already a 10 bagger. Even 3 years ago at its lowest it is a 15 bagger and potential 20 bagger soon.

Continued in thread...

$SEDG is an Israel based company with manufacturing in Hungary and Vietnam. While they manufacture in China they are well positioned to avoid tariffs and the ongoing trade war between the US and China.

I also like Israeli firm $FVRR Canada based $SHOP for similar reasons.

I also like Israeli firm $FVRR Canada based $SHOP for similar reasons.

The trend is your friend. Solar is the only viable renewable energy at large scale and its also the only renewable energy where costs decrease every year due to technological advances...

I also like that $SEDG American HQ is in Fremont close to $TSLA...

I also like that $SEDG American HQ is in Fremont close to $TSLA...

$SEDG ranks among the best power inverters. Private company Fronius is #1 in this article along with German company SMA publicly traded on the German stock exchange as $SMTGF https://www.cleanenergyreviews.info/blog/best-grid-connect-solar-inverters-sma-fronius-solaredge-abb

The question of micro inverter vs optimized inverter is discussed in this article. Pros and Cons to each. Mainly discussing $ENPH vs $SEDG here. It could be wise to own both to have full exposure to the solar market. both market caps around $9 bil fyi https://www.pacificsuntech.com/post/solaredge-or-enphase-which-is-better

Read on Twitter

Read on Twitter