We need to talk about MD's Purple Line project, public-private partnerships, and private equity.

A judge has ruled the P3 concessionaire can walk on the deal. And @shaverk at WaPo reports that the P3 "companies have not yet contributed their own money."

This is a problem.

A judge has ruled the P3 concessionaire can walk on the deal. And @shaverk at WaPo reports that the P3 "companies have not yet contributed their own money."

This is a problem.

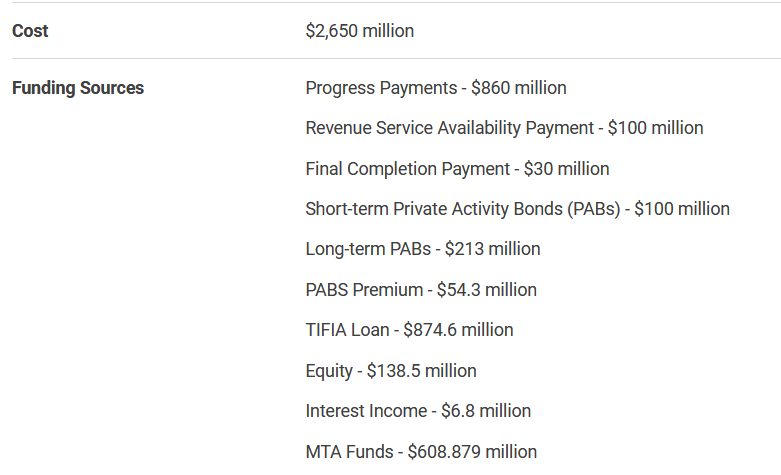

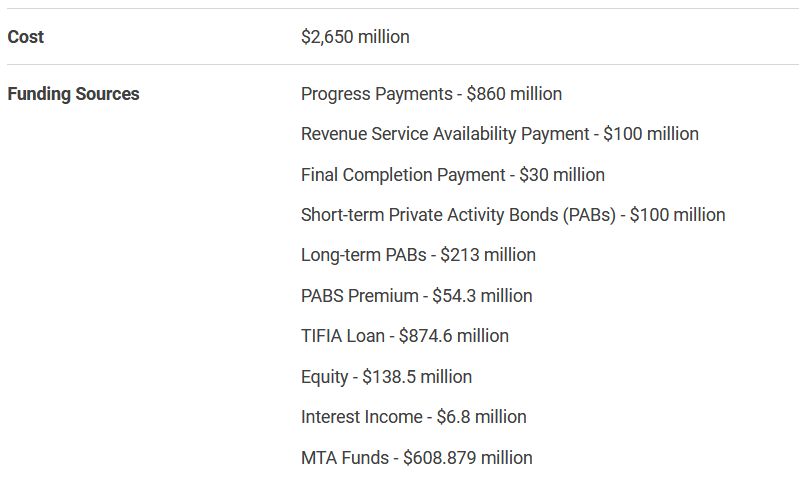

The role of private equity (PE) is motivation & accountability. PE is only 5% of Purple Line financing. The threat of losing PE for failing to complete a project or earning low ROI due to cost overruns should - in theory - motivate P3 firm to deliver on time and on budget.

The Purple Line shows how this logic breaks down due to the *timing* of PE.

Infra projects take years to build & P3 firms hold PE until the end to shorten interval between investment and ROI (from tolls or availability payments).

This delay kills the theory/value of PE.

Infra projects take years to build & P3 firms hold PE until the end to shorten interval between investment and ROI (from tolls or availability payments).

This delay kills the theory/value of PE.

