The interesting bit about digging into the details of the trade data, at least to me, is the stories that emerge.

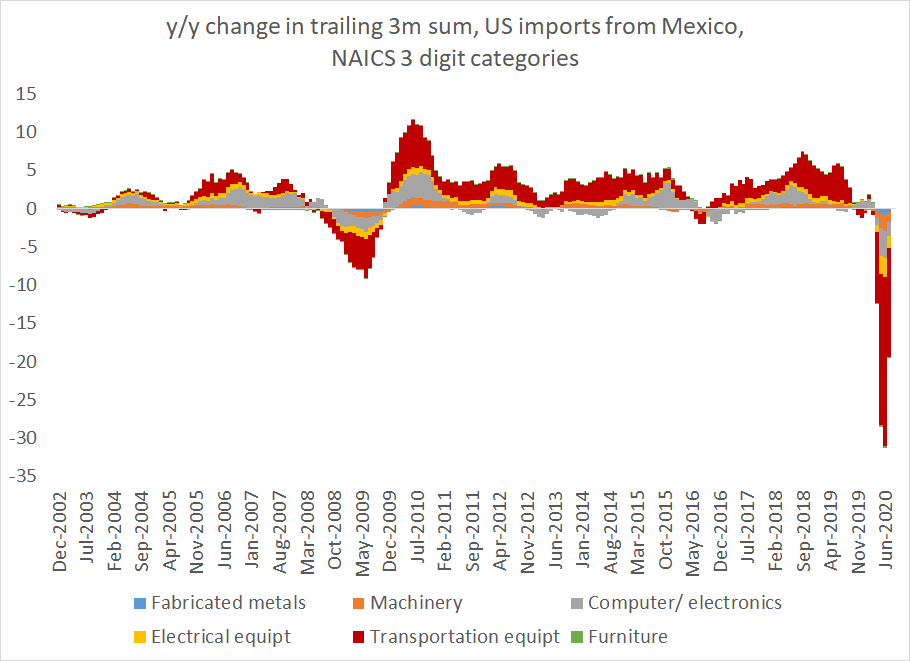

Especially the stories that you wouldn't expect. I for example would not have predicted that the COVID-19 shock would jump out in the data for Mexico ...

1/x

Especially the stories that you wouldn't expect. I for example would not have predicted that the COVID-19 shock would jump out in the data for Mexico ...

1/x

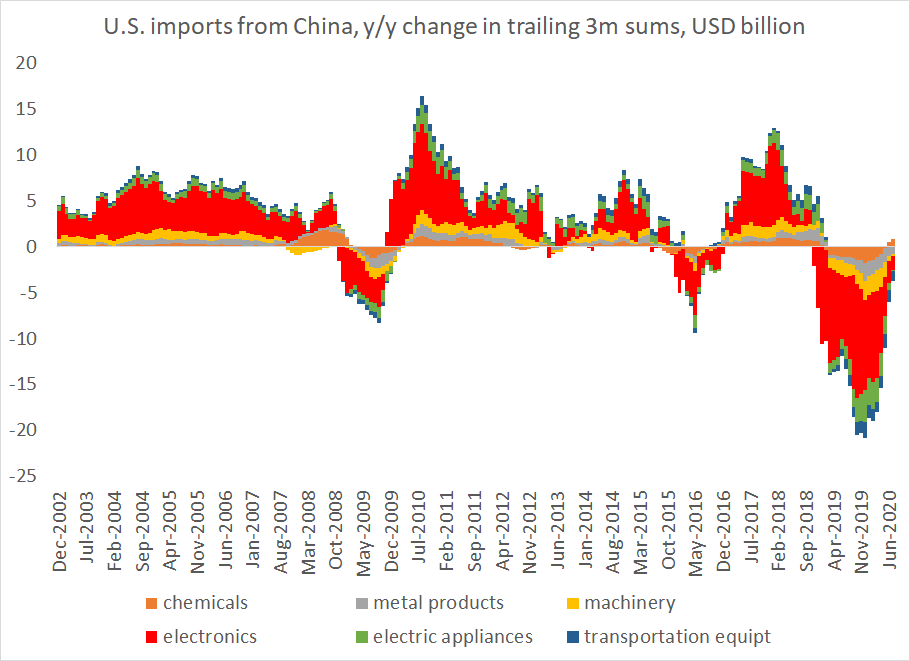

While the COVID 19 shock doesn't register that strongly in the data for China, in large part because it blurs together with impact of the trade war

