(1/n) A thread on the SEBI new circular with respect to increase in equity exposure across multi-cap funds

For brevity, Large caps (LCs), Mid caps (MCs) and Small caps (SCs)

For brevity, Large caps (LCs), Mid caps (MCs) and Small caps (SCs)

(2/n) Which funds are impacted by this?

ALL multi-cap funds. [It does NOT mean focused funds with multi-cap strategy or Combination funds (large & mid or mid & small cap types)]

A clean reading means Multi-cap funds with international exposure to equities will also be impacted

ALL multi-cap funds. [It does NOT mean focused funds with multi-cap strategy or Combination funds (large & mid or mid & small cap types)]

A clean reading means Multi-cap funds with international exposure to equities will also be impacted

(3/n) What is the definition of Multi-cap asset funds?

Any asset fund which invests a minimum of 65% allocation in equities. Rest 35% can be invested in other asset classes - debt, international equities, Gold or plain old liquid funds.

Any asset fund which invests a minimum of 65% allocation in equities. Rest 35% can be invested in other asset classes - debt, international equities, Gold or plain old liquid funds.

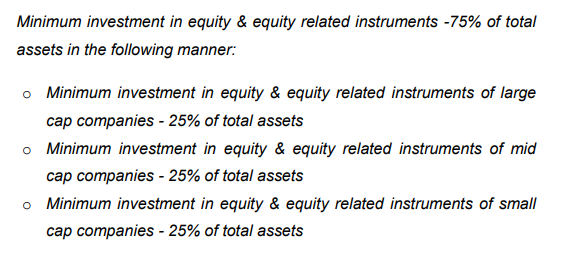

(4/n) what is the change in today's SEBI circular?

The equity asset allocation has been increased from 65% to 75% with a minimum exposure of 25% in each of m-cap categories i.e LCs, MCs and SCs

The equity asset allocation has been increased from 65% to 75% with a minimum exposure of 25% in each of m-cap categories i.e LCs, MCs and SCs

(5/n) How does it impact me as a MF investor?

It impacts if you are invested in any of these multi-cap funds. You got to watch the commentary & announcements from your respective fund houses regarding this as this entail sharp strategy changes

It impacts if you are invested in any of these multi-cap funds. You got to watch the commentary & announcements from your respective fund houses regarding this as this entail sharp strategy changes

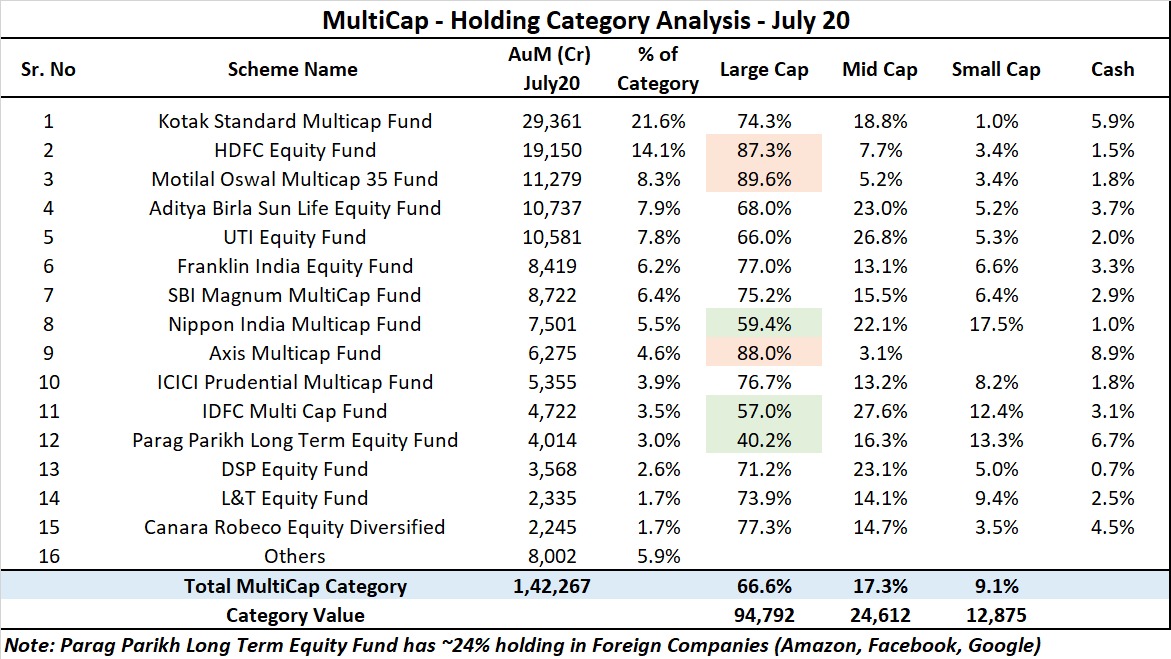

(6/n) But equities allocation is going up? This should be win-win situation for all.

Most multicaps have less allocation in smallcaps. Some even less than 10%. This means they need to buy SCs aggressively. Most SCs have poor liquidity. This increases investor risk significiantly

Most multicaps have less allocation in smallcaps. Some even less than 10%. This means they need to buy SCs aggressively. Most SCs have poor liquidity. This increases investor risk significiantly

(7/n) Do MFs have to compulsorily do this change?

They can decide not make any change. Remain true to their investors mandate and close the fund. This may not be practical for obvious reasons

They can decide not make any change. Remain true to their investors mandate and close the fund. This may not be practical for obvious reasons

(8/n) Can't MFs be changed to a large cap or a LC& MC fund or MC&SC fund?

Yes, that's a possibility that to avoid high turnover in the portfolios, AMCs may create a new category. Provided they don't already have a existing category

Yes, that's a possibility that to avoid high turnover in the portfolios, AMCs may create a new category. Provided they don't already have a existing category

(9/n) What is the timeline for this to be implemented?

31 Jan, 2021. Based on 31 Dec 2020 prices, m-cap classification list will be released in first week of Jan-2021. By month end, all changes need to be made.

31 Jan, 2021. Based on 31 Dec 2020 prices, m-cap classification list will be released in first week of Jan-2021. By month end, all changes need to be made.

(10/n) Is there a possibility of FMs not waiting till Jan-2021 and start making the change now, given they have low small cap exposure?

Yes, and that's why for small cap investors it is an exciting piece of little change. But remember, volatility works both sides!

Yes, and that's why for small cap investors it is an exciting piece of little change. But remember, volatility works both sides!

Read on Twitter

Read on Twitter