1/ Let's take a look at Binance's current banking situaiton (or lack thereof) - starting with the FMA's rejection of their bid to buy Union Bank AG in Lichtenstein

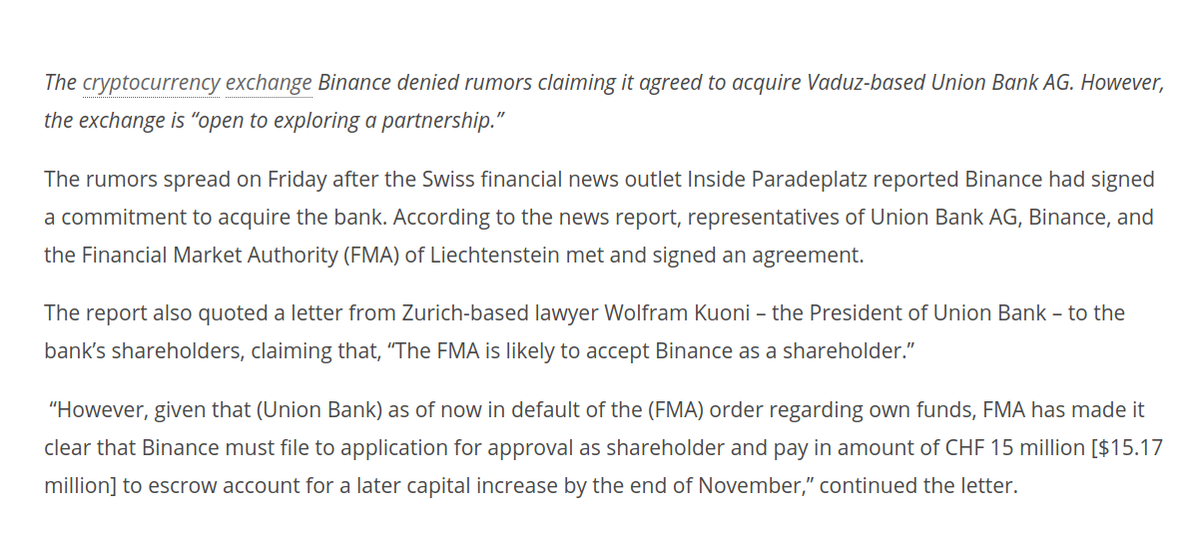

For some reason, Binance has been lying in various publications about their bid to buy the bank since December '19

For some reason, Binance has been lying in various publications about their bid to buy the bank since December '19

2a/ The most reliable (and consistent) reporting on this bank acquisition saga can be found in the 'Inside Paradeplatz' publication.

The most relevant articles on the situation (in chronological order), can be found:

A) https://insideparadeplatz.ch/2019/12/06/svp-anwalt-kuoni-dealt-mit-china-crypto-boerse/

B) https://insideparadeplatz.ch/2020/07/16/aufraeumen-im-laendle/

The most relevant articles on the situation (in chronological order), can be found:

A) https://insideparadeplatz.ch/2019/12/06/svp-anwalt-kuoni-dealt-mit-china-crypto-boerse/

B) https://insideparadeplatz.ch/2020/07/16/aufraeumen-im-laendle/

2b/ (Continuing the list of articles from the previous tweet)

C) https://insideparadeplatz.ch/2020/08/05/laendle-bank-von-svp-anwalt-vor-aus/

D) https://insideparadeplatz.ch/2020/08/10/vaduz-zieht-union-bank-den-stecker/

There are other articles that have covered the matter, but I feel these are the best to reference because this appears to be the most *direct* source

C) https://insideparadeplatz.ch/2020/08/05/laendle-bank-von-svp-anwalt-vor-aus/

D) https://insideparadeplatz.ch/2020/08/10/vaduz-zieht-union-bank-den-stecker/

There are other articles that have covered the matter, but I feel these are the best to reference because this appears to be the most *direct* source