2/x

2/x

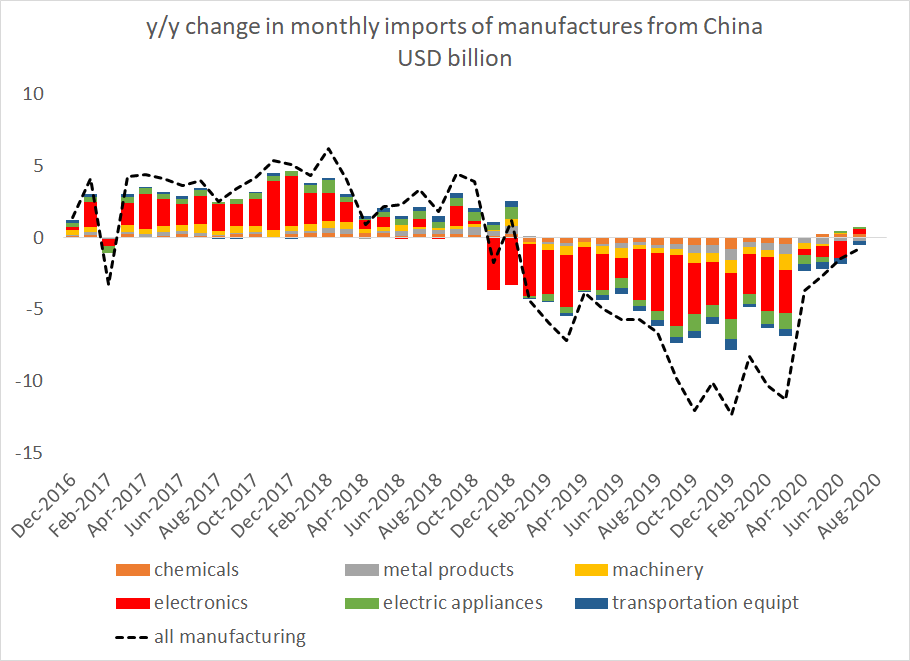

That is even more true when you zoom into the details of US imports from China, and look at the monthly numbers. COVID-19 does register (with hindsight, it blocked an incipient stabilization in trade), but not all that strongly.

3/x

3/x

The detailed data confirms something I have been hinting at for a long time -- namely that demand for imports from China recovered ahead of demand for other imports

