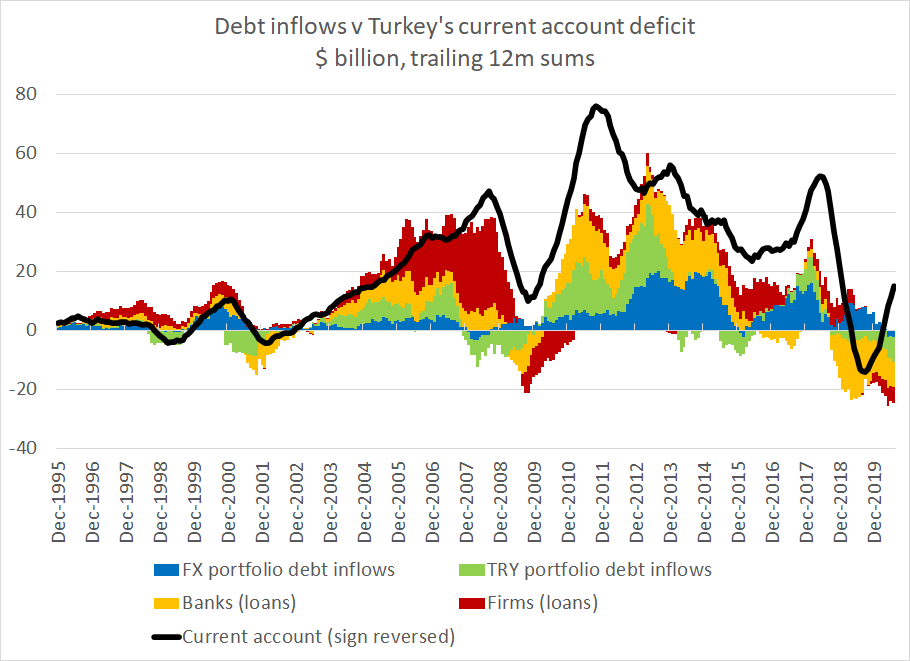

The mechanics of the CBRT's balance sheet are complicated, given the CBRT and the banks mutual dependence on swaps (CBRT gets the fx it needs, banks the TL funding they need). But the heart of Turkey's crisis is simple: the funding for a current account deficit isn't there

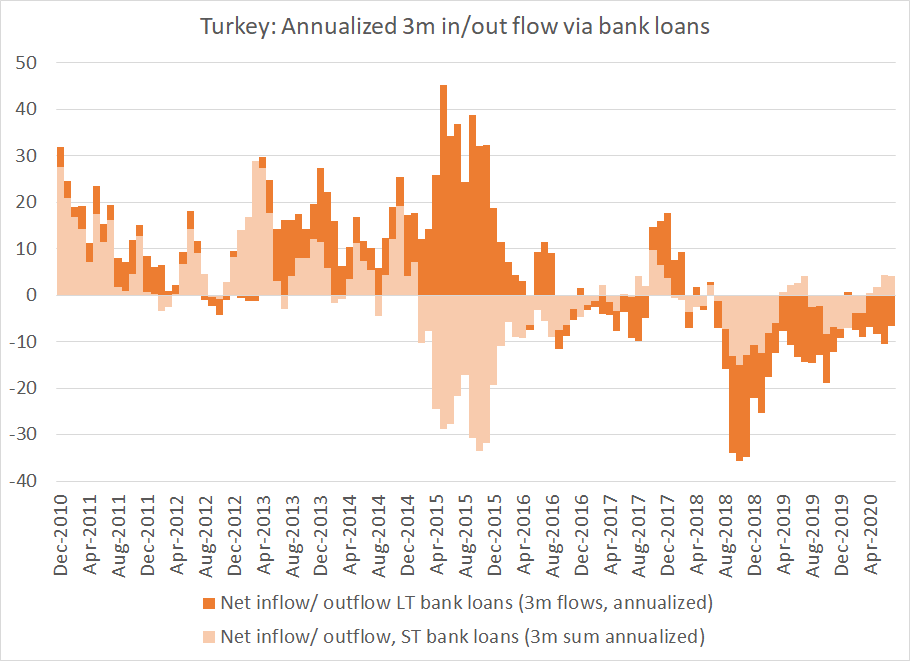

Especially if the banks are reducing their external borrowing ... and thus drawing on their external assets/ reserves to pay down external debt

(though there has been a bit of a rise in short-term borrowing recently)