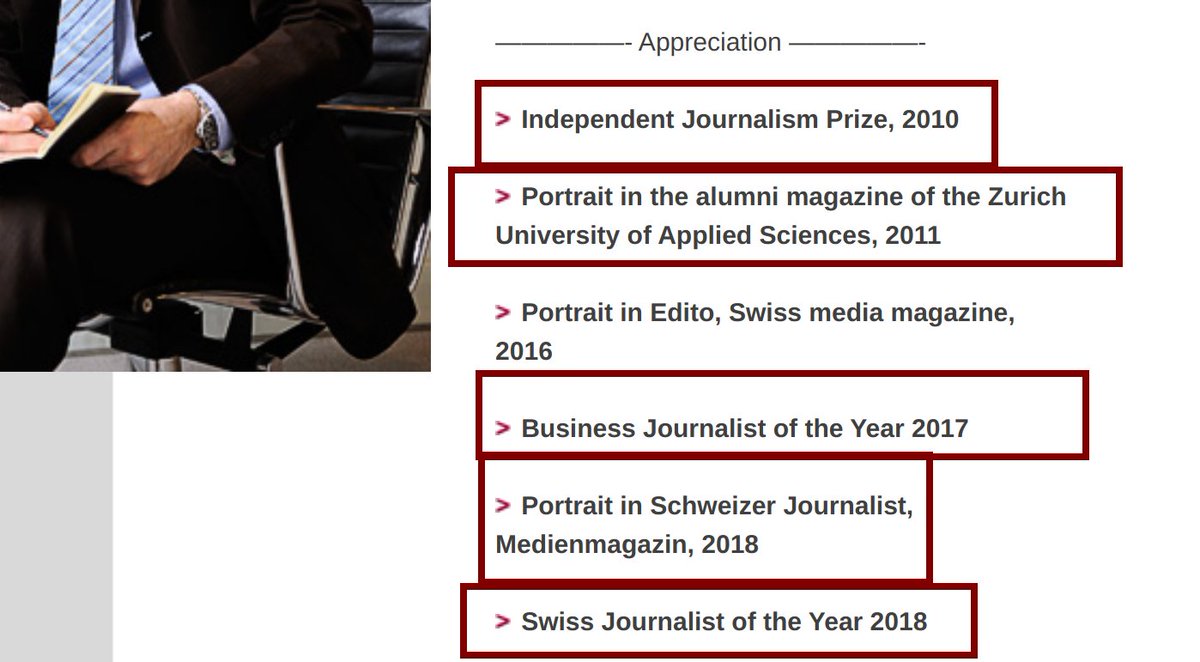

2c/ In terms of credibility, this source is *highly* credible. The editor is known as is the publication (running 10+ years) & its location.

Editor of this paper won Swiss Journalist of the year in 2018. Their source of revenue is transparently published as well.

Editor of this paper won Swiss Journalist of the year in 2018. Their source of revenue is transparently published as well.

3a/ Some may be tempted to say, "Perhaps Binance's bid to buy the bank was due to the fact that they're a blockchain/crypto-based company. Banks don't trust that."

Usually this would be a valid argument. But here? This is anything but the case.

Usually this would be a valid argument. But here? This is anything but the case.

3b/ Late 2019, the region passed the "Blockchain Act" which essentially was an open invitation, embracing crypto companies all over the world.

One could argue you may be at an *advantage* as a crypto-based entity.

source = https://www.liechtenstein.li/en/news-detail/article/liechtensteins-blockchain-act-receives-global-attention/

One could argue you may be at an *advantage* as a crypto-based entity.

source = https://www.liechtenstein.li/en/news-detail/article/liechtensteins-blockchain-act-receives-global-attention/

