Besides $AMWL and $SNOW, another IPO I’m really excited about is JFrog $FROG

It’s a DevOps platform that enables organizations to securely and continuously deliver software updates across any system.

Here’s a quick summary of its platform, market, financials, and competition:

It’s a DevOps platform that enables organizations to securely and continuously deliver software updates across any system.

Here’s a quick summary of its platform, market, financials, and competition:

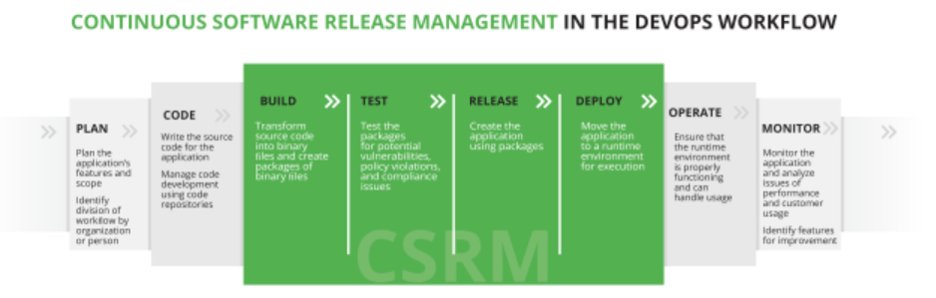

As every company is becoming a software company, it has never been more important to have a fast and secure software release cycle. DevOps enables this by integrating the planning, coding, building and testing done by devs and the deploying, operating, and monitoring by operators

While tools like Git, Docker, or Gradle address certain segments of DevOps, the bridge between developers and operators is increasingly difficult to build and manage at scale. This is where JFrog comes in, enabling a category called Continuous Software Release Management (CSRM).

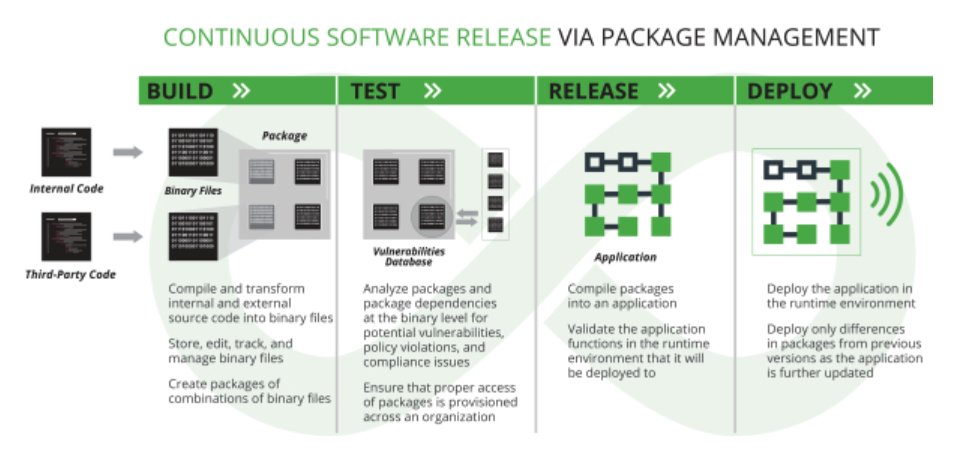

Organizations need tools that can turn source code into executable binary files, store and manage these binaries, and then create software packages, or combinations of binary files, that can then be released and deployed. JFrog platform manages and deploys these software packages

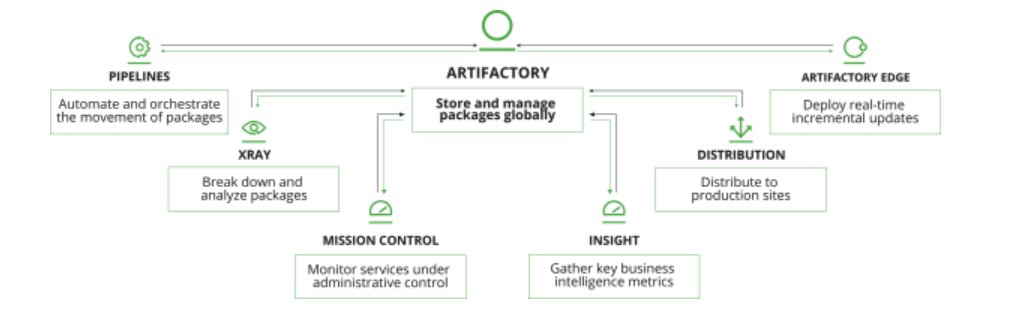

The core of its platform is the Artifactory, a system of record for all software in an organization. Here, DevOps teams can store and manage software packages and deliver them seamlessly to users in the background, thus accelerating release cycles and improving user experiences.

Code repositories like GitHub store and manage source code but lack the ability to deliver these updates automatically because they are not purpose-built to manage and cache binary files. JFrog’s platform also handles other DevOps functions like security through its Xray product.

GTM strategy: JFrog has a bottom-up, developer-driven model. They have been cash flow positive since 2014 and use no field salespeople. JFrog’s self-managed subscriptions are priced based on the number of servers, whereas SaaS, comprising 20% of revenue, is based on usage

Customers: JFrog is used by 5,800 organizations, including 75% of the F100. Their revenue base is also very diversified, with no customer accounting for more than 2% of their total revenue. Some customers include Google, Microsoft, Twilio, Visa, Morgan Stanley, and Splunk.

Competition: While they have no direct competition, competitors like Red Hat, Pivotal, VMware, and GitLab in self-managed deployments and Alphabet, Amazon, and Microsoft in SaaS have offerings that compete with some of their products.

Financials: In 2Q’20, JFrog boasted an incredible NDR of 139%, gross margins of 82%, operating margins of ~4%, a 6% FCF margin, ARR grew 46% YoY, and payback period was 14.3 months.

They have a $22B TAM today. LTM revenues were $128M, growing at 56%.

They have a $22B TAM today. LTM revenues were $128M, growing at 56%.

Overall, I think JFrog is a category leader with minimal competition and a large, underpenetrated market that will only grow as SaaS continues to proliferate. I especially like their very efficient GTM strategy and will consider starting a position when it debuts next Wed.

Read on Twitter

Read on Twitter