4/x

4/x

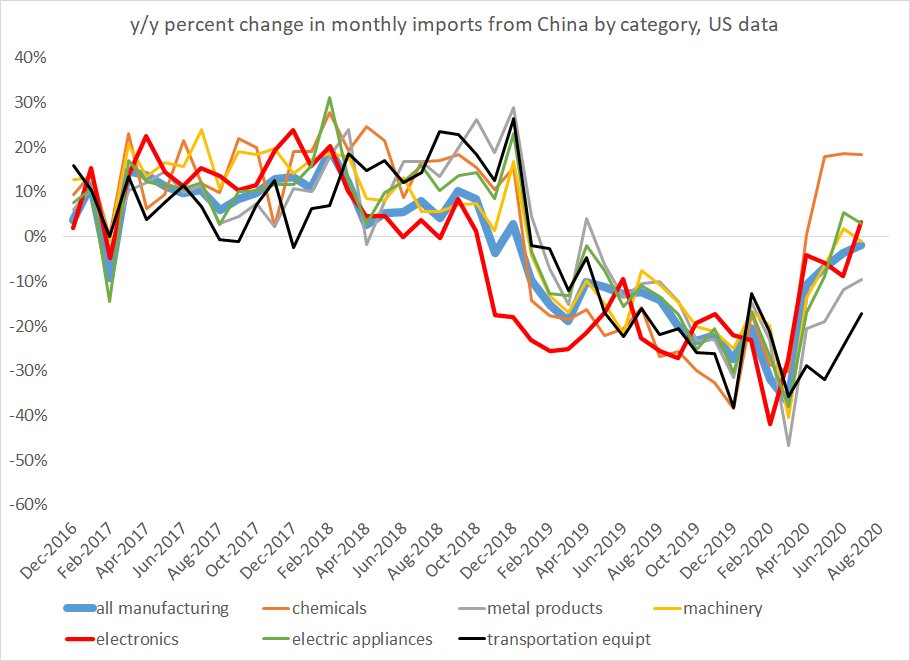

Looking at percentage changes in y/y imports from China further fleshes out the story -- the recovery in imports would actually be even stronger but for the ongoing fall in imports of transportation equipt (mostly auto parts in this case) and metals