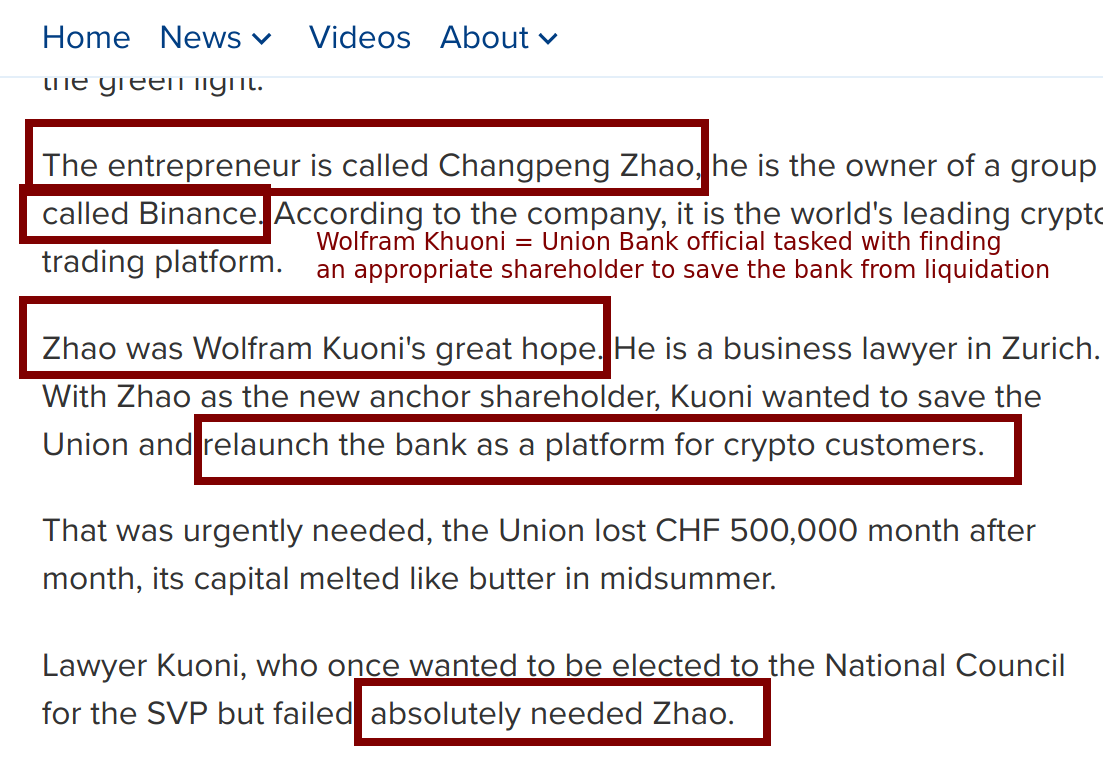

4/ So what was the deal with Binance's bid to acquire Union Bank AG that rubbed the FMA (regulatory authority) the wrong way?

Based on reporting, we know that Changpeng Zhao was essentially the bank's final hope.

Based on reporting, we know that Changpeng Zhao was essentially the bank's final hope.

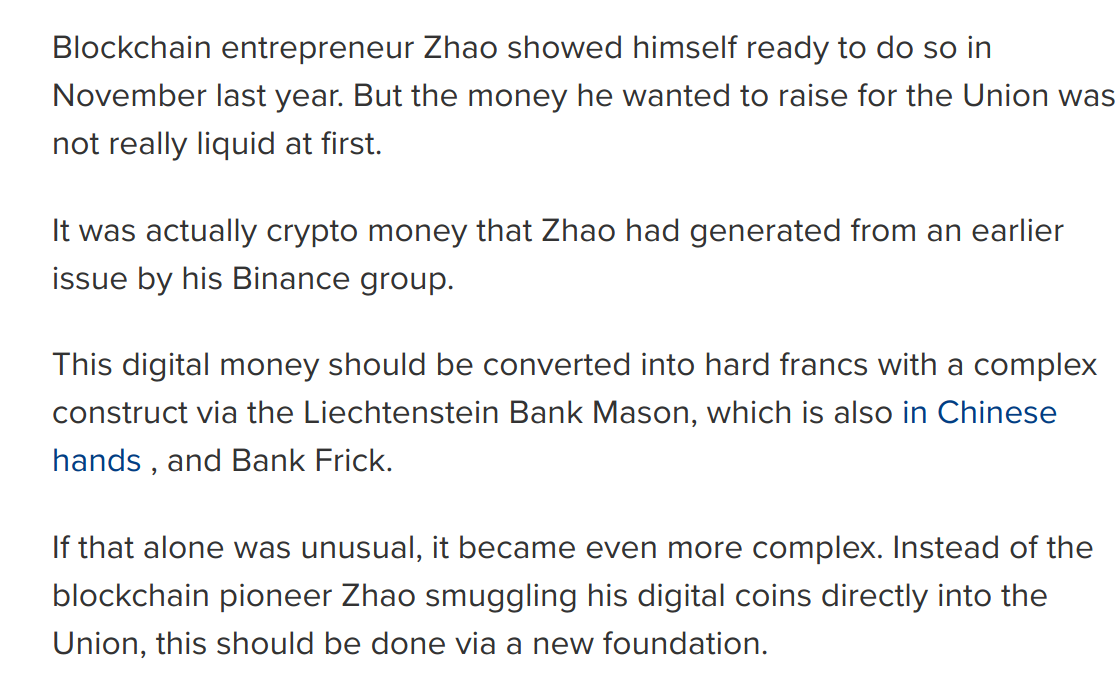

5a/ Turns out CZ / Binance's means of gathering the capital to acquire the bank was the real issue that resulted in their bid being rejected by the FMA.

