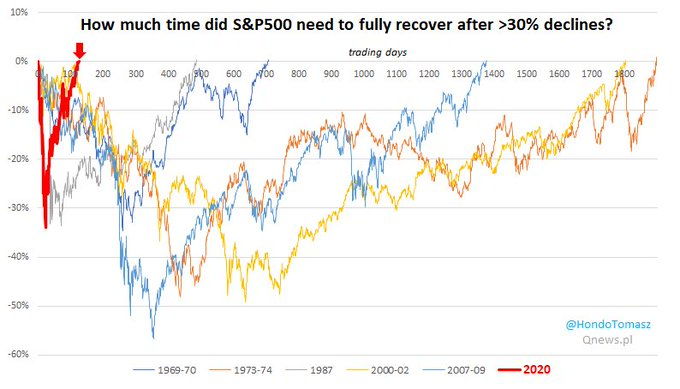

1) Traditional recessions typically occur when a deep-rooted issue (or issues) ruptures the capital markets

The market then has to remove that issue before it can advance. May take years

In 2008, it was the RE bubble, then the illiquidity in the banking system

The market then has to remove that issue before it can advance. May take years

In 2008, it was the RE bubble, then the illiquidity in the banking system

2) A stock market correction, is essentially a reduction in the activity of the economy, which causes a temporary pullback, in an otherwise healthy market

March (lock-down) was purposefully and structurally induced

There was no major loose bolt in the engine-room

March (lock-down) was purposefully and structurally induced

There was no major loose bolt in the engine-room

3) A stock market correction, is essentially a reduction in the economic activity, which causes a temporary pullback, in an otherwise healthy market

March (lock-down) was purposefully, structurally induced

March (lock-down) was purposefully, structurally induced

4) Therefore, the only thing that was required to stop the slump, was structural correction, by removing the lock-down.

If the market is going to tank, its going to be for some other reason

I still say, early bull market

If the market is going to tank, its going to be for some other reason

I still say, early bull market

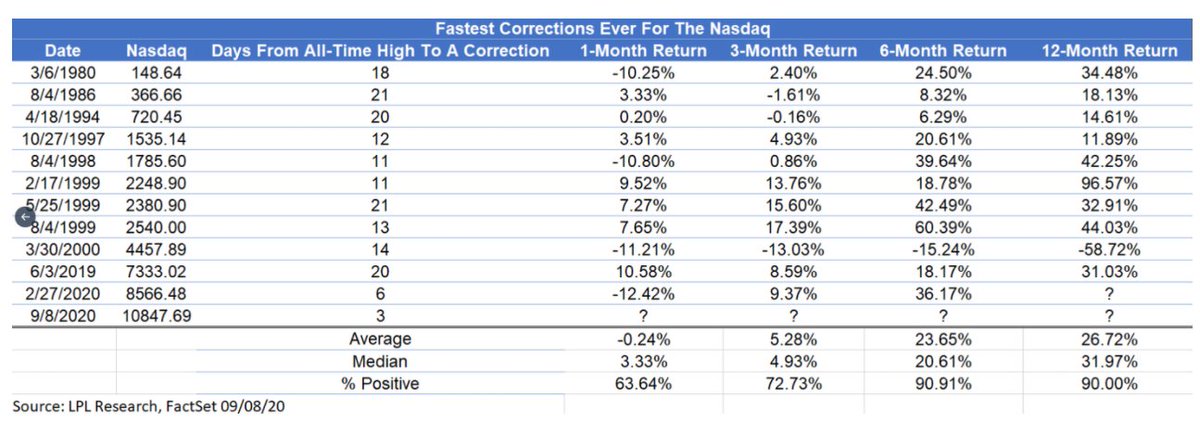

5) Here is a great slice of data from @RyanDetrick

It suggests we still have some more returns coming

Only instance where 12 months sucked was March 2000 (tech bubble pop)

That was a traditional recession

This one, is not

It suggests we still have some more returns coming

Only instance where 12 months sucked was March 2000 (tech bubble pop)

That was a traditional recession

This one, is not

6) That's my two cents

IT

IT

Read on Twitter

Read on Twitter