Tesla Q3 2020 Earnings Estimate (Thread)

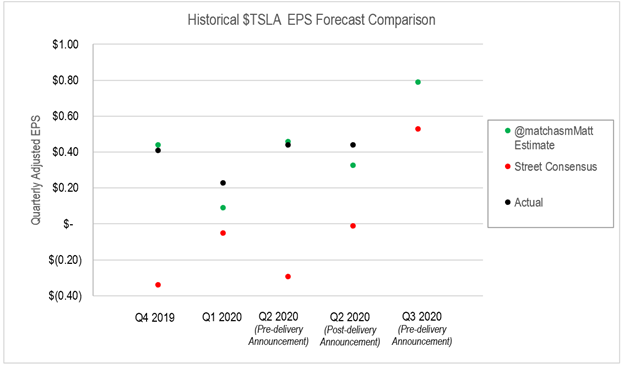

I’m projecting $0.79 of Adjusted EPS on deliveries of 143,000. This is higher than street estimates, but not nearly as drastically as it has been in the past.

I’m projecting $0.79 of Adjusted EPS on deliveries of 143,000. This is higher than street estimates, but not nearly as drastically as it has been in the past.

I have a lot of new followers since I last published my quarterly EPS estimates, so I thought I’d do a quick recap of my history on these posts and then dive into the specifics of my model.

Wall Street has historically been *horrible* at estimating Tesla’s EPS. Aside from getting delivery estimates woefully wrong, Wall Street analysts have also failed spectacularly at estimating Tesla’s automotive gross margin.

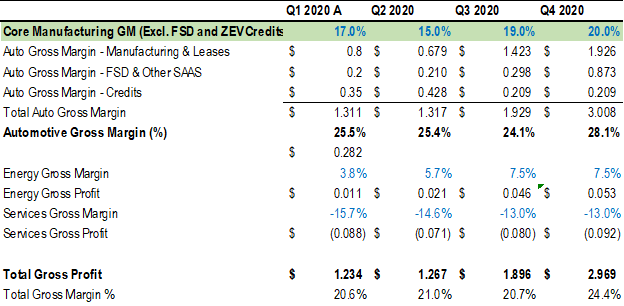

The chart below compares my own historical estimates (in green) with Wall Street consensus estimates (in red). Tesla’s actual reported figures are shown in black. I’m sure if we did the same exercise with other competent Tesla twitter bulls, we’d see similar results.

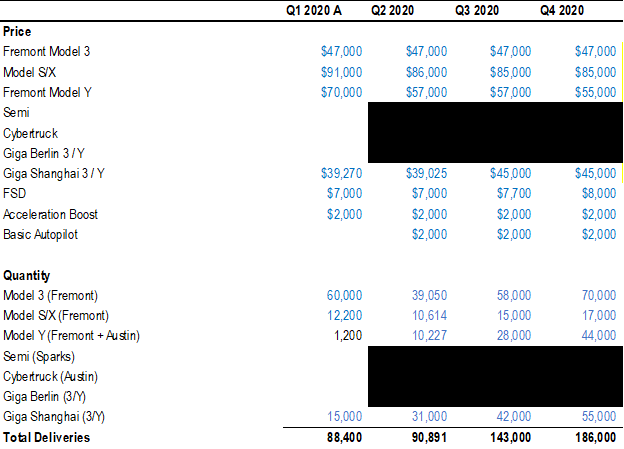

Starting with the build-up, I am estimating 143,000 vehicles. The average selling prices exclude FSD, as I prefer to strip those revenues out and evaluate them separately. For the full year, I’m estimating 508K deliveries.

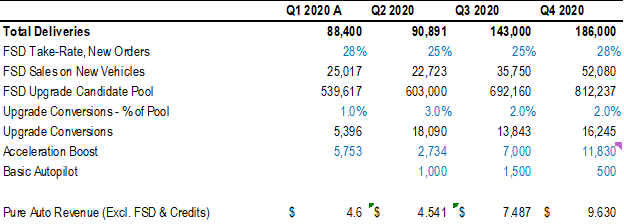

One pillar of my thesis for some time now has been extreme attention to detail on Tesla’s FSD software package. Due to its potential to generate so much pure margin it is very important to break this line item out in as much detail as possible.

As deliveries scale up, the majority of which do not include FSD with the initial purchase, the potential for this to be a significant financial driver increases rapidly over time.

I estimate that there are 692K vehicles which could be upgraded to FSD with the press of a button (trust your butt!). One apparently new development however is Tesla’s practice of selling >80% of used vehicles with the FSD upgrade attached. https://twitter.com/MatchasmMatt/status/1303145517518663682?s=20

Based on the information above and accounting for some level of upgrades from existing owners, I estimate that 2% of the fleet of “Upgrade Candidates” will result in FSD sales in Q3. This results in 13.8K upgrades, compared to 35.8K FSD sales on new vehicle purchases.

