The Fed recently announced a new monetary framework. What do we know about its effects in a low interest rate environment? A long(-ish) thread based on a recent paper with my PhD student at @NUSingapore 1/N

With the recent speech by J.Powell, the Fed announced that it will now be targeting average inflation instead of inflation itself. This is essentially a policy of forward guidance. 2/N

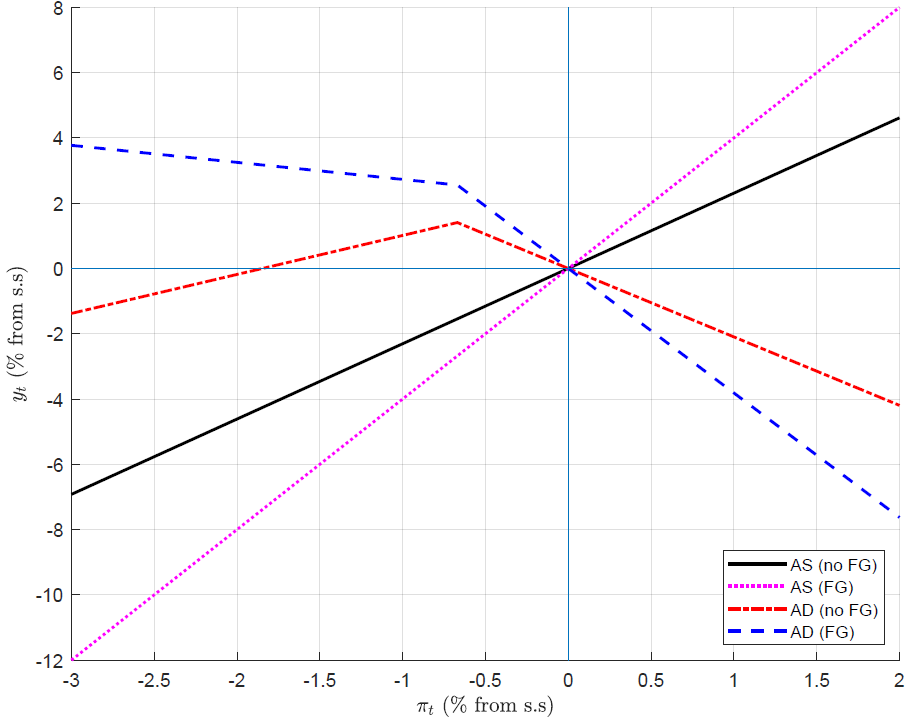

To understand what forward guidance is doing, let's see first what it is trying to cure. Take a standard New Keynesian model with a time varying natural rate of interest r*. It can be represented in an inflation/output gap graph as below. 3/N

A decrease in r* shifts the AD curve down. If this decrease is large enough, the economy ends up at the ZLB: AS intersects AD on its upward-sloping part. 4/N

In a seminal contribution, @GautiEggertsson & Woodford showed that, when that happens the Central Bank should promise to keep interest rate at zero even if r* is back to its initial pre-crisis level. This policy can be implemented with a suitable price level targeting rule. 5/N

Recently, @FlorinBilbiie developed an analytical framework to think about optimal forward guidance. In this framework, the Central Bank chooses the expected duration of zero interest rates after r* is back to its pre-crisis level. 6/N

It is optimal for this duration to be proportional to the initial decrease in r*. Now, remember the AS/AD Diagram? This policy essentially shifts AD back up, to an extent that maximizes inter-temporal welfare. 7/N