Reporting states that CZ had the funds - but they were in crypto - and this purchase required fiat, which he was *short* on

Reporting states that CZ had the funds - but they were in crypto - and this purchase required fiat, which he was *short* on

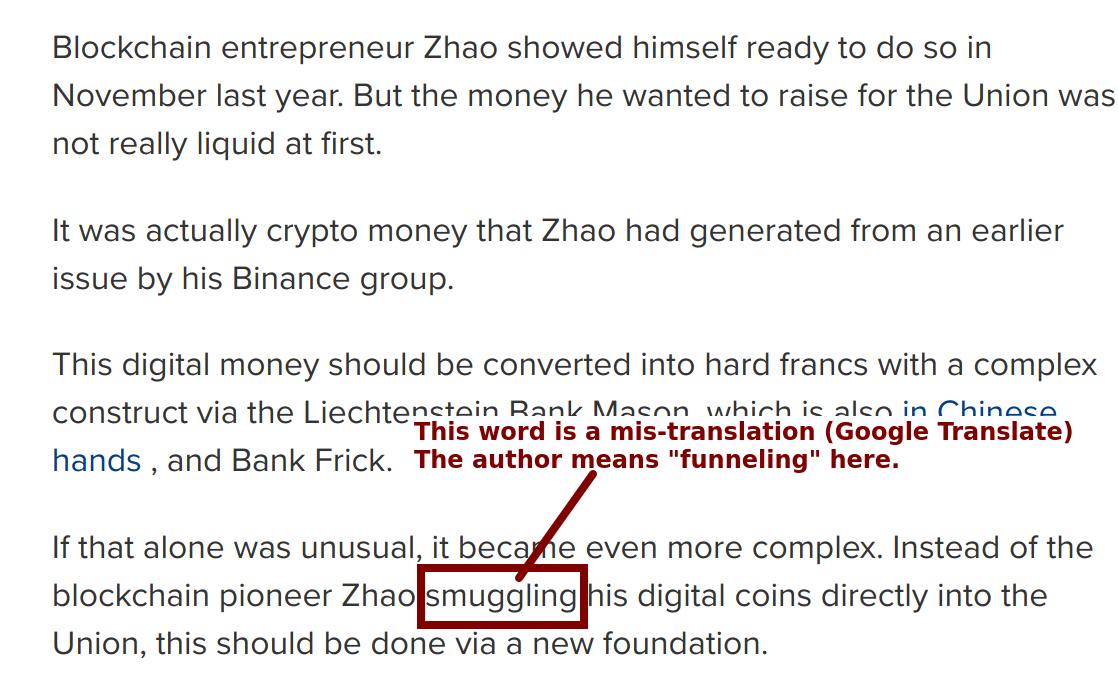

5b/ I need to provide some clarity to the previous post. These articles were originally written in German. So you all are reading a Google Translated version of the text.

In specific, the word "smuggled" here is a bad translation. Replace that with "funneling"

In specific, the word "smuggled" here is a bad translation. Replace that with "funneling"