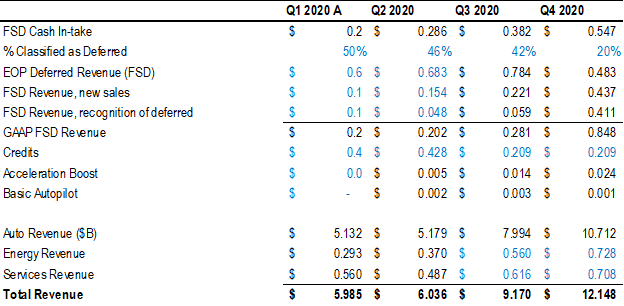

This translates to $382M of FSD cash flow in the door for Tesla, but unfortunately it’s not all recognizable as revenue. Accounting for some modest increases in FSD functionality in Q3, I estimate the percentage of FSD revenues which are deferred to drop from 46% to 42%.

This results in $281M in FSD revenue and $8B total of automotive revenue. Interestingly, the deferred revenue line continues to grow with these assumptions, reaching $784M in Q3. This will all flow down to NI at some point, and will therefore be a source of future earnings power.

I’m assuming a resumption of growth in Energy & Services revenue, for a total top-line figure of $9.2B.

By going through this very detailed revenue walk, we can isolate the pure margin revenue streams like FSD and Credits, so that we are left with an accurate measure of Tesla’s core automotive manufacturing margin.

I estimate these were 17.0% and 15.0% in Q1 and Q2, respectively. Importantly, we know from the last earnings call that the decline in this figure in Q2 was solely due to Coronavirus production issues, and Tesla confirmed that they have resumed normal manufacturing margins.

We also know that the margins on the Model Y and the MIC M3 are higher than the Fremont-made M3. We can therefore presume that as the Fremont-made M3 declines as a % of overall deliveries, Tesla’s core manufacturing margin will increase.

I’m projecting an increase to 19.0% in Q3 and 20% in Q4. This results in a pure automotive manufacturing margin of $1.4B. By combining this with the margins from FSD and credits, we get a total automotive gross margin of $1.9B.

I presume Energy and Services margins will improve modestly in Q3, bringing total Gross Profit to $1.9B

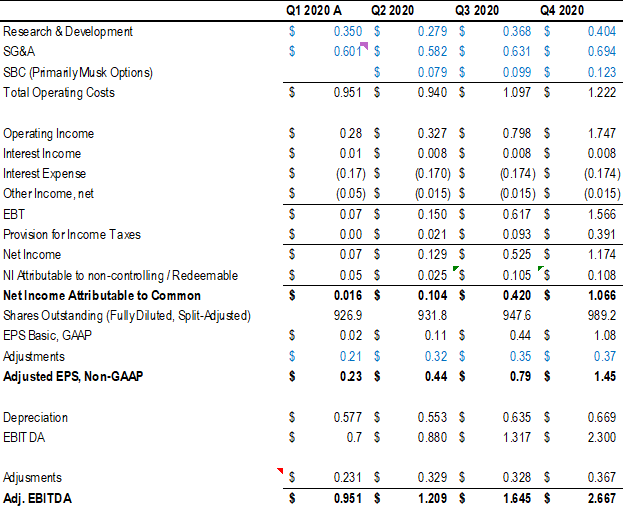

Backing out the other expenses, the result is that Tesla will quadruple Net Income in Q3 to $420M, or $0.79 of Adjusted EPS. I promise I did not fudge the numbers to get a $420M NI number (ok maybe I rounded down $3M) - that number just seems to be core to the company somehow.

By Q4 I anticipate over $1.0B of GAAP Net Income, as the company continues to take advantage of operating leverage to scale profitably, and higher recognition of deferred FSD revenue occurs as turning on city streets is enabled and the product nears “feature complete” status.

In addition to the base case presented here, I also note the potential for significant upside via either 1) greater recognition of deferred FSD revenue, or 2) a reduction in the valuation allowance in Tesla’s Deferred Tax Asset, as projected by @icannot_enough this quarter.

So that wraps up the fundamentals of my Q3 estimates. If you’d indulge me a little, I’d like to tack on shameless self-promotion. For those of you who are newer followers, my background is in Valuation and Investment Banking, but I now work in the Energy industry.

There seems to be a lack of knowledge in the Tesla community about what Tesla’s future business opportunity in the energy space might look like. I have posted a few threads on these topics before, but not yet a series of semi-comprehensive primers.

I am also working on a detailed valuation of Tesla, where I take each business line on a standalone basis and ascribe a share price value based on a discounted cash flow analysis. This will be very hard to adequately describe via Twitter threads.

As you can tell from this very lengthy thread, I like to give a lot of detail, and unfortunately even this version is significantly paring down my thought process. I’ve been toying with how best to convey some of this information, and ultimately I think video is the best medium.

I would like to create some videos to go into these topics and many others, but have yet to do so primarily due to a lack of time.

If this is content you would like to see, please subscribe to the channel below. If there is enough interest, I may bite the bullet and start posting a few videos. https://www.youtube.com/channel/UCMEgks5J4lvyhUR5nwJOrpw

@threadreaderapp unroll

Read on Twitter

Read on Twitter