5/x

5/x

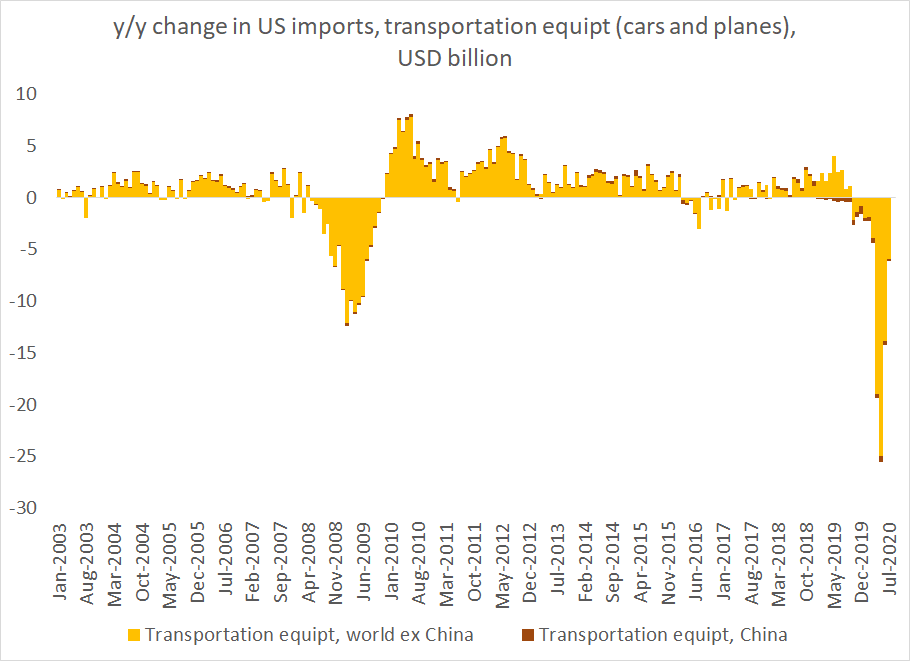

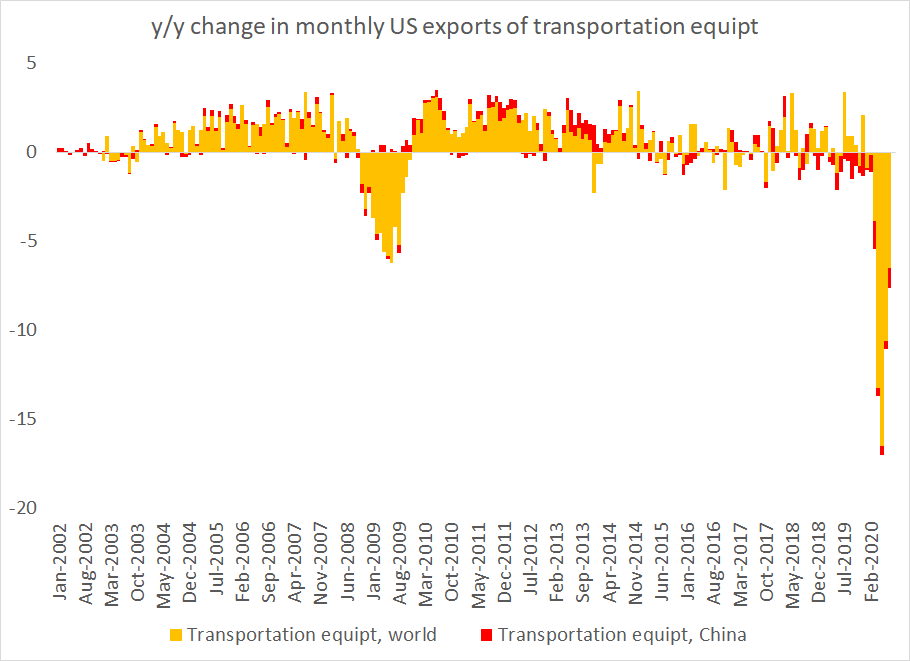

COVID 19 turned out to be a major shock to demand for imports of cars and planes and associated parts (transportation equipment) -- which is the sector where imports from China are statistically the least important

6/x

6/x

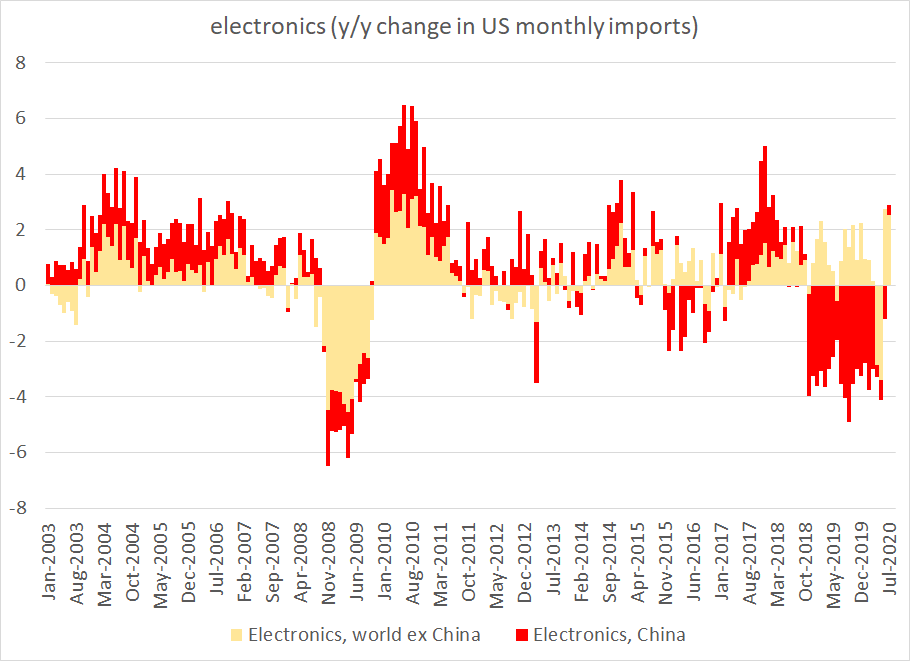

While it wasn't a huge shock to US demand for say imported electronics

(everyone is benefiting from higher US demand here, including China -- but China isn't as well here as it might have in the past)

7/x

(everyone is benefiting from higher US demand here, including China -- but China isn't as well here as it might have in the past)