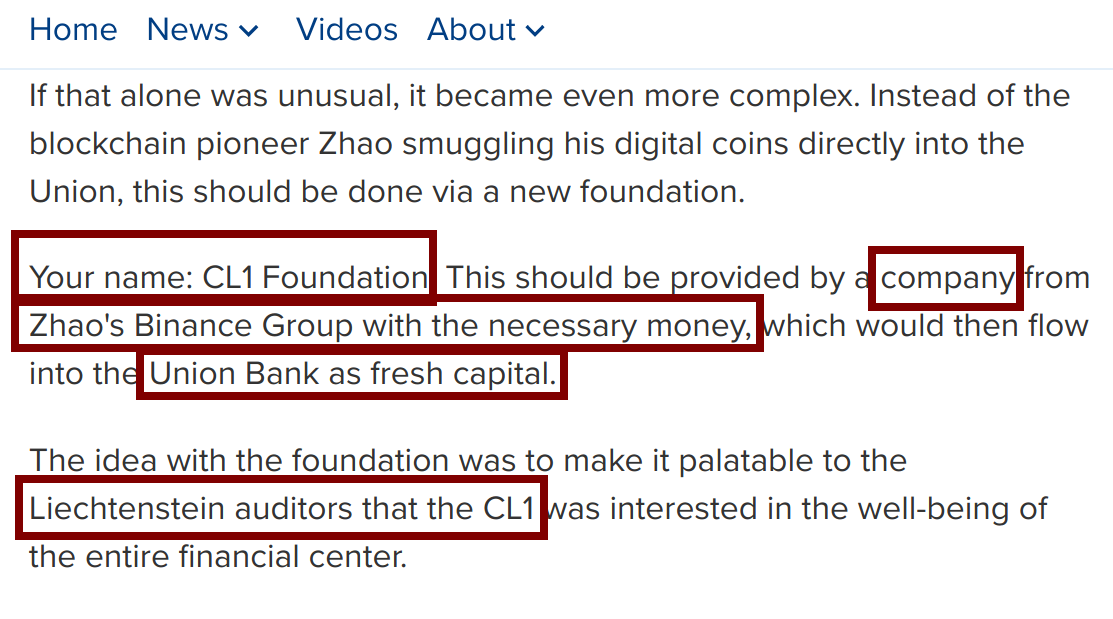

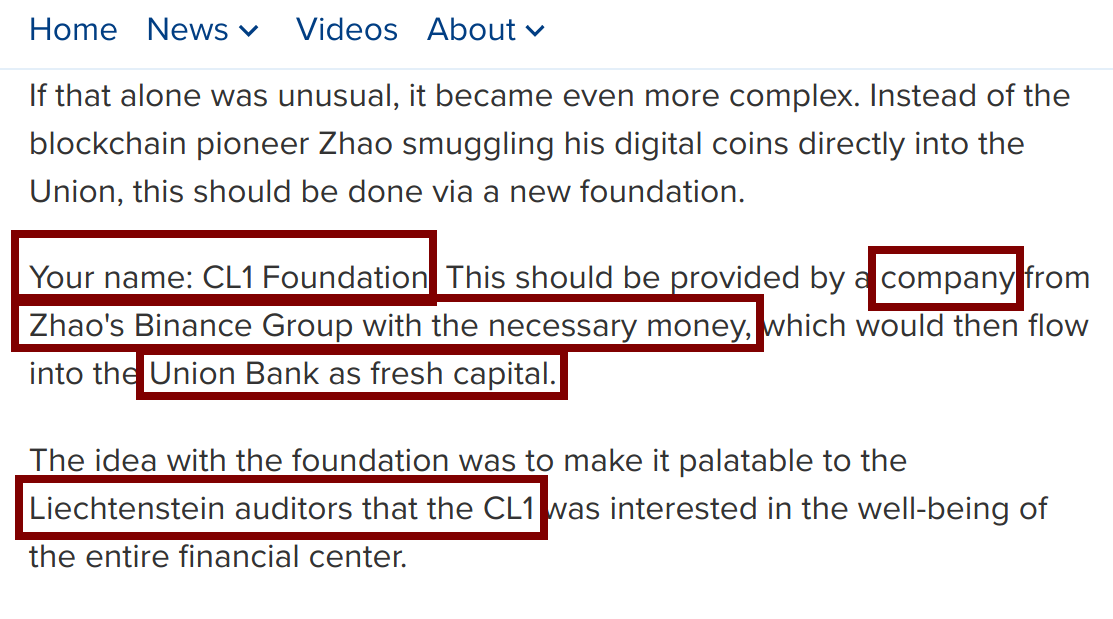

5c/ Ironically, the actual smuggling is outlined immediately afterward in the report as it details the scheme Binance set up where they were looking to cash out their currency at an *external bank* before transferring funds to the 'CL1 Foundation' to purchase UB under.

6/ Apparently, buying a bank via digital currency that's liquidated via an unknown external institution before being covertly transferred to a shell company (CL1 Foundation) is not acceptable.