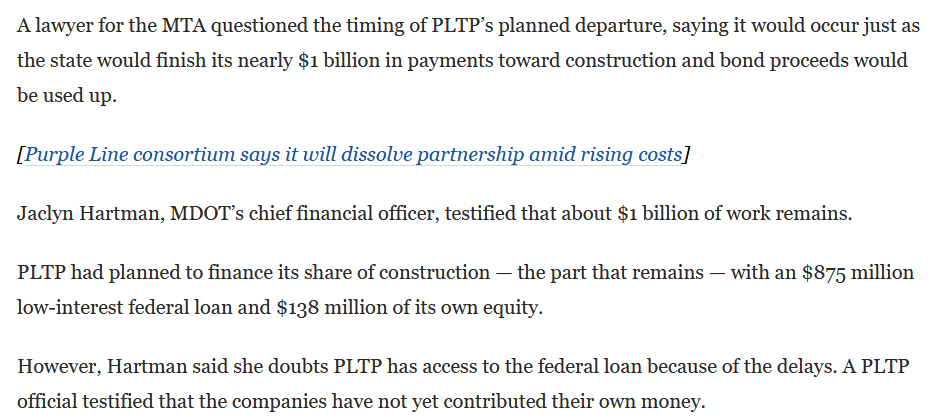

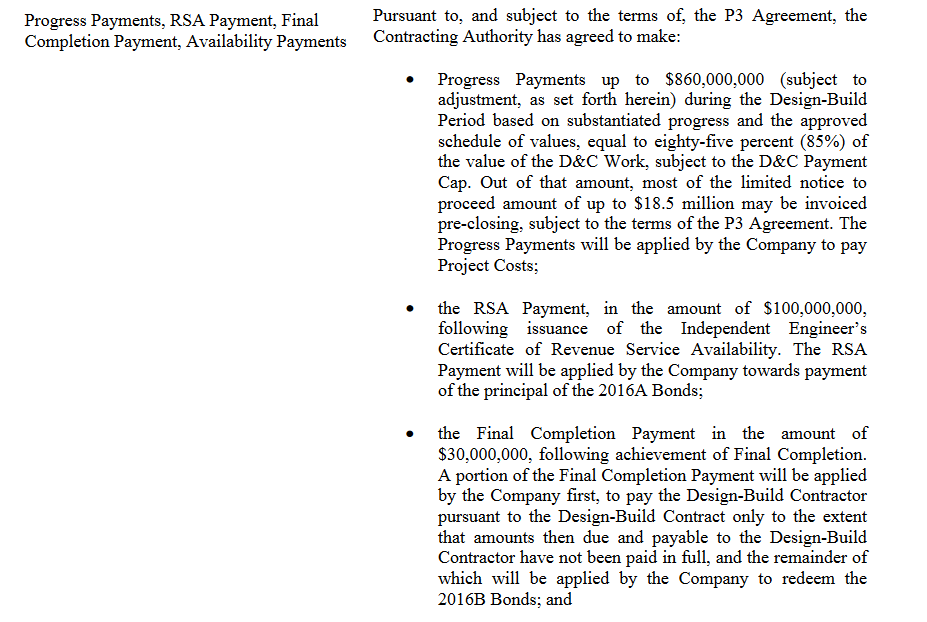

At this point in the project, the state has put in all the money and the Purple Line Transit Partners are going to walk before their money is on the line.

Yes, technically PLTP is the obligor on the construction PABs but as you can see from the bond docs its all state construction grant money backing these up.

No private equity investment = no skin in the game.

No private equity investment = no skin in the game.

States often justify the higher capital cost of P3s by arguing the contractual & financing structure allows risk transference to the concessionaire. It's time states re-evaluate that assumption.

For more check out https://www.americanprogress.org/issues/economy/reports/2019/12/11/478265/limits-risk-transference-public-private-partnerships/

https://www.americanprogress.org/issues/economy/reports/2019/12/11/478265/limits-risk-transference-public-private-partnerships/

For more check out

https://www.americanprogress.org/issues/economy/reports/2019/12/11/478265/limits-risk-transference-public-private-partnerships/

https://www.americanprogress.org/issues/economy/reports/2019/12/11/478265/limits-risk-transference-public-private-partnerships/

Read on Twitter

Read on Twitter