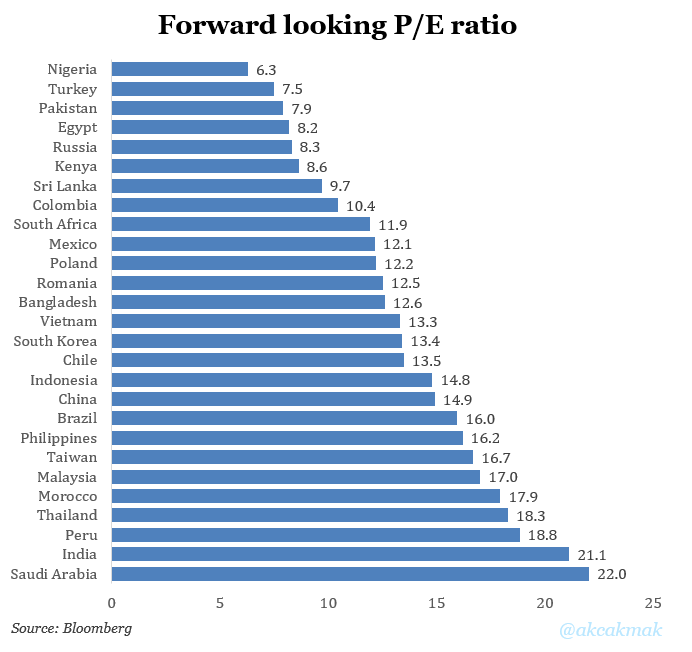

"The world's cheapest emerging markets" by forward looking price-to-earnings (P/E) ratios.

Nigeria: 6.3x

Nigeria: 6.3x

Turkey: 7.5x

Turkey: 7.5x

Pakistan: 7.9x

Pakistan: 7.9x

Egypt: 8.2x

Egypt: 8.2x

Russia: 8.3x

Russia: 8.3x

Kenya: 8.6x

Kenya: 8.6x

But wait! +++

Nigeria: 6.3x

Nigeria: 6.3x Turkey: 7.5x

Turkey: 7.5x Pakistan: 7.9x

Pakistan: 7.9x Egypt: 8.2x

Egypt: 8.2x Russia: 8.3x

Russia: 8.3x Kenya: 8.6x

Kenya: 8.6xBut wait! +++

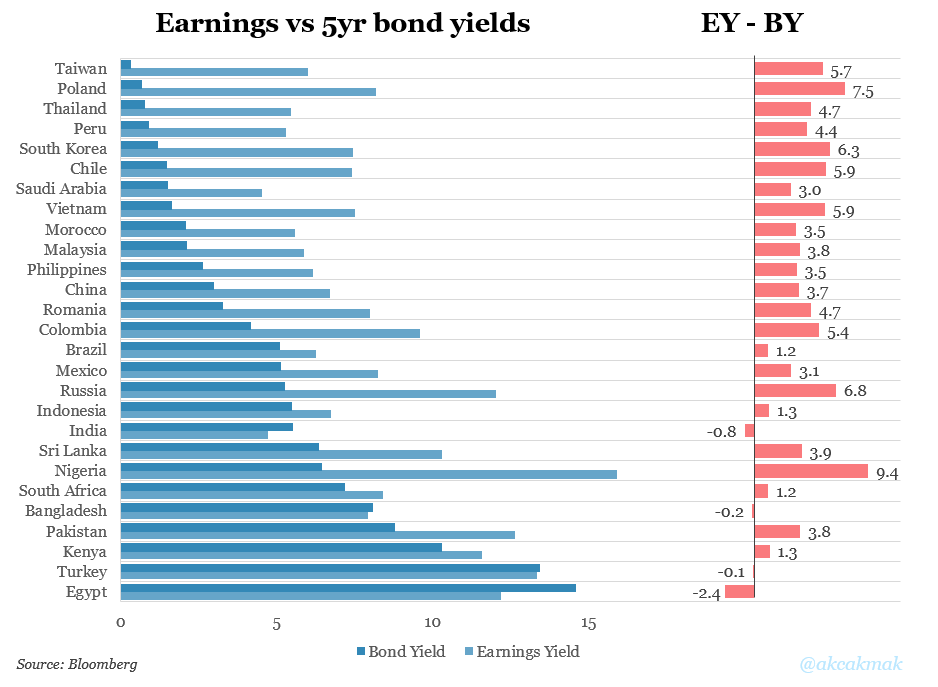

++ One must always consider local interest rates when making an assessment on P/E ratios.

Earnings yield (ie. reverse P/E) should be high enough to compensate investors for risk taken in stocks.

Take Thailand, for example. Stocks yield 4.7% more than bonds.

But wait! ++

Earnings yield (ie. reverse P/E) should be high enough to compensate investors for risk taken in stocks.

Take Thailand, for example. Stocks yield 4.7% more than bonds.

But wait! ++

+++

High inflation typically means higher rates, leaving little room for excess returns on EY vs BY.

High inflation typically means higher rates, leaving little room for excess returns on EY vs BY.

But high inflation also typically means higher growth for companies, thus more excess EY going forward.

But high inflation also typically means higher growth for companies, thus more excess EY going forward.

Or, is the inflation, thus rates are declining?

Or, is the inflation, thus rates are declining?

But wait! +++

High inflation typically means higher rates, leaving little room for excess returns on EY vs BY.

High inflation typically means higher rates, leaving little room for excess returns on EY vs BY. But high inflation also typically means higher growth for companies, thus more excess EY going forward.

But high inflation also typically means higher growth for companies, thus more excess EY going forward. Or, is the inflation, thus rates are declining?

Or, is the inflation, thus rates are declining?But wait! +++

++

Foreign investors lose it all in currency which tends to depreciate with high inflation...

Foreign investors lose it all in currency which tends to depreciate with high inflation...

Focus on real rates.

Wait again!

All indices, different member. Nigeria and Turkey P/E low on banks, Russia on oil, US high on tech.. Completely different business models. ++

All indices, different member. Nigeria and Turkey P/E low on banks, Russia on oil, US high on tech.. Completely different business models. ++

Foreign investors lose it all in currency which tends to depreciate with high inflation...

Foreign investors lose it all in currency which tends to depreciate with high inflation... Focus on real rates.

Wait again!

All indices, different member. Nigeria and Turkey P/E low on banks, Russia on oil, US high on tech.. Completely different business models. ++

All indices, different member. Nigeria and Turkey P/E low on banks, Russia on oil, US high on tech.. Completely different business models. ++

+++

Just like many fellow investors, I like to be aware of what's going on w P/E ratios but in reality, they don't make much sense. Lots of other considerations especially for global investors with many currencies.

Now, which market would you call the "cheapest" and why?

Just like many fellow investors, I like to be aware of what's going on w P/E ratios but in reality, they don't make much sense. Lots of other considerations especially for global investors with many currencies.

Now, which market would you call the "cheapest" and why?

Read on Twitter

Read on Twitter