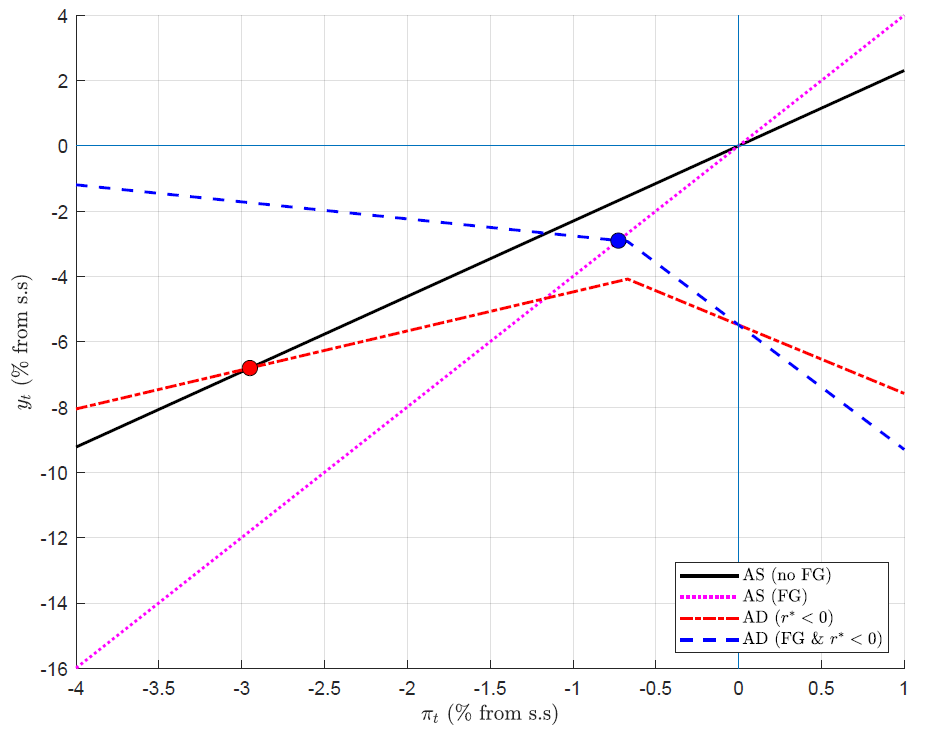

Now this framework is especially useful since it allows one to transition seamlessly from fundamental liquidity traps to sunspot liquidity traps. Sunspot liquidity traps happen when firms/households enter a low-confidence state that becomes self-fulfilling. 8/N

This is based on seminal work by Benhabib, Schmitt-Grohé & Uribe as well as Mertens and @MortnRavn. Back to the AS/AD framework, sunspot liquidity traps can be represented by the Figure below. 9/N

In this situation, the economy can "jump" in a liquidity trap and stay there for a long time. Now what can monetary policy do about this? If we consider again a policy of forward guidance, then remember that it shifts AD up. 10/N

But now this makes the sunspot equilibrium actually worse! To dampen recession, the Central Bank should tap into 'Neo-Fisherian' effects in sunspot liquidity traps and increase interest rates instead!11/N

In a recent paper, we develop an analytical framework to get further intuition about forward guidance. This builds heavily on early work by @GautiEggertsson and Pugsley as well as @FlorinBilbiie. We assume that the Central Bank can announce a medium run inflation target. 12/N

Crucially, this inflation target has to be *explicitly* linked with short run outcomes. That is how such a policy reaps the benefits associated with the optimal, full commitment policy. 13/N

Again back to the AS/AD framework. How does this policy materialize in this new framework? Once you make the inflation target explicitly depend on short run outcomes (in our case, inflation) then the *slopes* of both AS and AD change. 14/N

AS becomes steeper, while the slope of AD at the ZLB decreases. If this policy is pro-active enough, then the AD slope can even turn back to positive at the ZLB! What does that imply for liquidity traps? 15/N

Consider first a large decrease in r*. In the standard model, this brings about a vicious loop of output decrease and deflation. Under forward guidance, short run expected deflation is countered by expected medium run inflation. 16/N

The end result? A much milder recession. Sufficiently pro-active forward guidance policies can even avoid avoid the ZLB altogether if the shock is not too large. 17/N

This policy is especially interesting if we look at sunspot liquidity traps. As these 'confidence shocks' become more persistent, AS becomes flatter and AD becomes steeper at the ZLB: that's how you get the second intersection. 18/N

Forward guidance undoes this by tilting the curves back. Key take-away here: forward guidance can rid the economy of sunspot liquidity traps *only* if it is bold enough. If not bold enough, it actually makes things worse!19/N

Main message of the paper: how households/firms expect the Central Bank to behave in a dynamic world shapes what kind of liquidity traps actually happen. For example, sunspots have to be persistent to be supported in equilibrium (enough to generate second intersection). 20/N

If these are short-lived, then no effect in equilibrium. However, short lived confidence shocks combined with Central Bank policy that drags on deflation (opposite of forward guidance) opens the door to equilibrium sunspot liquidity traps. 21/N

Last but not least, a few words about implementation. This policy is quite straightforward to communicate: (1) announce by how much future inflation will catch up to short-term below target inflation and (2) the expected length of this higher than usual inflation. 22/N

In terms of instrument, what does that mean for the path of the nominal interest rate? 23/N

Surprisingly, we find that the path of the nominal interest rate is largely irrelevant. What matters is *expected inflation*, which can be engineered through increased, decreased or zero interest rates. For more details, we have two examples in the paper. 24/N

Finally, for simplicity most of the analysis has been done in an otherwise standard, representative agent New Keynesian model. 25/N

However, the framework is simple and can easily be extended to incorporate heterogeneous households/imperfect insurance along the lines of @FlorinBilbiie, @ChalleEdouard and @IvanWerning. 26/N

Another possibility is to extend this framework to the analytical HANK & SaM framework of @MortenORavn and Sterk. Yet another possibility is to include behavioral households/firms à la @xgabaix. 27/27

Link to the paper : https://www.dropbox.com/s/nhapgiavqi5dj9h/The_Promises__and_Perils__of_Forward_Guidance.pdf?dl=0

PS: paper builds a lot on papers by and discussions with @NakataTaisuke and @econschmidt!

Read on Twitter

Read on Twitter