7/x

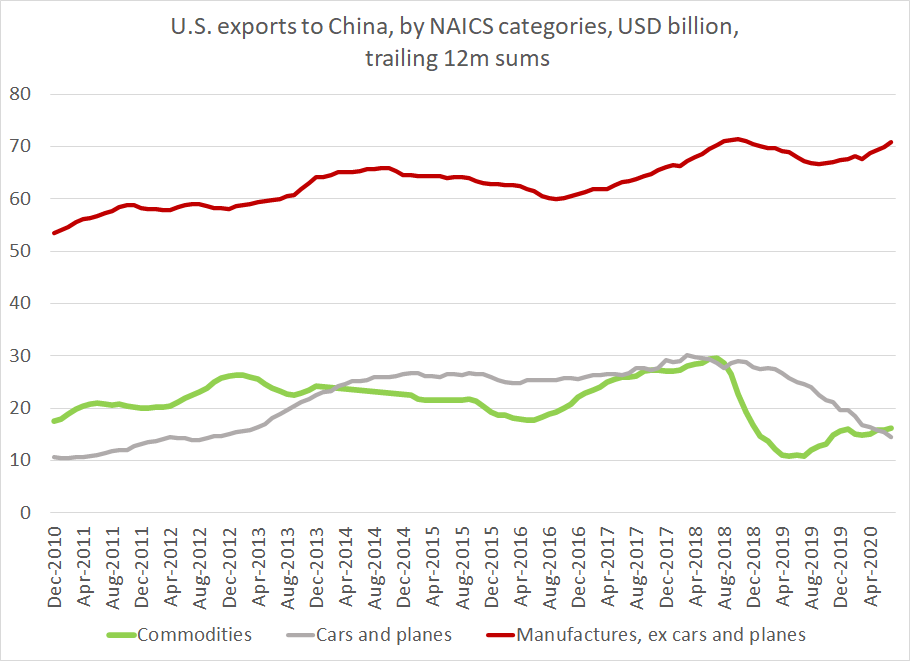

The same irony is present on the export side of the ledge -- the COVID 19 shock registers only weakly in numbers for US exports to China. The slump in commodities was tied to the trade way, and the slump in transportation equipt is mostly Boeing

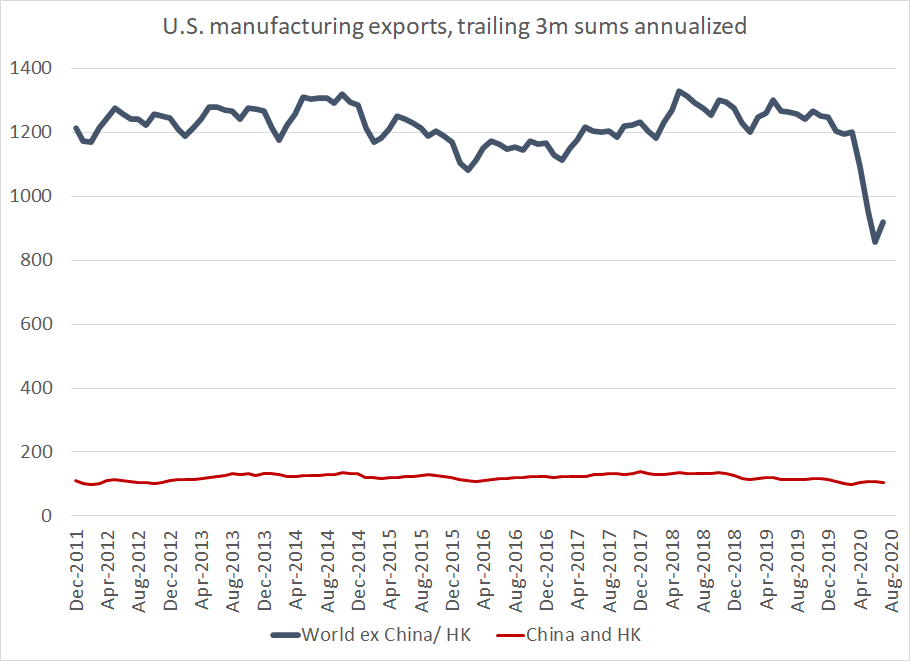

Yet for all the talk of how China has been driving global growth over the last ten plus years, China really wasn't driving U.S. manufacturing exports -- so the relatively stability of manufacturing exports to China was only of limited value ...