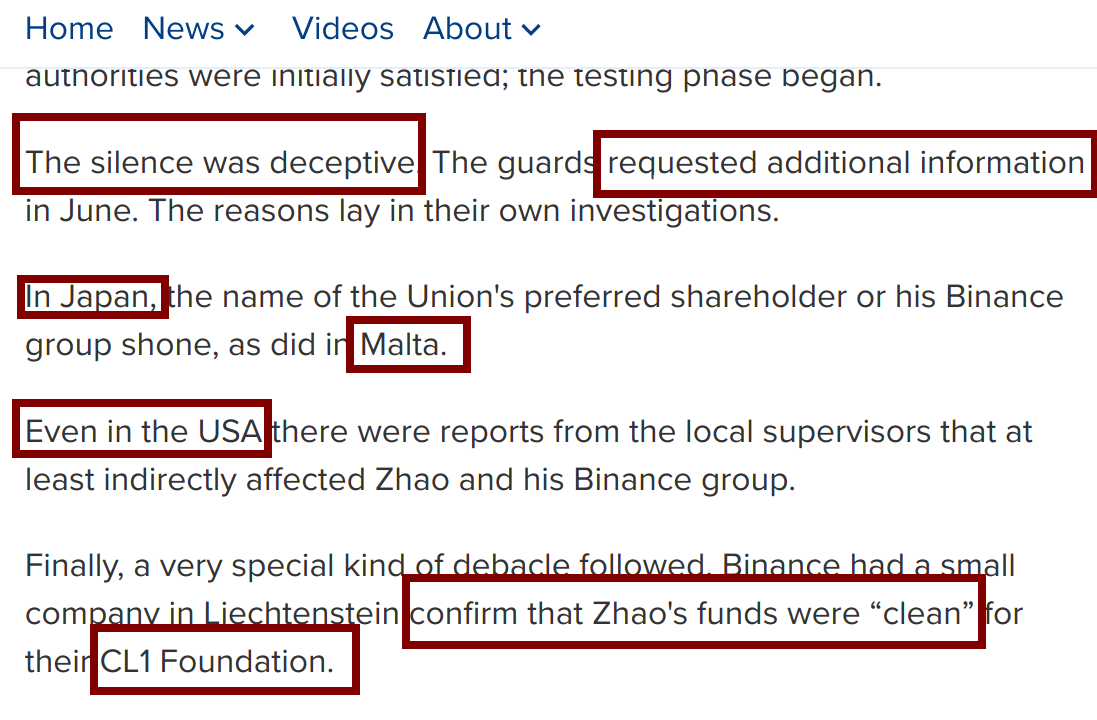

7a/ To make things worse, Binance essentially stonewalled the FMA Authorities when they began asking for more information about their business operations.

Curiously, Binance's reputation in prior jurisdictions (including the U.S.) was a problem too.

Curiously, Binance's reputation in prior jurisdictions (including the U.S.) was a problem too.

7b/ Also turns out that the entity they had vouch for Binance (i.e., to state that their "funds were clean"), ended up facing criminal proceedings initiated by Lichtenstein authorities for alleged fraud (among other things)

note: "shot in the neck" = mistranslated euphemism

note: "shot in the neck" = mistranslated euphemism

8/ As you can imagine, Binance's bid to buy the bank was denied.

The FMA found that "five out of five" criteria an applicant must have were not satisfied by Binance.

The article posits potential discrimination / bias as a reason for the denial (at least what "some" say)

The FMA found that "five out of five" criteria an applicant must have were not satisfied by Binance.

The article posits potential discrimination / bias as a reason for the denial (at least what "some" say)

8b/ To address the discrimination part - want to preface this by saying I am a black person in the U.S. - so, I am *not* predisposed to dismissing such a claim w/o serious thought as my personal experiences have taught me all too well that this can be a *significant* factor.

8c/ However, in this instance - I am inclined to disagree. Changpeng Zhao, perceived and identified as a Chinese citizen would be discriminated against on that basis if it were to occur (as the article suggests).

However, 'Mason Group Holdings' seems to suggest otherwise.

However, 'Mason Group Holdings' seems to suggest otherwise.

8d/ In 2017, Mason Group Holdings acquired a bank (just as Binance was attempting to do) in the same exact jurisdiction.

Like CZ, the purchasing company was identified as Chinese (keyword: identified)

Their bid was successful

source: https://www.reuters.com/article/raiffeisen-privatbank-liechtenstein-ma-m/hks-mason-group-to-buy-european-private-banking-firm-for-60-mln-idUSL4N1MU07C

Like CZ, the purchasing company was identified as Chinese (keyword: identified)

Their bid was successful

source: https://www.reuters.com/article/raiffeisen-privatbank-liechtenstein-ma-m/hks-mason-group-to-buy-european-private-banking-firm-for-60-mln-idUSL4N1MU07C

8e/ After buying the bank, Mason Group Holdings structured it to cater to digital currency-based banking by introducing "digital asset custody" through a partnership with another Hong Kong-based entity.

8f/ So in Mason Group Holdings, we have another *perceived* Chinese entity purchasing a bank (successfully) in the same region for essentially the same exact purpose around the same time (within 2 years of CZ's app).

And they were 100% succesful. No problems.

And they were 100% succesful. No problems.

9/ In conclusion, the report *is* real, there's no tangible reason for us to assume discrimination played a role & the area is *VERY* blockchain friendly.

Binance was denied because of BINANCE. Alone.

Binance was denied because of BINANCE. Alone.

Read on Twitter

Read on Twitter