(though there has been a bit of a rise in short-term borrowing recently)

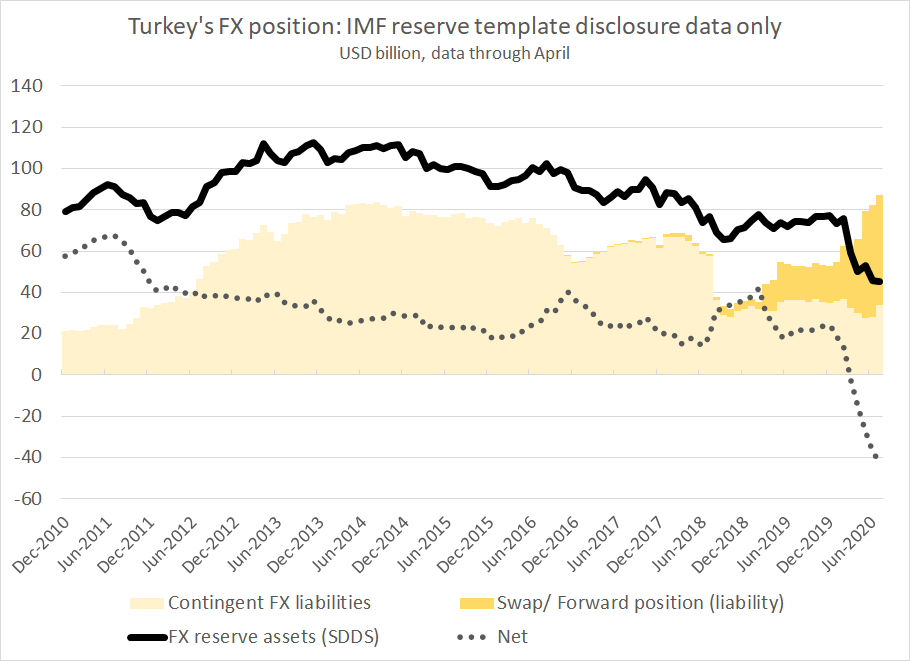

Now reserve sales were more modest in July (when with the forward adjustment) -- but that was in part because the state banks were forced to do the CBRT's dirty work with a rise in their open position.

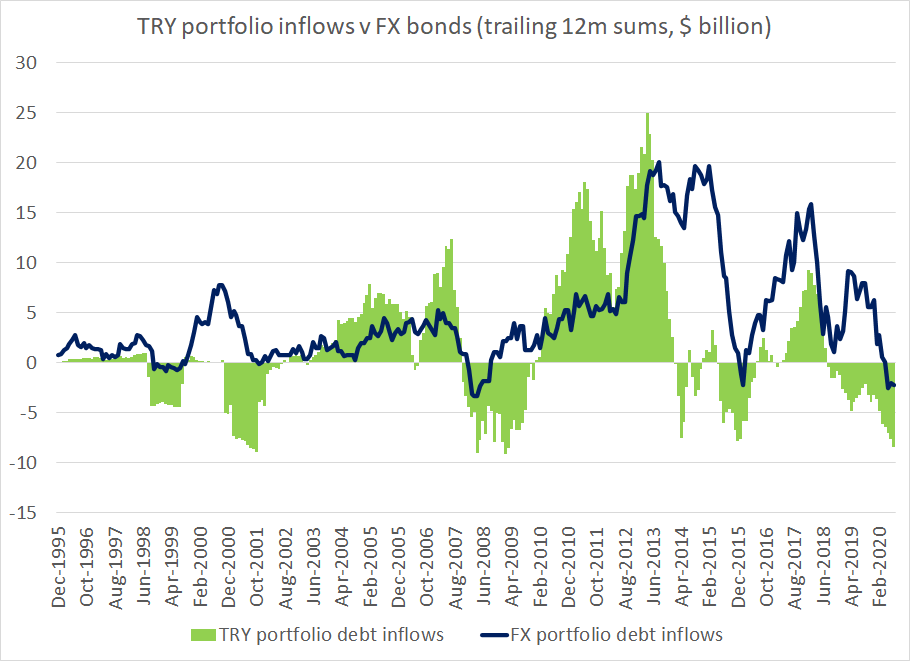

But with an ongoing current account deficit ( @RobinBrooksIIF expects it to rise in August based on the trade data) and net outflows from the banks and the bond market, it isn't hard to see why the CBRT has gone through at least $60b in fx since the end of 2019

Read on Twitter

Read on Twitter