On the export side, there is also an outsized impact from cars and planes (transportation equipment)

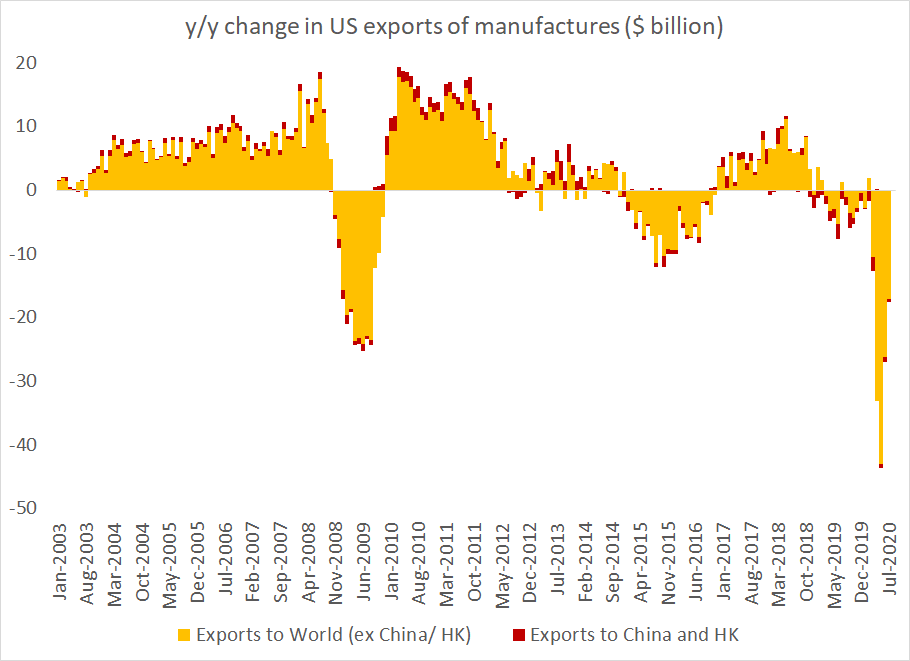

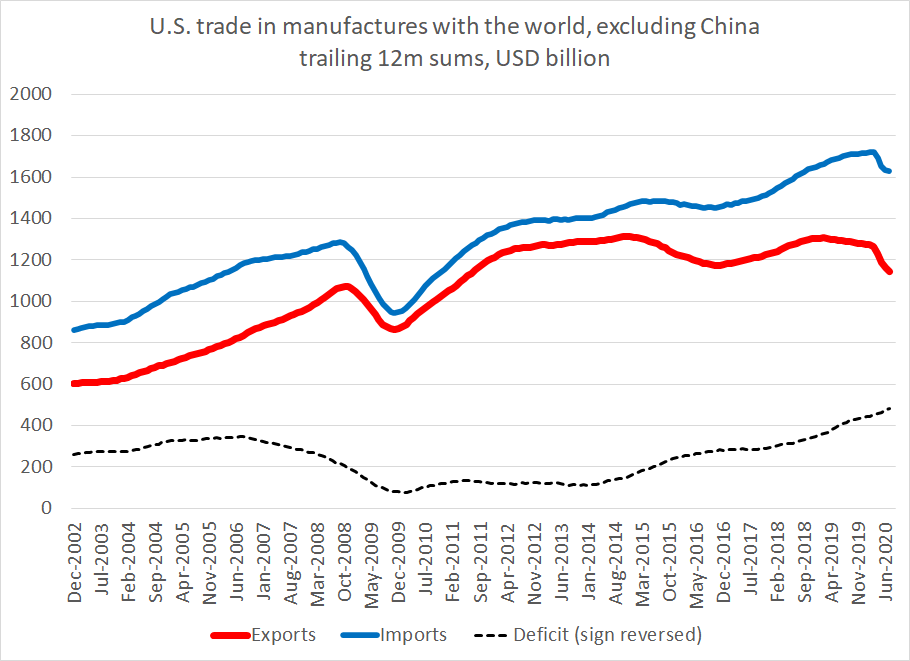

Finally, look at the trailing 12m sum of manufacturing trade after China is taken out of both sides of the ledger. Trump's trade wars register only lightly here. The dollar's appreciation in 14/15 shows up I think. But shocks from outside the trading system even more so

12/x

12/x

the trailing 12m sum moves very slowly, so there is a further downleg from COVID 19 that has yet to show up in the data

13/x

13/x

To sum up, to see the impact of COVID-19 on US trade, don't look at the data on trade with China ....

14/14

14/14

Read on Twitter

Read on Twitter