So basically (if I'm reading this right) $GFL did an IPO in order to delever so that they could get their hands on 2 big assets they knew were coming their way.

Paying for a platform. Intuitively makes sense given waste is a pretty regional business, having footprint matters.

In some ways $GFL reminds me of $CHTR: leverage, path to refinance & FCF accretion/lower capex intensity over the next few years.

$GFL CEO: I have too much skin in the game to make mistakes.

Why did an investor take 28+ million shares 3 years out at a 25% premium with a PIK pref structure?

"You can't buy a business like this anywhere else at 10-11x free cash flow".

"You can't buy a business like this anywhere else at 10-11x free cash flow".

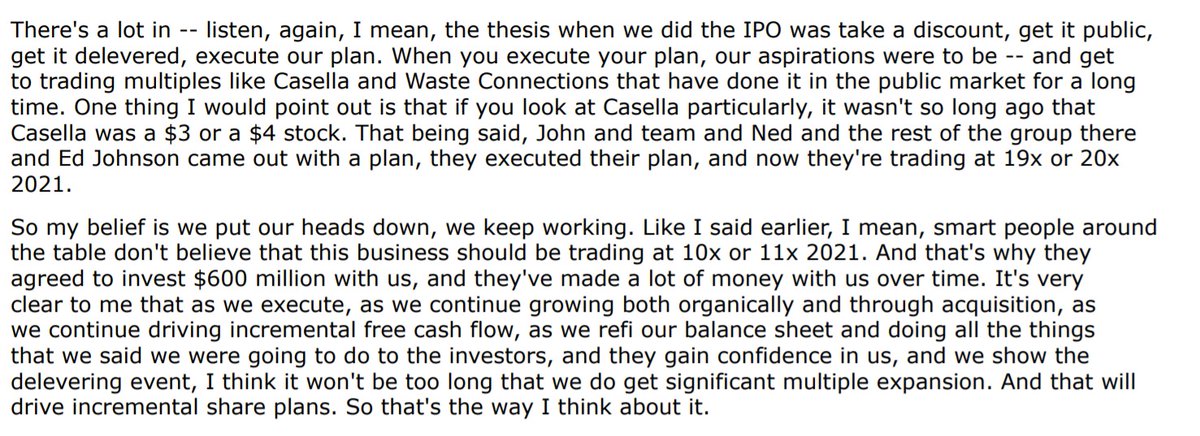

So yes, the plan was IPO at a discount to deleverage in order to buy 2 big assets and execute.

Nice way to close the thread. $GFL

Nice way to close the thread. $GFL

Read on Twitter

Read on Twitter