1/21: I pulled a thread together a few weeks ago about how the early stage fintech ecosystem has gotten a bit crazy and overheated. https://twitter.com/fintechjunkie/status/1299394396895563778. Since then I was asked to comment on the later stage madness. Unpacked:

2/21: The first thing to understand is that venture capital as an asset class is actually quite small. In 2019 about $136B of capital was deployed in the US with exits of about $256B.

3/21: Massive individual wealth can be generated for LPs and GPs if great investments are made and fortunes can be amassed for the Founders of break-out companies. But as an asset class the total money at work is quite small.

4/21: Compare VC to the US stock markets and you’ll get an idea of size. Market cap of NYSE > $25T with $200B+ traded daily. NASDAQ > $22B with $250B+ traded daily.

5/21: The value of all US residential real estate > $30T with turnover of about $2T a year. The currency markets are event larger with over $5T traded each day.

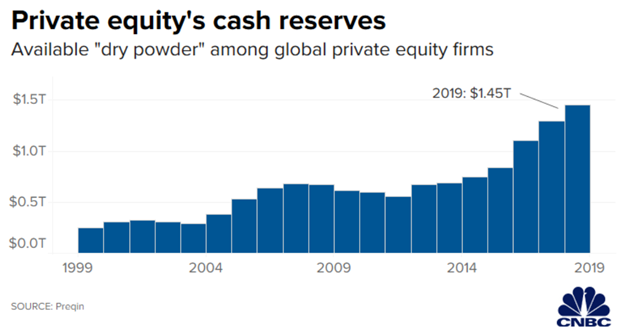

6/21: But one asset class has been gaining steam recently: Private equity. It’s in the process of growing from a relatively small asset class to a “mid-sized” asset class. There are many fundamental reasons driving this trend.

7/21: One driving factor is that alpha has mostly disappeared from the stock market. The vast majority of return can be attributed to a few stocks each year and only 1 in 25 stocks are investments worthy holding over the long-term (relative to Treasuries).

8/21: The number of listed companies has also been on a steady decline with big companies becoming bigger and smaller companies disappearing through mergers and failures. At peak, there were over 7,000 listed companies on the US exchanges and the number today is less than 4,000.

9/21: Buying an indexed fund is the equivalent to casting a very wide net and it will get you exposure to all of the stocks that drive performance. Owning the rest doesn’t hurt much when you always own all the winners.

10/21: Another factor is that companies are staying private longer than ever before which means that the highest growth companies are generating significant incremental returns in the private markets. The area under the returns curve is rapidly growing!

11/21: Another reason investors see value in the PE asset class is the attractive yield profile relative to the extremely low yield profiles of other investments like global Treasuries.

12/21: And a massively misunderstood benefit to private investing is that private securities can be structured while public securities can’t. Not all private securities are structured, but the ones that are can lop off the left hand tail of returns.

13/21: One example of structure is preferred stock. Preferred stock is basically debt with an equity option which can make an investor less sensitive to valuation if the pref stack is significantly less than the company is worth.

14/21: And some forms of structure lock in returns with “make-whole” provisions through ratchets if an IPO prices too low. Just look at what happened during the Square IPO if you want to study the phenomenon IRL.

15/21: So, with all these forces at work it’s not a surprise that money has been pouring into late-stage private markets companies. The asset class is finally big enough to matter (and getting bigger) and the alternatives are getting worse.

16/21: But if the return expectations from these investors is merely “beating the next best alternative” and the next best alternative is investing in the public markets, then these investors should be willing to pay more than historical norms for access to late stage companies.

17/21: This is having a ripple effect on the entire ecosystem because if later stage investors are willing to pay more it generates greater paper returns (and secondary liquidity returns) for earlier stage investors if nothing else changes.

18/21: But finding great early stage companies is highly competitive which means that when an early stage VC finds one they can justify “paying up to win” based on the increasing prices paid by later stage investors + the extra returns generated by staying private longer.

19/21: As an early stage investor, these changes in the overall ecosystem are exciting and terrifying at the same time. More expensive to play. More return to generate. It puts a premium on “getting it right”.

20/21: I’m hoping this thread is shared and discussed as widely as the last because the dialogue it inspired was fun to be part of. Sharing thoughts is encouraged. Tweet tweet!

21/21: And to leave the thread with a quote: “One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.” – William Feather.

Read on Twitter

Read on Twitter